CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Pro Forma Cash Flow

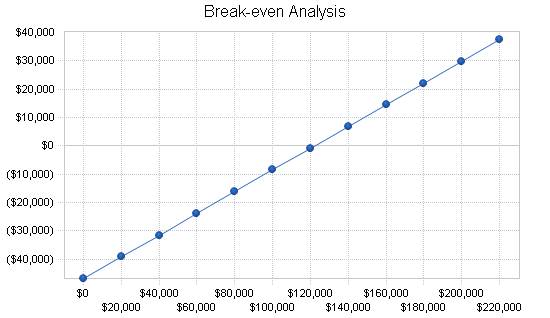

7.3 Key Financial Indicators The most important indicators in our case are are daily seating "counts" and weekly sales numbers. We must also make sure that we are turning our inventory rapidly so as to avoid food spoilage. We must target net profit/sales figures toward the 14% level with gross margins never dipping below 38%. Marketing costs should never exceed three percent of sales. 7.4 Break-even Analysis The Break-even Analysis shows that The Watertower has a good balance of fixed costs and sufficient sales strength to remain healthy. Our break-even point is $106,101 on sales averaging $12.54 per patron. This break-even position is achieved on a monthly fixed cost of $57,873 and per unit/patron variable cost of $5.70.

7.5 Projected Profit and Loss We expect income to approach $2.1 million for calendar year 2002. It should increase to $2.57 million by the end of the years covered in this plan. Date: 2016-01-05; view: 950

|