CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Managing differences

With the globalization of production as well as markets, you need to evaluate your international strategy.

Here’s a framework for approaching global integration to help you think through your options - the AAA Triangle. the AAA Triangle is the premise that companies growing their businesses outside the home market must choose one or more of three basic strategic options: adaptation, aggregation, and arbitrage. The three A’s stand for the three distinct types of global strategy. Adaptation seeks to boost revenues and market share by maximizing a firm’s local relevance. One extreme example is simply creating local units in each national market that do a pretty good job of carrying out all the steps in the supply chain; many companies use this strategy as they start expanding beyond their home markets. Aggregation attempts to deliver economies of scale by creating regional or sometimes global operations; it involves standardizing the product or service offering and grouping together the development and production processes. Arbitrage is the exploitation of differences between national or regional markets, often by locating separate parts of the supply chain in different places – for instance, call centers in India, factories in China, and retail shops in Western Europe.

Because most border-crossing enterprises will draw from all three A’s to some extent, the framework can be used to develop a summary scorecard indicating how well the company is globalizing. However, because of the significant tensions within and among the approaches, it’s not enough to tick off the boxes corresponding to all three. Strategic choice requires some degree of prioritization – and the framework can help with that as well.

The three A’s are associated with different organizational types. If a company is emphasizing adaptation, it probably has a country-centered organization. If aggregation is the primary objective, cross-border groupings of various sorts – global business units or product divisions, regional structures, global accounts, and so on – make sense. An emphasis on arbitrage is often best pursued by a vertical, or functional, organization that pays explicit attention to the balancing of supply and demand within and across organizational boundaries. Clearly, not all three modes of organizing can take precedence in one organization at the same time.

Most companies will emphasize different A’s at different points in their evolution as global enterprises, and some will run through all three.

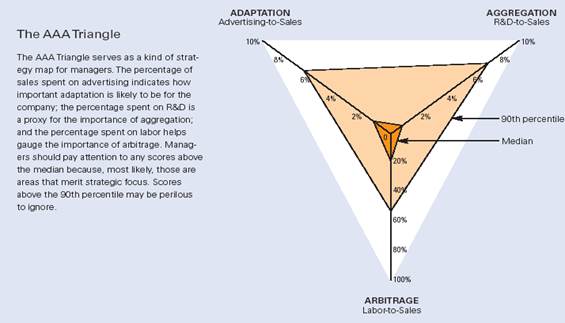

The AAA Triangle allows managers to see which of the three strategies – or which combination – is likely to afford the most leverage for their companies or in their industries overall. Expense items from businesses’ income statements provide rough-and-ready proxies for the importance of each of the three A’s. Companies that do a lot of advertising will need to adapt to the local market. Those that do a lot of R&D may want to aggregate to improve economies of scale, since many R&D outlays are fixed costs. For firms whose operations are labor intensive, arbitrage will be of particular concern because labor costs vary greatly from country to country. By calculating these three types of expenses as percentages of sales, a company can get a picture of how intensely it is pursuing each course. Those that score in the top decile of companies along any of the three dimensions – advertising intensity, R&D intensity, or labor intensity–should be on alert.

Although many companies will (and should) follow a strategy that involves the focused pursuit of just one of the three A’s, some leading-edge companies – IBM, P&G, TCS, and Cognizant among them – are attempting to perform two A’s particularly well. Success in “AA strategies” takes two forms. In some cases, a company wins because it actually beats competitors along both dimensions at once. More commonly, however, a company wins because it manages the tensions between two A’s better than its competitors do. The pursuit of AA strategies requires considerable organizational and material innovation. Companies must do more than just allocate resources and monitor national operations from headquarters. They need to deploy a broad array of integrative devices, ranging from the hard (for instance, structures and systems) to the soft (for instance, style and socialization).

Broader Lessons

The danger in discussions about integration is that they can .oat off into the realm of the ethereal. That’s why I went into specifics about the integration challenges

Focus on one or two of the A’s. While it is possible to make progress on all three A’s –especially for a firm that is coming from behind – companies (or, often more to the point, businesses or divisions) usually have to focus on one or at most two A’s in trying to build competitive advantage.

Make sure the new elements of a strategy are a good fit organizationally. you should pay particular attention to how well they work with other things the organization is doing.

Employ multiple integration mechanisms. Pursuit of more than one of the A’s requires creativity and breadth in thinking about integration mechanisms. Also essential to making such integration work is an adequate supply of leaders and succession candidates of the right stripe.

Think about externalizing integration. Not all the integration that is required to add value across borders needs to occur within a single organization.

Know when not to integrate. Some integration is always a good idea, but that is not to say that more integration is always better. First of all, very tightly coupled systems are not particularly flexible. Second, domain selection – in other words, knowing what not to do as well as what to do–is usually considered an essential part of strategy.

Date: 2015-01-12; view: 3399

| <== previous page | | | next page ==> |

| Management skills. | | | Market Leader Upper Intermediate |