CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

and risk warnings, and advice to

avoid them:

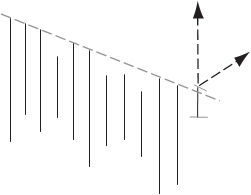

The market has formed on daily charts a specific formation, which I call a comb. (This is a sort of short-term trend seen on frame charts any time including intraday, daily, and weekly.)

USD/CHF, USD/JPY, EUR/USD, EUR/JPY and other Euro crosses.

Basic (conservative).

Take a position in the direction of the move on the break of the trendline limiting a comb from one side:

A. Buyon the break of the descending line, OR B. Sellon the break of the ascending line.

Any time.

Entry-stop order.

On the opposite side of the current day range. (Above the previous day high or below the previous day low.)

Recommended. (Automatic and simultaneous with stops.)

Average daily range (P1)End of the day (P2)Other

N/A

Average to High

Average to Low

Positive

The position was open in the The position was open in the direction direction of the medium-term of the main move of the previous day. trend.

RW#1:The position was open A#1:Move your stops closer and against the direction of the place them above (below) the previous medium-term trend. local extreme formed the same day. RW#2:The position was open A#2:Same as above.

against the main move of the previous day.

P1

P1

P2

Buy

Stop

FIGURE 20.1a

FIGURE 20.1a

Stop

Sell

P2

P1

FIGURE 20.1b

FIGURE 20.1b

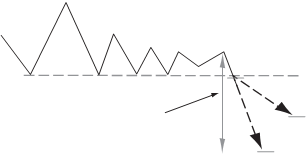

| Brief situation description: | The market has formed on intraday charts a comb formation. | ||

| Currency recommended for a trade: | USD/CHF, USD/JPY and some EUR crosses. | ||

| Trade characteristics: | Optional (risky). | ||

| Trade (entry point) suggestions: | Enter the market on the break of the line. | ||

| Entry time: | Any time. | ||

| Entry execution: | Entry-stop order. | ||

| Stop loss placed: | The opposite side of the day range | The nearest technical level | Other |

| Reverse if stops triggered: | Recommended. | ||

| Target (depends on the time frame): | End of the day (P1) | Average daily range (P2) | Other |

| Potential profit estimation: | N/A | ||

| Profit probability evaluation: | Average | ||

| Risks evaluation: | Average | ||

| P/L ratio: | Neutral | ||

| Potential advantages in favor of the open position: | A.The position was open in the direction of the main move of the day. B.The break of the line occurred simultaneously with forming of the new low or new high of the day. | ||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | ||

| Additional notices, recommendations, and trading tips: | To trade combs on an intraday basis is a bit problematic. It is better to trade having some other technical reasons to enter a position, because trading in limited time and space is always difficult for a trader. However, sometimes it works extremely well if you take profit at the right time. |

P2

P1

P1

Buy

Stop

FIGURE 20.2a

FIGURE 20.2a

Stop

Sell

P1

P2

P2

FIGURE 20.2b

FIGURE 20.2b

| Brief situation description: | A flat surface is formed on daily charts. | |||

| Currency recommended for a trade: | All majors and crosses. | |||

| Trade characteristics: | Optional. | |||

| Trade (entry point) suggestions: | Enter the market on the break of the surface. | |||

| Entry time: | Any time. | |||

| Entry execution: | Entry-stop order. | |||

| Stop loss placed: | The opposite side of the day range | Other technical level | ||

| Reverse if stops triggered: | Possible. | |||

| Target: | End of the day (P1) | Average daily range (P2) | Other | |

| Potential profit estimation: | N/A | |||

| Profit probability evaluation: | Average | |||

| Risks evaluation: | Average | |||

| P/L ratio: | Neutral | |||

| Potential advantages in favor of the open position: | N/A | |||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | |||

| Additional notices, recommendations, and trading tips: | Better when a position is open in the direction of the current medium-term trend. Also, some other reasons should support the idea of such a trade. However, if you trade on an intraday basis, the chance to make profit is quite acceptable. Can also be used for adding a position to another, profitable one. | |||

Average daily range

Average daily range

P2

P1

Buy

Stop

FIGURE 20.3a

FIGURE 20.3a

Stop

Sell

Average daily

range P2

P1

FIGURE 20.3b

FIGURE 20.3b

| Brief situation description: | A flat surface is formed on intraday charts. | |||

| Currency recommended for a trade: | All majors and crosses. | |||

| Trade characteristics: | Basic. | |||

| Trade (entry point) suggestions: | Enter the market on the break of the formation. | |||

| Entry time: | Any time. | |||

| Entry execution: | Entry-stop order. | |||

| Stop loss placed: | The opposite side of the day range. | Other technical level. | ||

| Reverse if stops triggered: | Recommended. | |||

| Target: | End of the day (P1) | Average daily range (P2) | Other | |

| Potential profit estimation: | N/A | |||

| Profit probability evaluation: | Average | |||

| Risks evaluation: | Average | |||

| P/L ratio: | Neutral | |||

| Potential advantages in favor of the open position: | N/A | |||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | |||

| Additional notices, recommendations, and trading tips: | Better when a position is open in the direction of the current move. Usually supports the view that the move in this direction will happen during the day. If you trade on an intraday basis, the chance to make profit is quite acceptable. Can also be used for adding a position to another, profitable one. | |||

Stop

Sell

Average daily

range P2

P1

P1

FIGURE 20.4a

FIGURE 20.4a

P1

P1

Average daily

range P2

Buy

Stop

FIGURE 20.4b

FIGURE 20.4b

| Brief situation description: | The market approaches the major trendline drawn through two (or more) absolutely extreme points. (There should be the whole chart on one side from such a line and a totally free space on the other side.) The trade can be executed only on the approach to a supportive line of the uptrend or at the resisting line of a downtrend. | ||

| Currency recommended for a trade: | All majors and crosses. | ||

| Trade characteristics: | Basic. | ||

| Trade (entry point) suggestions: | Enter the market 5 to 10 pips before the line in the direction, opposite to the direction of the move. | ||

| Entry time: | Any time. | ||

| Entry execution: | Limit or market order. | ||

| Stop loss placed: | Behind the line. | ||

| Reverse if stops triggered: | Recommended. (Trailing stop can also be used.) | ||

| Target: | End of the day (P1) | Average daily range (P2) | Other technical point or reason |

| Potential profit estimation: | N/A | ||

| Profit probability evaluation: | Above average | ||

| Risks evaluation: | Below average | ||

| P/L ratio: | Positive | ||

| Potential advantages in favor of the open position: | N/A | ||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | ||

| Additional notices, recommendations, and trading tips: | The bigger the number of points lying on such a line, the less the probability to commit a profitable trade. I prefer to trade this template on the third or (at the maximum) fourth approach to the line. In the case of the fourth approach, I usually take profit early, using some markets hesitation ahead of the line. |

Average daily range

P2

P1

P1

Buy

Stop

FIGURE 20.5a

FIGURE 20.5a

Stop

Sell

Average

Average

daily P1 range

P2

FIGURE 20.5b

FIGURE 20.5b

| Brief situation description: | The market breaks the major trendline drawn through three or more absolutely extreme points. (There should be the whole chart on one side from such a line and a totally free space on the other side.) The trade can be executed only on the approach to a supportive line of the uptrend or at the resisting line of a downtrend. | |||

| Currency recommended for a trade: | All majors and crosses. | |||

| Trade characteristics: | Basic. | |||

| Trade (entry point) suggestions: | Enter the market 5 to 10 pips at the break of the line in the direction of the move. | |||

| Entry time: | Any time. | |||

| Entry execution: | Entry-stop order. | |||

| Stop loss placed: | The opposite side of the day range | Other technical level | ||

| Reverse if stops triggered: | Recommended. (Trailing stops can be used also.) | |||

| Target: | End of the day (P1) | Average daily range (P2) | Other technical point | |

| Potential profit estimation: | N/A | |||

| Profit probability evaluation: | Above average | |||

| Risks evaluation: | Below average | |||

| P/L ratio: | Positive | |||

| Potential advantages in favor of the open position: | N/A | |||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | |||

| Additional notices, recommendations, and trading tips: | The bigger the number of points lying on such a line, the less the probability to commit a profitable trade. I prefer to trade this template on the fourth or larger approach to the line. The position can also be turned into a longer-term positional trade, because the break of such a line indicates the possibility of a trend change. | |||

Stop

Sell

P1

Average

daily P2

range

FIGURE 20.6a

FIGURE 20.6a

Average daily

Average daily

range P2

P1

Buy

Stop

FIGURE 20.6b

FIGURE 20.6b

| Brief situation description: | There is a CB intervention to support an undervalued currency in progress. | |||

| Currency recommended for a trade: | The undervalued currency and all its crosses. | |||

| Trade characteristics: | Trade of opportunity. | |||

| Trade (entry point) suggestions: | Enter the market on the run in the direction of the move using entry stops. | |||

| Entry time: | Any time. | |||

| Entry execution: | Entry-stop order. | |||

| Stop loss placed: | The opposite side of the day range | Other technical level | ||

| Reverse if stops triggered: | Not recommended. | |||

| Target: | End of the day (P1) | Other technical point (P2) | 100300 pips (P3) | |

| Potential profit estimation: | 100 pips and up | |||

| Profit probability evaluation: | Very high | |||

| Risks evaluation: | Very low | |||

| P/L ratio: | Positive | |||

| Potential advantages in favor of the open position: | N/A | |||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | |||

| Additional notices, recommendations, and trading tips: | The intervention always takes place in support of an undervalued currency. Because it always goes against the trend and the most current move in exchange rates, it would be logical to start a trade by placing entry stops above the current day high as soon as the market price moves down 50 to 60 pips from it. Then, on the way down, a trailing stop can be used. It has to trail the market 60 to 100 pips above the most current low. After the intervention has begun and is confirmed, a trailing stop can be used to assure the profit and protect from unexpected losses. | |||

P3 (100300 pips)

P3 (100300 pips)

Resistance

P2

Open

Entry P1 stop

Buy

Stop

FIGURE 20.7a

CHAPTER 21

A Sample Trade

|

trading profile and preferences.

On the chart, the market has formed a narrow horizontal channel at the beginning of a trading day and during the Asian session. Then, it broke the upper border of the channel, creating the opportunity to use Box 19.2 and to enter the market in the direction of the break for a quick and rela- tively moderate profit. For a more conservative trader who did not want the risk of entering the market with the position where the profit should be taken fast, there was another opportunity to enter the market. In accor- dance with another trading scheme (see Box 18.3), you can enter the mar- ket because it was moving in just one direction from the open price. If this trading opportunity was also considered an inappropriate one at the mo- ment, another trading opportunity would arise soon. Entering the market on the break of the low of the previous range was recommended in accor- dance with four (!) other different templates, Box 19.1, Box 18.2, Box 20.4, and even Box 18.1.

FIGURE 21.1

Then, the journey began, confirming several other thoughts and ideas described in the book.

First of all, on the way down, the market has formed at least three flat bottoms, and each of them was a clue for a trader that the move in this di- rection most likely would continue.

Second, as you can see, the idea of never opening a position against the main move of the day has also been confirmed, because the bottom pickers most likely were wiped out from the market by its powerful move. Because no major support or trendline was on the markets way during this day, a trade against the main move of the day would never pay off. It is important to remember that under similar circumstances it is usually very difficult (even close to impossible) to choose the right moment when the market may turn to the opposite direction. If you missed all the previous trading signals and opportunities, it would be better to stay away from the market, waiting for another trading day, than to take chances on picking a bottom without having a trading signal in favor of such an attempt.

Third, it is not really important where a position was entered and profit was actually taken. In any case, if during that day the trading strat- egy has been chosen in accordance with one or another template, the profit was unavoidable and would have ranged from 70 to 80 pips and up

A Sample Trade 209

to a couple of hundred pips. However, the real importance of the example is the fact that this particular trading day can be considered as typical for the market. Its behavioral pattern was a common one and seen frequently (with some unimportant variations, of course). Using the templates pro- vides a perfect opportunity to trade with no stress, and without the neces- sity of predicting the future or making forecasts in advance. A simple reaction in accordance with trading signals and basic techniques de- scribed in trading templates would do the job perfectly and would give a trader a great advantage against any other way of trading.

Index

Account size, requirements for, 1617

Account size, requirements for, 1617

Amplitude of day range, profit taking based on, 128129

Ascending channel, 8486

Ascending trendline, 7783

Asian trading session, opening position during, 122

Attitude toward market, philosophical conception of, 3031

Automatic order execution, 120

Automatic position entry, 120

Average daily trading range templates,

148157

Averaging trading techniques, 99101

Bank of Japan (BoJ), 141

Barings Bank, 101

Behavior of the market. See Market behavior

Black and gray boxes, 40

Break of trendline, 79. See also False break

good move after, 80 no, 7980

Bridge/CRB, 4

Broker company vs. Bucket shop, 21

Bucket shops, 2022

Buy ahead of a support and Sell ahead of a resistance, 118

Buy low, sell high formula, 6264

Capital: reserve, 99 trading, 811

Central Bank (CB):

trading strategy and intervention of,

141144

undervalued currency and intervention of, 204205

Channel:

ascending, 8486 descending, 8486 horizontal, 87, 164169 inclined, 170175

Chart:

bearish divergence of, 6061

Japanese candlesticks, 4849 point and figure, 4849

Client abuse, 20

Closing price, 6466

Comb formation, 160163, 191,

194195

on daily chart, 192193

on USD/DEM daily chart, 7374

Commissions for transaction, 1819

Common sense trading technique, 51,

Contract size, 910, 16, 130131

Currency:

choosing a pair to trade, 9596 daily trading range and, 5667 oscillation of, 8

undervalued, 204205

Current intermediate-term trend, 68

Current longer-term trends, 67

Cycles, in market activity, 135140

Daily chart:

analysis of, 72

comb formation on, 192193

flat surface formation on, 196197 gaps on, 7273

USD/DEM, comb formation on,

7374

Daily trading range, 5658 average, templates for, 148157

Data feed, 4

Dealer-customer relationships, 20

Dealers choice:

bucket shops and, 2022 commission payment in, 1819 contract size in, 16

margin value and leverage in,

1516

on-line trading opportunity in, 18 operation account size in, 1617 recent industry developments and,

2223

spread size in, 17

stop and limit orders terms in, 17

Decisions, impulsive, traders and, 29

Descending channel, 8486

Descending trendline, 7783

Diamond formation, 180181 potential, 182183

Discrete-systematic trading, 31

Discretionary methods vs. mechanical trading systems, 3336

Double bottom formation, 42

Double top (bottom) formation, 89

Double top formation, 42

Double (triple) top (bottom) formation,

188189

Dow retracement theory, 47

Dummy trading, 45, 62

Elliott Wave Theory, 4647

End-of-the day analysis, 6674

End-of-the-week analysis, 6674

Entry stop order, 78, 120, 134

European trading session, opening position during, 122

EUR/USD chart:

downtrend on, 65

70-pip ranges on, 56

False break:

of trendline, 78, 8083

of triangle formation, 9192

Fibonacci lines, drawing, 69, 71

Flag formation, 93

Flat surface formation, 196, 198199

FOREX market. See also FOREX

trading

dealer-customer relationships, 20 formations in, 72

specifications of, 7 trends of, 6364 volatility of, 6263

FOREX trading:

recent industry developments of,

2223

speculative trade on, 54

Formations. See Technical formation(s) Fundamental analysis, advantages and

disadvantages of, 3840

Gaps on daily charts, 7273

Getting started:

dummy trading, 45

information, data feed, and technical support, 4

overview of, 34

Good move after trendline break, 90

Gunn analytical method, 46

Head and shoulders (H&S) formation,

42, 8789 inverted, 69, 88, 186 potential, 184185

Hit-and-run technique, 117, 126

Horizontal channel, 87, 164169

Horizontal supports and resistances, 68

H&S. See Head and shoulders (H&S)

formation

Igrok method:

basic trading strategies and techniques, 7793

choosing currency pair to trade, 9596 entering the market, 117123 evaluating probabilities using

technical analysis, 5975 exiting the market, 125131 importance of timing, 133140 intraday trading plan principles,

113115

market behavior and trader discipline,

103109

money management rules and techniques, 97102

philosophy of, 5358

trading strategy during Central Bank intervention, 141144

Impulsive decisions, traders and, 29

Inclined channel, 170175

Indicators, 4346, 69

Informative services, 4

Intermediate-to-long-term trend, 6769

Internet trading, 18

Intraday chart, 73, 87

comb formation on, 194195

flat surface formation on, 198199

Intraday trade/trading:

advantages of, 112

money management and, 98 planning for, 113114

rules and techniques of stops placing,

114115 template, 145146 timing and, 135

trading activity of, 117

Inverted head and shoulders formation,

69, 8889, 186187

Japanese candlesticks charts, 4849

Legal issues, 20

LIBOR rates, 18

Limit orders, terms of, 17

Line-on-close chart (line chart), 69

Liquidation:

position, 125, 129132

of profitable position, 122 of unprofitable position, 98

Longer-term market analysis, 67

Long position, 5556, 84, 118

Long-term analysis, 4

Long Term Capital Management, 101

Loss:

averaging and, 99101

in broken trendline, 8081

central bank intervention and, 141 correcting, 98

in false break trendline, 8182 in no break trendline, 79 potential, calculating, 120 recovery from, 30

in triangle and triangle like formations, 9192

MACD, 69

Margin, 13, 1516

Market. See also Market behavior; Market movement

approaching major trendline, 200201 breaking trendline, 202, 204 characteristics of, 133135

choosing entry point to, 117118 constant motion of, 5556

cycles, 135140

drifting in one direction only, 150153 drifting up and down on both sides,

148149 emergence of, 78

entry timing rules, 118123

in false break trendline, 78, 8083 forming daily trading range, 5658 forming 80100 pips day range,

154155

forming specific formation on daily chart, 192193

making intraday high or low, 156157 paradoxes of predicting, 3840

profit-taking and speeding of, 126127 trader unprofitable position and,

9899

Market behavior:

discipline of trading and, 109 model of the market, 104105 predictability of the market, 105106 recommendation to beginning trader,

speculative trader and, 104 traders attitude and, 107109

Market movement:

directions of, 5354

new open position and, 119120 opening position against, 115, 121, 122 placing stop-loss order, 142

traders and, 30

Mechanical trading systems, discretionary methods vs.,

3336

Methods of definition, false breaks and,

Model of the market, 104105

Money management: averaging and, 99101 capital reserve and, 99 in false breaks, 82 overview of, 9798

restricting loss and, 9899 risk/reward ratio and, 101102 tactics and strategy in, 98

Money market, 53, 54

Murphy, John, 40

Neckline, 42

New York trading session, opening position after, 122123

No break of trendline, 7980

OHLC chart. See Open-high-low-close bar (OHLC) chart

Omega SuperCharts (end-of-day)

software, 6769

Online trading, 5, 18

Open-high-low-close bar (OHLC) chart,

Opening price:

market drifting in one direction only and, 150153

market drifting up and down from,

148149

Open position:

during Asian trading session, 122 at the break of neckline, 97

choosing an entry point and, 117118 against current market movement,

115, 121

against major market move, 122123 in market movement direction, 120 position liquidation and, 129132 profit-taking and, 125126 risk/reward ratio and, 101102

rules for, 117

Orders, stop and limit, 17

Overtrade risk, 11

Patterns, 4243

Point and figure chart, 4849 Postponed stops, 115

Potential diamond formation, 182183

Potential head and shoulders formation,

184185

Potential triangle formation, 178179

Precise borders formations, 93

Price:

closing, 6466 opening, 6466

Price level, opening positions and,

Probability evaluation technique,

5961

Profit, 55

in broken trendline, 8081

central bank intervention and fixing of, 144

exiting the market and, 125132 in no break trendline, 79 recommendation concerning, 109 in triangle and triangle like

formations, 9192

Profit/loss ratio, 101102

Protective stop, placing, 120

Psychological challenges of speculative trading, 2732

Quantum Fund, 101

Random position, 55

Recovery from losses, traders and,

Rectangle formation, 93

Reserve, capital, 99

Resistance, 118 horizontal, 68

Retractment Theories, 3

Reverse position, 129132

Risk/reward ratio (RRR), 84, 101102

Risks:

determining limits, 1113 overtrade, 11 undercapitalization, 811

Rounded top (bottom) formation,

RRR. See Risk/reward ratio (RRR) RSI, 69

Safe short trade, 122

Sell on weakness, buy on strength

formula, 6264

Sell position, 78

Short position, 5556, 84, 118

Short-term trading, 111 template, 145146

Shoulders formation. See Head and

Shoulder (H&S) formation

Side trend market movement, 5354

Software, 6769

Speculative trade/trader:

choice of currency for, 9596 on FOREX, 54

market and, 104106

money management and, 97 psychological challenges of, 2732 strategy and tactics of, 57

Spread size, in dealer selection, 17

Statistical analysis, 6264

Statistics, trading systems and, 36

Stochastics, 69

Stop and reverse position, 84

Stop-loss order, 143

Stop order, terms of, 17

Stops:

broken trendline and, 80, 81 channels and, 84

entry, 78

in inverted head and shoulders, 89 market technical levels and, 99 placing, rules and techniques of,

114115 postponed, 115

Storage fees, 18

Strategy and tactics:

of money management, 98 of speculative trade, 57 trading, 31, 51, 121

of trading in intervention of central bank, 141144

Stress factor, traders and, 2728, 31,

Substitution, 96

SuperCharts (Omega Research), 4

Support, 118 horizontal, 68

Support and resistance templates.

See Trendline

Support and Resistance Theory, 3,

Technical analysis, 3

advantages and disadvantages of,

4042

evaluating probabilities using,

5975 philosophy of, 53 theories of, 4647

Technical formation(s), 68. See also

Channel

diamond formation, 180181 potential, 182183

double bottom formation, 42 double top (bottom) formation, 89 double top formation, 42

double (triple) top (bottom)

formation, 188189 flag formation, 93

head and shoulders formation, 42,

8789, 186

inverted, 69, 8889, 186 potential, 184185

potential diamond formation, 182183 potential triangle formation,

178179

rectangles formation, 93 rounded top (bottom) and

V-formation, 93 templates, 159189

triangles and triangle-like formation,

4142, 8993, 176177 potential, 178179

Technical support, 4

Templates, 145146

average daily trading range,

148157 sample trade, 146

short-term trading, 145146 technical formation, 159189 trendlines, support, and resistance,

191205

Tiger Fund, 101

Timing:

importance of, 133135 market cycles and, 135140 profit-taking and, 128

rules for market entry, 118123

Trader(s). See also Speculative trader; Trading

beginning, recommendation to,

broken trendline and, 8081 choosing right dealer, 1323 discretionary vs. mechanical trading

systems, 3336 establishing an account, 713 false break trendline and, 8083 getting started, 35

groups of, 37

impulsive decisions of, 29 intraday trading plan, 113115 market recommendations for, 108 market relationship and, 29 mistakes of, 106

money management and, 98102 in no break of trendline position,

profit recommendations for,

psychological challenges of speculative trading, 2732

reaction of, 54

recovery from losses, 30

Trade sample, 207209

Trade templates, guide to, 146

Trade theory, preparation on, 3

Trading. See also Intraday trading; Online trading; Short-term trading; Trading account; Trading method, developing

averaging trading techniques in,

99101

based on ascending and descending trendlines, 7783

based on channels, 84, 87

based on other technical formations,

8791, 93

capital, insufficient, 811 cycle, 84

discipline of, 109 discrete-systematic, 31 dummy, 45, 62

importance of timing in, 133140

Internet, 18

strategy of, 31, 141144

Trading account:

about, 78

determining risk limit, 1113 overtrade risk, 11

size of, 1617

terms of opening, 22 undercapitalization risk, 811

Trading method, developing. See also Fundamental analysis; Technical analysis

discretionary vs. mechanical trading systems, 3336

psychological challenges of speculative trading, 2732

Trading range, daily, 5658

Transaction execution, opening new position and, 118119

Trendline. See also Break of trendline ascending, 7783

descending, 7783 drawing, 6869

major, market approaches, 200201 market breaking, 200, 202

no break, 7981

support, and resistance templates,

191205

Triangles and triangle-like formations,

4142, 8993, 176177 potential, 178179

Uncertainty, traders and, 29

Undercapitalization risk, in trading, 811

Undervalued currency, 204205

Uptrend sample, 65

USD/CHF daily chart, 60

USD/DEM chart:

daily, comb formation on, 7374 medium-term local trends on, 74 monthly, bullish triple divergence,

USD/JPY daily chart, double bottom formation on, 42

USDX, unfilled gap on daily chart, 72

V-formation, 93, 126

Virtual dummy trading, 5

Weekly chart: analysis, 6772 cable on, 43

Wishful thinking: avoiding, 107 traders and, 2829

Date: 2015-12-17; view: 1349

| <== previous page | | | next page ==> |

| Technical Formation Templates | | | Carbohydrates - Sugars and Polysaccharides |