CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

And risk warnings, and advice to

avoid them:

From the day opening during the Asian session, the market was drifting slowly in only one direction from the open price at a distance 40 to 60 pips without forming any specific pattern.

USD/CHF, USD/JPY, EUR/USD, EUR/JPY and other Euro crosses.

Basic (conservative).

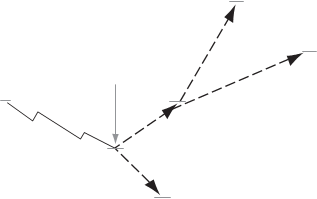

Take a position in the direction of the move on the break of the opposite side of the range:

A. Buyon the break of the previous range as soon as the market reaches the top and makes a new high directly after forming the bottom of the range,

OR

B. Sellon the break of the previous range as soon as the market reaches the bottom and makes a new low directly after forming the top of the range.

European or NY session. Entry-stop order.

On the opposite side of the range. (Above the previous day high or below the previous day low.)

Recommended. (Automatic and simultaneous with stops.) Average daily range (P1)End of the day (P2)

50 to 100 pips

Average to High

Average to Low

Neutral to Positive

The position was open The position was open The market broke in the direction of the in the direction of the an important medium-term trend. main move of the trendline, support

previous day. or resistance.

RW#1:The position was A#1:Move your stops closer and place open against the direction them above (below) the previous local of the medium-term trend. extreme formed the same day.

RW#2:The position was A#2:Same as above. open against the main

move of the previous day.

RW#3:The market has A#3:Accept the risk.

formed a “flat surface”

on the opposite side of

the range.

Stop

Open

Average daily range

Sell

P2

P1

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.2a

FIGURE 18.2a

P1

P2

Average

daily range

Open

Buy

Stop

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.2b

FIGURE 18.2b

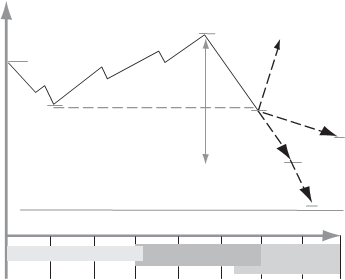

| Brief situation description: | From the day opening during the Asian session, the market was drifting slowly in only one direction from the open price at a distance 40 to 60 pips without forming any specific pattern. | ||||||||

| Currency recommended for a trade: | Cable, USD/CHF, USD/JPY, EUR/USD, EUR/JPY and other Euro crosses. | ||||||||

| Trade characteristics: | Optional (risky). | ||||||||

| Trade (entry point) suggestions: | Take a position in the opposite direction of the move and toward the open price of the day. | ||||||||

| Entry time: | A.End of the Asian session—beginning of the European session; OR B.As soon as the range of 40 to 60 pips is formed, but not later than 2 to 3 hours into the European session. | ||||||||

| Entry execution: | Market order. | ||||||||

| Stop loss placed: (Can be chosen in accordance with a trader’s individual situation and preferences. Money management principles must apply.) | 50 pips from the position opening price. | Below the nearest obvious support or above the nearest resistance. | Above the previous day high (below the previous day low). | Behind the nearest major trendline (if applied). | |||||

| Reverse if stops triggered: | Not recommended. | ||||||||

| Target (custom choice): | The day open price (P1) | Average daily range (P2) | End of the day (P3) | ||||||

| Potential profit estimation: | 50 to 160 pips | ||||||||

| Profit probability evaluation: | Average to Above average | ||||||||

| Risk evaluation: | Below average to Average | ||||||||

| P/L ratio: | Neutral to Positive | ||||||||

| Potential advantages in favor of the open position: | A flat surface on the opposite side of the range is formed. | Common gaps near the day open price are formed. | The main move of the previous day was in the same direction as your position is. | ||||||

| Possible complications, disadvantages, and risk warnings, and advice to avoid them: | RW#1:The position was open against the direction of the medium-term trend. RW#2:The position was open against the main move of the previous day. | A#1:Take profit at the day open price. A#2:Take profit at the day open price. | |||||||

| Additional notices, recommendations, and trading tips: | If the market after a position was open comes to the day open price, you can move your stops closer and place them right on the opposite side of the range. In this case, the target to take profit can also be moved further and placed at the end of the day or at average day range. | ||||||||

Stop

Stop

Sell

Open

P1

Average daily range

P3

P2

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.3a

P2

P2

P3

Average

daily range

Open

P1

Buy

Stop

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.3b

FIGURE 18.3b

| Brief situation description: | The market has formed the day range 80 to 100 pips by the end of the European session—beginning of the NY session. Now it’s closer to the end of the range, which is opposite to the previous day’s main move direction (or the medium-term trend direction) after going all the way from the opposite side of the range. | |

| Currency recommended for a trade: | USD/CHF, USD/JPY, Cable, EUR/USD, EUR/JPY and other Euro crosses. | |

| Trade characteristics: | Trade of opportunity. | |

| Trade (entry point) suggestions: | Open a position in the direction of the main move of the previous day (or the medium-term trend) at 30 pips ahead of the day high or low. | |

| Entry time: | Very late European session and/or NY session. | |

| Entry execution: | Entry-stop order. | |

| Stop loss placed: | At the closest side of the range. | |

| Reverse if stops triggered: | Recommended with automatic entry-stops. | |

| Target (custom choice): | Average daily range (P1) | End of the day (P2) |

| Potential profit estimation: | 100 to 140 pips | |

| Profit probability evaluation: | Average | |

| Risk evaluation: | Below average | |

| P/L ratio: | Positive | |

| Potential advantages in favor of the open position: | N/A | |

| Possible complications, disadvantages, and risk warnings, and advice to avoid them: | N/A | |

| Additional notices, recommendations, and trading tips: | If the stops were triggered before the profit is taken, there is a good probability to cover the initial loss within the same trading day. |

High

Stop and reverse

Open

Sell

Average daily range

Low

P2

P1

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.4a

FIGURE 18.4a

Average daily range

P1

P2

High

Buy

Open

Low

Stop and reverse

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.4b

FIGURE 18.4b

| Brief situation description: | The market makes a new intraday high or low after going all the way from the opposite side of the intraday range. At this moment the range is 2/3 or more of the size of an average daily range. Just 3 to 5 hours or less are left till the end of the trading day. | |||

| Currency recommended for a trade: | USD/CHF, EUR/USD, EUR/JPY and other Euro crosses. | |||

| Trade characteristics: | Basic (conservative). | |||

| Trade (entry point) suggestions: | Enter a position in the direction of the move on the break of the previous intraday high or low. | |||

| Entry time: | Late NY session. | |||

| Entry execution: | Entry-stop order. | |||

| Stop loss placed: | On the other side of the previous range. | On the previous intraday swing top/bottom. | ||

| Reverse if stops triggered: | Recommended with automatic entry-stop. | Cautiously recommended. | ||

| Target (custom choice): | Average daily range (P1) | End of the day (P2) | Major trendline, support or resistance (P3) | |

| Potential profit estimation: | 30 to 60 pips | |||

| Profit probability evaluation: | Very high | |||

| Risks evaluation: | Very low | |||

| P/L ratio: | Negative | |||

| Potential advantages in favor of the open position: | N/A | |||

| Possible complications, disadvantages, and risk warnings, and solutions to avoid them: | N/A | |||

| Additional notices, recommendations, and trading tips: | N/A | |||

Resistance P2

Resistance P2

P1

High

Buy P3

Open

Average daily range

Low

Stop

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.5a

FIGURE 18.5a

High

Stop

Open

Average daily range

Low Sell

P2

P1

Support P3

Asian session European session NY session

21 0 3 6 9 12 15 18 21

GMT

FIGURE 18.5b

FIGURE 18.5b

CHAPTER 19

Date: 2015-12-17; view: 1073

| <== previous page | | | next page ==> |

| Average Daily Trading Range Templates | | | Technical Formation Templates |