CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

THE BENEFITS OF DIVERSIFICATION

Market participants hold combinations of different financial assets rather than one asset to take advantage of diversification. Diversification is the allocation of surplus funds to more than one financial instrument in order to reduce risk.

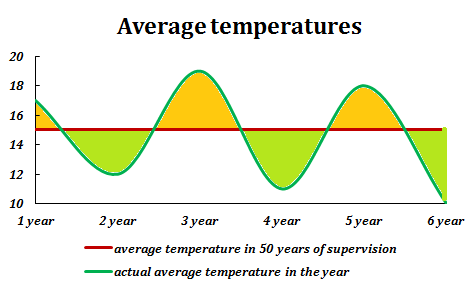

Suppose there are two companies – SwimmingPools Inc. and SkiResorts Inc. – which issued stocks with perfectly negatively (inversely) correlated return. For example, SwimmingPools pays 16 percent dividends each year when environment temperatures are above average and zero percent in other years, while SkiResorts pays the same 16 percent dividends each year when temperatures are below average and doesn’t pay dividends in other years. Imagine that a half the time the temperatures are above average and a half the time they are below average.

The graphical treatment

It means that the expected return to holding either stock is 8 percent, but the risk (or probability of losses) is extremely high due to fluctuation of return from zero to 16% (the income can be received only in case of favourable outcome).

Dividends payments

| 1 year | 2 year | 3 year | 4 year | 5 year | 6 year | |

| SwimmingPools Inc. | 16% | × | 16% | × | 16% | × |

| SkiResorts Inc. | × | 16% | × | 16% | × | 16% |

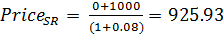

Fluctuation of return results in changes of stocks’ prices. When the price of one increases by a certain percent, the price of the other decreases by the same percent.

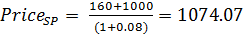

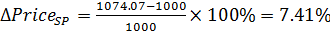

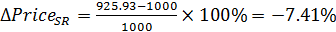

For example, if the expected price of each stock in a year is 1000 ˆ and it predicted abnormally warm weather, for one-year period of holding we can expect following changes in the stock prices:

But if an investor distributed his surplus funds equally between two companies he has guaranteed return of 8% in form of dividends every year.

Let’s illustrate it with the following table:

| possible outcomes | probability | expected return to owner (weighted average) | risk per unit of return[2] | |

| SwimmingPools Inc. | 16% | 50% | 0.16×0.5+0×0.5=0.08 | 100% |

| 0% | 50% | |||

| SkiResorts Inc. | 16% | 50% | 0.16×0.5+0×0.5=0.08 | 100% |

| 0% | 50% | |||

| Diversified Portfolio | 8% | 100% | 0.08×1=0.08 | 0% |

There are no fluctuations in revenue

At the same time the decrease in price of one share is fully compensated by the growth in price of other share. The value of the portfolio is invariable.

In discussed case risk has been eliminated because the returns to the two assets were perfectly inversely correlated. But in the real world, returns are usually not perfectly correlated (directly or inversely), meaning that the prices of the two stocks usually do not always change by the exact same percent. In such case risk can be reduced for any given expected return but not eliminated through diversification in full.

Date: 2014-12-22; view: 1626

| <== previous page | | | next page ==> |

| THE PRICE OF COMMON STOCK | | | INFLUENCE OF EXPECTED RATE OF RETURN ON STOCK AND BOND PRICES |