CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Lecture 7 - The Government Economic Policy

1. The Economic Policy & Its Types

2. Monetary and Fiscal Policies

3. The Stabilization Policy

1. The Economic Policy & Its Types

Economic policy refers to the actions that governments take in the economic field. It covers the systems for setting interest rates and government budget as well as the labour market, national ownership, and many other areas of government interventions into the economy.

Policy is generally directed to achieve particular objectives, like targets for inflation, unemployment, or economic growth. Sometimes other objectives, like military spending or nationalization are important.

To achieve these goals, governments use policy tools which are under the control of the government. These generally include the interest rate and money supply, tax and government spending, tariffs, exchange rates, labour market regulations, and many other aspects.

Government and central banks are limited in the number of goals they can achieve in the short term. For instance, there may be pressure on the government to reduce inflation, reduce unemployment, and reduce interest rates while maintaining currency stability. If all of these are selected as goals for the short term, then policy is likely to be incoherent, because a normal consequence of reducing inflation and maintaining currency stability is increasing unemployment and increasing interest rates.

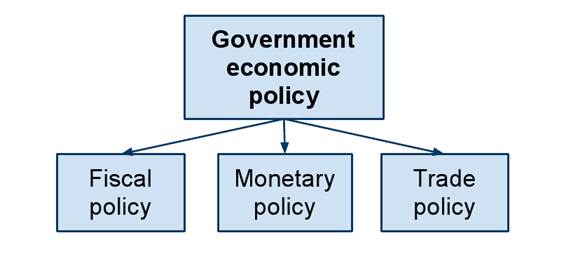

Types of economic policy:

2. Monetary and Fiscal policies

Fiscal policy is the use of government expenditure and revenue collection to influence the economy. The two main instruments of fiscal policy are government expenditure and taxation. Changes in the level and composition of taxation and government spending can impact the following variables in the economy:

- Aggregate demand and the level of economic activity;

- The pattern of resource allocation;

- The distribution of income.

Fiscal policy refers to the use of the government budget to influence the first of these: economic activity.

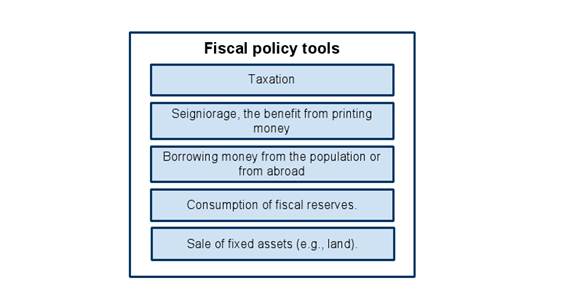

Governments spend money from its budget on a wide variety of things, from the military and police to services like education and healthcare, as well as transfer payments such as welfare benefits. This expenditure can be funded in a number of different ways. All of these except taxation are forms of deficit financing.

The three possible stances of fiscal policy are neutral, expansionary and contractionary. The simplest definitions of these stances are as follows:

A neutral stance of fiscal policy implies a balanced economy. This results in a large tax revenue. Government spending is fully funded by tax revenue and overall the budget outcome has a neutral effect on the level of economic activity.

An expansionary stance of fiscal policy involves government spending exceeding tax revenue.

A contractionary fiscal policy occurs when government spending is lower than tax revenue.

However, these definitions can be misleading because, even with no changes in spending or tax laws at all, cyclical fluctuations of the economy cause cyclical fluctuations of tax revenues and of some types of government spending, altering the deficit situation; these are not considered to be policy changes. Therefore, for purposes of the above definitions, "government spending" and "tax revenue" are normally replaced by "cyclically adjusted government spending" and "cyclically adjusted tax revenue". Thus, for example, a government budget that is balanced over the course of the business cycle is considered to represent a neutral fiscal policy stance.

Monetary policy is the process by which the Central Bank of a country controls the supply of money, often targeting a rate of interest to reach a set of objectives oriented towards the growth and stability of the economy.

Date: 2015-02-28; view: 7763

| <== previous page | | | next page ==> |

| Learning from Each Other Opinion: Learning from Each Other | | | Monetary policy and Transmission mechanism |