CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Forms of Business Organization

Steven Jobs and many other entrepreneurs have organized their companies as corporations, A corporation is one kind of business organization. Other kinds ofbusiness organizations are sole proprietor ships and partnerships.

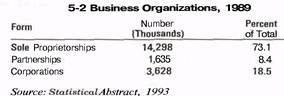

Sole Proprietorship. A sole proprietorship is a business owned by one person. As indicated in Table 5-2, sole proprietorships are the most numerous kind of business organization, but most are very small. They are popular because they are the easiest—-and the least costly—to organize.

There are other advantages. Sole proprietors own all the profits of their enterprises, and they are their own bosses, free to make whatever changes they please. They have minimal legal restrictions and do not have to pay the special taxes placed on corporations. Sole proprietors also have the opportunity to achieve success and recognition through their individual efforts.

There are also disadvantages. A very serious one is the unlimited liability that each proprietor faces. All debts and problems associated with the business belong to the owner. If a business fails, the owner must personally assume the debts. This could mean the loss of personal property such as automobiles, homes, and savings. A second disadvantage of the sole proprietorship is its limited capital. The money that a proprietor can raise is limited by the amount of his or her savings and ability to borrow. Also, when the owner dies, the business dies. Other disadvantages may include lack of opportunities for employees, limitations of size and growth, and lack of management resources.

Partnership. A partnership is a business organization that is owned by two or more persons. Partnerships offer certain advantages over sole proprietorships:

• Partners bring additional funds to a proprietorship.

• Partners can bring fresh ideas and talents to business

organizations.

• Like the sole proprietorship, partnerships are relatively

easy to form and are not subject to special taxes.

Partnerships have the following disadvantages:

• In many cases, each of the partners is subject to unlimited liability. Partners are individually responsible for all business debts. In other words, if the business were to fail, its creditors (those to whom money is owed) would have the right to recover their money from any, or all, of the partners.

ü Such was the case with Harry Nodough, Gloria Poor, and Esteban Rich who owned the Trio Dress Shoppe as a partnership. Under the terms of their partnership agreement, Nodough and Poor were each entitled to 40 percent of the profits, while the remaining 20 percent went to Rich. Last month the firm collapsed. After selling off everything it owned, the company still owed its creditors $10,000. Since Nodough and Poor had no assets of their own, the creditors recovered the total amount from Rich's personal bank account.

Partnership agreements, however, can be designed to limit the liability of each partner so that investors like poor Mr. Rich can be protected.

• Any time a partner dies or withdraws from the business, the partnership is legally terminated. If the business is to continue, a new partnership agreement must be signed.

• The amount of capital a partnership can raise is limited. That limit depends on business earnings and the partners' wealth and ability to borrow.

• Partners may disagree, causing management conflicts that could threaten the firm's existence.

Corporation. A corporation is a business organization created under a government charter. Ownership of a corporation is represented by shares of stock, so corporate owners are known as stockholders. A corporation may have many stockholders or only a limited few, such as the members of a family or a group of business associates.

One feature of the corporation is that courts treat it as a legal "person." For example, it can sue or be sued, can enter into contracts, and must pay taxes.

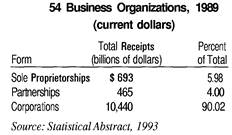

Although corporations are outnumbered by about four to one by sole proprietorships, they dominate American business. Corporations are so important because of the advantages they offer over sole proprietorships and partnerships:

• Limited liability. Unlike the owners of proprietorships and partnerships, who can be held personally liable for the debts of their firms, the most that corporate shareholders can lose (i.e., their liability) is limited to whatever they paid for their shares of stock. Limited liability is so important that corporations in most English-speaking countries outside of the United States add the abbreviation "Ltd." (for Limited) to their company name.

• Ease of transfer. Stockholders can enter or leave a corporation at will simply by buying or selling shares of stock in that corporation.

• Unlimited life. When corporate stockholders die, their shares of stock are passed on to their heirs; the corporation can conduct business as usual.

• Tax advantages. In certain instances individuals can reduce their personal tax liability by incorporating.

With all of these advantages you might wonder why there are so many more unincorporated businesses than incorporated ones. The answer has to do with the disadvantages of the corporation:

• Expense. It is difficult and expensive to organize a corporation. The process of obtaining a charter usually requires legal help. Most small firms prefer to avoid such expenses by forming proprietorships and partnerships.

• Double Taxation. Corporations are subject to special taxes. The federal government, along with many state and local governments, taxes both corporate income and stock dividends to shareholders. (Dividends are the portion of a corporation's profits that are distributed to the stockholders.)

• Regulations. Corporations whose stock shares are sold to the public give up their right to privacy. The law requires that these large, open corporations disclose information about their finances and operations to anyone interested in reading about them. The purpose of this legislation is to give people information about companies in which they might invest. But information that helps investors also may be of value to the competition. For that reason, some corporations do not trade their stock publicly. They remain closed corporations, rather than reveal information they would prefer to keep secret.

Date: 2015-02-16; view: 2307

| <== previous page | | | next page ==> |

| Starting a Small Business | | | Special Types of Business Organizations |