CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Business finance

Capital

When people want to set up or start a company, they need money, callcd capital. Companies can borrow this money, called a loan, from banks. The loan must be paid back with interest: the amount paid to borrow the money. Capital can also come from issuing shares or equities - certificates representing units of ownership of a company. (See Unit 29) The people who invest money in shares are called shareholders and they own part of the company. The money they provide is known as share capital. Individuals and financial institutions, called investors, can also lend money to companies by buying bonds - loans that pay interest and are repaid at a fixed future date. (See Unit 33)

Money that is owed - that will have to be paid - to other people or businesses is a debt. In accounting, companies' debts are usually called liabilities. Long-term liabilities include bonds; short-term liabilities include debts to suppliers who provide goods or services on credit - that will be paid for later.

The money that a business uses for everyday expenses or has available for spending is called working capital or funds.

BrE: shares; AmE: stocks BrE: shareholder; AmE: stockholder

Revenue

All the money coming into a company during a given period is revenue. Revenue minus the cost of sales and operating expenses, such as rent and salaries, is known as profit, earnings or net income. The part of its profit that a company pays to its shareholders is a dividend. Companies pay a proportion of their profits to the government as tax, to finance government spending. They also retain, or keep, some of their earnings for future use.

dividends

revenue

share capital

Y

| capital | company | profits |

t

tax

debt (bonds and loans)

retained earnings

expenses

Financial statements

Companies give information about their financial situation in financial statements. The balance sheet shows the company's assets - the things it owns; its liabilities - the money it owes; and its capital. The profit and loss account shows the company's revenues and expenses during a particular period, such as three months or a year.

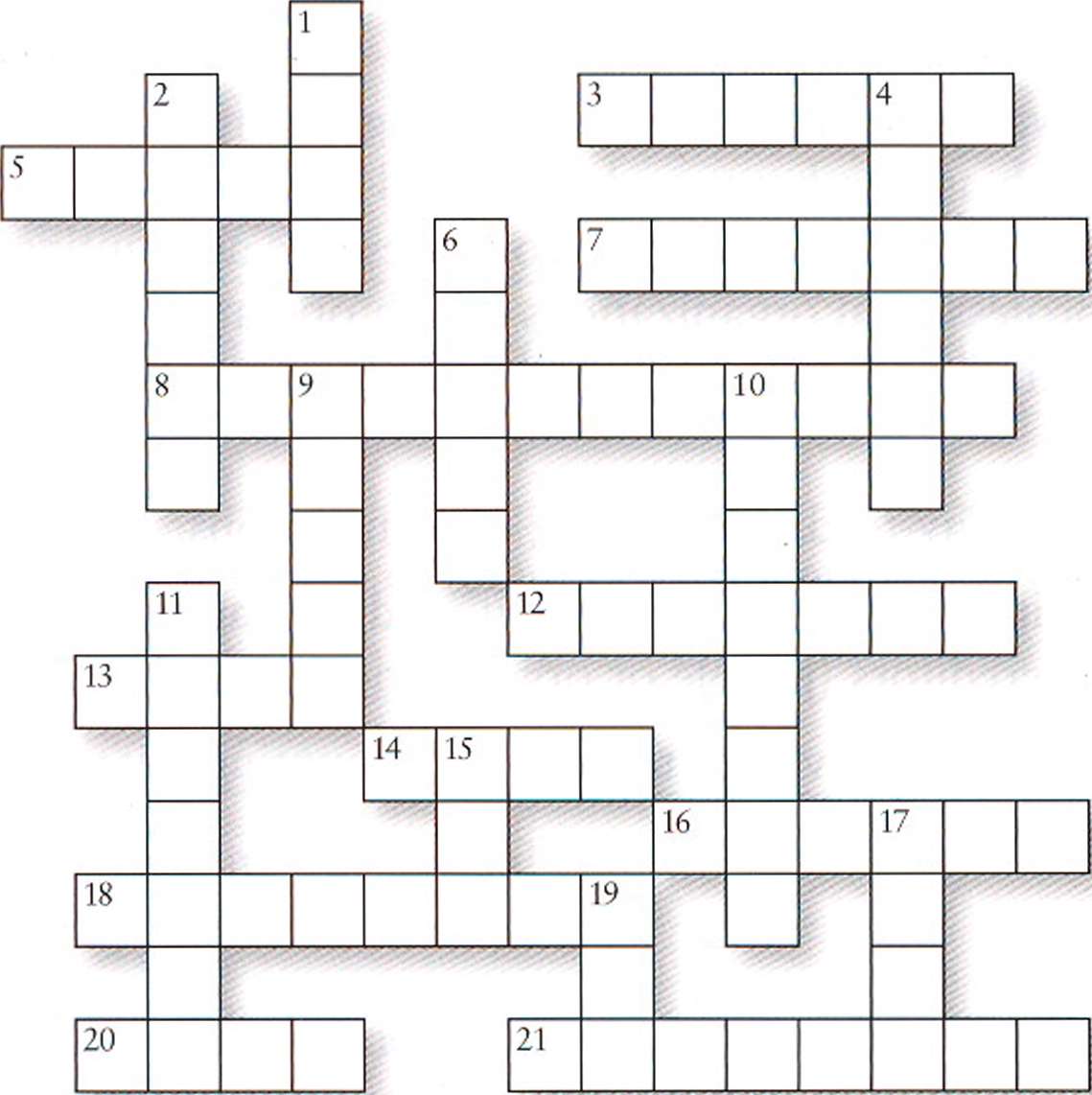

Complete the crossword. Look at A, B and C opposite to help you.

Across

3 Small companies often try to get bank loans when they need to money. (6)

5 We don't have sufficient............. to build a completely new factory. (5)

7 and 6 down Details of a company's liabilities are shown on the............................................................ (7,5)

8 We're going to raise more money by selling new shares to our existing............................................... (12)

12 We had to raise ˆ50,000 ............... in order to start the business. (7)

13 We're going to pay back some of the people who lent us money, and reduce our........................ (4)

14 1 decided to buy a $10,000 .............. instead of shares, as it's probably safer. (4)

16 Another term for profit is net................. (6)

18 I think this is a good investment: it pays 8%.... (8)

20 When they saw our financial statements, the bank refused to us any more money. (4)

21 Profit is the difference between revenue and.. (8)

Down

The profit and............... account shows if a company is receiving more money than it's

spending. (4)

If you don't like taking risks, you should only in very successful companies. (6)

4 A company's retained earnings belong to its..... (6)

6 See 7 across.

9 Anything a company uses to produce goods or services is an.. (5)

10 The company made such a big profit, I expected a higher .(8)

11 We sold a lot more last year, so our went up. (7)

15 We............ our suppliers $100,000 for goods bought on

credit. (3)

17 Everyone who buys a share.............. part of the company. (4)

19 Thirty per cent of our profits goes straight to the government in............... (3)

Think of the company you work for, or one that you are interested in. How was it financed when it was set up, and how is it financed now?

Ov&r +o Upu

"It's been a great year - let's hope we can keep the shareholders from finding out."

Date: 2015-02-28; view: 9488

| <== previous page | | | next page ==> |

| Money and income | | | Accounting and accountancy |