CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Chapter 2. Valuing bonds.

The list of bonds issued by Walt Disney Company and its main characteristics are presented in the table below (20.11.2012):

Table 4 Bonds Valuation, bonds are sorted by maturity date

| # | Bonds issue | Type | Credit rating | Quantity available, $ mln | Coupon rate, % | Coupon payment frequency, times per year | First Coupon Date | Maturity date | Callable | Secured | Price, % | YTM, % |

| DISNEY WALT CO MTNS BE | Corp | A | 6.2 | 12/20/2002 | 6/20/2014 | No | No | 115.51 | 0.114 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 1.35 | 2/16/2012 | 8/16/2016 | No | No | 101.51 | 1.02 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 5.625 | 3/15/2007 | 9/15/2016 | No | No | 120.59 | 1.189 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 5.5 | 9/15/2009 | 3/15/2019 | No | No | 122.89 | 2.097 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 3.75 | 12/1/2011 | 6/1/2021 | No | No | 113.31 | 2.19 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 2.75 | 2/16/2012 | 8/16/2021 | No | No | 103.16 | 2.383 | |||

| DISNEY WALT CO MTNS BE | Corp | A | 9/1/2002 | 3/1/2032 | No | No | 149.01 | 3.577 |

In this table we can see that all the bonds are evidently corporate, have the Fitch’s credit rating of “A”. Disney’s bonds have typical available quantity of $50—100 million, ranging from $10 million to the $250 million. Coupon rates are widely spread along the interval of 1—7%, but have an average of some 5%. All the coupons are semi-annual. Currently available bonds have the date of issue in the 2000s and maturity dates ranging from 2014 to 2032 year. They all are not callable, and none of them is secured by particular assets. They have different YTMs, but they have a usual trend of growth. The weighted average YTM is 1.83%[1][d1] .

The company’s bonds are issued to raise money for general corporate purposes, mergers & acquisitions and implementations of different projects. For instance, in the 24 of October, 2001 Disney acquires Fox Family Channel for $3 billion, plus the assumption of $2.3 billion in debt, and renames it ABC Family[2]. The acquisition of the company with Fox Family Channel was seen as a means of beefing up its portfolio of cable networks as well as strengthening Disney's position with younger viewers.

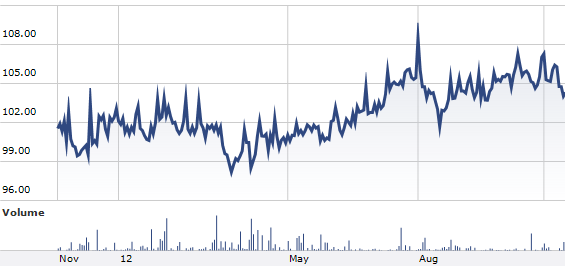

The graphs below show the price and yields dynamics of one of the Disney’s recent bonds[3] — DISNEY WALT CO MTNS BE_16-Feb-2012 (#8 in the Table above). The data is shown for the 2012-year period. The relationship between yield and price is inverse: when price goes up, yield goes down and vice versa.

Figure 1 Price dynamics for 2012

Price dynamics 2012

Figure 2 Yield dynamics 2012

Yield dynamics 2012

A strong company such as Disney with high credit ratings means that the chance of defaulting on a bond is very small. A credit grade served to the Company incredibly well over the past decade including when liquidity dried up for most companies in 2008. During the financial crisis the Disney Company’s net income dropped to $4.4 billion from $4.7 billion. Decline in advertising hurt two Disney properties, ABC and ESPN, leading to a 4% drop in income at the media networks unit. Income at the theme parks also dropped 4% because of lower bookings at Disneyland and higher costs at Walt Disney World. The Disney’s strategy during the crisis was to decrease prices on its entertainment services, and these discounts helped Disney sustain attendance levels despite the tough economic environment. There was the same and even more visitors as the year before, but with the special deals Disney was not making more money out of it.

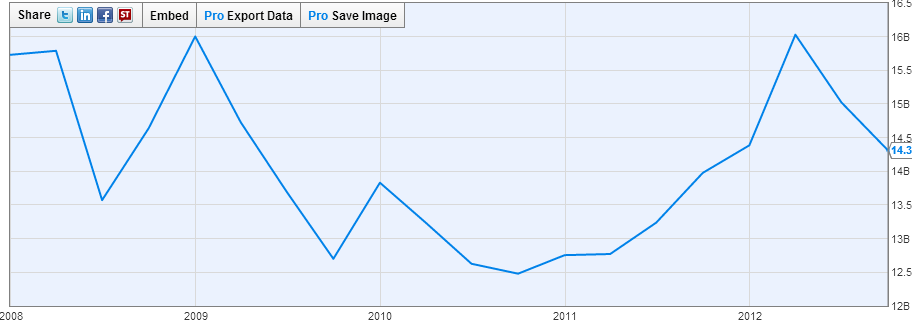

Figure 3 Disney’s long-term debt for 5 years, $ bln

Disney’s long-term debt for 5 years, $ bln

Date: 2015-01-29; view: 1212

| <== previous page | | | next page ==> |

| Chapter 1. General characteristics of the company. | | | Fair value |