CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

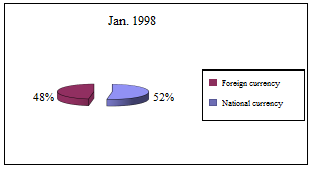

The total deposits ratio in national and foreign currency in 1998

* Source: Statistics agency of the Republic of Kazakhstan

On November 1, 1998 the volume of deposits in the banking system reached 77.0 billion tenge, including legal entities, with the exception of banks owned 45.7 billion tenge, and individuals - 31.3 billion tenge. In January and February there was a decrease in deposits in the banking system (10.8%). Excess levels of December last year was only at the end of May (0.4%). The main growth in deposits was observed in the period from March to August (13.3%).

Deposits in the banking system from 1997 to 1998 have decreased by 0.5% to $ 79.8 billion.Deposits in national currency decreased by 18.3% to $ 50.3 billion, in foreign currency increased by 58.3% to 29.5 billion tenge.

Deposits of non-banking legal entities decreased by 6.0% accounted for 49.4 billion, of which the national currency - 29.4 billion (down 28.0%) in foreign currency - 20.0 billion tenge (an increase of 70.2%).

Deposits of the population (including non-residents) increased by 8.8% to 31.3 billion tenge, including in the national currency - 20.7 billion (an increase of 1.3%) in foreign currency - 10.6 billion (an increase of 27.2%).

In the first half of 1998 the inflow of free money people and companies in the deposits of the banking system increased. In January - August 1998 increased deposits in the banking system amounted to 9.9 billion tenge, which is almost two times less than the increase over the same period in 1997

However, in September 1998 increased devaluation expectations, not only contributed to the inflow of deposits in national currency deposits in foreign currency, but also an outflow of deposits from the banking system as a whole. As a result, there was the reduced share of deposits in national currency - from 76.8 to 63.0% and the share of foreign currency deposits from 23.2 to 37.0%.

There has been an increase in the proportion of deposits (including non-residents) in total deposits in the banking system - from 35.9 to 39.2%.

Stage 3 (from 1999 to 2001): This stage of development of the deposit market is characterized by the growth stage. During this period, banks have increased their efforts to raise domestic resources by expanding the supply of banking products (of deposits) and services. Against the backdrop of fierce competition in the deposit market, improved quality of service. The actions were accompanied by active advertising of banks, branch expansion - point of deposit. Also at this stage of market development contributions have been two significant events that contributed to the growth of confidence of depositors in the banking system - is a system of guaranteeing (insurance), term deposits and improvement of legislation on banking secrecy in relation to the accounts of individuals.

As a result of devaluation occurred in 1999, the situation in the deposit market evolved favorably. A deposit in the banking system is characterized by a tendency to increase. Mass withdrawals from deposit accounts and public enterprises did not happen, because the measures of the National Bank have been provided to convert tenge deposits into foreign currency at the rate of 88.3 tenge per U.S. $ 1.

In 1999 the volume of deposits of residents (legal and natural persons) in the banking system increased by 2.1 times (excluding foreign exchange gain - an increase of 75.1%), amounting to 168.9 billion tenge (in dollar terms - a, $ 2 billion).

Deposit amounts in national currency have increased by 74.3% to $ 87.7 billion. Deposits in foreign currency real (excluding exchange rate effects) increased by 66.8% to $ 81.2 billion (587 million dollars at the end of 1998 - 352 million dollars).

In the course of 1999 the growth rate of foreign currency deposits in the main ahead of the growth rate of tenge deposits. This was due to increase in devaluation expectations entities deposit market, since a significant reduction in the exchange rate, natural and legal persons, and mostly preferred to foreign currency deposits. Moreover, the revaluation of foreign currency deposits also increased in the last Tenge. As a result, the share of foreign currency deposits in total deposits during the year rose from 48 percent to 56 percent.

Date: 2015-12-11; view: 3093

| <== previous page | | | next page ==> |

| The main stages in the development of the deposit market in the Republic of Kazakhstan. | | | The total deposits ratio in national and foreign currency in 1999 |