CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

How the Price System Answers the What, How and Who Questions

Supply and demand are important because the American economic system is largely price-directed. That is, when supply and demand operate freely, prices answer the What, How, and Who questions.

What Goods and Services Will Be Produced.

The demand for an item can be described in a demand schedule or demand curve. Since producers are in business to earn profits, their decisions will depend on their ability to earn a profit at prices consumers are willing to pay and at quantities they will buy. If consumer demand increases, more items will be provided at higher prices. If demand decreases, the opposite will occur.

Of course, producers can ignore consumer demand. But those who produce goods to sell at prices consumers are unwilling to pay will suffer financially. So will those who produce less than they might have sold at the market price.

How Goods and Services Will Be Produced.

The market system answers the How question by rewarding those who reduce their production costs and punishing those who do not. The following example illustrates this point.

Annamayshunn Inc. manufactures computer game cartridges that wholesale for $15 through computer stores and other outlets. At the present time, the company relies exclusively on hand assembly, and its production costs average $12 per unit.

Recently, Annamayshunn Inc. purchased a robot that could reduce the amount of labor needed to assemble cartridges. The company's engineers calculated that the machine will help the firm lower production costs by 25 percent to $9 per unit.

Can you see why Annamayshunn Inc. decided to invest in new equipment? With production costs at $9, the company will double its profits from $3 to $6 per unit at the current market price.

Even if the price should fall, Annamayshunn's reduced costs will allow it to sell its goods at a lower price. For example, suppose that other game manufacturers also enter the market and the supply of games increases. An increase in supply usually reduces market price and, sure enough, the price of cartridges falls from $15 to $12 per unit.

Annamayshunn can still operate profitably at the new market price. If it had not invested in new equipment, it might have gone out of business.

Who Will Receive the Goods and Services That Are Produced? Market prices provide a means of rationing the economy's scarce resources. That is, they help determine who will receive goods and services and who will not.

Table 3-14 contains a demand and supply schedule for CDs in a very small town. In this market there are 12 buyers and 12 sellers, each of whom would like to either buy or sell one CD. According to the table, equilibrium falls at a market price of $12, where 6 CDs will be sold.

But if only 6 CDs were actually sold, then 6 buyers went home empty-handed. How did the market make its rationing decisions? Which buyers got to own a CD?

The buyers who purchased CDs were the 6 willing to pay $12 or more for the item. Those who did not buy a CD were the 6 who set $9 or less as their limit.Those who sold CDs were the 6 willing to take $12 or less for the item. Those unable to sell their CDs were the 6 who set $15 or more as their lowest selling price. In this way the market decided who would get to buy and sell the CDs and who would not.

In some cases government price controls keep the market from working smoothly. When that happens, either shortages or surpluses develop. When prices are set below the market price, for example, there will be more buyers than sellers and some other way needs to be found to determine who will receive goods or services.

Consumers may be forced to wait in long lines to buy the goods they need, or the government may establish a rationing plan as the U.S. did during World War II.

Market economies are directed by prices. As the price of an item rises, sellers are encouraged to increase production, and consumers are discouraged from purchasing the item. When the price falls, the opposite is true. In this way prices send out "signals" to buyers and sellers, keeping the economy responsive to the forces of supply and demand.

In a free market economy, prices are determined by the interaction of the forces of supply and demand. Demand is the quantity of goods or services that buyers would purchase at all possible prices. Demand varies inversely with price. That is, at a higher price fewer items would be bought than at a lower one. The degree to which price changes affect demand will depend upon the elasticity of demand for a particular item.

Supply, which is the quantity of goods or services that sellers would offer for sale at all possible prices at a particular time and place, varies directly with price. So, at a high price, more goods and services will be offered for sale than at a low one, and vice versa.

The price at which goods and services actually change hands is known as the equilibrium—market— price. It is the point at which the quantity demanded exactly equals the quantity supplied. Market price can be represented graphically as the point of intersection of the supply and demand curves.

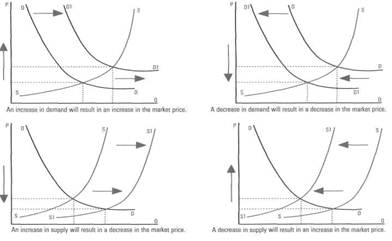

Shifts in demand or supply will affect market price. When everything else is held constant, an increase in demand will result in an increase in market price, and vice versa. Similarly, an increase in supply will result in a decrease in price, and vice versa.

The History of Economic Thought

Alfred Marshall (1842-1924)

Price Theory Pioneer

The topics discussed in this chapter are from the writings of the great English economist Alfred Marshall. His textbook, Principles of Economics (1890), and the doctrines that it discussed became the standard for teaching economics until the 1940s. Marshall spent most of his career as a professor of economics at Cambridge University. His most famous pupil, John Maynard Keynes, described Marshall as "the greatest economist of the 19th century." Interestingly, Keynes became the most influential economist of the 20th century.

Marshall is best known for the order that he made out of the theories of the earlier "classical economists" like Adam Smith, David Ricardo, and John Stuart Mill. ("Classical" is the name modern economists give to the theories of those whose views were most widely held during the 75 years following the publication of Adam Smith's The Wealth of Nations.) Although 100 years have passed since Principles was published, his analysis of market forces is still used to explain economic events. In Marshall's world, economic events could be explained in terms of the equilibrium market price resulting from the interaction of supply and demand. One of Marshall's lasting contributions was differentiating between supply and demand in the short run and the long run. Comparing the two forces to the blades of scissors, he argued that neither could function without the other. But, just as one blade can be more active than the other (depending on how the scissors are held), so supply and demand vary in importance in the long and short run. In the short run, the quantity of available goods is more or less fixed (because crops have been planted, production schedules set, etc.). Therefore, it is the demand for those items that will most influence their price. But in the long run, he said, the opposite is true. Both farmers and businesses can add to or reduce their production facilities as needs dictate. In that way the supply side of the market most influences price.

Date: 2015-02-16; view: 2263

| <== previous page | | | next page ==> |

| The Effects of Changes in Demand and Supply | | | Assumptions |