CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Financial account

The financial account of the balance of payments covers all transactions associated with changes of ownership in the foreign financial assets and liabilities of an economy.

Three types of investment (foreign direct investment (FDI), portfolio and other) make-up the financial account, along with financial derivatives and official reserve assets. A positive value for the financial account indicates that inward investment flows (inward FDI, portfolio and other investment liabilities) exceed reserve assets and outward investment flows (outward FDI, portfolio and other investment assets). This was the case for 14 EU Member States in 2011, with the highest value relative GDP reported by Cyprus (9.5 % of GDP), while 13 EU Member States had a negative financial account: the financial account for the euro area was almost balanced, standing at -0.2 % of GDP in 2011, with net outflows recorded for direct and other investments.

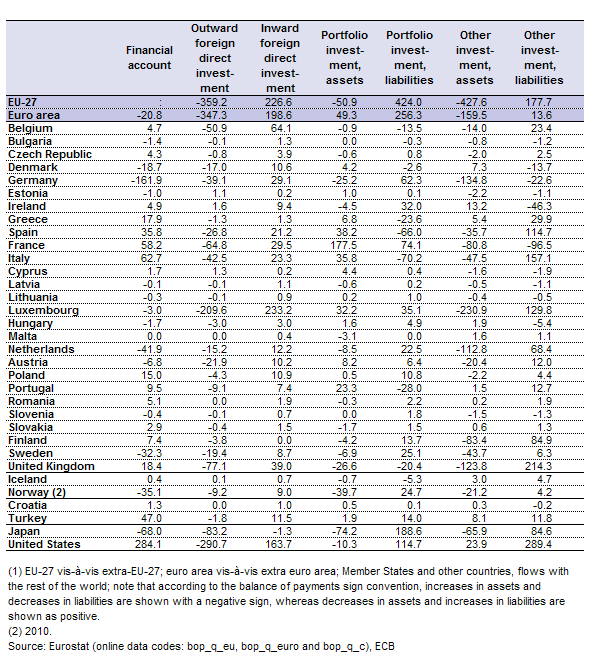

As can be seen in Table 4, the EU-27 continued to be a net direct investor vis-à-vis the rest of the world in 2011. Outward flows of FDI represented 2.8 % of GDP, while inward flows of FDI represented 1.8 % of GDP. The effect of the financial and economic crisis was apparent in relation to levels of direct investment which, having peaked in 2007, fell for three consecutive years. However, in 2011 the situation was reversed as inward flows of direct investment rose by 55 % (compared with the year before) and outward investment rose by 50 %. Luxembourg recorded by far the highest levels of both inward and outward FDI (in relation to GDP), followed by Belgium and France. Luxembourg also recorded the highest level of FDI transactions in absolute value terms (see Table 3) for outward flows (followed by the United Kingdom and France), as well as for inward flows (followed by Belgium and the United Kingdom).

Contrary to FDI flows, the EU-27 consistently recorded net inflows of portfolio investment. Portfolio investment assets (outward investment) were equivalent to 0.4 % of GDP in 2011, while portfolio investment liabilities (inward investment) were valued at 3.4 % of GDP. Although portfolio investment liabilities remained the most important source of inward capital coming into the EU, its value in 2011 fell by 23 % when compared with 2010, while portfolio investment assets recorded a much more significant contraction (83 %). Some 13 of the EU Member States recorded disinvestment for portfolio assets, with particularly large flows for Luxembourg (75.7 % of GDP), Cyprus (24.8 %), Portugal (13.6 %) and France (8.9 %). The largest investments in portfolio assets in relative terms were recorded in Malta (-47.9 % of GDP) and in absolute values in United Kingdom and Germany (both in excess of EUR -25 000 million). Disinvestment in portfolio liabilities was less common (apparent in eight EU Member States), including Portugal, Greece, Spain, Italy and Belgium – each of which reported negative flows in excess of 3 % of GDP; as did Iceland. In absolute terms, the largest disinvestments in portfolio liabilities in 2011 were recorded in Italy and Spain, followed – at some distance – by Portugal and Greece. Luxembourg again reported the largest positive flows (relative to GDP) at 82.5 %, followed by Ireland (20.1 %), while in absolute terms inflows were highest into France and Germany.

For other assets and liabilities (such as currency and deposits, loans and trade credit) the EU-27 recorded net capital outflows equivalent to 2.0 % of GDP in 2011. Investment in other assets was equal to 3.4 % of the EU-27’s GDP, with the largest investments (in relative terms) recorded for Luxembourg, Finland and the Netherlands. Inward investment in other liabilities was equivalent to 1.4 % of GDP in the EU-27 in 2011. Again the largest investments in relative terms were recorded in Luxembourg, followed at some distance by Finland, Malta and Greece, with substantial disinvestment recorded in Ireland and Cyprus. Net outflows of other investments from the EU-27 were twice as high in 2011 (EUR 249 900 million) as in 2010 – but remained below their level of 2008 and 2009. There were 12 EU Member States having net other investment inflows in 2011, most notably the United Kingdom, Spain and Greece.

http://epp.eurostat.ec.europa.eu/statistics_explained/index.php/Balance_of_payment_statistics

Date: 2014-12-21; view: 1916

| <== previous page | | | next page ==> |

| Main statistical findings | | | Advantages and disadvantages of a single currency in Europe |