CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Trade theories and economic development

Three economic issues

Economics is the study of how people choose to allocate scarce resources to satisfy their unlimited wants. The main problem in economics is the question of allocating scarce resources between competing uses. In this section three economic issues are discussed to show how society allocates its scarce resources between competing uses. In this connection the question what, how and for whom to produce is of great significance.

The oil price shocks

Oil is an important commodity in modern economies. Oil and its derivatives provide fuel for heating, transport, and machinery, and are basic inputs for the manufacture of industrial petrochemicals and many household products ranging from plastic utensils to polyester clothing. From the beginning of this century until 1973 the use of oil increased steadily. Overmuch of this period the price of oil fell in comparison with the prices of other products. Economic activity was organized on the assumption of cheap and abundant oil.

In 1973 - 74 there was an abrupt change. The main oil-producing nations, mostly located in the Middle East but including also Venezuela and Nigeria, belong to OPEC - the Organization of Petroleum Exporting Countries. Recognizing that together they produced most of the world's oil, OPEC decided in 1973 to raise the price at which this oil was sold. Although higher prices encourage consumers of oil to try to economize on its use, OPEC countries correctly forecast that cutbacks in the quantity demanded would be small since most other nations were very dependent on oil and had few commodities available as potential substitutes for oil. Thus OPEC countries correctly anticipated that a substantial price increase would lead to only a small reduction in sales. It would be very profitable for OPEC members.

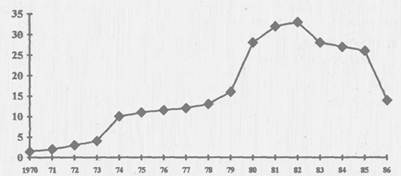

Oil prices are traditionally quoted in US dollars per barrel. Fig. 1 shows the price of oil from 1970 to 1986. Between 1973 and 1974 the price of oil tripled, from $2,90 to $9 per barrel. After a more gradual rise between 1974 and 1978 there was another sharp increase between 1978 and 1980, from $12 to $30 per barrel. The dramatic price increases of 1973 - 79 and 1980 - 82 have become known as the OPEC oil price shocks, not only because they took the rest of the world by surprise but also because of the upheaval they inflicted on the world economy, which had previously been organized on the assumption of cheap oil prices.

People usually respond to prices in this or that way. When the price of some commodity increases, consumers will try to use less of it but producers will want to sell more of it. These responses, guided by prices, are part of the process by which most Western societies determine what, how and for whom to produce.

Consider first how the economy produces goods and services.

When, as in the 1970s, the price of oil increases six-fold, every firm will try to reduce its use of oil-based products. Chemical firms will develop artificial substitutes for petroleum inputs to their production processes; airlines will look for more fuel-efficient aircraft; electricity will be produced from more coal-fired generators. In general, higher oil prices make the economy produce in a way that uses less oil.

Oil price ($ per barrel)

Figure 1. The price of oil. 1970 - 86

How does the oil price increase affect what is being produced?

Firms and households reduce their use of oil-intensive products, which are now more expensive. Households switch to gas-fired central heating and buy smaller cars. Commuters form car-pools or move closer to the city. High prices not only choke off the demand for oil-related commodities; they also encourage consumers to purchase substitute commodities. Higher demand for these commodities bids up their price and encourages their production. Designers produce smaller cars, architects contemplate solar energy, and research laboratories develop alternatives to petroleum in chemical production. Throughout the economy, what is being produced reflects a shift away from expensive oil-using products towards less oil-intensive substitutes.

The for whom question in this example has a clear answer.

OPEC revenues from oil sales increased from $35 billion in 1973 to nearly $300 billion in 1980. Much of this increased revenue was spent on goods produced in the industrialized Western nations. In contrast, oil-importing nations had to give up more of their own production in exchange for the oil imports that they required. In terms of goods as a whole, the rise in oil prices raised the buying power of OPEC and reduced the buying power of oil-importing countries such as Germany and Japan.

The world economy was producing more for OPEC and less for Germany and Japan. Although it is the most important single answer to the 'for whom' question, the economy is an intricate, interconnected system and a disturbance anywhere ripples throughout the entire economy.

In answering the 'what' and "how1 questions, we have seen that some activities expanded and others contracted following the oil price shocks. Expanding industries may have to pay higher wages to attract the extra labour that they require. For example, in the British economy coal miners were able to use the renewed demand for coal to secure large wage increases. The opposite effects may have been expected if the 1986 oil price slump had persisted.

The OPEC oil price shocks example illustrates how society allocates scarce resources between competing uses.

A scarce resource is one for which the demand at a zero price would exceed the available supply. We can think of oil as having become more scarce in economic terms when its price rose.

VOCABULARY NOTES

Assignments

I. Suggest the Russian equivalents

to increase steadily; try to economize on the use of...; to choke off the demand; to encourage consumers to purchase smth; to encourage the production of...

II. Replace the parts in italics by synonyms

three economic questions; to give a share of resources; to have scarce supplies of raw materials; a sudden change; realising that; potential replacements; to encourage people who use oil; price increases six times; try to cut down on the use of oil

III. Find in the text antonyms for the following words

rare, scarce; outputs; expensive; exports; straightforward; get, acquire; not to need; getting smaller

IV. Fill in the gaps with the words and expressions from the text

1. Economics is the study of how people choose scarce resources to satisfy their

2. Economic activity was organized on the assumption of____________ oil.

3. In 1973 - 74 there was an change in oil prices.

4,_______ countries correctly forecast that __________ in the quantity demanded would be small.

5. Most nations are very dependent on oil and have few commodities available as for oil.

6. Oil prices are traditionally_________ in US dollars per barrel.

7. The price of oil_________ , from $2.90 to $9 per barrel.

8. There was another_______ between 1978 and 1980, from $12 to $30 per barrel.

9. The dramatic price increases inflicted________ on the world economy.

10. These responses, _______ prices, are part of the process by which most Western societies what,

_______ how and for whom to produce.

11.Chemical firms will develop __________ for petroleum inputs to their production processes; airlines will look for more______________________ aircraft.

12. Firms and________ reduce their use of products.

13. Commuters form_________ or move closer to the city.

14. High prices not only______ for oil-related commodities; they also encourage consumers to purchase .

15.OPEC________ from oil sales increased from $35 billion in 1973 to nearly $300 billion in 1980.

16. The rise in oil prices raised_________ of OPEC.

17.The economy is an__________ , interconnected system and a anywhere ripples throughout the entire economy.

18.______ industries may have to pay higher wages to attract the________ labour that they require.

19. A scarce resource is one for which the demand at a zero price would the available supply.

V. Find in the text English equivalents for the following

ðàñïðåäåëÿòü ðåñóðñû; îãðàíè÷åííûå ðåñóðñû; çíà÷èòåëüíîå ïîâûøåíèå öåí ïîâëå÷åò çà ñîáîé íåñóùåñòâåííîå ñíèæåíèå îáúåìà ïðîäàæ; öåíà âîçðîñëà â òðè ðàçà; ðåçêèé ïîäúåì; ðåçêèé âçëåò öåí; âîçðîñøèå äîõîäû; ïîâûñèòü/ïîíèçèòü ïîêóïàòåëüíóþ ñïîñîáíîñòü; ïîâûøàòü çàðàáîòíóþ ïëàòó äëÿ ïðèâëå÷åíèÿ äîïîëíèòåëüíîé ðàáî÷åé ñèëû

VI. Explain in English

prices are quoted; a gradual rise; a sharp increase; household; commuters; commodities

VII. Check your grammar

Present Tenses

Use the following verbs to complete the paragraph below: concern, base, discuss, be, show, take up, hope for, say, offer, wish, live, suggest, provide, govern

Students_______ economics for different reasons. Some _______ a career in business, some for a deeper understanding of government policy, and some ______________ about the poor or the unemployed.

This book _______ an introduction, which ___ that economics a live subject.

It real insights into the world in which we . The material that we in this book by two ideas. The first ___________ that there a body of economics, which has to be learned in any introductory course. The second on the belief that modem economics is more readily applicable to the real world than traditional approaches .

Past Tenses

Write the following sentences out in full, likå this:

Keynes/famous/his/day/economist/own/a/in... (be)

Keynes was a famous economist in his own day

* 1915/ Treasury/ London/ in/ he/ in/ the/... (join)

* best-known/ 1935/ his/ book/ in...(publish)

* public/ war/ during/ he/ service/ the/ to... (recall)

* 5th/ in/ Cambridge/ June/ Keynes/ 1883/ on... (bear)

* student/ he/ distinguished/ a... (be)

* instrumental/ the IMF/ in/ the/ 1944/ World Bank/ he/ in/ and/ starting... (be)

* Cambridge University/ to/ 1902/ he/ in... (go)

* a/ he/ as/ Cambridge/ teacher/ to... (return)

* time/ he/ a/ economist/ by/ as/ this/ brilliant... (accept)

* also/ heavy/ his/ he/ by/ workload... (exhaust)

* The General Theory of Employment, Interest and Money/ it... (call)

* 1919/ in/ he/ with/ Treaty of Versailles/ he/ because/ the... (resign, disillusion)

* April/ on/ 21st/ he/ 1946... (die)

* book/ conventional/ this/ thinking/ enemies/ many/ and/ him... (go against, make)

Arrange the sentences you have made into a single paragraph.

VIII. Answer the questions

1. What are the three main questions of the economy?

2. What do you need in order to understand economics?

3. What happened to the price of oil from 1900 to 1973?

4. What did OPEC decide in 1973?

5. Why was there only a small reduction in oil sales?

6. What is an oil price shock? What did the oil price shocks lead to?

7. How do people respond to a higher price for a commodity?

8. What effect do higher oil prices have on the economy?

9. What happens throughout the economy when there are high oil prices?

10. What 2 effects did high prices have on oil-importing countries?

11. When did oil become scarce?

12. What is a scarce resource?

IX. Translate using active vocabulary

Trade theories and economic development

If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it of them with some part of our own industry.

Adam Smith

CHAPTER OUTLINE

■ Basis for international trade

0 Production possibility curve

0 Principle of absolute advantage

0 Principle of comparative/relative advantage

■ Exchange ratios, trade, and gain

■ Factor endowment theory

■ The competitive advantage of nations

■ A critical evaluation of trade theories

0 The validity of trade theories

0 Limitations and suggested refinements

■ Economic cooperation

0 Levels of economic integration

0 Economic and marketing implications

■ Conclusion

■ Case 2.1 The United States of America vs. the United States of Europe

PURPOSE OF CHAPTER

The case of Botswana illustrates the necessity of trading. Botswana must import in order to survive, and it must export in order to earn funds to meet its import needs. Botswana’s import and export needs are readily apparent; not so obvious is the need for other countries to do the same. There must be a logical explanation for well-endowed countries to continue to trade with other nations.

This chapter explains the rationale for international trade and examines the principles of absolute advan- tage and relative advantage. These principles describe what and how nations can make gains from each other. The validity of these principles is discussed, as well as concepts that are refinements of these princi- ples. The chapter also includes a discussion of factor endowment and competitive advantage. Finally, it

concludes with a discussion of regional integration and its impact on international trade.

MARKETING ILLUSTRATION BOTSWANA: THE WORLD’S FASTEST-GROWING ECONOMY

In 1966, Botswana had only three-and-a-half miles of paved roads, and three high schools in a country of

550,000 people. Water was quite scarce and precious, leading the nation to name its currency pula, meaning rain. At the time, Botswana’s per capita income was

$80 a year.

Fast forward it to the new millennium. Botswana, one of Africa’s few enclaves of prosperity, is now a model for the rest of Africa or even the world. Its per capita income has rocketed to $6600. While the other African currencies are weak, the pula is strong – being backed by one of the world’s highest per capita reserves ($6.2 billion).

How did Botswana do it? As a land-locked nation in southern Africa that is two-thirds desert, Botswana is a trader by necessity, but, as the world’s fastest growing economy, Botswana is a trader by design. Instead of being tempted by its vast diamond wealth

that could easily lead to short-term solutions, the

peaceful and democratic Botswana has adhered to free-market principles. Taxes are kept low. There is no nationalization of any businesses, and property rights are respected.

According to the World Bank’s World Develop- ment Indicators (which reports on the world’s eco- nomic and social health), the fastest growing economy over the past three decades is not in East Asia but in Africa. Since 1966, Botswana has outperformed all the others. Based on the average annual percentage growth of the GDP per capita, Botswana grew by

9.2 percent. South Korea is the second fastest per- former, growing at 7.3 percent. China came in third at 6.7 percent.

Sources: “World’s Fastest Growing Economy Recorded in Africa, “ Bangkok Post, April 18, 1998; and “Lessons from the Fastest-Growing Nation: Botswana?” Business Week, August 26, 2002, 116ff.

BASIS FOR INTERNATIONAL TRADE

BASIS FOR INTERNATIONAL TRADE

Whenever a buyer and a seller come together, each expects to gain something from the other. The same expectation applies to nations that trade with each other. It is virtually impossible for a country to be

completely self-sufficient without incurring undue costs.Therefore, trade becomes a necessary activity, though, in some cases, trade does not always work to the advantage of the nations involved. Virtually all governments feel political pressure when they experience trade deficits. Too much emphasis is

often placed on the negative effects of trade, even though it is questionable whether such perceived disadvantages are real or imaginary. The benefits of trade, in contrast, are not often stressed, nor are they well communicated to workers and consumers.

Why do nations trade? A nation trades because it expects to gain something from its trading partner. One may ask whether trade is like a zero-sum game, in the sense that one must lose so that another will gain.The answer is no, because, though one does not mind gaining benefits at someone else’s expense, no one wants to engage in a transaction that includes a high risk of loss. For trade to take place, both nations must anticipate gain from it. In other words, trade is a positive-sum game. Trade is about “mutual gain.”

In order to explain how gain is derived from trade, it is necessary to examine a country’s pro- duction possibility curve. How absolute and relative advantages affect trade options is based on the trading partners’ production possibility curves.

Production possibility curve

Without trade, a nation would have to produce all commodities by itself in order to satisfy all its needs. Figure 2.1 shows a hypothetical example of a country with a decision concerning the produc- tion of two products: computers and automobiles. This graph shows the number of units of computer or automobile the country is able to produce. The production possibility curve shows the maximum number of units manufactured when computers and

A

automobiles are produced in various combinations, since one product may be substituted for the other within the limit of available resources. The country may elect to specialize or put all its resources into making either computers (point A) or automobiles (point B). At point C, product specialization has not been chosen, and thus a specific number of each of the two products will be produced.

Because each country has a unique set of resources, each country possesses its own unique production possibility curve. This curve, when ana- lyzed, provides an explanation of the logic behind international trade. Regardless of whether the opportunity cost is constant or variable, a country must determine the proper mix of any two prod- ucts and must decide whether it wants to specialize in one of the two. Specialization will likely occur if specialization allows the country to improve its prosperity by trading with another nation. The principles of absolute advantage and relative advan- tage explain how the production possibility curve enables a country to determine what to export and what to import.

Principle of absolute advantage

Adam Smith may have been the first scholar to investigate formally the rationale behind foreign trade. In his book Wealth of Nations, Smith used the principle of absolute advantage as the justification for international trade.1 According to this principle, a country should export a commodity that can be produced at a lower cost than can other nations. Conversely, it should import a commodity that can only be produced at a higher cost than can other nations.

Consider, for example, a situation in which two nations are each producing two products. Table 2.1

Units of computer

C

Units of automobile B

provides hypothetical production figures for the USA and Japan based on two products: the com- puter and the automobile. Case 1 shows that, given certain resources and labor, the USA can produce twenty computers or ten automobiles or some

Figure 2.1 Production possibility curve:

constant opportunity cost

combination of both. In contrast, Japan is able to produce only half as many computers (i.e., Japan

Table 2.1 Possible physical output

Product USA Japan

for practicality, each person should concentrate on and specialize in the craft which that person has mastered. Similarly, it would not be practical for

| Case 1 | Computer | consumers to attempt to produce all the things | ||

| Automobile | they desire to consume. One should practice what | |||

| Case 2 | Computer | one does well and leave the manufacture of other | ||

| Automobile | commodities to people who produce them well. | |||

| Case 3 | Computer | |||

| Automobile | Principle of comparative/relative |

produces ten for every twenty computers the USA produces). This disparity may be the result of better skills by American workers in making this product. Therefore, the USA has an absolute advantage in computers. But the situation is reversed for auto- mobiles: the USA makes only ten cars for every twenty units manufactured in Japan. In this instance, Japan has an absolute advantage.

Based on Table 2.1, it should be apparent why trade should take place between the two countries. The USA has an absolute advantage for computers but an absolute disadvantage for automobiles. For Japan, the absolute advantage exists for automobiles and an absolute disadvantage for computers. If each country specializes in the product for which it has an absolute advantage, each can use its resources more effectively while improving consumer welfare at the same time. Since the USA would use fewer resources in making computers, it should produce this product for its own consumption as well as for export to Japan. Based on this same rationale, the USA should import automobiles from Japan rather than manufacture them itself. For Japan, of course, automobiles would be exported and computers imported.

An analogy may help demonstrate the value of the principle of absolute advantage. A doctor is absolutely better than a mechanic in performing surgery, whereas the mechanic is absolutely supe- rior in repairing cars. It would be impractical for the doctor to practice medicine as well as repair the car when repairs are needed. Just as impractical would be the reverse situation, namely for the mechanic to attempt the practice of surgery. Thus,

advantage

One problem with the principle of absolute advan- tage is that it fails to explain whether trade will take place if one nation has absolute advantage for all products under consideration. Case 2 of Table 2.1 shows this situation. Note that the only difference between Case 1 and Case 2 is that the USA in Case

2 is capable of making thirty automobiles instead of the ten in Case 1. In the second instance, the USA has absolute advantage for both products, resulting in absolute disadvantage for Japan for both. The efficiency of the USA enables it to produce more of both products at lower cost.

At first glance, it may appear that the USA has nothing to gain from trading with Japan. But nine- teenth-century British economist David Ricardo, perhaps the first economist to fully appreciate rela- tive costs as a basis for trade, argues that absolute production costs are irrelevant.2 More meaningful are relative production costs, which determine what trade should take place and what items to export or import. According to Ricardo’s principle of relative (or comparative) advantage, one country may be better than another country in producing many products but should produce only what it pro- duces best. Essentially, it should concentrate on either a product with the greatest comparative advantage or a product with the least comparative disadvantage. Conversely, it should import either a product for which it has the greatest compara- tive disadvantage or one for which it has the least comparative advantage.

Case 2 shows how the relative advantage varies from product to product. The extent of relative advantage may be found by determining the ratio of

computers to automobiles. The advantage ratio for computers is 2:1 (i.e., 20:10) in favor of the USA. Also in favor of the USA, but to a lesser extent, is the ratio for automobiles, 1.5:1 (i.e., 30:20). These two ratios indicate that the USA possesses a 100 percent advantage over Japan for computers but only a 50 percent advantage for automobiles. Consequently, the USA has a greater relative advan- tage for the computer product. Therefore, the USA should specialize in producing the computer product. For Japan, having the least comparative disadvantage in automobiles indicates that it should make and export automobiles to the USA.

Consider again the analogy of the doctor and the mechanic. The doctor may take up automobile repair as a hobby. It is even possible, though not probable, that the doctor may eventually be able to repair an automobile faster and better than the mechanic. In such an instance, the doctor would have an absolute advantage in both the practice of medicine and automobile repair, whereas the mechanic would have an absolute disadvantage for both activities. Yet this situation would not mean that the doctor would be better off repairing auto- mobiles as well as performing surgery, because of the relative advantages involved.When compared to the mechanic, the doctor may be far superior in surgery but only slightly better in automobile repair. If the doctor’s greatest advantage is in surgery, then the doctor should concentrate on that specialty. And when the doctor has automobile problems, the mechanic should make the repairs because the doctor has only a slight relative advan- tage in that skill. By leaving repairs to the mechanic, the doctor is using time more productively while maximizing income.

It should be pointed out that comparative advantage is not a static concept. John Maynard Keynes, an influential English economist, opposed India’s industrialization efforts in 1911 based on his assumption of India’s static comparative advantage in agriculture. However, as far back as 1791, Alexander Hamilton had already endorsed the doctrine of dynamic comparative advantage as a basis of international trade.3 This doctrine explains why

Taiwan and India’s Bangalore have now become high- technology centers that have attracted investments from the world’s top technology companies. It also explains why or how the United Kingdom, forging more steel than the rest of the world combined in

1870, lost the lead to the USA. Andrew Carnegie’s mills among others were able to produce twice as much steel as Great Britain three decades later.4

Date: 2014-12-21; view: 2105

| <== previous page | | | next page ==> |

| THREE ECONOMIC ISSUES | | | EXCHANGE RATIOS, TRADE, AND GAIN |