CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Improving the Management of an investment portfolio structure and management of effective expenses

The theory of financial management has dramatically changed the former notions on the management of corporate finances, mainly, in the reference to the strategic aim of its functioning, which is the growth of the welfare of owners, providing the increase in the market value of the company but not the profit maximization. Accordingly, the optimal Management of an investment portfolio structure is such a combination of proprietory and borrowed Management of an investment portfolio, which provides the maximum market valuation of the whole Management of an investment portfolio.

The acknowledgment of the company value increase as its main strategic objective requires the development of the conceptual frameworks of the Management of an investment portfolio structure optimization in the system of total cost management. It is necessary to point out that, despite the presence of a large body of research in this sphere, there is no integral conception of the formation of optimal Management of an investment portfolio structure within the value approach to the corporate governance in economic literature.

The term conception (lat. conceptio) has a meaning of a master plan, which defines the strategy of actions at the implementation of reforms, projects, plans, programs; the frame of reference for the processes and events in the nature and in society according to the Contemporary economic dictionary[1]. The Great Soviet Encyclopedia uses the specified term for the identification of principal intentions, and a design concept in different types of activity[2].

The term optimization has a double meaning: the process of determining values of economical indicators, at which the optimum is reached, which is the best condition of the system, as well as the process of bringing of the system to the best (optimal) condition[3].

On the basis of the current conception of examined terms, the conception of the optimization of financial structure of the Management of an investment portfolio may be understood as the system of scientifically grounded and generalized practical experience on the opinions and objectives, which define the process of formation of the optimal financial structure of the Management of an investment portfolio in the system of the company total cost management

The fundamental point at the development of present conception is the correct identification of objectives, which determine the optimization of the process for the company Management of an investment portfolio structure. Notwithstanding that the theory of structure of the Management of an investment portfolio considers the growth of market value of the company as the objective optimality criterion; the economic literature and economic behavior usually take various criteria into account.

Thus, I.A. Blank points out that the contemporary theories of the Management of an investment portfolio structure have a vast methodical tool of optimization of this factor at their disposal, at which the basic criteria are as following:

- maximization of the trade value of the company;

- minimization of the weighted average cost of the company Management of an investment portfolio;

- minimization of the level of financial risks in the activity of the company;

- maximization of the level of financial profitability.

Based on the determination of such criteria, I.A. Blank concludes that ?the optimal Management of an investment portfolio structure refers to such a ratio of usage of proprietory and borrowed funds, at which the most efficient proportionality between the financial earning capacity index and the financial stability index of the company is established, i.e. its market value is maximized[4].

One may argue that it is possible to use the whole complex of indicated criteria at the structural optimization. We believe that the most accurate in this case is the position of M. Yenson, who stated that multiple objectives are their absence[5].

Indeed, it is logically impossible to maximize simultaneously in more than one dimension, unless these dimensions are in the direct proportion. The object-orientated formation of the Management of an investment portfolio structure requires the existence of a clear objective function. The objective and the priority of the optimization criterion of the company Management of an investment portfolio structure is the maximization of its market value.

It should be pointed out that the foreign theory of Management of an investment portfolio structure in the Russian financial practice and various alternative models have application mainly for the analysis of liability structure with the primary objective for the provision of financial stability but not the maximization of market value of the company. Some researchers consider such models as not applicable in Russian conditions, where the Management of an investment portfolio market is almost absent, and, therefore, it is impossible to speak about the market value of the company, the maximization of which is the objective for the analysis of the Management of an investment portfoliostructure[6].

We suppose that the reforming of financial system in Russia, which is mainly touched upon the company finances as its basic fundamental unit, the realignment of ownership rights during privatization process, development of financial market institutions and other processes, which accompany the market reconstruction of the Russian economy, condition the necessity of active implementation of modern models in the Management of an investment portfolio structure formation and the development of the value approach to the corporate governance - Value Based Management (VBM) into the economic life of the company.

The basic principles of VBM may be defined as follows:

· the value maximizing of the company is the key factor of the company performance efficiency and the top target of strategic management, which supposes the objective formation and system definition of key factors for the creation of value;

· the money flows and Management of an investment portfolio value, which is invested into assets for the generation of these flows play the leading role in the system of key factors for the creation of value.

At the same time, at the implementation of VBM, it is necessary to take into account, that the value approach, like any other approach to the company management, is the definite model of social realm. The comparative effectiveness of the model, concerning the available alternatives, is defined by its efficiency to explain and forecast the corresponding economic processes.

The world practice has demonstratively proved the advantages of choice in the company market value as the priority criterion of its activity results and are based upon the value approach in comparison with the alternative modes:

- the increase of value for the shareholders does not contradict with the long-term interests of other interested parties and the society as a whole, as the shareholders are the permanent claimants upon the flow of money of the companies. The residual equity undertakes the maximum risk, but it itself conjugates the partnership rights in the corporate governance. Strong impulses stimulate the shareholders to maximize their requirements;

- the assessment of the market value requires the fullest data on the operation of the company;

- market value, as contrasted with the value, based on the accounting reporting, allows to take all expenses into account (including the alternative costs), risks of the company operation, as well as the time factor;

- the value approach makes it possible to combine long-term and short-term objectives of the company development in the optimal way by means of development of quantitative indicators, which rest upon the key value drivers, build integrated management control system of the company, which is based on the clear structure hierarchy of indicated factors, as well as to expand the "agent problem" by means of creation of the system of material consideration, which is directly "pegged? to the dynamics value (evaluation, planning and control of the key value drivers in "the area of responsibility" of the corporate employees).

The criteria of value are not absolutely perfect. But, as M. Yenson indicates, for now there is no other criterion, which is equal in ability to reflect a great variety of various factors in the single criterion, upon which the company future may depend[7]. In this respect the criterion of value stands down both as the factors of absolute financial result of business operation (clean profit, inclusive of the accounted for one share), and the relative factors (return on the assets, investments, shareholders' funds etc.). Such indicators, which are built on the index of the accounting income, characterize the latest activity of the company and slightly correlate with the market value. Such statement is proved a posteriori. According to calculations of professional consultants, engaged into the valuation, the correlation index of profit and company value makes not more than 8%[8]. According to the T. Coupland data, changes of the profit for the share do not affect their value[9].

Meanwhile the problem of optimization of the Management of an investment portfolio structure is often decided based on the search of such correlation of proprietory and borrowed Management of an investment portfolio of the company in economic literature and financial practice, at which the desired values of normal financial coefficients are reached: financial leverage, earnings per share, return on equity etc. At the systematizing the optimization of the Management of an investment portfolio structure of the company, names such approach as accounting one, opposing it to the financial approach, based on the usage of indicators, and connected with the investment risk (weighted average cost of the Management of an investment portfolio)[10].

One of the methods within the accounting approach, described by I. Ivashkovskaya, is a method of operating profit, directed to the determination of the allowable level of debt in the Management of an investment portfolio structure by means of detection of the likelihood of business smashup on the ground of the assessment of the volatility of its profit.

Observing the disadvantages of the present method (usage of historic significance of profit, not accounting the indirect bankruptcy costs etc.), I. Ivashkovskaya points out that the method of operational profit is completely applicable as one of the elements of the complex approach to the optimization model of the Management of an investment portfolio structure, and it is also very convenient as far as the express methods and the preliminary appraisals of the Management of an investment portfolio structure are concerned.

Another method of formation of the optimal Management of an investment portfolio structure is the method EBIT-EÐS, which is described by T.V. Teplova in particular. The search of correlation of the borrowed and proprietory funds, wherein the company value is the highest, is carried out coming from the assumption about the direct dependence of the profitability from the risk.

The optimal Management of an investment portfolio structure, which corresponds to the existing balance of interests in the house, is the one, at which the maximum level of net income per share at the minimal financial risk is reached, which is characterized by the level of financial leverage - the risk of transformation of earnings before interest and taxes (EBIT) into the net income (EÐS). The situation when the level of net income per share is achieved at the minimal financial risk, is characterized by the achievement of the point of indifference, at which the value of EBIT ponds to the maximal value of EÐS at the minimal value of financial risk, which means that the net income per share is the same both with the attraction of the borrowed funds and without, when only proprietory funds are used. In this case the return on assets of the company is equal to the average rate interest at the open market. If the company increases the net income per share at the expense of additional attraction of proprietory funds only, the production risk increases (the risk of transformation of marginal profit into the before-tax profits and interests), which can be increased without increasing of the fixed charges until the certain limit is reached. On the other hand, the size of net income per share may be increased by means of attraction of additional Management of an investment portfolio on the account of proprietory and borrowed funds in certain ratio. The mechanism of financial leverage is used for the conduction of optimization calculations.

At the determination of importance of the analyzed methods for the financial decisions they all have a common disadvantage, which is focused on the indices of the previous activity of the company, and consequently, the weak correlation with the index of enterprise value.

The optimization of Management of an investment portfolio structure according to minimization criterion of the weighted average cost of the Management of an investment portfolio (within the financial approach) has no such disadvantage. However, the minimization of weighted average cost of Management of an investment portfolio cannot come out as an optimality criterion of its structure by itself. The analysis of provisions of the examined theories of the Management of an investment portfolio structure testifies that the business Management of an investment portfolio should consist of the borrowed funds only at such approach, the value of which is always less than the stock Management of an investment portfolio at other equal conditions; but this means the loss of financial stability and the threat of business smashup.

It is necessary to indicate that at the reduction of cost of Management of an investment portfolio the company value will grow up only when the change of Management of an investment portfolio structure does not render the negative influence on the flow of money. If the decrease of the acceptable level of risk takes place as a result of procurement of a new borrowed Management of an investment portfolio and this leads to the subsequent reduction of the money flows, the company value may decrease even at the reduction of the Management of an investment portfolio value. Meanwhile, the objective of financial management is the maximization of the company value, instead of the cost minimization for the Management of an investment portfolio.

Thus, the growth of the market value acts as a valid economic criterion, which reflects the integral effect of the impact of the decisions made on all characteristics, on which the activity of the enterprise is estimated (market share and stability of competitive positions, incomes, investment requirements, operating efficiency, taxation load, regulation, and, finally, the money flow and risk level, which allows to range the variants in the situation with the multiple choice). The effectiveness of management of the Management of an investment portfolio structure formation is achieved at the presence of such an objective criterion only.

The establishment of optimal Management of an investment portfolio structure requires an application of not only the quantitative evaluation, but also the qualitative analysis of the particular set of external and internal factors, which condition the present structure. The resulting impact of such a set of factors defines the correlation of profitability, risk and liquidity parameters, provided at the formation of financial structure of the company Management of an investment portfolio.

Taking into account the stated above, the optimal financial structure of the company Management of an investment portfolio is such a correlation of all forms of proprietory and borrowed Management of an investment portfolio, at which the maximization of the substantiated market value of the company is achieved, taking into account the required balance profitability - risk - liquidity.

The optimization process of the Management of an investment portfolio financial structure is built on the certain principles. Contemporary economic literature on the problem considers mainly the principles of the Management of an investment portfolio formation rather than the optimization of its structure. This is explained by the fact that the process of Management of an investment portfolio formation includes the actions on the optimization of its structure as the most important constituent. The analysis of works, the authors of which pay special attention to the principles of Management of an investment portfolio formation [12], allows to define the following basic principles:

· accounting of prospects for the development of economic operations of enterprises;

· provision of correspondence of the attracted Management of an investment portfolio volume to the volume of formed assets of the enterprise;

· provision of the optimality of Management of an investment portfolio structure with the aim of the efficient use;

· provision of cost minimization on the Management of an investment portfolio formation from different sources;

· provision of the efficient use of Management of an investment portfolio in the process of business activity.

Some researchers also refer the stated principles to the formation of the Management of an investment portfolio structure of the organization[13], which is rather arguable to our mind. We consider the principles of the optimization of Management of an investment portfolio financial structure to have specific contents, and therefore they should be specified.

The principles (lat. principium means the basis, the beginning) mean the basic initial provisions of some theory, basic rules of activity; settled, rooted, generally accepted, and widely used rules of economic activity and character of economic processes.[14].

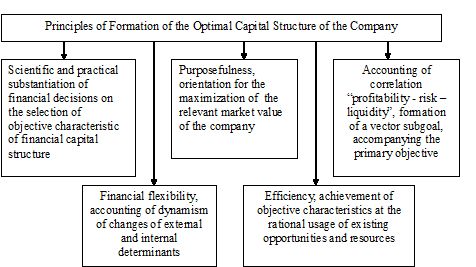

On this basis, the principles of formation of optimal financial Management of an investment portfolio structure refer to as the fundamental rules, which lie on its base and which should be observed at the making of corresponding financial decisions (picture 5).

One of the basic principles of the formation of optimal financial structure of the Management of an investment portfolio is the principle of scientific and practical substantiation. The relevant choice of objective characteristics of the financial Management of an investment portfolio structure, taking into account the present-day development of the financial theory and practice, and based on the results of the analysis of influence of the external and internal factors of the Management of an investment portfolio structure, allows to make decisions, which promote the efficient company development.

Figure 2. -Formation principles of the optimal Management of an investment portfolio structure of the company.[15].

The problem of optimization is always connected with the formulation of the objective and the choice of the optimization criterion of its achievement. It is impossible to speak about the optimization without its conditions and defined optimality criteria. In accordance with the mathematical description, the optimization suggests the achievement of the extreme (maximum or minimum) of the objective function at the set restrictions. Concerning the optimization of the financial Management of an investment portfolio, as it was shown, such objective criteria is the maximization of the company value. Therefore, one of the key principles of the formation of optimal financial structure of the Management of an investment portfolio is the principle of purposefulness, which means the orientation on the maximization of this factor.

Maximization of substantiated market value of the company must be reached under the predetermined correlation of earning power - risk - liquidity within the accepted financial policy (aggressive, moderate, conservative). Meanwhile, the given characteristics have a multidirectional nature, thus presupposing the necessity of their balancing for the achievement of the primary objective by means of formation of the vector of concomitant objectives (sub objectives). Accounting of correlation profitability-risk liquidityIsthus an important principle of formation of the optimal financial Management of an investment portfolio structure.

Another principle of formation of financial Management of an investment portfolio structure is the financial flexibility. It supposes the ability of the company to take into account the transformation of external and internal factors dynamically, react on the current changes both long-term and short-term adequately. Thus the process of formation of the optimal Management of an investment portfolio structure is the process of adoption of the current Management of an investment portfolio structure to the real conditions, allowing to take the new determinants into account.

Efficiency is also referred to the principle of formation of the financial Management of an investment portfolio structure. The exact contents of the notion efficiency, as G.B. Kleiner defines, depends on the peculiarity of economics, where the efficiency of the adopted or ruling paradigm is studied, the objective of the investigation, points of view and many other factors and conditions[16]. The analysis testifies that the determination of efficiency from the economic literature is mainly based on the notion about functioning of economic system as a chain "expenses? results? objectives (functions)" despite the existing differences? and supposes the opportunity to measure or estimate the expenses, results, and objectives [17]. Besides, the notion?efficiency? is considered as the basic principle of activity and the loyal vector of movement to get the end result, providing the achievement of the set objective with minimal expenses; as well as the characteristics of productivity activity, measuring the received effect with the use of expenses (recourses) for this.

We have the first rendition of this notion applicable to the task of our research. The efficiency of formation of the optimal financial Management of an investment portfolio structure means the opportunity to achieve the set objective characteristics at the rational usage of opportunities and resources, which are already at the disposal.

The optimization process of financial structure of the Management of an investment portfolio in the system of management of the company value should be carried out taking into account the interrelation of strategic objective, accompanying subgoals, depending on its achievements and factors of value creation.

The factors of creation of the value characterize the activity, upon which the result of the strategy of value growth depends[18]. It is a multilevel system, which exhibits its dependence upon the factors of higher level and shows, how the index value is related to the current activity. Therefore, the value management actually means the management of the system of value factors. Large companies may include various factors into the system, which management requires a lot of expenses. Therefore the primary task is to define the key and the most important factors, which should hold all the efforts on the value management.

Financial structure of the company Management of an investment portfolio refers to such key factors, which defines the importance of its optimization in the system of company value management. The process of formation of the optimal financial structure of the company Management of an investment portfolio is subject to the tasks for the provision of its efficient activity not only in prospect, but also in the running period; therefore it should be viewed in the strategic and current aspects.

The strategic objective of business activity of the company is the maximization of its substantiated market value, which conditions the objective orientation of the financial Management of an investment portfolio structure, as mentioned above. However, the current period should define the accompanying subgoals, the vector of which is related to the implementation of strategic objective.

The previous statement defined that the conventional financial characteristics, which are based on the financial income (net income, earnings per share, return on assets, return on equity), do not correlate fully with the market value index. This defines the necessity to establish the indicator, which should meet the given requirements.

Such indicator can be found if to take into account that the index of market value allows to combine the long-term and short-term objectives of the company activity by means of combination of the indices of value and economic profit, created in the company for the current period of time, for example a month, quarter, or year. The index value, built in respect to the principle of economic income, is defined by such a circumstance, that it can settle the contradiction between the bookkeeping and financial approach, as well as to formulate the limitations and assumptions, necessary for the implementation of the optimum of correlation of proprietory and borrowed Management of an investment portfolio, taking into account the system balance?profitability? risk - liquidity?.

Contrary to the accounting income, the utilization value of not only interest charges on the borrowed funds, but on all elements of the Management of an investment portfolio employed, is taken into consideration at the making up of economic income. That way the economic income serves as a criterion of the efficient use of Management of an investment portfolio. Its positive value indicates the growth of property asset (net assets) and means that the company has earned more than it is necessary to cover the value of utilize resources.[19].

The approach to the conflict resolution on the levels of profitability, risk, and liquidity can be presented in general in the following way. As it was stated above, with the increase of gearing in the overall structure of the Management of an investment portfolio, the profitability grows, but together with the financial risk, and in case of Management of an investment portfolio gearing on the short-term basis the current liquidity decreases. Thus, the growth of liquidity comes into conflict with the factors of financial risk and current liquidity. The settlement of examined contradiction is reached by special relation between the growth rate of economic profit (EP), borrowed funds (Å) and current assets (CÀ). This condition of optimization of the financial structure of the company Management of an investment portfolio can be presented as in the equation:

( EP >CÀ>Å )

At the fulfillment of the condition the exceeding of profit over the value of the utilize resources, the decrease in the risk of business solvency loss and the achievement of supportable level of liquidity are provided.

The growth of economic income reflects the process of creating the value in the running period, thus securing the succession of long-term and short-term objectives on the formation of the financial Management of an investment portfolio structure under the system of total cost management in the company.

The presented conceptual approach, in our opinion, can be taken as the basis for the development of current optimization of the financial Management of an investment portfolio structure and the creation of the corresponding model.

Conclusion

On the basis of the work carried out research on the problem of optimizing the Management of an investment portfolio structure of organizations, the developed theoretical, methodological and practical provisions to the following conclusions and suggestions:

In the process of organizing the views of local and foreign authors on the definition of "Management of an investment portfolio of the organization," highlighted the essential and formal approaches.Under the equity understand resource that creates the conditions for its development, defines the financial strength and is one of the most important pricing factors affecting its value.

The study of the classification of sources of Management of an investment portfolio funding organization has shown that they are not uniquely defined, the essential difference is the degree of detail.We have refined and expanded their grouping with the modern Russian conditions.

A system for the management of financial resources of the organization, which is understood as a set of elements that are interrelated and affect the formation and use of the company's Management of an investment portfolio within certain management techniques.

Optimization of Management of an investment portfolio structure of the organization and its sustainability, the use of market mechanisms for the organization of funds determined by the Government of the Russian Federation as its strategic objectives.

Fundamental role in the formation of Management of an investment portfolio play attracted the sources most likely to be influenced by environmental factors.

The study of the state of the company's Management of an investment portfolio has shown that the fundamental role played in its formation and joint stock companies.

Evaluation of Management of an investment portfolio structure allowing for the Kazakh accounting rules indicates that the implied power is insignificant proportion that can be described positively as increased importance of direct sources.

Qualitative assessment of the Management of an investment portfolio structure of organizations, taking into account the degree of resistance and the risk of forming his papers revealed that she is at risk of instability.Restrains the growth opportunities of Management of an investment portfolio sources with a high degree of stability and, ultimately, a negative impact on the optimization of its structure undeveloped regional financial market.

The technique of evaluation of the system of financial management organizations, including a set of quantitative and qualitative indicators to establish the level of management efficiency.In this case, preference is given to organizations such criteria as financial risk.At the same time, forming a Management of an investment portfolio structure that they do not pay enough attention to the efficiency of its use.

The final direction of generalization and evaluation of the system of financial management of organizations is to analyze the effectiveness of their financial management.Thus, each entity is building a system of self-management resources, based on their own financial situation, development concept, knowledge and experience of managers that are subject to risks of making wrong decisions.In the 'result under optimal Management of an investment portfolio structure appropriate to understand the structure in which the chosen strategy for managing Management of an investment portfolio will help maximize the effectiveness of its use:

Given the limited capacity of formation of financial resources in the stock market, the simultaneous growth of commercial bank loans mainly long-term, one way to optimize the Management of an investment portfolio structure is financial integration.In this paper we propose a mechanism of consolidation of Management of an investment portfolio.

As a result, the organization receives an investment loan, the use of which has a positive effect on the structure of its Management of an investment portfolio.

In order to optimize the Management of an investment portfolio structure in terms of "sustainability", based on expert judgment to construct a matrix of cross-analysis focused on the study of relationships in the flow of events and to quantify the most significant factors identified by calculating the degree of their influence on the integral indicator of the stability of the Management of an investment portfolio structure, which will, if necessary make appropriate management decisions on the mobilization of funding sources.Simultaneously, in a dynamic environment the task of money management is recommended to express using fuzzy logic methods.

To improve the efficiency of Management of an investment portfolio use the technique of optimizing its structure in terms of "yield", the main scientific idea which is the diversification of assets of an organization with a primary investment in the revenue.

In order to reduce the risk of developing and implementing incorrect tactical measures to optimize the financial resources it is recommended to use the methods of decision making.Given the characteristics of the development of regional financial markets through the use of fuzzy logic is considered three choices of sources of Management of an investment portfolio: placement of common shares, raising long-term and short-term loans.

The implementation proposed in the thesis work of methodological principles and practical recommendations aimed at optimizing the Management of an investment portfolio structure of organizations in the region at present.

Date: 2015-12-11; view: 1472

| <== previous page | | | next page ==> |

| Weighted average cost of management investment portfolio's structure and its optimization | | | Factors Determining Management of an investment portfolio Structure |