CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Theme 9. Currency market

Here is the relevant formula for the balance of payments.

Current account balance + Capital account balance + net errors and omissions = 0

Net errors and omissions simply reflect mistakes. Assuming no mistakes are made, then the formula will look like this.

Current account + Capital account = 0, hence Current account = Capital account.

In other words, if a country has a deficit on the current account (more imports than exports) then it must have an equal and opposite surplus on the capital account (and vice versa).

Exammple. If you buy a Mercedes car, what are the flows of monies involved? You go to the Mercedes showroom and buy the car using pounds. This money will end up back in Germany. But the German owners of Mercedes do not want the money in pounds. They will want Euros.

How are the pounds changed into Euros?

In the currency market, which forms part of the capital market.

Where will this transaction appear in the balance of payments?

In the capital account, probably under 'other investment'.

So, as we can see, any transaction that takes place in the current account must have an equal and opposite transaction somewhere in the capital account. Of course, in the real world, countries that run large current account deficits (like the UK) have to attract this foreign currency in the first place.

Theme 9. Currency market

1. The notion of currency market and its types.

2. Forex market.

1. The notion of currency market and its types.

A currency market

The currency market facilitates international trade by providing exchanges for investing across markets valued in different currencies.

The currency market includes the Foreign Currency Market and the Euro-currency Market. The Foreign Currency Market is virtual. There is no one central physical location that is the foreign currency market. It exists in the dealing rooms of various central banks, large international banks, and some large corporations. The dealing rooms are connected via telephone, computer, and fax. Some countries co-locate their dealing rooms in one center. The Euro-currency Market is where borrowing and lending of currency takes place. Interest rates for the various currencies are set in this market.

Trading on the Foreign Exchange Market establishes rates of exchange for currency. Exchange rates are constantly fluctuating on the forex market. As demand rises and falls for particular currencies, their exchange rates adjust accordingly. Instantaneous rate quotes are available from a service provided by Reuters. A rate of exchange for currencies is the ratio at which one currency is exchanged for another.

The foreign exchange market has no regulation, no restrictions or overseeing board. Should there be a world monetary crisis in this market; there is no mechanism to stop trading. The Federal Reserve Bank of New York publishes guidelines for Foreign Exchange trading. In their "Guidelines for Foreign Exchange Trading", they outline 50 best practices for trading on the forex market.

Spot Exchange

The spot exchange is the simplest contract. A spot exchange contract identifies two parties, the currency they are buying or selling and the currency they expect to receive in exchange. The currencies are exchanged at the prevailing spot rate at the time of the contract. The spot rate is constantly fluctuating. When a spot exchange is agreed upon, the contract is defined to be executed immediately. In reality, a series of confirmations occurs between the two parties. Documentation is sent and received from both parties detailing the exchange rate agreed upon and the amounts of currency involved. The funds actually move between banks two days after the spot transaction is agreed upon.

Forward Exchange

The forward exchange contract is similar to the spot exchange. However, the time period of the contract is significantly longer. These contracts use a forward exchange rate that differs from the spot rate. The difference between the forward rate and the spot rate reflects the difference in interest rates between the two currencies. This prevents an opportunity for arbitrage. If the rates did not differ, there would be a profit difference in the currencies. That is, investing in one currency for a year and then selling it should be the same profit or loss as setting up a forward contract at the forward rate one year in the future. Investing in one currency would be more profitable than investing in the other. Thus there would exist an opportunity for arbitrage. Forward exchange contracts are settled at a specified date in the future. The parties exchange funds at this date. Forward contracts are typically custom written between the party needing currency and the bank, or between banks.

Currency Futures and Swap Transactions

Currency futures are standardized forward contracts. The amounts of currency, time to expiry, and exchange rates are standardized. The standardized expiry times are specific dates in March, June, September, and December. These futures are traded on the Chicago Mercantile Exchange (CME). Futures give the buyer an option of setting up a contract to exchange currency in the future. This contract can be purchased on an exchange, rather than custom negotiated with a bank like a forward contract.

A currency swap is an agreement to two exchanges in currency, one a spot and one a forward. An immediate spot exchange is executed, followed later by a reverse exchange. The two exchanges occur at different exchange rates. It is the difference in the two exchange rates that determines the swap price. There is also something called a currency swap. This is a method to exchange an income stream of one currency for another.

Currency Options

A currency option gives the holder the right, but not the obligation, either to buy (call) from the option writer, or to sell (put) to the option writer, a stated quantity of one currency in exchange for another at a fixed rate of exchange, called the strike price. The options can be American, which allows an option to be exercised until a fixed day, called the day of expiry, or European, which allows exercise only on the day of expiry, not before. The option holder pays a premium to the option writer for the option.

The option differs from other currency contracts in that the holder has a choice, or option, of whether they will exercise it or not. If exchange rates are more favorable than the rate guaranteed by the option when the holder needs to exchange currency, they can choose to exchange the currency on the spot exchange rather than use the option. They lose only the option premium. Options allow holders to limit their risk of exposure to adverse changes in the exchange rates.

Hedging

It is also common for currency options to be used to hedge cash positions. Companies are not typically in the business of gambling with their profits on deals. It is in the company's best interest to lock in an exchange rate they can count on. They are motivated to insure that their profits are as expected. Two ways they might do this are to enter forward contracts or to buy options.

They would select an exchange rate that would be acceptable but not too expensive. They might choose to buy a slightly out-of-the-money call option to cover them if the currency exchange rate falls. If it stays the same or rises, they will exchange at the spot exchange rate at the time the payment is due.

2. Forex market.

Forex market is

The Forex market is useful because it helps enable trade and transactions between countries, and it also allows an investment opportunity for risk seeking investors who don't mind engaging in speculation. Individuals who trade in the Forex market typically look carefully at a country's economic and political situation, as these factors can influence the direction of its currency. One of the unique aspects of the Forex market is that the volume of trading is so high, partially because the units exchanged are so small. It is estimated that around $4 trillion goes through the Forex market each day.

The foreign exchange market, also known as the forex, FX, or currency market, involves the trading of one currency for another. Prior to 1996 the market was confined to large corporate banks and international corporations. However it has since opened up to include all traders and speculators. Today, the average daily turnover in forex markets is US$1.9 trillion, according to the Bank of International Settlementís Triennial Survey. The market is growing rapidly as investors gain more information and develop more interest.

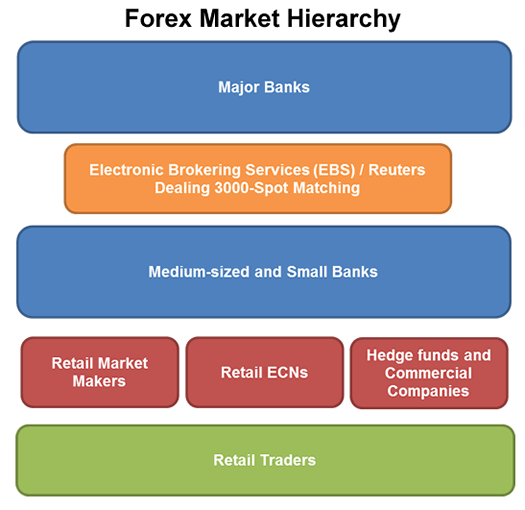

At the very top of the forex market ladder is the interbank market. Composed of the largest banks of the world and some smaller banks, the participants of this market trade directly with each other or electronically through the Electronic Brokering Services (EBS) or the Reuters Dealing 3000-Spot Matching.

The competition between the two companies - the EBS and the Reuters Dealing 3000-Spot Matching - is similar to Coke and Pepsi. They are in constant battle for clients and continually try to one-up each other for market share. While both companies offer most currency pairs, some currency pairs are more liquid on one than the other.

For the EBS plaform, EUR/USD, USD/JPY, EUR/JPY, EUR/CHF, and USD/CHF are more liquid. Meanwhile, for the Reuters platform, GBP/USD, EUR/GBP, USD/CAD, AUD/USD, and NZD/USD are more liquid.

All the banks that are part of the interbank market can see the rates that each other is offering, but this doesn't necessarily mean that anyone can make deals at those prices.

Like in real life, the rates will be largely dependent on the established CREDIT relationship between the trading parties. Just to name a few, there's the "B.F.F. rate," the "customer rate," and the "ex-wife-you-took-everything rate." It's like asking for a loan at your local bank. The better your credit standing and reputation with them, the better the interest rates and the larger loan you can avail.

Next on the ladder are the hedge funds, corporations, retail market makers, and retail ECNs. Since these institutions do not have tight credit relationships with the participants of the interbank market, they have to do their transactions via commercial banks. This means that their rates are slightly higher and more expensive than those who are part of the interbank market.

At the very bottom of the ladder are the retail traders. It used to be very hard for us little people to engage in the forex market but, thanks to the advent of the internet, electronic trading, and retail brokers, the difficult barriers to entry in forex trading have all been taken down.

FX trading volume has exploded reflecting an electronic revolution that has lowered trading costs, attracted new groups of market participants, and enabled aggressive new trading strategies. Between 1998 and 2010 turnover in the FX market grew by over 250 percent (BIS, 2010). The associated 8.4 percent average annual growth rate far exceeds the contemporary 5.5 percent annual expansion of global real GDP (Table 1).

Table 1: FX turnover and growth: Comparison with trade, GDP and equity trading volume

| a) Volumes | |||||||

| All instruments | |||||||

| Spot total | |||||||

| Forwards total | |||||||

| Growth, spot and forwards | 44% | 54% | 9% | 40% | 65% | 32% | |

| b) Ratios | |||||||

| Spot/Trade | |||||||

| Spot/GDP | |||||||

| Spot/Equity volume |

Note: Panel a) Constant 2010-values, in billions USD, for volumes based on BIS Triennial FX surveys corrected for inter-dealer and cross-border double-countin Panel b) Ratio of spot volumes to trade volumes (import and exports), GDP and equity volumes of 35 countries. The aggregate spot volume are created based on the currencies of the same 35 countries (EUR for the EU-countries after 1999).

Physically, FX trading remains heavily concentrated in London, which captures over one-third of global trading, and New York, which captures almost one-fifth of trading (Table 2). Londonís traditional dominance in FX grew out of the United Kingdomís worldwide economic dominance in the nineteenth century. It remains secure at the beginning of the twenty-first century because of its geographic location: Londonís morning session overlaps with Asian trading and its afternoon session overlaps with New York trading. Trading in the Asia-Pacific region, which in aggregate accounts for about one quarter of global trading, is dispersed among Tokyo, Hong Kong, Singapore, and Sydney. Latin America, Africa, and the Middle East each account for less than 1 percent of global turnover.

Despite the continued dominance of London and New York, there have been some subtle shifts in the global distribution of currency trading. The advent of the euro brought a decline in the share of European trading outside of London. Meanwhile, rapid economic growth in Asia has supported a surge in trading in the Asian regional centres. Hong Kong and Singapore now vie in importance with traditional European centres such as Switzerland and France.

Table 2: Geographical distribution of global foreign exchange market turnover (%)

Date: 2014-12-28; view: 1265

| <== previous page | | | next page ==> |

| Portfolio investment | | | Currencies thatare traded |