CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

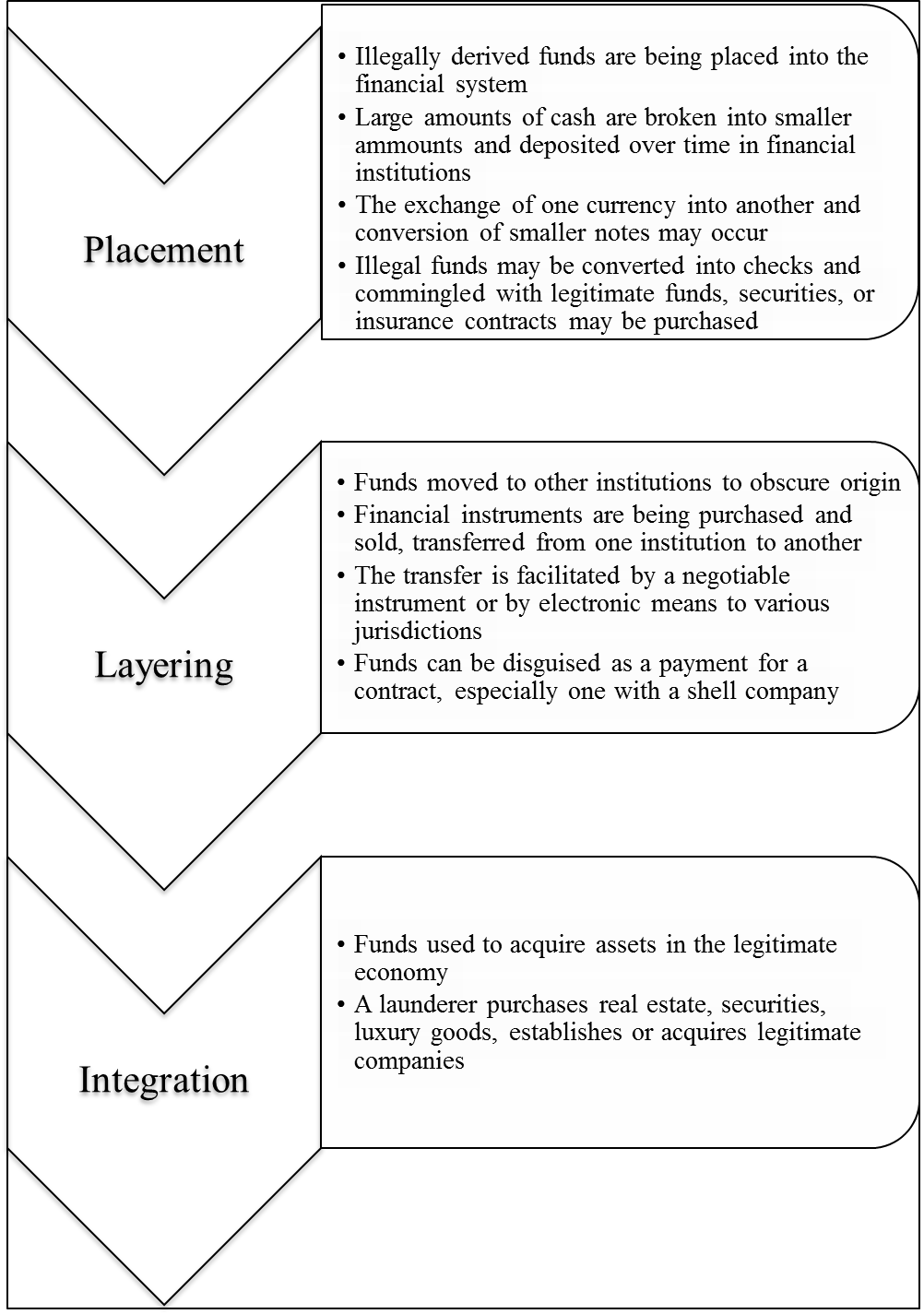

The process of money laundering

Lecture 3. Applying a risk-based approach to a model AML/CFT regime

Key words

∑ activities

∑ bankersí drafts

∑ commeasurable

∑ commodity futures

∑ customer

∑ customer due diligence (CDD)

∑ defense

∑ designated non-financial businesses and professions (DNFBPs)

∑ dissemination

∑ efficient allocation

∑ express trust

∑ factoring

∑ field operations

∑ financial commitments

∑ financial institutions

∑ financial intelligence unit (FIU)

∑ forfeiting

∑ index instruments

∑ interest rate instruments

∑ investigative authorities

∑ investment related

∑ judge

∑ law enforcement authorities

∑ liquid securities

∑ money laundering and terrorist financing typologies

∑ money or value transfer services (MVTS)

∑ money orders

∑ nominee shareholder

∑ operations

∑ prosecution

∑ record-keeping

∑ recourse

∑ regulatory agencies

∑ risk-based approach (RBA)

∑ safekeeping

∑ self-regulatory bodies (SRBs)

∑ sole practitioner

∑ supervisory agencies

∑ suspicious transaction report (STR)

∑ travelerís cheques

∑ trial

∑ trust and company service providers (TCSP)

∑ undertaking

∑ underwriting

Key Questions

∑ List main actors of a national AML/CFT regime.

∑ What is record-keeping?

∑ Why is it important to undertake CDD measures?

∑ What is the purpose of regulating and supervising the private sector?

∑ How can the private sector produce information for an STR?

∑ What kind of relevant information can the FIU obtain?

∑ Why would the FIU compile money laundering and terrorist financing typologies?

∑ Why law enforcement authorities request information from the FIU?

∑ What is the risk-based approach?

∑ How does the risk-based approach allow to allocate resources efficiently?

∑ Why is it necessary for the AML/CFT measures to be commeasurable with the risks identified?

∑ Why do actors of a national AML/CFT regime need to have effective mechanisms of cooperation and coordination?

∑ At which levels do mechanisms of cooperation and coordination need to be established?

∑ What does underwriting and placement of life insurance mean?

∑ Why do insurance intermediaries have to be subjected to AML/CFT requirements?

∑ Why the financial leasing activity AML/CFT requirements do not extend to consumer products?

∑ List the means of payment that can be issued and managed.

∑ Which persons, related to provision of money or value transfer services, are exempt from AML/CFT requirements?

∑ List the money market instruments.

∑ List categories of designated non-financial businesses and professionals.

∑ Describe two groups of activities undertaken by trust and company service providers.

∑ List three goals of assessing national risks of money laundering and terrorist financing.

∑ Which actors serve as recipients of information on the results of countryís money laundering and terrorist financing risk assessments?

∑ When is it possible to apply AML/CFT requirements to another type of institution, activity, business or profession?

∑ Under which circumstances is it possible to make exemptions and decide not to apply AML/CFT requirements to a particular type of a financial institution, activity or DNFBP?

∑ What should persons whose activity has been exempt from AML/CFT requirements do with gathered information? Which of the FATF Recommendations applies?

3.1. Key institutions of a national AML/CFT regime

| Compilation of money laundering and terrorist financing typologies for use by the private sector |

| Dissemination of information on persons who are suspected of money laundering or the financing of terrorism |

| Analysis of information in the FIUís database |

| Investigation and field operations, e.g. making searches, taking witness statements |

| Law enforcement and investigative authorities |

| Requests of information on suspected money launderers and financiers of terrorism |

| Other information relevant to money laundering, predicate offences and terrorist financing |

| Financial intelligence unit (FIU) |

| Gathering evidence, preparing criminal charges, entering a lawsuit |

| Disseminating suspicious transactions reports (STRs) on operations or activities of customers with probable relation to money laundering or the financing of terrorism |

| Obtaining additional information on customers and their activities by FIUís request |

| Prosecution |

| Judge |

| Financial institutions |

| Trial |

| Designated non-financial businesses and professions (DNFBPs) |

| Activities or operations for or on behalf of a customer |

| Analysis of information |

| Defense |

| Regulatory and supervisory agencies |

| Undertaking customer due diligence (CDD) |

| A verdict of guilty leads to a sentence |

| Record-keeping |

| Financiers of terrorism |

| Law-abiding clients |

| Money launderers |

Date: 2015-01-29; view: 1261

| <== previous page | | | next page ==> |

| Basic concept of money laundering | | | Methodology bases of a risk-based approach and national coordination |