CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

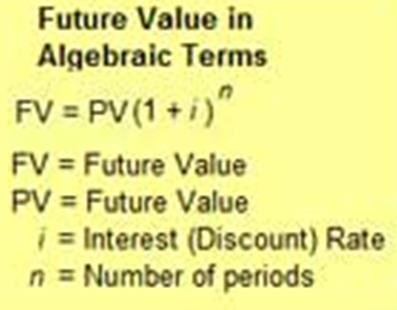

Discounted value. Conceptions of Net present value (NPV) and future present value (FV).

Discounted Cash Flow (DCF) is a cash flow summary adjusted so as to reflect the time value of money. With DCF, money to be received or paid at some time in the future is viewed as having less value, today, than than an equal amount that is received or paid today.

§ Present value (PV) is what the future cash flow is worth today.Futue value (FV) is the value, in non discounted currency units that actually flows in or out at the future time. A $100 cash inflow that will arrive two years from now could, for example, have a present value today of about $94, while its future value is still considered $100. The present value is discounted below the future value.

§ The longer the time period before an actual cash flow event occurs, the more the present value of future money is discounted below its future value.

§ The total discounted value (present value) for a series of cash flow events across a time period extending into the future is known as the net present value(NPV)of a cash flow stream.

DCF can be an important factor when evaluating or comparing investments, proposed actions, or purchases. Other things being equal, the action or investment with the larger DCF is the better decision. When discounted cash flow events in a cash flow stream are added together, the result is called the Net Present Value (NPV).

DCF and NPV and relatedtime value of money concepts are more easily understood when explained together and illustrated, along with related concepts such as discount rate,future value (FV), and present value (PV), as shown in the sections below.

1. The role of Microeconomics

2.  The Subject Matter of Microeconomics

The Subject Matter of Microeconomics

3. The use and limitation of Microeconomic theory

4. Economic methodology and microeconomic models

5. Equilibrium analysis

6. Positive and Normative Analysis

7. Demand Function: Individual Demand Function and Market Demand Function

8. Change in Quantity Demanded and Change in Demand

9. Inferior, Normal and Superior Goods

10. Supply Function. Change in quantity supplied and Change in supply

11. Market equilibrium

12. Market Adjustment to Change: shifts of Demand and shift of Supply

13. Changes in Both Supply and Demand

14. Cobweb theorem as an illustration of stable and unstable equilibrium

15. Government regulation of a market

16. Price ceiling and Price floor

17. Impact of a tax on price and quantity

18. Demand elasticity. Price Elasticity Coefficient and Factors affecting price elasticity of demand

19. Impact of demand elasticity on price and total revenue

20. Income elasticity of demand (YED) and Cross elasticity of demand (CED)

21. Price elasticity of supply

22. Market adaptation to Demand and Supply changes in long-run and in short-run

23. Three parts and three assumptions of consumer behavior theory

24. Consumer Choice and Utility

25. Total Utility (TU) and Marginal Utility (MU)

26. Indifference curves

27. Budget Constraint

28. The effects of changes in income and prices

29. Equimarginal Principle and Consumer equilibrium

30. Income Consumption Curve. Engel Curves

31. Price Consumption Curve and Individual Demand curve

32. Income and Substitution Effects

33. The process of production and it’s objective

34. Production Function

35. Time and Production. Production in the Short-Run

36. Average, Marginal and Total Product. Law of diminishing returns

37. Producer’s behavior

38. Isoquant

39. Isocost

40. Cost minimization (Producer’s choice optimisation)

41. The treatment of costs in Accounting and Economic theory

42. Fixed and variable costs

43. Average costs. Marginal Cost

44. Long run average cost. Returns to Scale

45. Different market forms

46. P- Competition

47. Economic profit in TRTC-model and in MRMC-model

48. Firm and industry demand in P-competitive market

49. Economic strategies of the firm in P-competitive market

50. Long run equilibrium

51. Definition of Monopoly Market. Causes of monopoly.

52. Monopoly Demand and Marginal Revenue

53. Monopoly Profit Maximization

54. Monopoly Inefficiency

55. "Natural" Monopoly

56. Imperfect competition and Monopolistic competition

57. Profit Maximization in Monopolistic Competition

58. Oligopoly

59. Firms behavior in Oligopoly

60. Kinked Demand Model

61. Competitive factor markets

62. The Demand for Inputs

63. Supply of Inputs

64. Equilibrium in a Market for Inputs

65. Labor market: labor demand and supply of labor.

66. The Marginal productivity approach to demand for labor.

67. Equilibrium and disequilibrium on labor market.

68. Particularities of Land market. Differential rent. Marginal productivity of land.

69. Main characteristics of Asset market. Demand for capital. Interest rate.

70. Discounted value. Conceptions of Net present value (NPV) and future present value (FV).

Date: 2016-03-03; view: 1102

| <== previous page | | | next page ==> |

| Main characteristics of Asset market. Demand for capital. Interest rate. | | | Katherine Mansfield |