CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Princeples and structure of balance of payments.

1. If a payment is received from overseas account, it is a credit transaction.

2. While if payment made to overseas account it is a debit transaction.

3. The chief items presented on the credit side (plus) are exports of goods and services, transferred receipts in the form of gifts, subscription etc from overseas account, borrowings from overseas account investments by overseas account in the nation and official sale of reserve assets incorporating gold to overseas account and abroad agencies.

4. The principal items on the debit side (minus) are imports of goods and services, unrequited payments to overseas account as gifts, subscriptions etc, lending to overseas account investments by residents to overseas account and official purchase of reserve assets or gold from overseas account and overseas agencies.

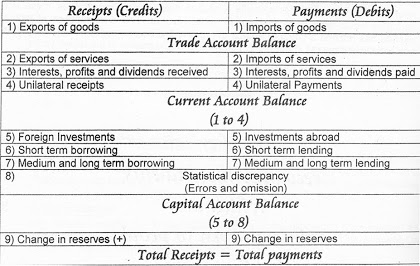

5. These credits and debits are presented vertically in the balance of payments sheet of a nation as per the principle of double entry book keeping.

6. Horizontally they are classified under three categories: the current account, the capital account and the official settlements accounts or the official reserve assets account.

Structure of Balance of Payment (BOP)

1. Trade Account Balance

It is the difference between exports and imports of goods, usually referred as visible or tangible items. Till recently goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or deficit on that account. If the exports are more than imports, there will be trade surplus and if imports are more than exports, there will be trade deficit. An industrial country with its industrial products comprising consumer and capital goods always had an advantageous position. Developing countries with its export of primary goods had most of the time suffered from a deficit in their balance of payments. Most of the OPEC countries are in better position on trade account balance.

2. Current Account Balance

It is the difference between the receipts and payments on account of current account which includes trade balance. The current account includes export of services, interest, profits, dividends and unilateral receipts from abroad and the import of services, profits, interest, dividends and unilateral payments abroad. There can be either surplus or deficit in current account. When debits are more than credits or when payments are more than receipts deficit takes place. Current account surplus will take place when credits are more and debits are less.

Current account balance is very significant. It shows a country's earning and payments in foreign exchange. A surplus balance strengthens the country's international financial position. It could be used for development of the country. A deficit is a problem for any country but it creates a serious situation for developing countries.

Date: 2014-12-28; view: 1309

| <== previous page | | | next page ==> |

| Concept and Types of Transactions. National accounts. | | | Portfolio investment |