CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Petroleum and Petroleum Products Wholesalers in Nigeria

Marketing and Distribution

Distribution and marketing of fuels and lubricants products is undertaken by 5 international companies - Agip, Elf, ExxonMobil Nigeria, Texaco Nigeria and Total Nigeria - and 3 domestic companies - African Petroleum, 40% owned by NNPC, (formerly BP who were ejected by the Nigerian government in 1979 for allegedly breaking the oil boycott against apartheid South Africa), National Oil (owned 40% by NNPC, 40% by Shell and 20% by private shareholders) and Unipetrol Nigeria (40% owned by NNPC). Total Nigeria, Mobil Producing Nigeria, African Petroleum and National Oil are all separately listed on the Nigerian Stock Exchange. There are also some 750 other marketing "independents" who are licensed by NNPC to market petroleum products. Of the total market, the three domestic companies hold a 30% market share and 45% of the market excluding the independents. The independents have a market share of approximately 36% with General Oil being the leading independent marketer. Although NNPC is not engaged directly in the marketing of refined products, it has substantial ownership in all of the marketing companies and therefore is involved along the whole downstream chain.

Distribution Infrastructure

Refined petroleum products are transported from the refineries through pipelines, coastal (marine) vessels, road trucks and rail wagons to the 21 regional storage / distribution depots, spread across the country, from where the marketing companies obtain their supplies. These distribution depots, with a total capacity of 1,422,000 cubic metres, and the transportation system are owned and managed by NNPC through its subsidiary, the Pipelines and Products Marketing Company Limited (PPMC). The depots are linked to the refineries and port terminals by a 3,001 km network of pipelines in five systems.

In November 2004, the World Bank approved a $125 million in investment guarantee for construction of the West African Gas Pipeline (WAGP), which will deliver 140 MMcf/d of natural gas to power stations in Ghana beginning in December 2006. The Multilateral Investment Guarantee Agency (MIGA) will provide $75 million of the total, while the International Development Association (IDA) will provide the additional $50 million. The $590 million, 420-mile pipeline will carry natural gas from Nigeria to Ghana, Togo, and Benin. Its initial capacity, expected to come online in June 2005, will be 200 Mmcf/d. The pipeline is expected to function at a full capacity of 470 Mmcf/d within 15 years. In March 2005, the West African Pipeline Company (WAPCo) contracted Zurich Financial Services (Switzerland) to provide political risk insurance for the WAGP.

According to the EIA Nigeria and Algeria are in discussions over the possibility of constructing a Trans-Saharan Gas Pipeline (TSGP). The 2,500-mile pipeline would carry natural gas from oil fields in Nigeria's Delta region via Niger to Algeria's Beni Saf export terminal on the Mediterranean. It is estimated that construction of the $7 billion project would take six years.

Pricing and Taxation

Since 1973, pricing has been controlled by the government at all levels in the industry. It regulates the transfer prices paid within NNPC and sets product prices at wholesale and retail level. The NNPC subsidiary, Pipelines and Products Marketing Company (PPMC) buys crude oil for the refineries at prices set by the government and then sells the refined products to the marketing companies. Retail prices are heavily subsidised. It is estimated that the government pays an amount of $2.5 billion in subsidies. Consequently, products are considerably cheaper in Nigeria than in neighbouring countries and cross-border smuggling of petroleum products from Nigeria has become a significant factor. Attempts to reduce the subsidy in line with World Bank recommendations met with stiff resistance but were eventually forced through in September 1994.

Companies and Organizations linked to Petroleum and Petroleum Products Wholesalers in Nigeria:

1. African Petroleum Plc

2. Andersoft Energy Nigeria Limited

3. Commodities Exchange Limited

4. Mid-Sea Petroleum Products Ltd

5. Mid-Sea Petroleum Products Ltd

6. National Oil Co. Plc

7. Nomada Limited

8. Oando Plc

9. Afroil Plc

10. Agip (Nigeria) Plc

11. Alpha-Pacific Petroleum (Nig) Ltd

12. Capital Oil Plc

13. Gaslink Nigeria limited

14. Hydrocarbon Services of Nigeria

15. Lenoil

16. Mobil Oil Nigeria plc

17. National Oil

18. Nigerian Petroleum Development Company

19. Oando Supply and Trading

20. Oblanjah Resources Ltd

Other Countries in Africa with Petroleum and Petroleum Products Wholesalers Profiles

| Algeria | Eritrea | Mali | Swaziland | ||

| Angola | Ethiopia | Mauritania | Tanzania | ||

| Botswana | Gabon | Mauritius | Togo | ||

| Burundi | Gambia | Morocco | Tunisia | ||

| Cameroon | Ghana | Mozambique | Uganda | ||

| Cape Verde | Guinea | Namibia | Zambia | ||

| Chad | Guinea-Bissau | Niger | Zimbabwe | ||

| Comoros | Kenya | Rwanda | |||

| Congo | Lesotho | São Tomé and Príncipe | |||

| Côte d'Ivoire | Liberia | Senegal | |||

| Democratic Republic of The Congo | Libya | Sierra Leone | |||

| Egypt | Madagascar | South Africa | |||

| Equatorial Guinea | Malawi | Sudan | |||

14.0 Nigeria and Sub-Regional African Market

As the engine of the economy (93% of the export revenue in 2009), oil has brought joy and tears to Nigeria. Apart from its strategic implications, which explain the vagaries and inconsistencies of the national fuel policy, Nigeria oil is the commodity that has most polarized the regional market, both official and informal.

A. Main features of the Nigerian Oil Sector

While Nigeria’s weight in West Africa stems from the size of its population (approx. 150 million), its power is based on its substantial oil production. With output of around 2 million barrels a day, Nigeria is the leading producer in Africa, the sixth-largest within the Organization of Petroleum Exporting Countries (OPEC) and the tenth-largest in the world.

Since 1971, when Nigeria joined OPEC and embarked in a policy of nationalizing petroleum activities, the oil sector became the country’s main source of foreign currency. In 1999, oil produced 68% of the fiscal revenues. The Nigeria National Petroleum Company (NNPC), founded in 1977, is the cornerstone of the country’s four refineries: Port Harcourt I (the oldest, built in 1963), Warri (1978), and Port Harcourt 2 (1989). However, the management of the oil sector has been little short of chaotic. Despite a theoretical refining capacity of 450,000 barrels/day, the country’s four refineries have never operated at more than 65% of their capacity.

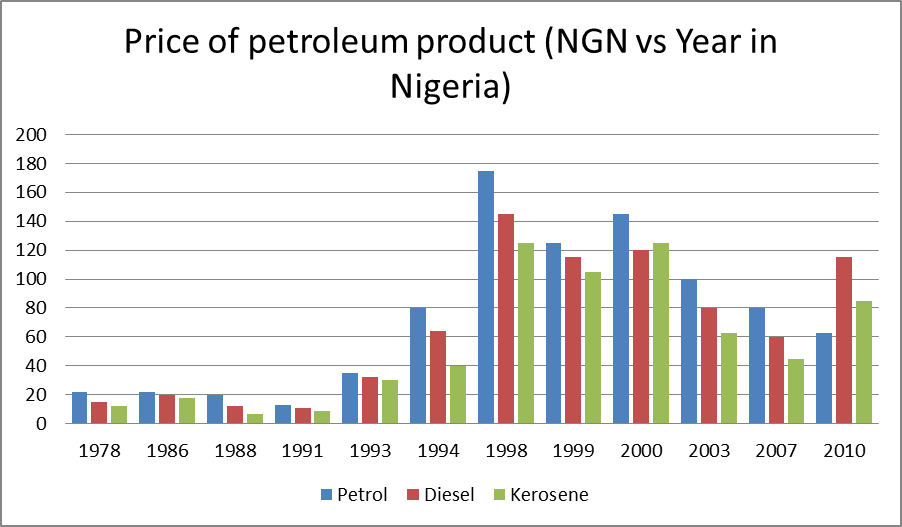

Even worse, since last quarter 1999, only the Warri refinery has been operational; have stood idle, due to inadequate maintenance or sabotage. As a result, Nigeria has to import more than two-third of its needs (estimated at over 450,000 barrels/day) of refined petroleum product equivalent from the world market. This situation means high distribution price, which has led the government to subsidize them. Although the government has raised price over 10 times since 1978, it has not managed to abolish the subsidy, which some analyst estimate at more than $4 billion per year, despite the pressure to do so from the IMF and the World Bank. In spite of the controversial rise in June 2000, Nigerian fuel prices are still the lowest in the sub-region, which encourages a thriving illegal trade between Nigeria and its immediate neighbours.

B. Official trade

Two main products constitute the official trade: crude oil (the bulk of transaction) and refined oil. Nigeria export refined oil to Niger until 1993, when because of problems at the Kaduna refinery (which supplied Niger) the Nigerian government terminated these exports.

| Export of Nigeria Crude within Africa |

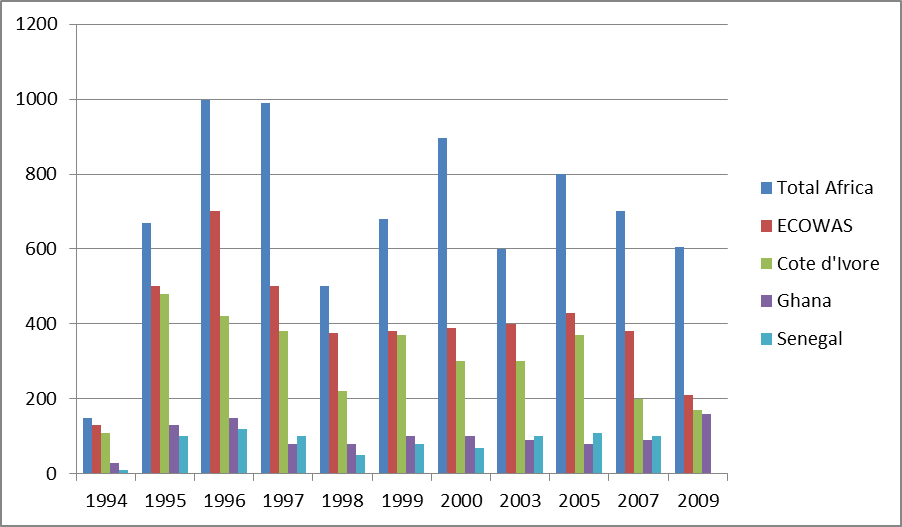

Only Chad currently has a contract with Nigeria for the supply of refined oil. In 1996, the Nigerian government planned to grant licenses to two private companies to build and operate two refineries for export product-Brass Refinery and the Oliviria Petroleum Refinery, with respective outputs of 200,000 barrels/day and 100,000 barrels/day – but these plans fell through. As a result, since 1994 only crude oil has been exported officially. The countries of the sub-region that import Nigerian crude are those with operational refineries: Cote d’Ivoire, Ghana, Senegal (in West Africa) and Cameroon (Central Africa). Cote d’Ivoire is the biggest consumer, with purchase that account for over 4% of Nigeria export sales. The ECOWAS countries altogether purchase about 5% of Nigeria’s crude oil export compared with about 4.4% - 6.7% for the whole of Africa. Though exports only reached their peak in volume in 1997, they attained their highest nominal value in 1996. The continous decline in the price per barrel until 1999 has considerably reduced the revenues Nigeria derived from the export of petroleum products.

C. Illegal trade in Nigerian fuel

Known by various names in the sub region, such as federale (federal) in Cameroon and kpayo (not good) in Benin, Nigerian petrol is traded intensely between Nigeria and the neghbouring countries. The ramifications of this trade even extend to countries that do not have land borders with Nigeria, such as Togo and Burkina Faso. The driving force behind this trade is the difference on either side of the border. Taxation and exchange rate differences (depreciation of the naira and the stability of the CFA franc) have created a significant gap between price in Nigeria and prices in other countries. The profit margin from the illegal export is substantial, even though it decreases with distance from the border.

D. Importance of Illicit Trade

Since this trade is illegal in all countries (except in eastern Niger where the government has granted licenses to private operators to supply this part of the country with imports from Nigeria), it is difficult to evaluate its overall volume accurately. The fuel is transported by various means: tankers, small sea and leak going vessels, vehicle fuel tanks and 4-, 10-, 20- and 50-litres jerrycans.

In 1994, a Nigerian inquiry estimated that 150,000 barrels of oil were being exported illegally from Nigeria (i.e. 33% of Nigeria’s theoretical daily refining capacity). External studies also show that over 300,000 litres of Nigerian petroleum products were being imported into Benin alone.

The rise in prices at the pump in Nigeria and a series of shortages at the distribution stations strongly reduced illegal exports to neghbouring countries in the 90s. However, in recent times the fuel subsidies reduces the refined petroleum product pump prices in Nigeria, thereby making the export to other neghbouring sub-regional countries in Africa a highly profitable business for illegal exporters. Deregulation of the downstream sector is the only way to encourage competition and check against illegal export of refined petroleum product at the expense of the government.

E. Illegal trade-Impact and prospects

This is one of the most controversial aspects of the illegal trade in petroleum products. While it is clear that traders make large profits and those customers benefits by increasing or maintaining purchasing power, the situation of the countries is more ambiguous.

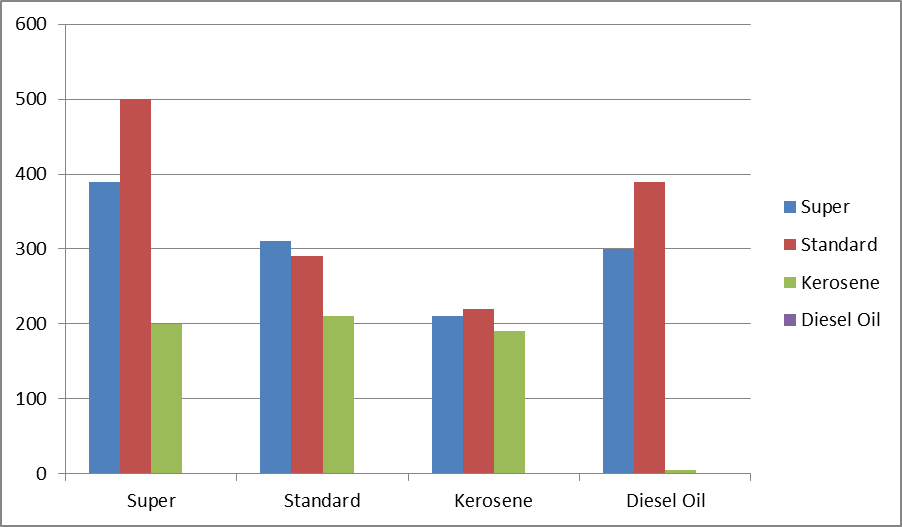

The profit margin for refined petroleum products exported to other sub-regional African countries ranges from 15% to 40% of the cost price of the various products delivered.

Risk

Risk profile:

There are risks associated with investment in Nigeria. These can be grouped into three main categories, political activity and civil unrest, border disputes and government underfunding. There is also the continuing problem of corruption within the system.

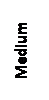

The various possible risk associated with investing in the Nigerian downstream sector of the Oil & Gas industry are classified based on their relative likelihood to occur (low, medium and high) and their respective impacts in NPV equivalent of the entire project forecasted cashflow (low, medium and high) as shown below in our 2-Dimensional (2D) risk classifier:

| Likelihood |

| 16. Jetty unavailability 17. Legal/Regulatory Compliance |

| 9. Ondo Channel 10. Contracting capacity |

| 1. Feedstock Supply 2. Regional Security 3. Local Business Environment |

| 18. Industrial Action 19. Product Supply Competition 20. HSE Incident 21. Asset Integrity |

| 22. Storage Capacity 23. Business Continuty and Resilience |

| 11. Experience & Knowledge 12. Value price review |

| 4. Cost Consciousness 5. Sustainability of organizational & operational model 6. Shareholders Alignment |

| 13. Fraud 14. Marketers Loyalty 15. Fiscal-Tax, Insurance |

| 7. Corporate Harmony |

| -------------------------------------------------------------------------------------------------------------------------------------------------------- |

| -------------------------------------------------------------------------------------------------------------------------------------------------------- |

High Risks

Feedstock supply

The dependence of the Refinery on crude oil supplies from Federal government controlled refineries could be a problem. This might be a major problem as it is believed that logistics and corruption problems might come to the fore. The OKFTZ Refinery is strongly advised to diversify its portfolio by backward integration towards owning and producing its crude stock. To this end, it is expected that Shayaz must quickly acquire its oil block for exploration and production activities. This will ensure steady supply of feed stock of crude oil to this refinery being proposed.

This is one of the most challenging risks to the refinery plant project. However, it can be successfully managed because Chevron has guaranteed to supply the needed crude oil (feedstock) to the proposed refinery plant.

Regional Security (Political activity & civil unrest)

The issue at the basis of most civil unrest is the equitable sharing of the country’s annual oil revenues among its population and the question of the environmental responsibilities of the oil multinationals. Although all multinationals have been targeted in the disputes, Shell has been the main target. Civil unrest has resulted in over 700 deaths since 1993 and resulted in the shut in of terminals and flow stations. The situation is exacerbated by corruption within the industry and the government.

Understanding of the local political environment of business has become necessary as it allows management an opportunity to work in tandem with the host government. Nigeria presents a complex political environment that should be well understood for business success.

Sudden change in government policy for instance can lead to various shocks to the business.

Local Business Environment

Marine pollution, carbon emission, gas flaring and other forms of pollutions will be of great concern to the industry watch dogs and the community.

Shayaz Refinery must put in place pollution control methodology in the refinery design and also have a disaster recovery procedure in place. Oil spillage must be avoided and be prepared for as this will position the company towards a speedy response to disaster.

Restive community

The local community in which the refinery will be located expect certain positive contributions to their lives. They could become violent in their expectations and demand. This could affect production and operations in the refinery. It may also lead to kidnapping of Refinery workers and demand for ransom as evidenced by the activities of the restive community in the Niger Delta.

Shayaz must have a comprehensive Corporate Social Responsibility (CSR) for the benefit of the host community. Such infrastructures like roads, drinking water, electricity and employment will be appreciated and can go a long way to reduce tension in the society.

Cost Consciousness

The price at which the refinery plant will purchase their feedstock from Chevron or the prospective supplier is very important in determining if the plant will be profitable or not. This risk can be hedged by using the Forward or Future Crude Oil Purchase or Supply contract for a minimum renewable period of 2 years. However, for the purpose of this preliminary cash flow analysis, we shall use the current crude oil price as the worst case scenario, the possible future and forward contract prices as the base, and negotiable crude oil purchase prices as the best case scenario.

Asset Security

Discussing project risk in Nigeria without mentioning security is an incomplete risk assessment analysis. The Refinery Plant security risk can be managed jointly by the Project Developers (Shayaz Nig. Ltd) and the Ondo State Government. This could be done using modern security gadgets, technologies and also using the mobile police and private security outfits etc.

International Prices & Foreign Currency Exposure

Fluctuating prices in the international market and foreign currency movements can also present some challenges to the company.

There is need to have a sound financial management team in the treasury department and financial Control Departments to mitigate the effects. Sound financial decisions could be taken to mitigate the impact of fluctuating prices. Hedging against foreign currency fluctuations using spot and futures trading techniques could be helpful.

Breaking the Imported Refined Product Market Monopoly Risk

The aforementioned market monopoly can be managed by ensuring that Ventech (the refinery plant designers) designs and delivers best/optimized performing refinery plant that is designed putting the Nigerian crude oil specifications into consideration. This will enable the refinery refined petroleum products to be the Nigerian customers’ number one choice based on its performance on their engines as compared to other imported refined petroleum products.

Refined Petroleum Products Price Risk in Nigeria

The Federal Government of Nigeria (FGN) through its Petroleum Products Pricing Regulatory Agency (PPPRA), a subsidiary of the Nigerian National Petroleum Corporation (NNPC) subsidies the prices of imported petroleum products. This is done to compensate the masses for the non functional refineries in Nigeria that is directly or indirectly the government’s fault. Although, the proposed deregulation in the Nigerian oil & gas downstream sector would liberalize the market and make refinery business in Nigeria highly profitable. In spite of all these, we shall run this preliminary cash flow analysis by assuming that the refinery is not entitled to refined petroleum products subsidies and also that the deregulation will not happen. This assumption will enable us investigate the refinery plant economic performance in Nigeria’s energy market as at today. This risk can be managed by using the Nigerian refined petroleum products prices in evaluating the refinery project cash flow.

Corporate Harmony

The OKFTZ Refinery project is a new project and will be managed by a complete new set of people from different backgrounds and ethnicities. Therefore, the associated risk in this kind of system has to do with internal corporate relationship and harmony. This kind of risk can only be managed by mutual respect for one another, strict adherence to the company’s policies.

Medium Risks

Ondo Channel

This is a medium profile risk that has to be treated like a high risk. This is because the Ondo channel is the gateway to the Olokola Free Trade Zone (OKFTZ) access for high sea going vessels. This risk if not properly managed can truncate the logistics during the procurement and installation of the refinery plant sub-plant systems and modules. Also, this risk has the capacity to also affect refined product distribution from the refinery plant to other parts of the country and beyond.

One of the ways to manage this risk is to prevail on the Ondo State Government to persuade the Olokola Free Trade Zone (OKFTZ) project developers to dredge the channel and put adequate logistics infrastructure in place to facilitate smooth logistic in and out of the refinery plant.

Experience and Know-how

Experience and know-how for a high-tech process plant like the OKFTZ refinery is a potential risk. The refinery plant is a multi-billion dollar project and as such the investors cannot afford to allow the process plant be managed by armatures.

However, Shayaz is managing this risk already by ensuring that the plant is being managed by world class experienced Ventech Engineers with proven record in modular refinery plant construction, operation and management.

Fraud

Fraud is simply corruption irrespective of the magnitude and type. The OKFTZ refinery should be operated with ZERO TOLERANCE FOR CORRUPTION and appropriate sanctions should be meted on anybody found wanting of fraud or corruption not minding how highly or lowly placed the person is in the corporation. This can be achieved by involving the law enforcement agencies, use of judiciaries.

Market Locality

Market locality would consider the risk associated with inadequate market research and feasibility studies. This risk is managed by this feasibility study report that is aimed at understanding the commodity market and the developing a comprehensive business plan to holistically handle all possible risks.

Fiscal Regimes

The fiscal regimes in Nigeria are considered a medium risk because for mega projects like the OKFTZ refinery, some incentives are supposed to be enjoyed. However, this project is handled with the assumption that there are no tax holidays and all fiscal obligations must be meet. This is important in the project economic forecast in order not to overestimate the cash flow by assuming favourable fiscal regimes like tax holidays and other incentives that such projects were suppose to enjoy.

Low Risks

Jetty Unavailability

The jetty unavailability risk associated with this project is a low profile risk that can be managed by the either the Olokola Free Trade Zone (OKFTZ) managers putting adequate jetty infrastructure in place or it will constructed as part of the capital projects.

Legal and Regulatory Compliance

The Nigerian legal framework regulations if adhered to will facilitate successful business operation in Nigeria. However, if the intention of the investor and project managers is to cut corners and defraud the Federal Government of Nigeria, then it becomes a risk that can cripple the business. Managing this risk is simple, “the investor and project partners will ensure that the OKFTZ refinery project management strictly adhere to the rules and regulations of the Nigerian Government.

Product Supply Competition

Product supply competition risk can be managed by signing off-takers agreements, product branding, embarking on aggressive competitive product supply strategies and using promotional adverts that will make customers loyal to the OKFTZ refinery refined product brand.

Asset Integrity & HSE Incident

The Asset Integrity & Health Safety and Environment (HSE) risk associated with a refinery plant is very important factor to be considered in the business is going to be profitable or not. To this end, the Shayaz group is contracting the refinery plant HSE management to the equipment manufacturers “Ventech Engineers.”

Storage Capacity

Shayaz is working towards managing this risk by ensuring that the storage tanks are part of the things to be considered in the first phase of the refinery plant construction alongside other civil engineering works.

Border disputes

In the complex boundary delimitations of the Niger Delta area, border disputes are common. Nigeria is currently in dispute with Equatorial Guinea over borders relating to oil finds in the Gulf of Guinea.

Nigeria is in dispute over Equatorial Guinea’s sole ownership of the Zafiro oilfield in Block B from which Mobil began producing in 1996. Elf holds the concession OML 102 in Nigeria, just 3.5km north of Equatorial Guinea’s Block B. Nigeria and Elf contend that the seismic evidence indicates that Zafiro is part of an oilfield that straddles the international boundary between the two countries. In 1998, Elf announced the Ekanga discovery based on two wells drilled in OML 102. Equatorial Guinea claims that the wells were drilled in their territorial waters in Block B. Nigeria has called for a determination of the boundary and the establishment of a joint field operation. Negotiations have met with little success so far.

Date: 2015-01-29; view: 2113

| <== previous page | | | next page ==> |

| CHEVRONTEXACO (MRS) | | | Government underfunding |