CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Financial regulation and

Government regulation

Mei Lee is the compliance officer at a large US bank with subsidiaries in major financial centres: she has to make sure that everybody obeys government regulations and follows internal procedures.

The financial services industry was deregulated in the 1980s: lots of government controls were removed to make the market freer and more efficient. But a lot of regulations still exist. We're still regulated and supervised by government agencies. For example, in Britain there's the Financial Services Authority (FSA), and here in the States there's the Federal Reserve (or the Fed) and the Securities and Exchange Commission (SEC).

The Fed supervises banks, and the SEC tries to protect investors by requiring full disclosure: it makes sure that public companies make all significant financial information available. And it tries to prevent fraudulent or illegal practices in the securities markets, such as companies artificially raising their stock price by using dishonest accounting methods or issuing false information.'

Internal controls

'I have to make sure no one here does any insider trading or dealing - buying or selling securities when they have confidential or secret information about them. For example our mergers and acquisitions department often has advance information about takeovers. This information is usually price-sensitive: if you used it you could make the share price change. This gives the people in M&A huge opportunities for profitable insider dealing, but we try to keep what we call "Chinese walls" around departments that have confidential information. This means having strict rules about not using or spreading information.

Another thing I have to deal with is conflicts of interest - situations where what is good for one department is not in the best interests of another department. For example, if banks want to win investment banking business from a company, their analysts in the research department could produce inaccurate reports exaggerating the client company's financial situation and prospects. This could lead the fund management and stockbroking departments to buy securities in that company, or recommend them to clients, because of false information.'

Sarbanes-Qxley

'Because of lots of serious conflicts of interest in banks, the US government passed the Sarbanes-Oxley Act in 2002. This requires research analysts to disclose whether they hold any securities in a company they write a research report about, and whether they have been paid by the company.

Another outcome of Sarbanes-Oxley was the establishment of a board to oversee or supervise the auditing of public companies, and to prevent auditors doing non-audit services while they're auditing a company. That's because an auditing firm that is also doing lucrative - profitable - consulting work with a company might be tempted not to audit the accounts very carefully, and to ignore evidence of illegal practices or "creative accounting". (See Unit 3)

supervision

Another part of my job is making sure no criminal organization uses us for money laundering - converting illegal or criminal funds into what looks like legitimate or legal income, by passing it through a lot of transactions, companies and bank accounts.'

42.1 Match the words in the box with the definitions below. Look at A, B and C opposite to help you.

| compliance | disclosure | fraudulent | insider dealing |

| money laundering | price-sensitive | oversee |

1 adjective meaning able to influence or change a price

2 behaving according to regulations, rules, policies, procedures, etc.

3 buying or selling stocks when you have confidential information about a company

4 disguising the source of money acquired from criminal activities

5 adjective meaning dishonest and illegal (intending to get money by deceiving people)

6 giving investors and customers all the information they need

7 to watch something to make certain that it is being done correctly

42.2 Match the two parts of the sentences. Look at B and C opposite to help you.

1 Criminal organizations try to hide the origin of illegally received money

2 People with privileged, confidential information about a stock could make money

3 Some banks might try to get business from companies, e.g. issuing stocks and bonds,

4 Some companies might try to make their auditors less rigorous

5 Some companies try to raise their stock price

a by acting on that information and buying and selling the stock,

b by also paying them to do consulting work.

c by moving it through lots of different companies and bank accounts,

d by not following accepted accounting methods or by publishing false information,

e by publishing reports that overstate the companies' financial health.

42.3 Complete the newspaper headlines with words from the box. Look at A, B and C opposite to help you.

| Chinese walls | compliance officer | conflicts of interest |

| deregulation | insider traders | laundering money |

FSA warns that criminal gangs are

still............................... through

bureaux de change

Sarbanes-Oxley has greatly reduced £

£

............................. for auditing firms,

\

report says

Senator says even the smallest financial company needs a

4

FSA says it's time to get tough on : they are almost

never prosecuted

5 |

Fed says.............................................. not j

functioning in investment banks:

suspicious trading is increasing f

______________________________________ J

^ 25 years after................................................. [

bankers say there's still too much government control f

Ov^r +o ijpu

Have there been any major cases of financial institutions breaking the law in your country recently? What happened and what could be done to stop it occurring again?

International trade

Trade

Most economists believe in free trade - that people and companies should be able to buy goods from all countries, without any barriers when they cross frontiers.

The comparative cost principle is that countries should produce whatever they can make the most cheaply. Countries will raise their living standards and income if they specialize in the production of the goods and services in which they have the highest relative productivity: the amount of output produced per unit of an input (e.g. raw material, labour).

Countries can have an absolute advantage - so that they are the cheapest in the world, or a comparative advantage - so that they are only more efficient than some other countries in producing certain goods or services. This can be because they have raw materials, a particular climate, qualified labour (skilled workers), and economies of scale - reduced production costs because of large-scale production.

Balance of payments

Imports are goods or services bought from a foreign country. Exports are goods or services sold to a foreign country.

A country that exports more goods than it imports has a positive balance of trade or a trade surplus. The opposite is a negative balance of trade or a trade deficit. Trade in goods is sometimes called visible trade. Services such as banking, insurance and tourism are sometimes called invisible imports and exports. Adding invisibles to the balance of trade gives a country's balance of payments.

"Good invisible export figures this quarter, sir."

Protectionism

Governments, unlike most economists, often want to protect various areas of the economy. These include agriculture - so that the country is certain to have food - and other strategic industries that would be necessary if there was a war and international trade became impossible. Governments also want to protect other industries that provide a lot of jobs.

Many governments impose tariffs or import taxes on goods from abroad, to make them more expensive and to encourage people to buy local products instead. However, there are an increasing number of free trade areas, without any import tariffs, in Europe, Asia, Africa and the Americas.

The World Trade Organization (WTO) tries to encourage free trade and reduce protectionism: restricting imports in order to help local products. According to the WTO agreement, countries have to offer the same conditions to all trading partners. The only way a country is allowed to try to restrict imports is by imposing tariffs. Countries should not use import quotas - limits to the number of products which can be imported - or other restrictive measures. Various international agreements also forbid dumping - selling goods abroad at below cost price in order to destroy or weaken competitors or to earn foreign currency to pay for necessary imports.

Complete the crossword. Look at A, B and C opposite to help you.

| <X | ||||||||||||||

Across

2 Countries that export a lot of oil or manufactured goods tend to have a positive.................................. ..................................................................................

(7,2,5)

5 A country exporting more than it imports has a trade......................................................................... (7)

6 In a free trade area, governments cannot impose a on imports. (6)

8 A limit to the quantity of goods that can be imported is a............................................................ .................................................................................. (5)

10 and 9 down Adding trade in services to trade in goods gives you the of........................................................................ (7,8)

11 Billions of dollars leave the USA every year because the country has a big trade........................ (7)

14 Attempting to reduce imports in favour of local production is called................................................. (13)

Osier +o Upu 4

What are your country's major exports and imports? Which industries in your country would find it difficult to compete if there was completely free trade?

15 The import and export of goods is called trade. (7)

Down

1 Producing in large quantities becomes cheaper because of economies of........................................... .................................................................................. (5)

3 and 4 If a country can produce something more cheaply than anywhere else in the world it has an.......................... (8,9)

7 Many economists encourage governments to abolish import taxes and have completely

............... • (4,5)

9 See 10 across.

11 A number of international agreements make it illegal to goods on foreign markets at a

price that doesn't give a profit. (4)

12 The comparative........... principle is that

countries should make the things they can produce the most cheaply. (4)

13 The.......... has established rules of trade

between nations. (3)

Exchange rates

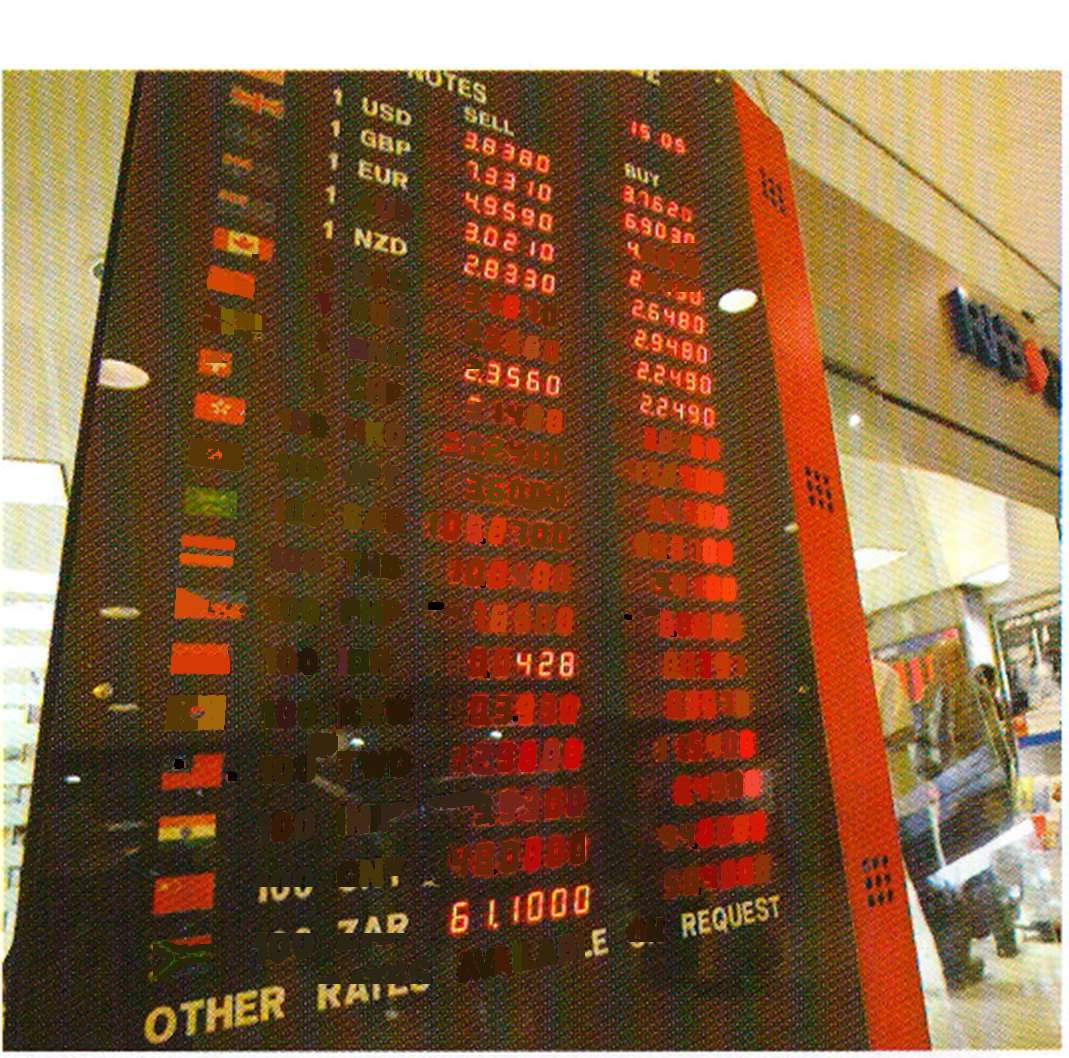

Why exchange rates change

An exchange rate is the price at which one currency can be exchanged for another (e.g. how many yen are needed to buy a euro). In theory, exchange rates should be at the level that gives purchasing power parity (PPP). This means that the cost of a given selection of goods and services (e.g. a loaf of bread, a kilowatt of electricity) would be the same in different countries. So if the price level in a country increases because of inflation, its currency should depreciate - its exchange rate should go down in order to return to PPP. For example, if inflation increases in the US, the dollar exchange rate should go down so that it takes more dollars to buy the same products in other countries.

In fact, PPP does not work, as exchange rates can change due to currency speculation - buying currencies in the hope of making a profit. Financial institutions, companies and rich individuals all buy currencies, looking for high interest rates or short-term capital gains if a currency increases in value or appreciates. This means exchange rates change due to speculation rather than PPP. Over 95% of the world's currency transactions are purely speculative, and not related to trade. Ranks and currency traders make considerable profits from the spread between a currency's buying and selling prices.

Fixed and floating rates

For 25 years after World War II, the levels of most major currencies were determined by governments. They were fixed or pegged against the US dollar (e.g. from 1946-67, one pound was worth $2.80), and the dollar was pegged against gold. One dollar was worth one thirty-fifth of an ounce of gold, and the US Federal Reserve guaranteed that they could exchange an ounce of gold for $35. This system was known as gold convertibility. These fixed exchange rates could only be adjusted if the International Monetary Fund agreed. Pegging against the dollar ended in 1971, because following inflation in the USA, the Federal Reserve did not have enough gold to guarantee the American currency.

Since the early 1970s, there has been a system of floating exchange rates in most western countries. This means that exchange rates are determined by people buying and selling currencies in the foreign exchange markets. A freely floating exchange rate means one which is determined by market forces: the level of supply and demand. If there are more buyers of a currency than sellers, its price will rise; if there are more sellers, it will fall.

Since the introduction of a common currency in 2002, fluctuating exchange rates among many European countries are no longer a problem. But the euro continues to fluctuate against the US dollar, the Japanese yen and other currencies.

Government intervention

Auo

4* 1 cad 523,, 1 SQd I'Oio , t BND t*S60 f CHF 100 HKD s r8°

° r ** £ 2S

_ 100 SA* <os.?To

— 100 THB 10.0 H00

► 100 PHP - 76 500

mm 100 IDR 0.0

E3 100 KRW G 3-9 30

• . 10(TTWD I^SBOO 100 IN»r ^»JD

_ rNv H8.000C

& AVAltA*

> *0H6c

•Heron IHIOC

99.3 IOC

as icc * "6.8800 Q039i Q3510 I 15H00 aH93B

HS.00CC 58.H000

ON

Governments and central banks sometimes try to change the value of their currency. They intervene in exchange markets, using foreign currency reserves to buy their own currency - in order to raise its value - or selling to lower it. The resulting rates are known as managed floating exchange rates. But speculators generally have a lot more money than a government has in its reserves of foreign currency, so central banks or governments only have limited power to influence exchange rates.

44.1Are the following statements true or false? Find reasons for your answers in A and B opposite.

1 Purchasing power parity is a theory that doesn't apply in reality.

2 Inflation should lead to an increase in the value of a country's currency.

3 Speculators buy currencies when they expect their value to increase.

4 Speculators generally sell currencies if their interest rate rises.

5 Currency traders offer different buying and selling prices.

6 A lot more currency is exchanged for buying or selling goods than for speculation.

7 The Federal Reserve will no longer exchange US dollars for gold.

8 Most exchange rates used to be fixed; now they float.

9 If more people want to buy a currency than sell it, its price will go down.

44.2Complete the table with words from A, B and C opposite and related forms. Put a stress mark in front of the stressed syllable in each word. The first one has been done for you.

Verb Noun(s) Noun for people Adjective

| appreci'ation | - | - | |

| - | converted | ||

| depreciate | - | - | |

| - | interventionary | ||

| speculative |

44.3 Complete the newspaper headlines with the correct forms of words from 44.2 above. 1

US inflation will cause dollar to , economists warn

Top economists say currency undervalued, call for government

to allow it to ............................... 5-10%

__________________________________________________________ ____________________

Increasing currency......................................... is making exchange rates

more volatile

Common currency: Economic consultant says...................................................

pound to euro would cost British businesses £12bn

Chinese experts say the betting on revaluation are

threatening the economy

Central bank not expected to.................................................. in currency crisis

Over +o upu

What has happened to the value of your currency in the past few years? What do you think were the probable causes of any changes?

Professional English in Use Finance

Date: 2015-02-28; view: 9598

| <== previous page | | | next page ==> |

| Financial planning | | | Financing international trade |