CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

UNIT 1 Designed for the Internet

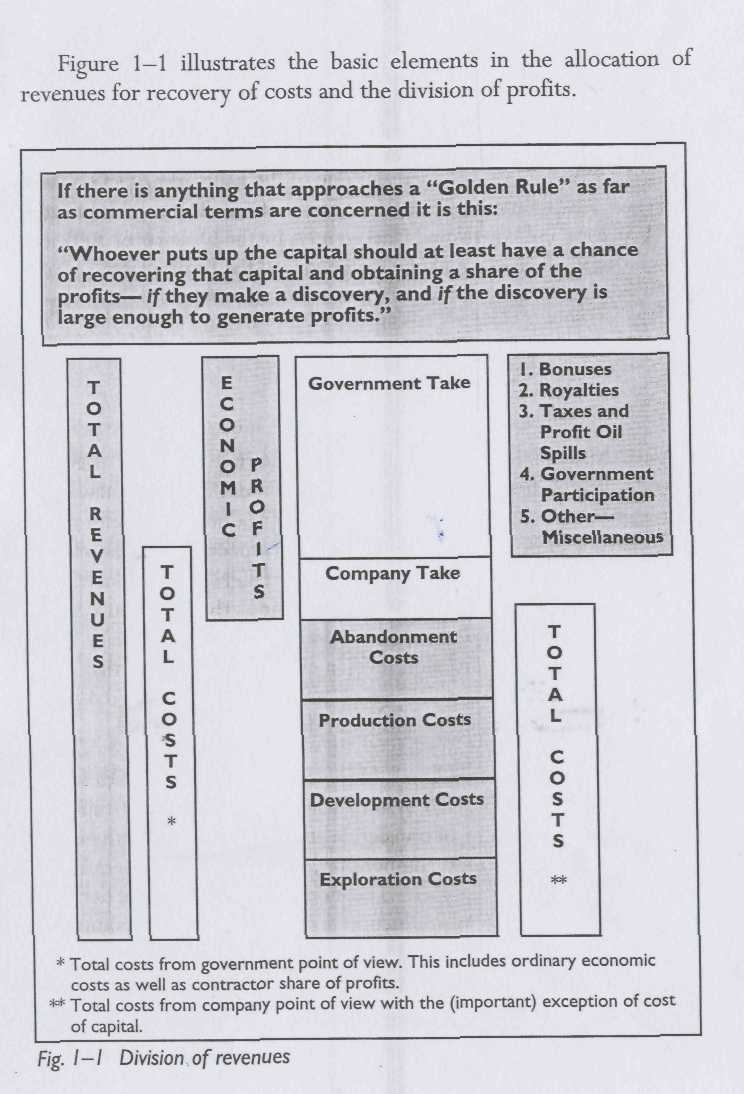

The concept of economic rent comes from the foundations of economic theory and the produce of the earth, which is derived from labor, machinery, and capital. Rent theory deals with how this produce is divided among the holders of the land, the owners of the capital, and the laborers through profit, wages, and rent. A strict distinction can be made between profits and rent, but in the popular language of the industry, this distinction is sometimes missed. But it is an important issue. Excess profits are synonymous with economic rent. That is the way it is defined in this text. However, there are other definitions used in the industry. For example, some economists equate rent with profit.

Economic rent is the difference between the value of production and the cost to extract it. The extraction cost consists of normal exploration, development, and operating costs as well as required rates of return or share of profit for the contractor. Rent deals with the surplus. Governments attempt to capture as much as possible of the economic rent through various means, including taxation, levies, royalties, and bonuses,

The problem for governments in determining how to efficiently capture rent is that nearly 9 out of 10 exploration efforts are not successful. This important element of risk strongly characterizes the upstream end of the oil industry. Developing fiscal terms that are capable of yielding sufficient potential rewards for exploration efforts must account for this risk. It is not an easy matter. Present value theory, expected value (EV) theory, and taxation theory are the foundation stones of fiscal system design and analysis.

The objective of host governments in designing petroleum fiscal systems is to structure an efficient system where exploration and development rights are acquired by those companies who place the highest value on those rights. In an efficient market, competitive bidding can help achieve this objective. But one of the hallmarks of an efficient market is availability of information. Exploration efforts are dominated by numerous unknowns and uncertainty. In the absence of sufficient competition, efficiency must be designed into the fiscal terms.

Governments can seek to capture economic rent at the time of the transfer of rights through signature bonuses or during the production phase of a contract, or concession through royalties, production sharing, or taxes.

Royalties, taxes, and/or production-sharing formulas used for extracting rent are contingent upon production. The contractor and government therefore share in the risk that production may not result from exploration efforts. An important aspect as far as risk is concerned is that oil companies are risk-takers who theoretically diversify their risk. On the other hand, as far as their exposure in the exploration business is concerned, governments are not likely to be diversified. Their risk aversion level is quite different than that of an international oil company. This aspect provides much of the dynamics of international negotiations and fiscal design.

Theoretically, a simple bonus bid with no royalties or taxes would be the ultimate example of a system where the government captured the economic rent at time of transfer. In an efficient market with perfect information and sufficient competition, the bonus would equal the present value of the total expected economic rent. This kind of behavior is seen to some degree in production acquisitions between companies where oil production is purchased and sold. From the government point of view, there is a trade-off between risk aversion (leaning toward bonus bids and royalties to some extent) and risk sharing (through production sharing or profit sharing through taxation schemes).

|

Governments have devised numerous frameworks for the extraction of economic rents from the petroleum sector. Some are very efficient and some perhaps not. Some are well balanced and cleverly designed and some are quite complex. But the fundamental issue is whether or not exploration and/or development is feasible under the conditions outlined in the fiscal system.The following pages outline the key aspects of contract negotiations and the numerous fiscal devices and systems designed to maximize host government profitability.

UNIT 1 Designed for the Internet

Before you read

Discuss these questions

1. Which of the following does your bank offer?

a) branches in every town b) telephone banking services c) internet banking

2. How do you usually manage your account?

a) visit the local branch b) by post c) by phone d) on the Internet

3. Would you like to change the way you bank? Why?/Why not?

Reading tasks

A. Identifying general content

Read the text about an internet bank and match the sub-headings (1-6) with the extracts (a-f).

| 1. transfer cash out conveniently & easily 2. designed for the Internet, not the high street 3. opening an account is simple it only takes an instant | 4. manage your finances the easy way 5. high interest rates 6. your money is safe with us |

B. Understanding details

Mark these statements true (T) or false (F) according to the text. Find the part of the text that gives the correct information.

first-e...

| 1. has a prestige high street address in every town. 2. offers high interest rates on savings. 3. lets you open an account without the need for paper documents. 4. allows you to transfer funds on-line. | 5. doesn't make any bank charges to its customers. 6. takes 3 days to transfer funds from one first-e account to another. 7. offers customers a cheque book. 8. protects customer security using encryption technology. |

OPEN AN ACCOUNT TODAY

a) Next time you're in a High Street Bank, look around you and think how much it must cost to run a prestige address, a nice office for the manager, lots of staff and glossy leaflets. You might as well enjoy it because you're paying for it. With first-e, overheads and bank charges just don't apply. This means better interest rates for you.

b) first-e offers high interest on every pound you put in. We accrue interest daily and pay it monthly, without deducting tax, as long as you fill in the form we give you.

c) We use the most advanced and secure systems available to protect your assets so your money is just as safe as it is in a High Street Bank. A number of sophisticated security layers including advanced encryption technology are used to protect all first-e customers.

d) All you have to do is:

1. Complete and submit the on-line application form. You will then receive a confirmatory e-mail. As soon as you receive this e-mail, you will be able to access your account and transfer money from your current bank account.

2. Print, sign and post the relevant documents to us. Once we have received these documents, we'll confirm without delay that your account is fully active.

e) You can transfer funds on-line from one first-e account to another easily, instantaneously and without charge. Similarly, you can use the on-line transfer facility to transfer funds to and from another bank account in the UK, free of charge. Transfers to another bank normally take three working days to complete.

Note that we do not currently accept cheques for the first-e savings account. Handling cheques is a slow and expensive practice. By not processing cheques, we can pass the savings straight onto our customers.

f) We've all stood in bank queues, trying to find a deposit slip and fill it in while we're standing up with a biro on a chain that doesn't work. We've all tried in vain to get an appointment with some junior manager for an overdraft. First-e aims to change all of that, and make banking easy and convenient. We've done everything we can to make our services as friendly and simple as possible.

* first-e internet bank ("first-e") is a trademark used by Banque dEscompte for banking on the internet.

Vocabulary tasks

A. Definitions

Match these terms with their definitions.

| 1. overheads 2. bank charges 3. interest rate 4. assets 5. savings 6. overdraft | a) money kept in the bank to earn interest b) money spent on the general running of a business, not related to producing goods or selling services c) what customers pay the bank in return for its services d) amount the bank will pay customers on their deposits e) arrangement that allows customers to take out more money from their account than they have put in f) funds belonging to an individual |

B. Synonyms

Find a word or phrase in the text that has a similar meaning.

| 1. put money into your account 2. fill in a form | 3. present 4. as soon as possible | 5. money in your account 6. free |

C. Opposites

Find a word or phrase in the text that has the opposite meaning.

| 1. old-fashioned 2. risky | 3. difficult 4. cheap | 5. complicated 6. impersonal |

D. Understanding expressions

Choose the best explanation for each of these phrases from the text.

1. glossy leaflets

a) advertising material printed on expensive paper b) attractive plants used to decorate a bank or office

2. we accrue interest daily

a) interest is added to your account each day b) the bank earns interest on your account each day

3. encryption technology

a) writing data in a code that people can not access b) using computers to transfer funds quickly

4. relevant documents

a) documents the bank sent b) documents that have been signed

5. deposit slip

c) envelope you put money in when you pay cash into your account

d) form you complete when you pay money into your account

6. in vain

a) taking a lot of time and effort b) trying hard but without success

E. Collocations

Match the verbs and nouns as they occur in the text.

| 1. offer 2. deduct 3. fill in 4. protect 5. open 6. submit 7. transfer 8. accept | a) funds b) interest c) an account d) a form e) assets f) cheques g) tax h) an application |

F. Complete the sentence

Use an appropriate phrase from Exercise E to complete each sentence.

1. The bank of 5% on all deposits.

2. The customer was asked to and hand it in at the desk.

3. With internet banking, it is possible to on-line from one account to another.

4. In order to reduce costs, many internet banks don't .

5. To apply for a job or to open a new account, you have to .

6. Many people at a bank when they start their first job.

7. Interest is paid gross, which means that the bank does not .

8. Customers needn't worry about security, the bank uses sophisticated encryption technology to their .

Over to you

1. Make a list of the disadvantages and disadvantages of internet banking. Discuss it with a partner.

2. Visit the first-e website at www.first-e.com and see what other information you can get about the bank.

3. Make a comparison between first-e and any bank that offers internet banking services in your country.

Date: 2014-12-21; view: 9037

| <== previous page | | | next page ==> |

| Economic Rent | | | UNIT 2 Electronic cash |