CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

The Second Scenario

(Good Move after the Trendline is Broken)

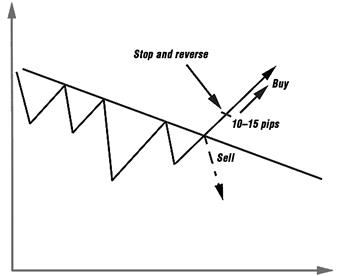

This one is a bit more difficult than the first one, but it shouldnít cause ex- ceptional problems for traders. After light stress caused by initial loss, you soon will experience emotional relief. When a trendline breaks, following an active move in the direction of a break, your stops will be activated au- tomatically. After losing 20 to 30 pips on an initial position, you already have another open position in the direction of a trend, on which you grad- ually accumulate profit when the market moves farther from the point of a break. See Figure 9.4. Donít forget to place stops, which should protect your new position. In this case, the risk of losses on a new position will again be equal to the risk you had on the initial one. Next, pray the break wasnít the false one.

The Third Scenario

(The Trendline Break Was False)

The third scenario is the most unpleasant one for a trader. Prayers donít help when a false break occurs. After the break, which activates stops and entry stops, the market makes some insignificant movement, which has

FIGURE 9.4 In case of a break of the trendline, the initial position should be liq- uidated and reversed.

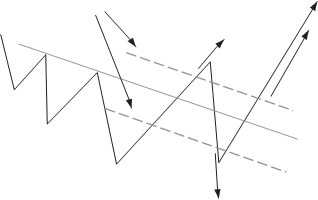

nothing to do with real follow-through; and then returns without giving the trader an opportunity to realize any profit. Thus the market again crosses a trendline, but from the opposite side. Stops are activated again and the trader loses on two transactions in a row, twice reacting to false signals. Even in this case, traders can still beat the situations using the fol- lowing technique.

The correctly identified and drawn trendline divides trade space into two parts. Usually, the market doesnít allow such an important line inside the established range. The market shouldnít continue crossing the trend- line repeatedly in different directions. Here it will be possible to apply the trading technique based on my method and the principles of money man- agement. Donít allow the market to leave a narrow 20 to 30 pips zone with the trendline going through the middle of it, unless you have a position open in the direction of the current movement of the market. In that case, each time, you should place stops at 15 to 20 pips distance from both sides of a trendline for liquidation of a previous position and open a new posi- tion in an opposite direction. See Figure 9.5.

Sooner or later, the market will leave its congestion zone at a dis- tance, sufficient to cover all losses from trade on a choppy market. The only problem might be that something considered sooner for the market, could become too late for a trader. Therefore, you must limit the number

Stop and reverse levels

Stop and reverse levels

Sell

FIGURE 9.5 A false break usually leads to two consecutive trading losses. These could be avoided by applying some intraday trading techniques that allow evaluation of the probability of a false break.

FIGURE 9.5 A false break usually leads to two consecutive trading losses. These could be avoided by applying some intraday trading techniques that allow evaluation of the probability of a false break.

of consecutive losses to three, four, or five and make a decision that de- pends on the size of the trading contract, size of your account, margin re- quirements, and strength of your nerves.

There are some other methods of dealing with false breaks, including methods of definition of their probability and also some other approaches using money management. We will talk about these later, in Part V. In any case, you always have to assume that any break of any trendline can be a false one.

I devoted a separate chapter of the course to different strategies in case of a false break of various trendlines, necklines, technical forma- tions, borders, supports, and resistances.

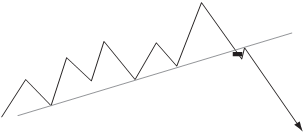

Because in this chapter we talk only about the trendlines angled to the horizon, there is one important detail you have to pay special atten- tion to: The signal to enter the market at the break of the trendline is valid only when the market breaks the ascending supportive trendline or descending resisting trendline. When the market breaks a rising resis- tance or falling support, you have to react to such a signal with the cau- tion of the great probability that the break will become a false one. See Figure 9.6a and b.

Buy

a

a

Sell

b

b

FIGURE 9.6 Figures 9.6 a and b show that if multiple unsuccessful attempts to break a trendline are seen, then a trade plan should be based on entering the mar- ket on the break of such a trendline.

FIGURE 9.6 Figures 9.6 a and b show that if multiple unsuccessful attempts to break a trendline are seen, then a trade plan should be based on entering the mar- ket on the break of such a trendline.

| TRADING BASED ON CHANNELS | ||

The formation of the channel on the charts of any time frame indicates to me an opportunity to make a profitable trade. The channel is one of my fa- vorite technical formations because I can easily define the degree of risk, which also can be supervised easily during a trade. The channel gives a clear view of the size of the potential profit. When I receive signals from the channel formation, the risk/reward ratio (RRR) exceeds the average RRR that I have when I make transactions on signals received from other sources. See Figure 9.7a and b.

There are three types of channels: ascending, descending, and hori- zontal. They are often formed on short-term intraday charts and are good just for a short-term trade. Channels are present on daily and weekly charts, too, but as a part of a long-term trend, their borders frequently are a bit dim.

Date: 2015-12-17; view: 1460

| <== previous page | | | next page ==> |

| Basic Trading Strategies and Techniques | | | Ascending and Descending Channels |