CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Assess the level ofrisk managementîf China construction bank

In 2013, both domestic and global economic and financial situations remained complex and volatile. The growth rate of global economy edged down, developed economies achieved slightly strengthened growth momentum, while emerging economies experienced increasing pressure in economic growth, resulting in significant regional divergence. The Chinese economy in general made progress while ensuring stability. The economic growth slowed down in tandem with accelerated structural adjustments, the market-oriented reforms were rapidly promoted, competition from inside and outside the financial sector became increasingly intense, financial reforms were continuously deepened and regulatory policies were further tightened. All these were testing the Group’s adaptability to changes, adjustment ability and promoting capability for management reforms, and driving the Group to steadily move forward, actively develop transformation and get a head start among peers.

Adhering to the strategy featuring “integration, multifunction and intensiveness” and scrupulously abiding by the general keynote of steady development, the Group persisted in supporting the real economy and accelerated strategic transformation. It maintained a “stable” operation as a whole during the process of upgrading and transforming traditional businesses and accelerating the development of emerging businesses, realised “progress” in strategic focuses and key areas, and achieved new growth while maintaining stability in operating results and market performances. All these produced generous returns to shareholders, customers and the society. At the end of 2013, the Group’s total assets exceeded RMB15 trillion. The return on average assets and the return on average equity were 1.47% and 21.23%, respectively. Total capital ratio was 13.34%. Our key financial indicators continued to lead the market. On account of the favourable operating results, the Board of the Bank has recommended a final cash dividend of RMB0.30 per share.

In 2013, the Bank refined its comprehensive risk management framework, strengthened control over key business lines and potential risk fields, proactively dealt with practical issues in market risk management and operational risk management, with remarkably improved initiative, prospectiveness and effectiveness in terms of risk management.

Refining comprehensive risk management framework system . Based on regulatory requirements and business development needs, the Bank developed a comprehensive risk management approach, and defined the processes of recognition and measurement, monitoring and control, as well as reporting on various kinds of risks. Based on risks sorted out in different business lines and fields, the Bank developed a plan to set up a comprehensive risk management responsibility mechanism covering all employees, whole processes, all institutions and all risk types. This helped to establish a good foundation for a sound comprehensive risk management system. The Bank explored to establish a system to monitor and analyse various risks, enrich the comprehensive risk report, and conduct view research on comprehensive risk management, to improve the overall ability of risk warning and control.

Optimising the foundation of risk management. The Bank studied and formulated risk management policies on off-balance sheet business, and clarified risk selection and access bottom line for off-balance sheet business. The Bank improved the organisational system of risk management for overseas entities, standardised their credit risk classification and post-lending management, and launched risk investigation and analysis on their material loans. The Bank refined the country-specific risk management system, and scientifically made provisions for country-specific risk. It amended collateral management measures and completed the second phase of collateral system optimisation in order to support the revaluation and monitoring of the collaterals. The Bank developed risk management policies for wealth management business, clarified requirements on industries and customer selection standards, and integrated the wealth management business into the bank-wide unified credit approval management. It promoted the Group’s consolidation risk management system, conveyed the bank’s unified preference, policy, limit, standard and rating to all subsidiaries, and strengthened the risk management of cross-border and cross-industry institutions.

Completing the regulatory inspection and evaluation of advanced measurement on capital management . While maintaining the operation and maintenance and continuous monitoring of 27 corporate customer credit rating models, the Bank pertinently accomplished customer rating optimisation for wholesale and retail industry as well as newly established small businesses. It developed technology tools such as score cards for small and micro business application and behaviour, and for anti-fraud management of credit card business. The optimisation of launching and application of the nine score cards for credit card and personal loans well supported automated approval and bulk monitoring. Currently, the Bank has the ability to independently develop risk measurement tools. The implementation level of advanced measurement on capital management was basically in line with that of the world leading banks, which laid a solid foundation for the implementation of Capital Management Measures for Commercial Banks issued by the CBRC.

The Board of Directors of the Bank has established Risk Management Committee, responsible for making risk management strategies and policies, monitoring the implementation, and evaluating the overall risk profile on a regular basis.

The Bank has established a centralised and vertical risk management organisation structure, with a vertical risk management line, consisting of “chief risk officer – risk supervisors – risk heads – risk managers”.

At the head office level, the chief risk officer is responsible for comprehensive risk management under the direct leadership of the president. The Risk Management Department is responsible for overall risk reporting, formulating risk management policies, developing risk measurement tools, monitoring and analysis and other issues. The market risk management department and the risk management team for overseas entities under the Risk Management Department are responsible for the risk management of financial market business and overseas entities respectively. The Credit Management Department is responsible for credit approval and credit risk monitoring. Other departments at the head office perform their risk management duties within their respective scopes of duty.

At branch level, there are risk supervisors in tier-one branches, who report to the chief risk officer, and are responsible for organising risk management and credit approval within the branch. There are risk heads at tier-two branches and risk managers at sub-branches, responsible for risk management in their respective branch or sub-branch. The risk management personnel have two reporting lines: the first reporting line is to risk management officers at higher levels, and the second is to managers of their respective entities or business units.

At subsidiary level, the Bank vigorously promotes the establishment of a comprehensive risk management framework. It strengthens prospective risk management and consolidation of risk management at group level, enhances internal control and internal audit system to lead and push forward the subsidiaries to launch their risk self-examination and investigation in order to discover and improve internal control deficiencies and problems in time.

TheRiskManagementDepartmenttakestheleadinthedevelopmentandimplementationofthecreditriskmeasurementtoolsincludingcustomersratingandfacilitiesgradingandisresponsibleforthespecialassetsresolutions.TheCreditManagementDepartmentisresponsibleforestablishingcreditriskmanagementpoliciesandmonitoringthequalityofcreditassets.TheCreditApprovalDepartmentisresponsibleforthegroup’scomprehensivecreditlimitsandcreditapprovalofvariouscreditbusinesses.WhiletheCreditManagement Departmenttakesthelead,boththeCreditManagementDepartmentandtheCreditApprovalDepartmentwillcoordinatewiththeCorporateBankingDepartment,theSMEBusinessDepartment,theInstitutionalBanking Department,theInternationalBusinessDepartment,theGroupClientsDepartment,theHousingFinance&PersonalLendingDepartment,theCreditCardCenter,andtheLegalAffairsDepartmenttoimplementthecreditriskmanagementpoliciesandprocedures.

Withrespecttothecreditriskmanagementofcorporateandinstitutionalbusiness,theGrouphasacceleratedtheadjustmentofitscreditportfoliostructure,enhancedpost-lendingmonitoring,andrefinedtheindustry-specificguidelineandpolicybaselineforcreditapproval.Managementalsofine-tunedthecreditacceptanceandexitpolicies,andoptimiseditseconomiccapitalandcreditrisklimitmanagement.Allthesepolicieshaveimplementedtoimprovetheoverallassetquality.TheGroupmanagescreditriskthroughouttheentirecreditprocessincludingpre-lendingevaluations,creditapprovalandpost-lendingmonitoring.TheGroupperformspre-lendingevaluationsbyassessingtheentity’screditratingsbasedoninternalratingcriteriaandassessingtherisksandrewardswithrespecttotheproposedproject.CreditapprovalsaregrantedbydesignatedCreditApprovalOfficers.TheGroupcontinuallymonitorscreditbusinesses,particularlythoserelatedtotargetedindustries,geographicalsegments, productsandclients.Anyadverseeventsthatmaysignificantlyaffectaborrower’srepaymentabilityarereportedtimelyandmeasuresareimplementedtopreventandcontrolrisks.

Withrespecttothepersonalcreditbusiness,theGroupreliesoncreditassessmentofapplicantsasthebasis forloanapproval.Customerrelationshipmanagersarerequiredtoassesstheincomelevel,credithistory,andrepaymentabilityoftheapplicant.Thecustomerrelationshipmanagersthenforwardtheapplicationandrecommendationstotheloan-approvaldepartmentsforconsent.TheGroupmonitorsborrowers’repaymentability,thestatusofcollateralandanychangestocollateralvalue.Oncealoanbecomesoverdue,theGroupstartstherecoveryprocessaccordingtostandardpersonalloanrecoveryprocedures.

Tomitigaterisks,theGrouprequeststhecustomerstoprovidecollateralandguaranteeswhereappropriate.Afinemanagementsystemandoperatingprocedureforcollateralhavebeendeveloped,andthereisaguidelinetospecifythesuitabilityofacceptingspecifictypesofcollateral.Collateralvalues,structuresandlegalcovenantsareregularlyreviewedtoensurethattheystillservetheirintendedpurposesandconformtomarketpractices.

RiskManagementDepartmentistheoverallbusinessriskmanagementdepartment.CreditManagementDepartmentistheoverallcreditriskmanagementdepartment.CreditApprovalDepartmentistheoverallcreditbusinessapprovaldepartment.InternalControlandComplianceDepartmentisthecoordinationdepartmentforoperatingriskmanagement andinternalcontrolandcomplianceriskmanagement.Otherdepartmentsareresponsibleforvariouscorrespondingrisks.

Toidentify,evaluate,monitorandmanagerisk,theGrouphasdesignedacomprehensivegovernanceframework,internalcontrolpoliciesandprocedures.Riskmanagementpoliciesandsystemsarereviewedregularlytoreflectchangesinmarketconditions,productsandservicesoffered.TheGroup,throughitstrainingsystem,standardisedmanagementandprocessmanagement,aimsatdevelopingadisciplinedandconstructivecontrolenvironment,inwhichallemployeesunderstandtheirrolesandobligations.

In line with regulatory requirements, the Group proactively adopted a series of measures to prevent large exposure concentration risk, including further tightening lending criteria, adjusting business structure, controlling the credit granting pace, revitalising existing credit assets and innovating products. At the end of 2013, the gross loans to the largest single borrower accounted for 3.86% of the net capital of the Group, while those to the ten largest customers accounted for 14.76% of the net capital.

The following table 2.5 presents the maximum exposure to credit risk as at the end of the reporting period without taking into consideration any collateral held or other credit enhancement.

Table 2.5- Concentration of loans

| Indicators | |||

| Ratio of loans to the largest single customer (%) Ratio of loans to the ten largest customers (%) | 2.76 | 3.30 | 3.86 |

| Ratio of loans to the largest single customer (%) Ratio of loans to the ten largest customers (%) | 15.18 | 14.76 |

Liquidity risk is the type of risk that occurs when, despite its debt servicing ability, the Bank cannot obtain sufficient funds in time, or at a reasonable cost, to meet the needs of asset growth or repay liabilities as they are due. The Bank’s objective for liquidity risk management is to maintain a reasonable level of liquidity, and ensure the payment and settlement security in compliance with the regulatory requirements, while striving to enhance fund yields by deploying its funds in an effective and reasonable way.

In 2013, the PBC lowered the statutory deposit reserve ratio twice by a total of one percentage point, and continuously injected liquidity into the market through reverse repurchase transactions, gradually easing the tight liquidity situation in the interbank market. However, as the statutory deposit reserve ratio was still at a high level, the banks’ function of creating derivative deposits was inhibited to some extent, leading to increased competition for deposits business. In response to its liquidity situation, the Bank took timely measures, including actively attracting deposits, adjusting the amounts of investments in debt securities, financial assets held under resale agreements, deposits with banks and non-bank financial institutions, and other products that have large influence on liquidity, and making flexible adjustments in accordance with its liquidity position. The results (table 2.6) showed that under the stress scenarios, although liquidity risk increased, it stayed within a controllable range.

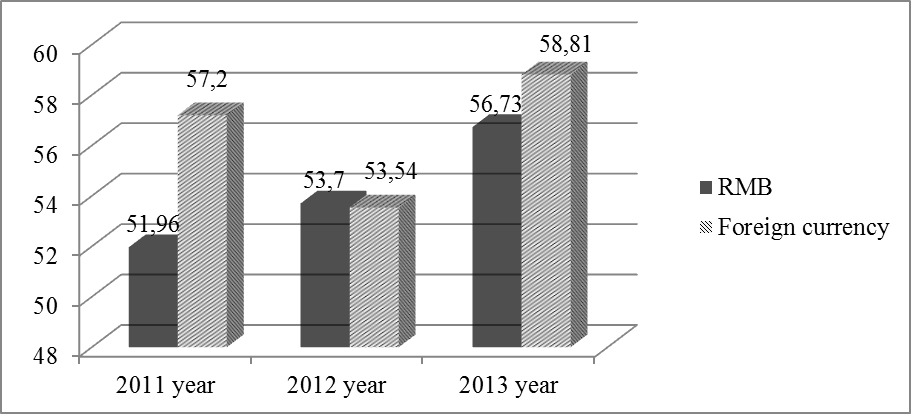

Table 2.6- The liquidity ratios of RMB and foreign currency of the Group

| % | Indicator | Regulatory standard | |||

| Liquidity ratio | RMB | ≥25 | 51.96 | 53.70 | 56.73 |

| Foreign currency | ≥25 | 57.20 | 53.54 | 58.81 |

Through these effective measures, the Bank continued to maintain a reasonable level of liquidity, and ensured normal payment and settlement. Figure 2.4 shows the effect of these parameters on the bank's liquidity.

Figure 2.4 - The liquidity ratios of RMB and foreign currency of the Group

The Bank conducted regular stress tests on its liquidity risk, in order to gauge its risk tolerance in extreme scenarios of low probability and other adverse circumstances.

Amountduefrombanksandnon-bankfinancialinstitutionsincludesdepositsandplacementswithbanksandnon-bankfinancialinstitutions,andfinancialassetsheldunderresaleagreementsofwhichcounterpartiesarebanksandnon-bankfinancialinstitutions (Table 2.7).

Table 2.7 - Distribution of amounts due from banks and non-bank financial institutions

| Indicator | Group | Bank | ||

| Individuallyassessedandimpairedgrossamount | ||||

| Allowancesforimpairmentlosses | (56) | (34) | (56) | (31) |

| Subtotal | ||||

| Neitheroverduenorimpaired | ||||

| –gradeAtoAAA | 957,554 | 656,824 | 961,185 | 745,727 |

| Continuation of table 2.7 | ||||

| –gradeBtoBBB | 4,169 | 3,688 | 4,096 | 3,231 |

| –unrated | 70,487 | 94,282 | 73,870 | 94,211 |

| Subtotal | 1,032,210 | 754,794 | ||

| Total | 1,032,236 | 754,798 | 1,039,151 | 843,169 |

AmountsneitheroverduenorimpairedareanalysedaboveaccordingtotheGroupandtheBank’sinternalcreditrating.Unratedamountsduefrombanksandnon-bankfinancialinstitutionsincludeamountsduefromanumberofbanksandnon-bankfinancialinstitutionsforwhichtheGroupandtheBankhavenotassigned aninternalcreditrating.

Marketriskistheriskofloss,inrespectoftheGroup’sonandoffbalancesheetactivities,arisingfromadversemovementsinmarketratesincludinginterestrates,foreignexchangerates,commoditypricesandstockprices.MarketriskarisesfromboththeGroup’stradingandnon-tradingbusiness.Atradingbookconsistsofpositionsinfinancialinstrumentsandcommoditiesheldeitherwithtradingintentorinordertohedgeotherelementsofthetradingbook.Non-tradingbookrecordsthosefinancialinstrumentsandcommoditieswhicharenotincludedinthetradingbook.

TheRiskManagementDepartmentisresponsibleforformulatingstandardisedmarketriskmanagementpoliciesandrulesandsupervisingtheimplementationofmarketriskmanagementpoliciesandrulesoftheBank.TheAssetandLiabilityManagementDepartment(the“ALM”)andtheInternationalBusinessDepartmentareresponsibleformanagingthesizeandstructureoftheassetsandliabilitiesinresponsetonon-tradingmarketrisk.TheFinancialMarketDepartmentmanagestheHeadOffice’sRMBandforeigncurrencyinvestmentportfolios,conductsproprietaryandcustomer-driventransactions,aswellasimplementingmarketriskmanagementpoliciesandrules.TheAuditDepartmentisresponsibleforregularlyperformingindependentauditsofthereliabilityandeffectiveness oftheprocessesconstitutingtheriskmanagementsystem.

TheGroup’sinterestrateriskmainlycomprisesrepricingriskandbasisriskarisingfrommismatchoftermstructureandpricingbasisofassetsandliabilities.TheGroupusesmultipletoolssuchasrepricinggapanalysis,sensitivityanalysisonnetinterestincome,scenarioanalysisandstresstesting,etc.tomonitortheinterestrateriskperiodically.

TheGroup’sforeignexchangeexposuremainlycomprisesexposuresfromforeigncurrencyportfolioswithintreasuryproprietaryinvestmentsindebtsecuritiesandmoneymarketplacements,andcurrencyexposuresfromitsoverseasbusiness.TheGroupmanagesitsforeignexchangeexposurebyspotforeignexchangetransactionsandbymatchingitsforeigncurrencydenominatedassetswithcorrespondingliabilitiesinthesamecurrency,andalsousesderivativesinthemanagementofitsownforeigncurrencyassetandliabilityportfoliosandstructuralpositions.

TheGroupisalsoexposedtomarketriskinrespectofitscustomerdrivenderivativesportfolioandmanagesthisriskbyenteringintoback-to-backhedgingtransactionsonatrade-by-tradebasiswithoverseasbanksandnon-bankfinancialinstitutions.

TheGroupmonitorsmarketriskseparatelyinrespectoftradingportfoliosandnon-tradingportfolios.Tradingportfoliosincludeexchangerateandinterestratederivativesaswellastradingsecurities.ThehistoricalsimulationmodelfortheValue-at-risk(“VaR”)analysisisamajortoolusedbytheBanktomeasureandmonitorthemarketriskofitstradingportfolio.Netinterestincomesensitivityanalysis,interestraterepricinggapanalysisandforeignexchangeriskconcentrationanalysisarethemajortoolsusedbytheGrouptomonitorthemarketriskofitsoverallbusinesses.

Interest rate risk is the risk of loss in the overall income and economic value of the banking book as a result of adverse movements in interest rates, term structure and other interest-related factors. Repricing risk and basis risk arising from mismatch of term structure and pricing basis of assets and liabilities are the primary sources of interest rate risk for the Bank. The overall objective of the Bank’s interest rate risk management is to maintain steady growth of net interest income, while keeping interest rate risk within a tolerable range in accordance with the risk appetite and risk management capability.

In 2013, the Bank further refined its interest rate risk system framework, and formulated emergency response scheme for the interest rate risk of its banking book. It conducted regular analysis by comprehensively using multiple tools such as interest rate sensitivity gap, net interest income sensitivity analysis, scenario simulation and stress testing, to enhance regular analysis and prediction of the net interest margin.

The overall interest rate risk in 2012 was kept within the set tolerable level and the net interest margin remained stable. In response to influence of the interest rate liberalisation, the Bank adopted the pricing strategy, which combined the standardised and differentiated techniques, adjusted the authorisation in time, and optimised the system, to promptly respond to the demands of customers.

VaRisatechniquewhichestimatesthepotentiallossesthatcouldoccuronriskpositionstaken,duetomovementsinmarketinterestrates,foreignexchangeratesandothermarketpricesoveraspecifiedtimehorizonandatagivenlevelofconfidence.

TheRiskManagementDepartmentcalculatesinterestrates,foreignexchangeratesandcommoditypricesVaRfortheBank’stradingportfolio.

Byreferencetohistoricalmovementsininterestrates,foreignexchangeratesandcommodityprices,theRiskManagement DepartmentcalculatesVaRonadailybasisforthetradingportfolioandmonitorsregularly.

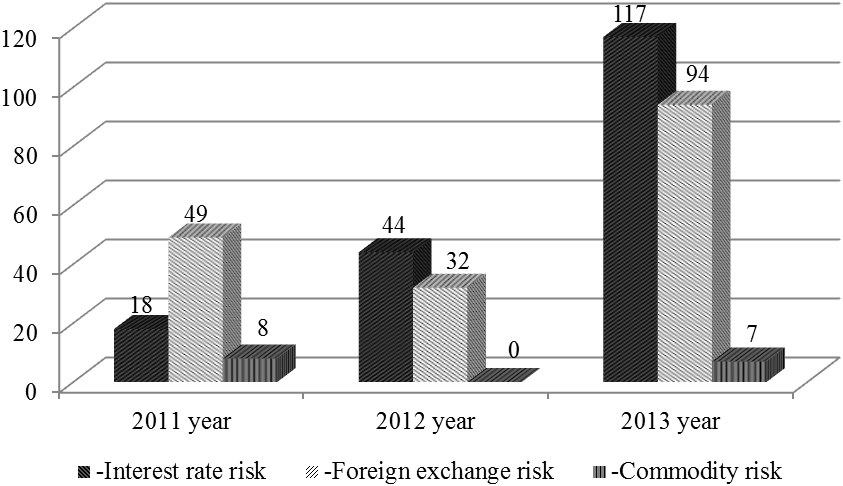

VaRiscalculatedataconfidencelevelof99%andwithaholdingperiodofoneday.A summary of the VaR of the Bank’s trading portfolio as at the end of the reporting period and during the respective years submitted in Table 2.8.

VaRforeachriskfactoristheindependentlyderivedlargestpotentiallossinaspecificholdingperiodandatacertainconfidencelevelduetofluctuationssolelyinthatriskfactor.

Table 2.8 - VaRanalysis of China Construction Bank

| Indicators | ||||||

| as at 2011 year | Average | as at 2012 year | Average | as at 2013 year | Average | |

| Riskvaluationoftradingportfolio: | ||||||

| -Interestraterisk | ||||||

| -Foreignexchangerisk | ||||||

| -Commodityrisk | – |

TheindividualVaRsdonotadduptothetotalVaRasthereisdiversificationeffectduetocorrelationamongsttheriskfactors.Figure 2.5 illustrate changes in VAR analysis results during 2011, 2012 and 2013 years.

Figure 2.5 – Changes in VAR analysis results in China Construction Bank

AlthoughVaRisanimportanttoolformeasuringmarketrisk,theassumptionsonwhichthemodelisbasedgiverisetosomelimitations,includingthefollowing:

1) A1-dayholdingperiodassumesthatitispossibletohedgeordisposeofpositionswithinthatperiod.Thisisconsideredtobearealisticassumptioninalmostallcasesbutmaynotbethecaseinsituationsinwhichthereisseveremarketilliquidityforaprolongedperiod;

2) A99percentconfidenceleveldoesnotreflectlossesthatmayoccurbeyondthislevel.Withinthemodelusedthereis1percentprobabilitythatlossescouldexceedtheVaR;

3) VaRiscalculatedonanend-of-daybasisanddoesnotreflectexposuresthatmayariseonpositionsduringthetradingday;

4) Theuseofhistoricaldataasabasisfordeterminingthepossiblerangeoffutureoutcomesmaynotalwayscoverallpossiblescenarios,especiallythoseofanexceptionalnature;

5) The VaRmeasureisdependentupontheBank’sposition andthevolatilityofmarketprices.The VaRofanunchangedpositionreducesifthemarketpricevolatilitydeclinesandviceversa.

Operationalriskincludestherisksresultedfromflawedorerroneousinternalprocesses,peopleandsystems,orexternalevents. TheGroupstrengtheneditsoperationalriskcontroloverkeybusinessareasandkeypositionsaccordingtoregulatoryrequirementsandthedevelopmenttrendofoperationalrisk.TheGroupcontinuedtopromotetheusageofoperationalriskmanagementtoolsandimprovetheoveralloperationalriskmanagementinformationsystem.

Foreign exchange rate risk is the risk of impact of adverse movement in foreign exchange rates on a bank’s financial position. The Bank is exposed to foreign exchange rate risks primarily because it holds loans, deposits, marketable securities and financial derivatives that are denominated in currencies other than RMB.

In 2013, the Bank continuously optimised the measurement, monitoring and reporting system of foreign exchange rate risk, and regularly reported to the senior management the composition of indicators such as foreign exchange rate risk exposure, stress tests and movement analysis (Table 2.9). The Bank attached importance to the construction of foreign exchange rate risk management system, and maintained a leading position among domestic peers in the system measurement capability. In terms of the transactional risk, the Bank optimised the measurement method of gold exchange rate risk exposure, while adjusted the measurement of US dollar exchange rate risk exposure to facilitate the trading in US dollar of the precious metal business of platinum and silver in the international market. In terms of the non-transactional risk, the Bank initiated the optimisation of asset and liability management system, to fully bring in the management data of overseas branches.

Table 2.9 – Currency concentration of China Construction Bank

| Indicators | ||||||

| USD | Total | USD | Total | USD | Total | |

| Spot assets | 358,091 | 658,797 | 524,730 | 804,603 | 731,627 | 944,234 |

| Spot liabilities | (276,244) | (595,467) | (432,09) | (771,753) | (540,063) | (831,751) |

| Forward purchases | 303,678 | 423,113 | 409,707 | 651,546 | 740,072 | 902,813 |

| Forward sales | (383,693) | (466,934) | (499,732) | (684,656) | (924,064) | (991,025) |

| Net options position | – | – | ||||

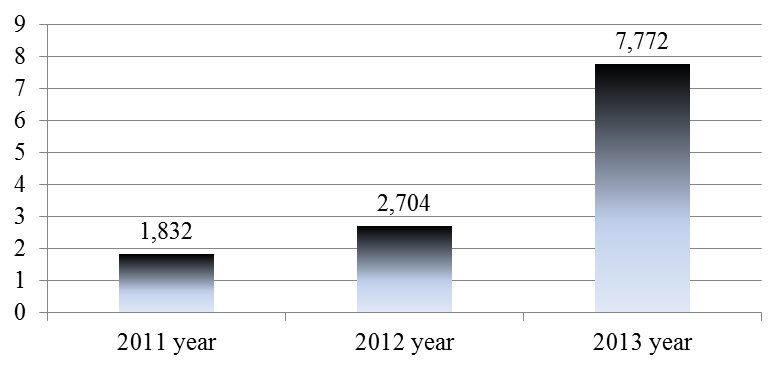

| Net long position | 1,832 | 19,509 | 2,704 | (233) | 7,772 | 24,471 |

As at 31 December 2012, the net exposure of the Group’s foreign exchange rate risk was a negative value of RMB233 million, a decrease of RMB19,742 million compared to 2011, indicating the further decrease of the Bank’s foreign exchange rate risk. Net long position in 2011 was 19,509. But in 2013 year this indicator increase to 24,471.All indicators have positive trand . During parced years all indexes are increasing. It’s occurs because bank revised his financial policy and started to optimize their activity.

Figure 2.6 present net long position during 2011 , 2012 and 2013 years.

Figure 2.6 – Net long position in China Construction Bank

The Board is responsible for establishing a robust internal control policy of valuation, and takes the ultimate responsibility for the adequacy and effectiveness of internal control system. The Supervisory Board takes charge of supervising the performance of the Board and Senior Management. According to the requirements of the Board and the Supervisory Board, Management’s responsibility is to organise and implement the internal control system over the valuation process to ensure the effectiveness of the internal control system of valuation.

The Group has established an independent valuation process for financial assets and financial liabilities. The relevant departments are responsible for performing valuation, verifying valuation model and accounting of valuation results.

Certain financial assets and financial liabilities of the Group are subject to enforceable master netting arrangements or similar agreements. The agreement between the Group and the counterparty generally allows for net settlement of the relevant financial assets and financial liabilities when both elect to settle on a net basis. In the absence of such an election, financial assets and financial liabilities will be settled on a gross basis, however, each party to the master netting arrangements or similar agreements will have the option to settle all such amounts on a net basis in the event of default of the other party. Certain financial assets and financial liabilities of the Group are subject to enforceable master netting arrangements or similar agreements which are not offset in accordance with IFRS.As at 31 December 2013, the amount of the financial assets and financial liabilities subject to enforceable master netting arrangements or similar agreements are not material to the Group.

The Group has implemented a comprehensive capital management policy, covering the management of regulatory capital, economic capital and accounting capital, including but not limited to management of capital adequacy ratio, capital planning, capital raising and economic capital.

Capital adequacy ratio is a reflection of the Group’s ability to maintain a stable operation and resist adverse risks. In accordance with CBRC’s “Measures for Capital Management of Commercial Banks (trial)” and relevant regulations, commercial banks should meet the minimum capital requirements from 1 January 2013. The Common Equity Tier 1 ratio should be at or above a minimum of 5%, Tier 1 ratio at or above a minimum of 6% and total capital ratio at or above a minimum of 8%. Systemically important domestic banks should also meet the 1% additional capital requirement, with their Common Equity Tier 1 capital. Meanwhile, in accordance with CBRC’s “Notice of relevant transitional arrangement for implementation of Measures for Capital Management of Commercial Banks (trial)”, a capital conservation buffer will be introduced progressively during the transitional period, which will be raised through Common Equity Tier 1 capital. If a countercyclical buffer is required or the Pillar 2 capital requirement is raised by the regulator to a specific commercial bank, the minimum requirements should be met within the transitional period.

The Group timely monitors, analyses and reports capital adequacy ratios, assesses if the capital management objectives have been met and exercises effective management of capital adequacy ratio. The Group adopts various measures such as controlling asset growth, adjusting the structure of risk assets, accumulating internal capital and raising capital through external channels, to ensure that the Common Equity Tier 1 ratio, Tier 1 ratio and total capital ratio of the Group and the Bank are in full compliance with regulatory requirements and meet internal management requirements. This helps to insulate against potential risks as well as support healthy business developments. The Group now fully complies with all regulatory requirements in this respect.

The Group’s capital planning has taken the regulatory requirements, the Group’s development strategy and risk appetite into consideration, and based on those factors the Group projects the capital usage and need. The Group regularly compares its position with its capital adequacy ratio target to ensure capital will be adequate for future or otherwise to plan for supplementation of capital.

The capital raising management of the Group involves reasonable utilisation of various capital instruments to ensure that both external regulatory and internal capital management objectives are met, taking in account capital planning and operating environment. This helps to optimise the Group’s total capital and structure, as well as improve the competitiveness of the Group’s cost of capital.

In 2013, the Bank continued to strengthen the building of anti-money laundering (AML) management policies and systems. By optimising the rules for filtering suspicious transactions and customer risk level classification, the Bank improved the reporting data quality of AML. In addition, the Bank carried out reinforced trainings and information-sharing on AML, and conducted transformation research on AML, which helped to define the method and process of AML, which are more closely related to daily operation and management.

Reputation risk is the risk of negative impacts or damages to the banks’ overall image, reputation and brand value, arising when commercial banks’ operational, managerial and other behaviours or contingencies are reported negatively by the media.

In 2013, the Bank further emphasized on reputation risk management, enhanced the reputation risk awareness among all levels of management and staff, clarified duties and requirements, and improved accountability management. The Bank launched the new generation public sentiment monitoring system, and set up the quick response mechanism for public sentiment both vertically and horizontally, to improve the reporting and response efficiency for public sentiment. In addition, the Bank amended its reputation risk management measures on the Group level and enhanced reputation risk controls over its subsidiaries and overseas entities. The Bank made emergency planning for reputation risk matters, clarified working procedures, and organised emergency drills in order to improve the reputation risk management capability.

The Bank conducts consolidated management over its subsidiaries, and imposes comprehensive and continuous management over the Group’s capital, finance and risks based on the single legal person, to identify, measure, monitor and assess the overall risk profile of the Group. In 2013, the Bank strengthened overall planning of consolidated management, optimised consolidated management system, and orderly conducted the follow-up consolidated management targeted at the weak links.

Reinforcing the Group’s large risk exposure management. The Bank optimised the industry limit management scheme by incorporating the subsidiaries into the industry limit management scope. The Bank promoted the unified credit management on the Group level to prevent excessive concentration of risks.

Conducting monitoring and supervision of consolidated management. The Bank organised and conducted examinations on consolidated risks, and timely found out and improved internal control deficiencies. The Bank actively cooperated with the CBRC to conduct on-site inspection of connected businesses of the shadow bank as well as the related audit checks by the National Audit Office to promote the Group’s compliance operation.

Enhancing risk management in other fields on the Group level. The Bank reinforced liquidity risk management on the Group level, and incorporated the liquidity risk profile of its subsidiaries into the Bank’s liquidity risk monitoring report. The Bank standardised the prevention work related to the Group’s legal risks, and made emergency response plans on material risks and contingencies in legal category. In addition, the Bank enhanced the data management of the Group’s internal transactions, with improved consolidated management of internal transactions.

Promoting the building of consolidated management information system in an active manner. The Bank initially established an information reporting and submission platform of the consolidated management in compliance with both the internal and external management requirements. The Bank integrated the financial statements and the underlying data of its subsidiaries, and clarified the information reporting and submission mechanism for consolidated management, to improve the standardisation and accuracy.

In order to promote the establishment of a sound and effective risk management mechanism, internal control system and corporate governance procedures, the Bank’s internal audit department evaluates the effectiveness of the internal controls and risk management, the effect of corporate governance procedures, the efficiency of business operations, and the economic responsibilities of key managers, and puts forward suggestions for improvement on the basis of its internal audit.

Date: 2015-02-16; view: 1228

| <== previous page | | | next page ==> |

| ANALYSIS OF THE EFFECTIVENESS OFRISKMANAGEMENTIN 10 TOPBANKS | | | Effectiveness analysisof risk managementin China construction bank |