CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Rent expense Depreciation expense

__________________________ __________________________

3/1 Bal. 0 3/1 Bal. 0

5. 5,000 9. 1,000

_______________ _______________

3/31 Bal. 5,000 3/31 Bal. 1,000

| Account Title | Debits | Credits | ||

| Cash | 264,000 | |||

| Accounts receivable | 65,000 | |||

| Inventory | 20,000 | |||

| Prepaid insurance | 6,000 | |||

| Equipment | 40,000 | |||

| Accumulated depreciation | 1,000 | |||

| Accounts payable | 20,000 | |||

| Note payable | 30,000 | |||

| Common stock | 300,000 | |||

| Sales revenue | 120,000 | |||

| Cost of goods sold | 70,000 | |||

| Rent expense | 5,000 | |||

| Depreciation expense | 1,000 | ______ | ||

| Totals | 471,000 | 471,000 | ||

1. Cash.......................................................................... 500,000

1. Cash.......................................................................... 500,000

Common stock............................................................. 500,000

2. Furniture and fixtures............................................... 100,000

Cash............................................................................. 40,000

Note payable ............................................................... 60,000

3. Inventory.................................................................. 200,000

Accounts payable......................................................... 200,000

4. Accounts receivable.................................................. 280,000

Sales revenue................................................................ 280,000

Cost of goods sold.................................................... 140,000

Inventory...................................................................... 140,000

5. Rent expense................................................................. 6,000

Cash............................................................................. 6,000

6. Prepaid insurance.......................................................... 3,000

Cash............................................................................. 3,000

7. Accounts payable...................................................... 120,000

Cash............................................................................. 120,000

8. Cash............................................................................ 55,000

Accounts receivable...................................................... 55,000

9. Retained earnings.......................................................... 5,000

Cash............................................................................. 5,000

10.Depreciation expense.................................................... 2,000

Accumulated depreciation............................................ 2,000

11.Insurance expense ($3,000 ÷ 12 months)......................... 250

Prepaid insurance......................................................... 250

List A List B

List A List B

k 1. Source documents a. Record of the dual effect of a transaction in

debit/credit form.

e 2. Transaction analysis b. Internal events recorded at the end of a

reporting period.

a 3. Journal c. Primary means of disseminating information

to external decision makers.

j 4. Posting d. To zero out the owners’ equity temporary

accounts.

f 5. Unadjusted trial balance e. Determine the dual effect on the accounting

equation.

b 6. Adjusting entries f. List of accounts and their balances before

recording adjusting entries.

h 7. Adjusted trial balance g. List of accounts and their balances after

recording closing entries.

c 8. Financial statements h. List of accounts and their balances after

recording adjusting entries.

d 9. Closing entries i. A means of organizing information; not part

of the formal accounting system.

g 10. Post-closing trial balance j. Transferring balances from the journal to the

ledger.

i 11. Worksheet k. Used to identify and process external

transactions.

Increase (I) or

Increase (I) or

Decrease (D)Account

1. I Inventory

2. I Depreciation expense

3. D Accounts payable

4. I Prepaid rent

5. D Sales revenue

6. D Common stock

7. D Wages payable

8. I Cost of goods sold

9. I Utility expense

10. I Equipment

11. I Accounts receivable

12. D Allowance for uncollectible accounts

13. I Bad debt expense

14. I Interest expense

15. D Interest revenue

16. D Gain on sale of equipment

Exercise 2-7

Account(s) Account(s)

Debited Credited

Example: Purchased inventory for cash 3 5

1. Paid a cash dividend. 10 5

2. Paid rent for the next three months. 8 5

3. Sold goods to customers on account. 4,16 9,3

4. Purchased inventory on account. 3 1

5. Purchased supplies for cash. 6 5

6. Paid employees wages for September. 15 5

7. Issued common stock in exchange for cash. 5 12

8. Collected cash from customers for goods sold in 3. 5 4

9. Borrowed cash from a bank and signed a note. 5 11

10. At the end of October, recorded the amount of

supplies that had been used during the month. 7 6

11. Received cash for advance payment from customer. 5 13

12. Accrued employee wages for October. 17 15

1. Prepaid insurance ($12,000 x 30/36).......................... 10,000

1. Prepaid insurance ($12,000 x 30/36).......................... 10,000

Insurance expense............................................. 10,000

2. Depreciation expense........................................... 15,000

Accumulated depreciation ............................... 15,000

3. Bad debt expense ($6,500 - 2,000)............................ 4,500

Allowance for uncollectible accounts................ 4,500

4. Salaries expense................................................... 18,000

Salaries payable................................................ 18,000

5. Interest expense ($200,000 x 12% x 2/12).................... 4,000

Interest payable................................................ 4,000

6. Unearned rent revenue.......................................... 1,500

Rent revenue (1/2x $3,000).................................. 1,500

Exercise 2-9

1. Interest receivable ($90,000 x 8% x 3/12).................... 1,800

Interest revenue................................................ 1,800

2. Rent expense ($6,000 x 2/3)...................................... 4,000

Prepaid rent...................................................... 4,000

3. Rent revenue ($12,000 x 7/12)................................... 7,000

Unearned rent revenue ..................................... 7,000

4. Depreciation expense........................................... 4,500

Accumulated depreciation................................ 4,500

5. Salaries expense .................................................. 8,000

Salaries payable................................................ 8,000

6. Supplies expense ($2,000 + 6,500 - 3,250).................. 5,250

Supplies............................................................ 5,250

1.  $7,200 represents nine months of interest on a $120,000 note, or 75% of annual interest.

$7,200 represents nine months of interest on a $120,000 note, or 75% of annual interest.

$7,200 ÷ .75 = $9,600 in annual interest

$9,600 ÷ $120,000 = 8% interest rate

Or,

$7,200 ÷ $120,000 = .06 nine-month rate

To annualize the nine month rate: .06 x 12/9 = .08 or 8%

2. $60,000 ÷ 12 months = $5,000 per month in rent

$35,000 ÷ $5,000 = 7 months expired. The rent was paid on June 1, seven months ago.

3. $500 represents two months (November and December) in accrued interest, or $250 per month.

$250 x 12 months = $3,000 in annual interest

Principal x 6% = $3,000

Principal = $3,000 ÷ .06 = $50,000 note

Requirement 1

Requirement 1

Exercise 2-11 (continued)

| BLUEBOY CHEESE CORPORATION | |||||||||||

| Balance Sheet | |||||||||||

| At December 31, 2011 | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash ..................................................... | $ 21,000 | ||||||||||

| Accounts receivable .............................. | $300,000 | ||||||||||

| Less: Allowance for uncollectible accounts | (20,000) | 280,000 | |||||||||

| Inventory............................................... | 50,000 | ||||||||||

| Prepaid rent .......................................... | 10,000 | ||||||||||

| Total current assets .......................... | 361,000 | ||||||||||

| Property and equipment: | |||||||||||

| Equipment ............................................ | 600,000 | ||||||||||

| Less: Accumulated depreciation ........... | (250,000) | 350,000 | |||||||||

| Total assets ................................... | $711,000 | ||||||||||

| Liabilities and Shareholders' Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable ................................. | $ 40,000 | ||||||||||

| Salaries payable .................................... | 8,000 | ||||||||||

| Interest payable .................................... Note payable ........................................ | 2,000 60,000 | ||||||||||

| Total current liabilities ..................... | 110,000 | ||||||||||

| Shareholders’ equity: | |||||||||||

| Common stock ..................................... | $400,000 | ||||||||||

| Retained earnings ................................. | 201,000* | ||||||||||

| Total shareholders’ equity ............... | 601,000 | ||||||||||

| Total liabilities and shareholders’ equity | $711,000 | ||||||||||

*Beginning balance of $100,000 plus net income of $101,000.

Exercise 2-11 (concluded)

Requirement 2

December 31, 2011

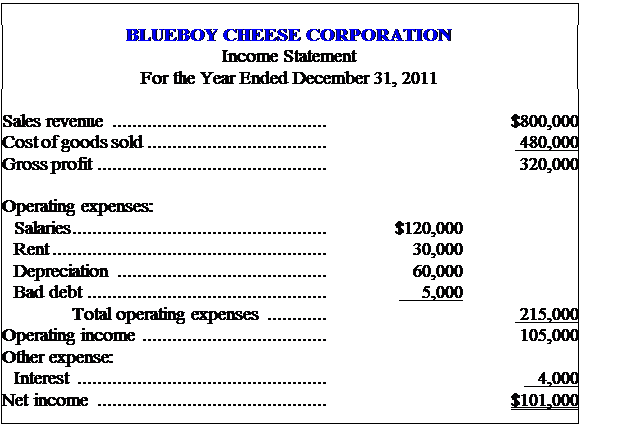

Sales revenue............................................................. 800,000

Income summary................................................... 800,000

Income summary....................................................... 699,000

Cost of goods sold................................................. 480,000

Salaries expense.................................................... 120,000

Rent expense......................................................... 30,000

Depreciation expense............................................ 60,000

Interest expense..................................................... 4,000

Bad debt expense.................................................. 5,000

Income summary ($800,000 - 699,000)........................... 101,000

Retained earnings.................................................. 101,000

December 31, 2011

Sales revenue............................................................. 750,000

Interest revenue......................................................... 3,000

Income summary................................................... 753,000

Income summary....................................................... 576,000

Cost of goods sold................................................. 420,000

Salaries expense.................................................... 100,000

Rent expense......................................................... 15,000

Depreciation expense............................................ 30,000

Interest expense..................................................... 5,000

Insurance expense................................................. 6,000

Income summary ($753,000 - 576,000)........................... 177,000

Retained earnings ................................................. 177,000

Exercise 2-13

December 31, 2011

Sales revenue............................................................. 492,000

Interest revenue......................................................... 6,000

Gain on sale of investments ..................................... 8,000

Income summary................................................... 506,000

Income summary....................................................... 440,000

Cost of goods sold................................................. 284,000

Salaries expense.................................................... 80,000

Insurance expense................................................. 12,000

Interest expense..................................................... 4,000

Advertising expense.............................................. 10,000

Income tax expense............................................... 30,000

Depreciation expense ........................................... 20,000

Income summary ($506,000 – 440,000)........................... 66,000

Retained earnings ................................................. 66,000

Requirement 1

Requirement 1

Supplies

11/30 Balance 1,500

Expense 2,000

Purchased ?

12/31 Balance 3,000

Cost of supplies purchased = $3,000 + 2,000 - 1,500 = $3,500

Exercise 2-14 (continued)

Requirement 2

Prepaid insurance

11/30 Balance 6,000

Expense ?

12/31 Balance 4,500

Insurance expense for December = $6,000 - 4,500 = $1,500

December 31, 2011

Insurance expense..................................................... 1,500

Prepaid insurance.................................................. 1,500

Requirement 3

Wages payable

10,000 11/30 Balance

Wages paid 10,000 ?Accrued wages

15,000 12/31 Balance

Accrued wages for December = $15,000

December 31, 2011

Wages expense.......................................................... 15,000

Wages payable...................................................... 15,000

Exercise 2-14 (concluded)

Requirement 4

Unearned rent revenue

2,000 11/30 Balance

Earned for Dec. 1,000

1,000 12/31 Balance

Rent revenue recognized each month = $3,000 x 1/3 = $1,000

December 31, 2011

Unearned rent revenue.............................................. 1,000

Rent revenue.......................................................... 1,000

Exercise 2-15

Requirement 1

| Debit | Credit | ||

| Feb. 1 | Cash ............................................... | 12,000 | |

| Note payable .............................. | 12,000 | ||

| April 1 | Prepaid insurance ........................... | 3,600 | |

| Cash ............................................ | 3,600 | ||

| July 17 | Supplies .......................................... | 2,800 | |

| Accounts payable ........................ | 2,800 | ||

| Nov. 1 | Note receivable ............................... | 6,000 | |

| Cash ............................................ | 6,000 | ||

Requirement 2

| Debit | Credit | ||

| Dec. 31 | Interest expense ($12,000 x 10% x 11/12) | 1,100 | |

| Interest payable ........................... | 1,100 | ||

| Dec. 31 | Insurance expense ($3,600 x 9/24)...... | 1,350 | |

| Prepaid insurance ....................... | 1,350 | ||

| Dec. 31 | Supplies expense ($2,800 - 1,250)......... | 1,550 | |

| Supplies ..................................... | 1,550 | ||

| Dec. 31 | Interest receivable ........................... | ||

| Interest revenue ($6,000 x 8% x 2/12)....................................................................... | |||

Exercise 2-16

Unadjusted net income $30,000

Adjustments:

a. Only $2,000 in insurance should be expensed + 4,000

b. Sales revenue overstated - 1,000

c. Supplies expense overstated + 750

d. Interest expense understated ($20,000 x 12% x 3/12) - 600

Adjusted net income $33,150

| Stanley and Jones Lawn Service Company | ||||||||

| Income Statement | ||||||||

| For the Year Ended December 31, 2011 | ||||||||

| Sales revenue (1)....................................... | $315,000 | |||||||

| Operating expenses: | ||||||||

| Salaries ................................................. | $180,000 | |||||||

| Supplies (2)............................................ | 24,500 | |||||||

| Rent ...................................................... | 12,000 | |||||||

| Insurance (3) .......................................... | 4,000 | |||||||

| Miscellaneous (4) ................................... | 21,000 | |||||||

| Depreciation ......................................... | 10,000 | |||||||

| Total operating expenses ......... | 251,500 | |||||||

| Operating income .................................... | 63,500 | |||||||

| Other expense: | ||||||||

| Interest (5).............................................. | 1,500 | |||||||

| Net income .............................................. | $62,000 | |||||||

(1) $320,000 cash collected less $5,000 decrease in accounts receivable.

Cash ............................................................................ 320,000

Accounts receivable (decrease in account)....................... 5,000

Sales revenue (to balance)............................................... 315,000

(2) $25,000 cash paid for the purchase of supplies less $500 increase in supplies.

Supplies expense (to balance) ........................................ 24,500

Supplies (increase in account)....................................... 500

Cash ............................................................................... 25,000

Exercise 2-17 (concluded)

(3) $6,000 cash paid for insurance less $2,000 ending balance in prepaid insurance.

Insurance expense (to balance) ........................................ 4,000

Prepaid insurance (increase in account)............................ 2,000

Cash ............................................................................... 6,000

(4) $20,000 cash paid for miscellaneous expenses plus increase in accrued liabilities.

Miscellaneous expense (to balance) ............................... 21,000

Accrued liabilities (increase in account).......................... 1,000

Cash ............................................................................... 20,000

(5) $100,000 x 6% x 3/12 = $1,500

Interest expense .............................................................. 1,500

Interest payable............................................................... 1,500

Exercise 2-18

Cash basis income ($545,000 – 412,000) $133,000

Add:

Increase in prepaid insurance ($6,000 – 4,500) 1,500

Deduct:

Depreciation expense (22,000)

Decrease in accounts receivable ($62,000 – 55,000) (7,000)

Decrease in prepaid rent ($9,200 – 8,200) (1,000)

Increase in unearned service fee revenue ($11,000 – 9,200) (1,800)

Increase in accrued liabilities ($15,600 – 12,200) (3,400)

Accrual basis income $ 99,300

| Requirement 1 | |||||||||||||||||||||||||||||||

| Account Title | Unadjusted Trial Balance | Adjusting Entries | Adjusted Trial Balance | Income Statement | Balance Sheet | ||||||||||||||||||||||||||

| Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | ||||||||||||||||||||||

| Cash | 20,000 | 20,000 | 20,000 | ||||||||||||||||||||||||||||

| Accounts receivable | 35,000 | 35,000 | 35,000 | ||||||||||||||||||||||||||||

| Allowance for | |||||||||||||||||||||||||||||||

| uncollectible accounts | 2,000 | (2) 3,000 | 5,000 | 5,000 | |||||||||||||||||||||||||||

| Prepaid rent | 5,000 | 5,000 | 5,000 | ||||||||||||||||||||||||||||

| Inventory | 50,000 | 50,000 | 50,000 | ||||||||||||||||||||||||||||

| Equipment | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||||||

| Accumulated depreciation- | |||||||||||||||||||||||||||||||

| equipment | 30,000 | (1) 10,000 | 40,000 | 40,000 | |||||||||||||||||||||||||||

| Accounts payable | 23,000 | 23,000 | 23,000 | ||||||||||||||||||||||||||||

| Wages payable | (3) 4,000 | 4,000 | 4,000 | ||||||||||||||||||||||||||||

| Common stock | 100,000 | 100,000 | 100,000 | ||||||||||||||||||||||||||||

| Retained earnings | 29,000 | 29,000 | 29,000 | ||||||||||||||||||||||||||||

| Sales revenue | 323,000 | 323,000 | 323,000 | ||||||||||||||||||||||||||||

| Cost of goods sold | 180,000 | 180,000 | 180,000 | ||||||||||||||||||||||||||||

| Wage expense | 71,000 | (3) 4,000 | 75,000 | 75,000 | |||||||||||||||||||||||||||

| Rent expense | 30,000 | 30,000 | 30,000 | ||||||||||||||||||||||||||||

| Depreciation expense | (1) 10,000 | 10,000 | 10,000 | ||||||||||||||||||||||||||||

| Utility expense | 12,000 | 12,000 | 12,000 | ||||||||||||||||||||||||||||

| Bad debt expense | 4,000 | (2) 3,000 | 7,000 | 7,000 | |||||||||||||||||||||||||||

| Net Income | 9,000 | 9,000 | |||||||||||||||||||||||||||||

| Totals | 507,000 | 507,000 | 17,000 | 17,000 | 524,000 | 524,000 | 323,000 | 323,000 | 210,000 | 210,000 | |||||||||||||||||||||

Exercise 2-19 (continued)

Requirement 2

Exercise 2-19 (concluded)

| WOLKSTEIN DRUG COMPANY | |||||||||||||

| Balance Sheet | |||||||||||||

| At December 31, 2011 | |||||||||||||

| Assets | |||||||||||||

| Current assets: | |||||||||||||

| Cash ........................................................ | $ 20,000 | ||||||||||||

| Accounts receivable ................................ | $ 35,000 | ||||||||||||

| Less: Allowance for uncollectible accounts | (5,000) | 30,000 | |||||||||||

| Inventory ................................................ | 50,000 | ||||||||||||

| Prepaid rent ............................................ | 5,000 | ||||||||||||

| Total current assets ............................. | 105,000 | ||||||||||||

| Property and equipment: | |||||||||||||

| Equipment .............................................. | 100,000 | ||||||||||||

| Less: Accumulated depreciation | (40,000) | 60,000 | |||||||||||

| Total assets ...................................... | $165,000 | ||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||

| Current liabilities: | |||||||||||||

| Accounts payable .................................... | $ 23,000 | ||||||||||||

| Wages payable ........................................ | 4,000 | ||||||||||||

| Total current liabilities ......................... | 27,000 | ||||||||||||

| Shareholders’ equity: | |||||||||||||

| Common stock ........................................ | $100,000 | ||||||||||||

| Retained earnings .................................... | 38,000* | ||||||||||||

| Total shareholders’ equity ................... | 138,000 | ||||||||||||

| Total liabilities and shareholders’ equity | $165,000 | ||||||||||||

*Beginning balance of $29,000 plus net income of $9,000.

Exercise 2-20

Requirement 1

Date: 2015-12-11; view: 1436

| <== previous page | | | next page ==> |

| Cash Accounts receivable | | | Transaction Journal |