CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Retention growth model

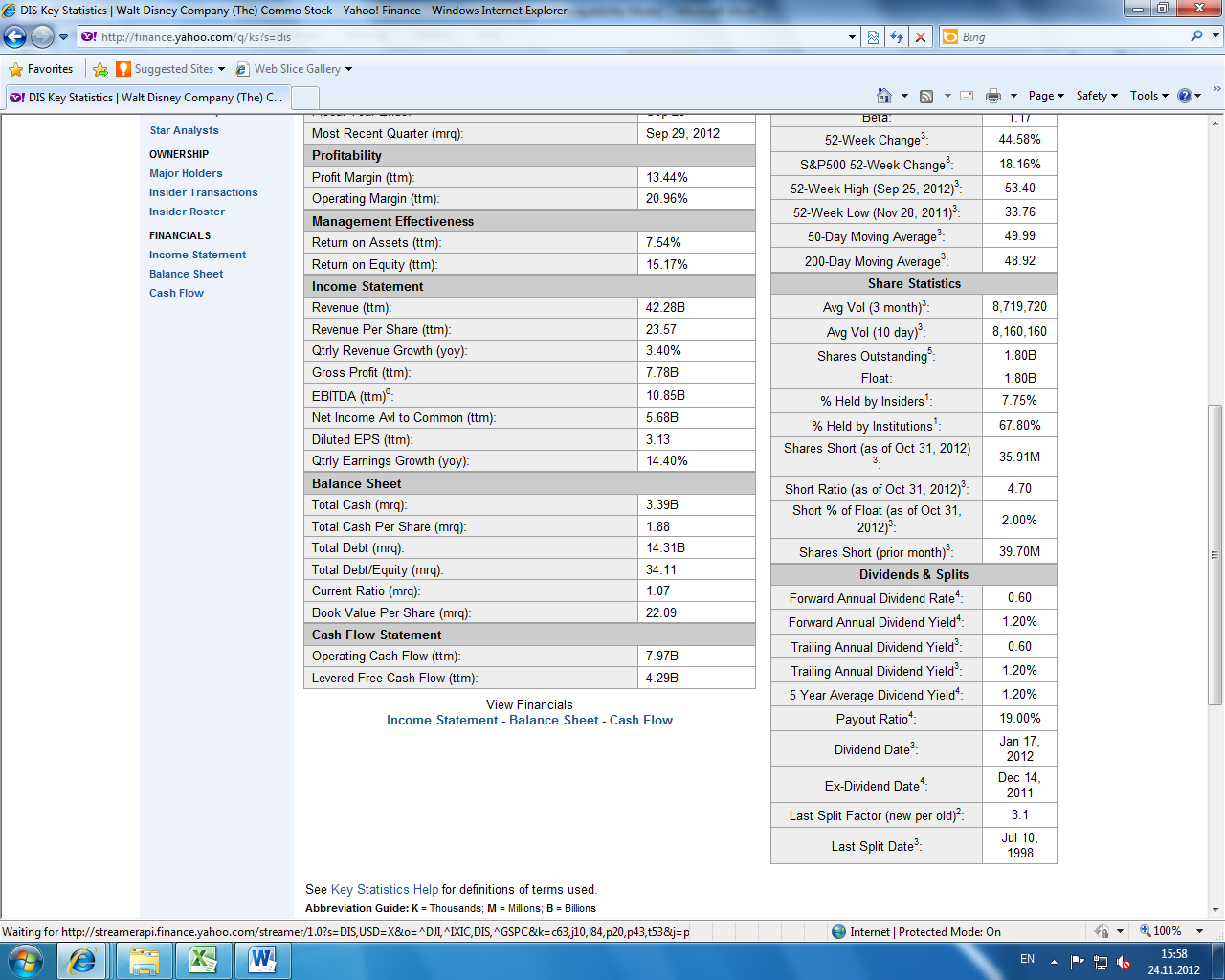

First of all, to use this method we need information from Yahoho about Dividends & Splits:

Figure 8 Dividends & Splits

So having this information the percent of net income that the firm pays out as dividends in our case equals to 19.00%, that means Disney pays out 19,00% of net income as dividends. This is not a big amount, as if we consider payout ratio of S&P500 companies[21], we can see that the majority of them has payout ratio higher.

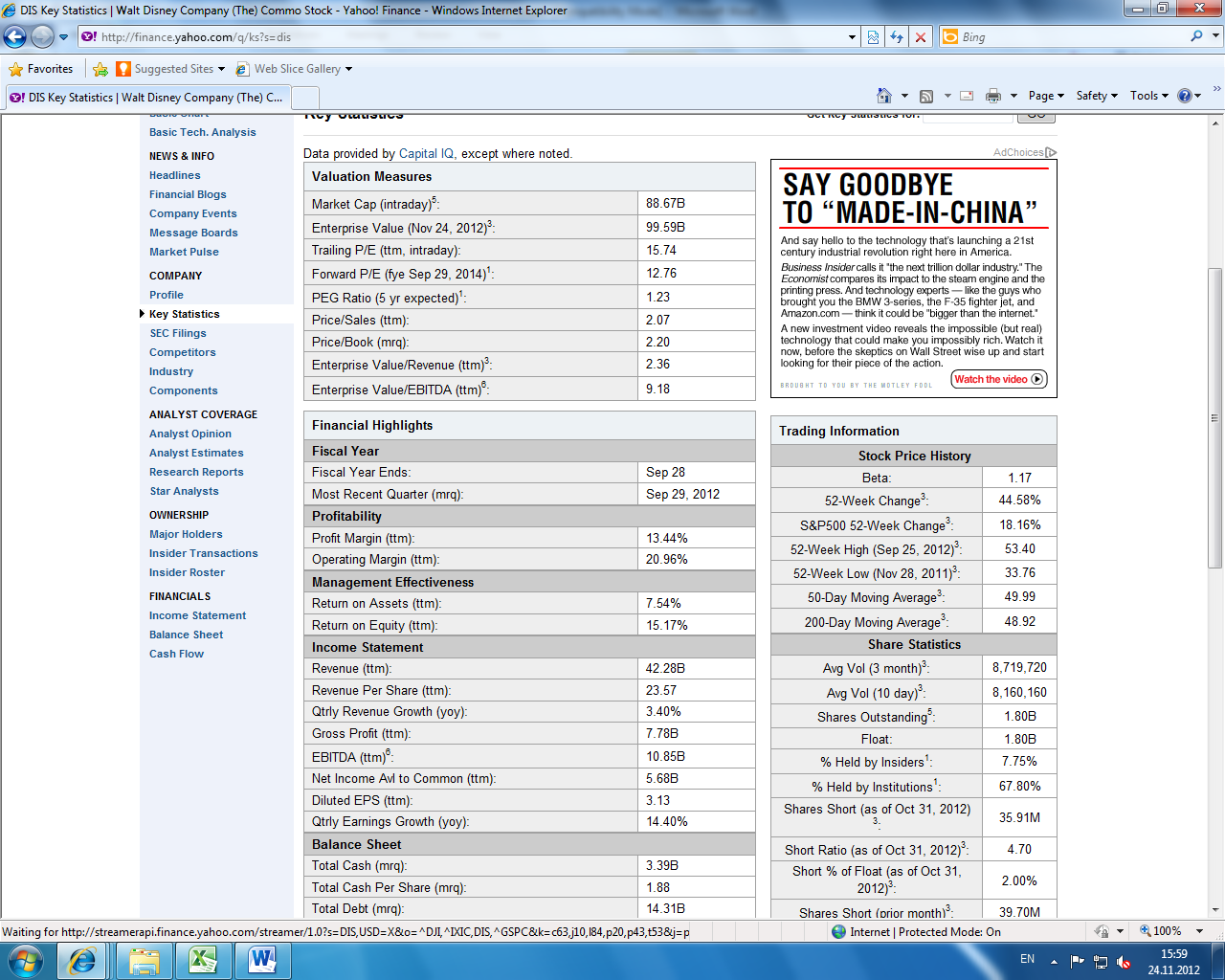

For the next step we need information about return on equity (ROE), which shows how the profit margin, the total assets turnover, and the use of debt interact to determine the return on equity.

Figure 9 Management Effectiveness

We use Yahoo data : ROE=15,17%

Our return on equity equals to 15.17%. Now we can calculate dividend growth rate using our model: g2=ROE*(1-Payout ratio), g2= 16.12%

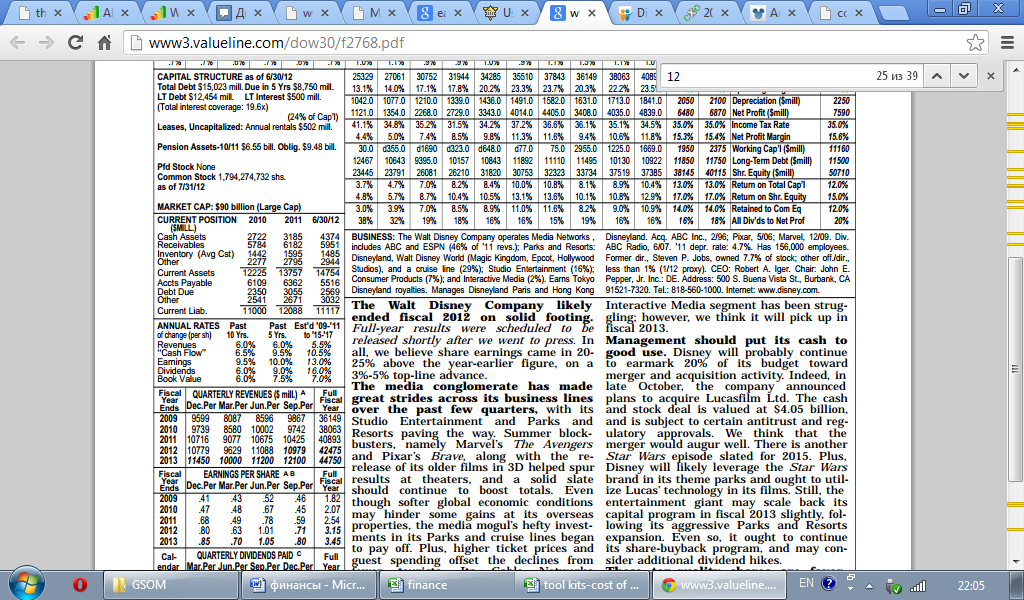

Analystís forecasts[22]

According to Value Line analysis dividends annual growth rate over the next 5 years equals 16%.

Figure 10 Annual Rates

Thus g3=16%. So eventually, we have all data to calculate price of the stock.

Table 15 Stock Price Data

| Current stock price, $ | 48,67 |

| g1 | 11.88% |

| g2 | 16.12% |

| g3 | 16% |

The results are as following:

Table 16 Stock's Growth Rate

| Price of the stock | |

| with g1 | 13,26% |

| with g2 | 17,55% |

| with g3 | 17,43% |

From our point of view, g2 is the best choice for further calculations, despite that it is almost the same as g3.

There is no significant difference in g2 and g3. However studies have shown that analystsí forecasts usually represent the best source of growth rate data for DCF cost of capital model[23]. Moreover analysts, probably, take into account more factors than other models, which are mostly based on mathematics, but not on the logic itself.

Date: 2015-01-29; view: 1644

| <== previous page | | | next page ==> |

| Dividend-Yield-Plus-Growth-Rate or Discounted Cash Flow Approach | | | The cost of capital |