CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Mexico: Time for action!February 1, 2012

This sponsored supplement was produced by Focus Reports. Project Director: Mary Carmen Luna. Project Coordinator: Maria Elena Gomez. Edited by Henrique Bezerra. Contributors: Maite Reyes. Project Supervisor: Crystelle Coury. For exclusive interviews and more info, plus log onto www.energy.focusreports.net or write to contact@focusreports.net It is home to the world's second largest non-public company by market value, with assets totaling U$ 417.75 billion; it has been the US' second or third biggest oil provider in the last three years with imports of more than 1 million bbl/d; as of 2010, it ranked seventh among world oil producers, ahead of Norway, the United Kingdom, Venezuela, Iraq, and Brazil; it is a stable and plural democracy with free trade agreements with all major economies; its oil and gas sector contributes to more than a third of the national government budget and 15% of its exports; and violence is actually lower than in its other three major Latin American oil and gas counterparts Colombia, Venezuela or Brazil. It's Mexico. One must wonder how broken the Mexican PR machine is. Although most news that crosses the Rio Grande is soaked in stereotypes of slow-moving bureaucracy, production and reserve declines (all of them true to a certain degree), the opportunities hidden south of the border outweigh those challenges by far.

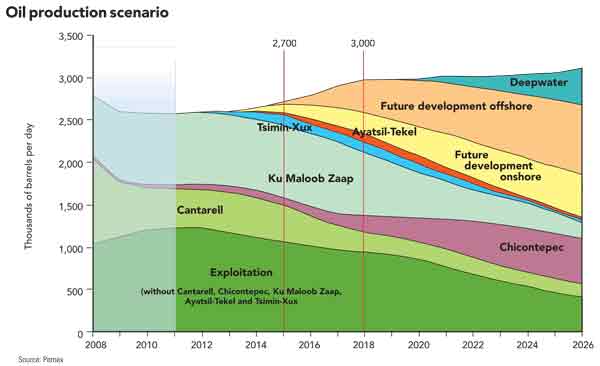

That is not to say that the Mexican oil and gas industry is not at a crossroads. Its oil output has fallen from 3.5 million bbl/d in 2004 to a projection of 2.6 million bbl/d in 2012. Though the government says it has reached the bottom, the US Energy Department projects that, if current trends and policies are left unchanged, the Mexican oil production will decline by an additional 600,000 bbl/d by 2020, transforming what was once the second biggest oil exporter into a net importer. The consequences of such a scenario would be devastating not only for Mexico itself but for the US as well. If Mexico becomes a net oil importer, America's desire to decrease its energy dependency from "unreliable sources" elsewhere would be seriously jeopardized.

But PEMEX, the NOC that holds the monopoly over all hydrocarbons under Mexican soil, has a somewhat different production scenario for the coming years. Even though reserves have fallen for the 12th consecutive year up to 2010, when proved reserves fell 1.4 percent to the equivalent of 13.8 billion barrels of oil, the company is hoping to replicate its apparent success in 2011 in stabilizing its proved reserves. From 2013 on, it hopes to increase its net proven reserves in order to augment its production to around 3.3 million bbl/d by 2024 and add to its current reserves' life of about 10 years.

To increase production from 2.6 to 3.3 million bbl/d in more than twelve years doesn't seem like a very big challenge at first sight. Many down play it by comparing it with Petrobras' production targets for the same period, where production would grow from around 2 to more than 6 million bbl/d. However, such a comparison is misleading. In contrast with countries like Brazil, which have continuously invested in exploration due to its historical oil scarcity, Mexico has had it easy for a long time.

The reason behind this is Cantarell Mega Field. Discovered in the mid 1970s and located 50 miles offshore in the Bay of Campeche, it has generated more than half a trillion $US in revenue for PEMEX. Production in 1981 was 1.16 million bbl/d and had fallen to 1 million bbl/d by 1995. However, a nitrogen injection EOR project increased production to 2.14 million bbl/d in 2004, when it reached its peak. Since then, production has fallen to a staggeringly low 558,000 bbl/d. This obliged Mexico to further exploit its existing reserves in order to avoid a supply shock, making it dangerously dependent on mature reserves. When compared with that of Saudi Arabia, Mexico's production is one to four, whereas the proven reserves of the former are one to twenty. Faced with such a scenario, Juan Josè Sùarez Coppel, PEMEX general director, tried to shed some light on optimistic future production targets, "Our plan is to reach 2.7 million bpd by the end of 2012 and hit 3 million bbl/d by 2017-2018. This will of course require significant investments and we therefore need to invest in addition to the U$ 22-24 billion planned". Besides strong investments in EOR, Suárez Coppel, is also betting on the potential of natural gas in Mexico, "In the past, a lack of investment led to the decline in non-associated gas production in the Veracruz and Burgos basins. But today we have discovered very significant gas fields in deepwater and we expect production to start by 2015. Last but not least, I believe we also have opportunities in our shale gas potential."

Carlos Morales, PEMEX E&P general director is more specific; "Two years ago, we discovered Lakach deepwater natural gas field and more recently Piklis, which together form part of the same sub-basin in the Gulf's deepwaters. This discovery also means that PEMEX has entered into a challenging area of deepwater operations. At 1,900 meters (6,000 feet) this is the deepest well that we have drilled." The stakes in these fields are high; Lakach together with Piklis has the potential to produce approximately 800 bcf, which equates to 80 percent of the country's current gas imports. "We have an assessment of approximately 28 billion barrels of oil equivalent of prospective resources and we are going to speed up the exploration process in deepwaters to hopefully deliver the expected results", says Morales. If PEMEX wants to bring its future production targets any closer to its 3 million bbl/d, it had better invest heavily and quickly.

After discovering the Mesozoic basins in the South and the Gulf of Campeche in the early 1970s, PEMEX has essentially abandoned mature fields without extracting the reserves that were still in place. Therefore, there is still a great potential for those fields, since the country has only extracted 17 percent of their volume. According to Morales, there is potential to extract at least twice as much. But PEMEX cannot do all this on its own. "We need to look at additional capacity for those mature fields, which is why we are trying to bring in people through new contracts. The first incentive-based contracts (IBCs) biddings have been going on for a while and so far we have had very good responses from the interested parties. We have 45 bases and 22 companies for sale and overall we believe we have very strong offers on the table that are attractive to the industry", Morales acknowledged while the bids were still going on. These biddings resulted in the signing of three IBCs in late 2011 with multinational companies, one with Schlumberger and two with Petrofac. The Mexican oil and gas industry most certainly offers a great deal of challenges, as well as opportunities. The huge investments announced for the coming ten years have raised eyebrows everywhere, and it is undeniable that the country has woken up to the need to modernize its oil and gas industry. The question of when Mexico will really loosen up its grip on its hydrocarbon reserves is, as usual, more a question of how much more pain will it take to convince Mexican legislators to ask for help. Hopefully for Mexico and its neighbor to the north, it won't take too long. If production peaked in 2004 and PEMEX was already clearly incapable of maintaining and increasing production on its own, why did it take so long to start working with other international partners who have the technology and expertise to safeguard Mexico's energy security? Politics, of course. First reform When Felipe Calderón took office as President of Mexico in 2006, he made the so-called "Mexican energy reform" the backbone of his modernization roadmap for the Mexican economy during his six year mandate. In the midst of a sharp oil production decline and the emergence of other successful regional NOCs that were partially privatized and exposed to a competitive environment, many expected Mexico to follow suit and open up its energy sector for private competition, allowing national and international companies to compete with PEMEX for Mexico's hydrocarbon reserves. However, those who thought so underestimated Mexicans' strong nationalistic feelings towards its oil and gas reserves. A national holiday recalling the day on which President Lázaro Cardenas nationalized the oil industry (March 18, 1938) is the strongest symbol of Mexico's oil nationalism. After years of political debate, the energy reform was passed in 2008, only to have important parts of it taken to the Supreme Courts, which ultimately acknowledged its constitutionality. The main aspect of the reform was the introduction of the new Incentive Based Contracts (IBCs), replacing the multiple-service contracts (MSC) offered in 2003. The latter allowed PEMEX to hire contractors only on a set-fee basis, operators owned no equity in projects and were unable to book reserves. These contractors received no extra benefits if their work boosted production beyond what was required by their contract. By contrast, the new IBCs offer performance-linked rewards and more flexible remuneration for operators in the case of oil-price hikes. "Clearly the reforms have provided a great level of flexibility to PEMEX. Now the company has the flexibility to enter, design and implement contracts pretty much like any NOC or IOC, to a great extent", says Rogelio Lopez-Velarde of law firm LVHS. "One of the most important items of the reform is that it changed the architectural institutional framework of Mexico. To some extent now there is a definition of who is the policy maker (the Ministry of Energy); who is the regulator (the CNH, which stands for National Commission for Hydrocarbons); and who is the operator (PEMEX)", he concludes. However, the reform failed to allow ownership of reserves, not granting permission to build and run refineries either, as President Calderòn had proposed. As explained by CNH's president Dr. Juan Carlos Zepeda Molina, CNH's responsibilities can be summed up into four main categories: technical regulation and enforcement in the upstream oil and gas industries; technical assessment of all exploration and production projects; determination of the country's hydrocarbon reserves; and the provision of advisory activities for the Ministry of Energy. Even though the Mexican oil and gas sector is becoming more flexible and open, most companies still depend directly on PEMEX's choices and its ultimate fate. To say that there is no flourishing Mexican oil and gas industry without PEMEX is as true as to say that there is a flourishing Mexican oil and gas industry in spite of PEMEX. PEMEX predominant role is felt at all levels. And it takes stamina to thrive in Mexico's overly concentrated market with merely one order giver. Rolando Maggi, CEO of FCM, the exclusive representative of Kimray Inc.'s control equipment products and also holder of other partnerships with foreign companies, "One of the biggest challenges faced in the Mexican oil and gas industry is the purchasing system, where the law forbids direct purchasing from PEMEX for new products. Hence even if one has the best product it needs to go through a public bidding process. Saying that, you end up doing two sales: to PEMEX and to all the bidders. As you can imagine, the process tends to be very slow", explained the young CEO. Most of the changes and reforms highlighted were driven more by PEMEX's changing needs than Mexico's. While the two are not mutually exclusive, but they are certainly not the same. PEMEX's role as a company is disguised and is still considered by many as a de facto public regulator due to its monopolistic market control. Nevertheless the creation of CNH was an acknowledgement by Mexican legislators that, even though state-owned, PEMEX could not regulate its own activities while safeguarding the long-term interest of Mexico's energy security. Clearly, Cantarell's fast and, according to some, irresponsible depletion left its scars. Zepeda Molina puts it bluntly; "No oil company in the world is capable of developing the resources that we have here in Mexico by itself. PEMEX needs new partnerships. Hence, the full implementation of the new IBCs is crucial and central for the challenges that we are facing now." PEMEX is expected to apply the new IBC to mature northern fields, such as the onshore Chicontepec basin and the deepwaters of the Gulf of Mexico (GOM). Chicontepec's output, PEMEX hopes, could rise to around 70,000 b/d with the right kind of investment. On that note, Juan Manuel Delgado, general director, Schlumberger Oilfield Services Mexico and Central America comments, "A lot of people compare Chicontepec to Cantarell, which is misleading. Chicontepec is one of those unique fields where even with all the tools available today it is not easy to understand and follow the continuity and multiple compartments of its reservoirs. Exploitation of Chicontepec does not have a magic solution and it is not, by any means, straightforward. There is no one simple field development plan that will lead to immediate success like in the majority of other fields. With fields in the southern part of the country, it is hard to reach the oil, but once you have achieved this, it is relatively easy to extract. Chicontepec is the opposite." It's no wonder that so much emphasis is given to Chicontepec's exploration. PEMEX to date has spent more than U$ 5 billion in developing the Chicontepec field, which has resulted in less than 60,000 bbl/d even though the field contains around 17.7 billion boe of possible reserves. The 2008 energy reform package also contained specific features related to renewable energy, energy efficiency and other important environment-related issues. In one of their most sensible acts, Mexican legislators acknowledged the country's need to depend less on oil, now an expensive and scarce resource, while also taking measures to comply with Mexico's international environmental obligations embodied in treaties such as the Kyoto Protocol. According to Mexico's Energy Secretariat (Sener), fuel oil and diesel were responsible for the lion's share of Mexico's conventional thermal generation mix feedstock. However, even before the 2008 energy reform, natural gas consumption for electricity generation had risen dramatically and natural gas is now the dominant feedstock in the Mexican Energy mix. Unsurpisingly, PEMEX dominates Mexico's natural gas value chain. PEMEX itself is the single largest consumer of natural gas, representing around 40 percent of domestic demand. It also operates over 5,700 miles of natural gas pipelines in Mexico and has twelve natural gas processing centers, with liquids extraction capacity of 5.9 Bcf per day in 2010. Mexico's natural gas pipeline network includes ten active import connections with the United States. In 2010, Mexico imported 342 Bcf of natural gas from the United States, while it exported 30 Bcf to the United States. Natural gas' midstream and downstream sectors were liberalized by previous reforms in the 1990s and early 2000s. Thanks to these, vast opportunities were opened to companies such as GDF Suez. The company country manager, Germain Manchon explains: "GDF Suez is the number one private sector natural gas transmission company in Mexico, with over 900 km of pipelines constructed, and we are the second most important natural gas distribution company in Mexico, serving 400,000 customers through our 6 distribution companies. The company also has some participation in the power sector with over 300 MW of cogeneration-installed capacity."

Based on the new Federal Electricity Commission (CFE) requirements, Mexico has a huge need for energy infrastructure in the next 10 years. "GDF Suez is a world leader in terms of the management of pipes and infrastructure, so I believe we have much to offer. Gas distribution of course is also important because Mexico needs to incentivize a higher market penetration", highlights Manchon, who also notes that the company is increasingly thinking about how they can introduce environmental services in their offers, as a response to Mexico's growing environmental concerns. …..Then Perform Petrofac won international headlines by securing the first ever IBC in Mexico for the Santuario and Magallanes fields. As explained by Harry Bockmeulen, general manager of Petrofac Mexico, "The basis of the contract is a fee per barrel paid by PEMEX and reimbursement of some capital costs. PEMEX asked companies to bid a fee per barrel to produce over and above a certain minimum production that exists in the fields. They will give us a fee for all incremental production above that. Petrofac will invest and PEMEX will repay up to 75% of that amount." The IBC was strategic not only for its profit prospects, but by the precedent it opened for Petrofac. "It is not a one-off opportunity. PEMEX announced multiple similar opportunities in the future and this seemed like a good place for us to start in Latin America", says Bockmeulen.

According to him, contractually Petrofac will spend approximately U$ 200 million in the first two years in both blocks, which is a function of PEMEX's contract bidding conditions and the minimum expenditure levels that were part of the bidding process. The minimum development spend on the fields over the 25-year contracts is approximately U$500 million. "The contracts are very well designed to incentivize the contractor to maximize production and we will look for every opportunity to do so", Bockmeulen concludes.

In a market that many regard as impenetrable and even xenophobic, the key to winning such a strategic bid was to have established offices in the country and to have build up a local network prior to that. As Bockmeulen puts it, "Doing so establishes a credibility that you are seriously interested in coming here and it gives you an opportunity to establish relationships with people who you hope to work with in the future. I know that PEMEX is contemplating a second round of contracts sometime soon. Petrofac is focusing very much on delivering the first two fields but we will study what PEMEX has to offer in rounds two, three, and four."

Schlumberger, the other winner of the first IBCs bidding round, had the contract assigned after the original winner failed to meet the requirements for the Carrizo field in southern Mexico. According to Delgado, "2011 has been a good year to explore and consolidate different prospects in the industry around the so-called ‘mature fields contracts'. They will add more activity and bring more players into the picture, helping PEMEX increase its oil production. Although they might not yet have had as great an impact as PEMEX initially hoped for, they are a good way to start the Mexican model of private company participation in the oil and gas production industry. It is clear, however, that PEMEX is the only company taking equity on the assets, and any changes to this would be left to the government to decide. We, as a service industry, have to comply with the rules of the game set by PEMEX and the government." Prior to this, Schlumberger had won the highest number of contracts in Mexico amongst oilfield service providers over the past 12 years.

The new IBCs are also expanding the options to existing local EPC players. Nuvoil, a company traditionally focused on the management and treatment of natural gas from well to sale points, is interested in the opportunities they could create in oil assets through partnership with other companies,. Mariano Hernández, Nuvoil's director, explains how, "Nuvoil is aligning itself with a third company involved in the exploration of oil. Our aim is to participate in the IBCs expected for 2012. Nuvoil wants to have more strategic alliances while continuing to strengthen cooperation with the most technologically-advanced companies present in the Mexican market". Nuvoil already enjoys a strategic partnership with Calgary-based TESCO Corporation.

Instead of fearing the new competition brought by the flock of foreign companies considering Mexico's friendlier regulatory environment, Hernandez believes that competition will force local players to invest in productivity. "There is a certain sense of excessive comfort enjoyed by local firms, thanks to the lack of local competition, they are not investing much in their competitiveness and end up losing opportunities in countries like Colombia, Bolivia or Peru; this is not the case of Nuvoil." Hopefully new measures such as the IBCs will bring more competition to Mexico's still "overly comfortable" market. Oscar Vázquez Sentíes, CEO of Grupo Diavaz, makes the following assessment of IBCs, "The previous type of contracts were limited in that companies like Grupo Diavaz were only providing what our customer asked for, and were not including new ideas or new technologies and also the services were not oriented to produce more, they were oriented just to provide more services. With the IBCs, Grupo Diavaz is now able to include all our capabilities and we believe these new contracts will mean higher productivity as they will create a win-win situation between our customers and the services that we provide, they induce the contractor to produce more using better technologies." Grupo Diavaz currently provides services to PEMEX and other companies in marine operations, gas distribution and exploration and production. The company assists PEMEX to produce gas in Burgos Basin in the North Region, where it also helps PEMEX to produce oil, whereas in the Marine Region they operate underwater pipelines.

One of the key strengths of Diavaz over the years has been its ability to create and strengthen firm partnerships with international players, bringing new technologies to the Mexican oil and gas industry. The latest such partnership is with Fugro for deepwater development and exploration. "Grupo Diavaz has been working with Fugro in the offshore market for over twenty years. Thanks to this, we now provide services to deepwater fields. Geotechnical and geophysical studies are the very first step to develop them, now Grupo Diavaz is working on it", says Vázquez. Protexa, a local EPC with activities in onshore and offshore oil piping laying and oil drilling, besides maritime constructions, also expects considerable benefits from the new IBCs. "The new IBCs and other measures brought by the 2008 energy reform opened many business opportunities that weren't feasible before, such as alliances between PEMEX and other companies to increase production, which will ultimately bring many multinational companies that are still not based in Mexico. The newcomers will naturally search for synergies with local players who can offer them local experience and market knowledge, making Protexa a unique partner of choice", says Fernando Lobo, head of Protexa. This Mexican family-owned company is focusing on providing value to PEMEX's requirements. The company has built about 25% of the pipelines or submarine lines in Mexico and installed approximately 90% of the fixed offshore platforms in the country. "As is well known, PEMEX plans to replenish its reserves by more than 100% in the coming years, which represents a lot of work and opportunities. To maintain a production of 2.5 million bbl/d means to significantly increase drilling activities, among other things, and this can give much impetus to Protexa's offshore business", anticipates Lobo. His growth strategy is to promote new technologies and to enter Mexico's promising deepwater explorations. However, Protexa also intends to continue promoting the maintenance of PEMEX' platforms and marine facilities, as this represents Protexa's main cash flow. Becoming better After nearly three decades of operations, Oil International Services (OIS) has built a skilled team with a deep understanding of both the Mexican and the international oil industry and has gained a broad experience in onshore and offshore construction, manufacturing and maintenance of marine drilling rigs.

According to the company's operational director Adrian Bustamante, OIS growth has always been linked to its clients' needs and has also succeeded in meeting national and international requirements: "Our structure and capabilities give us the flexibility to offer our services directly to PEMEX or to any international company by using incentive contract schemes." OIS provides products and services using leading edge technologies. Bustamante asserts: "At OIS we are always looking for new ways to help the oil and gas industry to improve its performance and to achieve the best possible outcome." Among these services OIS offers two key solutions: providing Dynamic Equipment with safety and environmental protection systems in order to address environmental and safety issues respectively. During the past five years, the oil and gas industry in Mexico has experienced a steady decline in production. Nevertheless Bustamante asserts that OIS has fulfilled its commitment in terms of production in various niches such as drilling modules overhauling and providing enclosures for gas turbines in the Mexican Oil Industry commissioning between Singapore and Mexico. In addition Bustamante feels confident about the future as he asserts that the company has "a long term vision to anticipate the customers' future needs; that is why within the group we have an area of research and development which allows us to have a clear image of the technological trends and to help us understand the applications and solutions to be implemented in PEMEX's PEP development program." OIS partnership strategies have played a key role in the company's growth: "We have been working with foreign companies that are already established in Mexico or with others that intend to penetrate the market. At OIS we are open to forming partnerships as long as they are in a win-win format for all parties involved. We have also established in Mexico City, Ciudad del Carmen and Houston to fulfill our clients' needs and concentrate on strategic alliances. As for the long-term goals, Bustamante insists that OIS vision and mission will remain: "to become a model group in its niche." He also adds that the company is committed to continue searching new and further solutions to actively contribute to improve the Mexican oil industry. Deepwater Cliff Divers One must not underestimate the knowledge accumulated in a century by Mexico's oil and gas industry. When offshore exploration was only a speck in the distance for countries such as Norway or Brazil in the 1960s, Mexico was already working its way to discovering the world's second largest mega field in its shallow waters. But sadly, easy come, easy go. After decades of easy oil and lack of market competition, the technologies available for the expansion of Mexico's hydrocarbon industry have lagged behind its international counterparts and failed to meet its increased hard-to-find oil needs. Adrian Lajous, PEMEX general director from 1994 to 1999, is categorical about Mexico's current challenges to expand into new oil frontiers, "The main potential for discoveries is where we have not explored in the past, which is in deep and ultra-deepwater in the Gulf of Mexico. This is more a recognition of our ignorance than any specific knowledge of what may be discovered or where." Two recent deepwater discoveries have shaken the Mexican oil and gas industry, "Three years ago, PEMEX discovered important deepwater natural gas reserves at the Lakach field and, more recently, it has found gas reserves in the Piklis field, which together form part of the same sub-basin in the Gulf's deepwaters", highlights Carlos Morales, PEMEX E&P general manager. Coincidently or not, these findings came out in 2008, at the same timeas the approval of the energy reform bill by Mexican legislators. Bejamin Torres-Barron, partner at Baker & McKenzie explains the impact of the 2008 energy reform in the deepwater sector and beyond. "I believe the greatest achievement of our energy reform is, on one side, the DAC (Disposiciones Administrativas de Contratación) or the ‘Administrative Procurement Guidelines', which include more flexible mechanisms and add particular features to facilitate contracting with private parties. It is a rather modern contractual structure that is designed to encourage private parties and our national industry to ‘dive' into deepwaters. Maybe later than sooner (not as early as we would like), but finally Mexico will be able to exploit the challenging deepwaters in the Gulf of Mexico, whereas before, PEMEX was unable to do so."

He goes on to emphasize that "The energy reform is not only related to oil matters. The reform package also contained specific features related to renewable energy and energy efficiency. Some progress has been made on this front, particularly in the electricity sector. In terms of renewables, the power industry has been more effective as a result of the policies and the guidelines that the Mexican Energy Regulatory Commission has issued and implemented to encourage the use and exploitation of electricity based on renewable sources."

With all nuances of the 2008 reform, Torres-Barron acknowledges that the real interest and revenue for international oil companies will be in the Gulf of Mexico's deepwaters. However, what is important for most IOCs is the ability to book reserves. At the moment, if an IOC goes into a field for E&P, Mexico's legal framework does not allow it to book these reserves. Torres reckons that "This prohibition to booking reserves is not clear enough and is subject to different arguments and interpretations with respect to its scope and mandatory effect". Not very comforting for an already overly risky industry. Jose Aguilar, director general of C&C Technologies Mexico, describes some symptomatic signs of the lack of favorable regulatory conditions for deepwater projects, "While C&C Technologies' main activity is deepwater, there have been no substantial developments in this market in Mexico nor do I foresee any in the next five years. We are currently participating in Lakach field, the only deepwater activity in Mexico, by providing engineering services for various land facilities. Having also done work for Lakach five years ago, we at C&C Technologies are proud of our long service to the only deepwater production site in Mexico."

C&C Technologies is still working at Mexico's offshore and shallow water areas and also provides geotechnical services. According to Aguilar, what explains C&C Technologies' success in the Mexican market is their "Ability to offer a number of services in one package. C&C can offer a customer both onshore and offshore solutions. I want C&C Technologies to be one vendor that is able to provide a whole set of products. I also want to offer a company with the highest technology with a 100 percent Mexican workforce."

While offshore work is normally C&C Technologies' cash cow, in Mexico they earn similar revenues from their onshore work. Aguilar concludes by saying the "We at C&C Technologies are benefitting from volume instead of bulk. We are applying offshore technology to all land technology, which can be simple but, nevertheless, it has never been done before".

Milton Costa, general director of Petrobras Mexico, couldn't be more diplomatic in his comments about PEMEX, Mexico and its latest energy reform, "The energy reform was something very important. However, time is going to prove whether changes made are going to achieve what authorities want. Mexico is a fantastic country with a huge economy and a large population. It is a big challenge to supply the amount of energy that its industry and 110 million inhabitants demand. Regarding Petrobras as a model, it is true that the company is a very appealing model to exemplify how a state oil company can be managed and grow very fast in a successful way." When asked if one can compare Petrobras to PEMEX, here is his answer, "The point is that conditions are different. In Brazil we were always looking for oil because we were not self-sufficient, while Mexico had considerable amounts of easy-to-extract oil and gas. So the approaches were really very different. When we discovered oil in Brazil, it was in deepwater, which meant a big technical challenge for Petrobras. Facing and solving this challenge has shaped our business culture and made Petrobras what it is today. We have a larger experience and we can share it with PEMEX." Being an experienced employee of Petrobras, a NOC itself, Costa is well aware of the greater advantages of joining forces with local NOCs rather than trying to compete directly with them. Local knowledge, local content While addressing the subject of deepwater development and Mexico's needs, Adrian Lajous, former PEMEX general manager draws attention to the huge knowledge gap facing Mexico: "Naturally, never having to explore these areas has left a serious lack of know-how in the areas where we actually have the potential to find new reserves".

The challenges are not just in E&P, as PEMEX's ambitious investment plan also targets downstream sectors. In the words of PEMEX's current general manager, "Today we produce 1.4 billion barrels in both oil and gas liquids. Our development costs are about $15 per barrel and the refining cost reaches from $1.5 up to $2.5 per barrel. The other part of our strategy is to turn around the situation in downstream. In past years petrochemicals and refining activities were in deficit", says Juan Josè Sùarez Coppel, general director of PEMEX. Since PEMEX is willing to increase its current production levels from 2.5 million bbl/d to 3 million bbl/d by 2018 and improve its local refining capacity, the U$ 22-24 billion annual investments planned for the coming years will surely run short.

Technological research centers such as Ciateq have spotted the opportunities brought by such aggressive investment plays and are trying to fill Mexico's technology gap as soon as possible. Since 2001, the research institute has shifted its attention to the growing technological needs of Mexico's oil and gas industry. "At first, the institution worked with gas processing technologies, but now we are focusing on fluid flow measurement, directly applied to oil and gas flows, and exploratory and producing wells' productivity", highlights Francisco Antón, Ciateq's general director. Ciateq has continually worked with PEMEX's subsidiaries and over the years PEMEX Gas has become its main client, while the research institution also completed projects for PEMEX Refining and PEMEX Exploration & Production.

In order to meet PEMEX's needs for large natural gas flow measurement installations, Ciateq has entered into partnerships with institutes in the United States and Canada, such as Southwest Research Institute and Transcanada, which complement its capabilities and enable Ciateq to execute large projects for PEMEX. Naturally, being a public research center facilitates Ciateq's access to the equally public-owned PEMEX, making it an interesting channel for introducing new technologies and processes into Mexico's oil and gas industry.

Nevertheless, to develop Mexican know-how and technologies, companies will need a large pool of skilled workers available. According to Alejandro Martin, country manager of London Offshore Consultants (LOC), this will become a major challenge. Martin states that, "Mexico will need thousands of skilled people to do the work its oil and gas industry requires. There are thousands and unfilled qualified jobs at the moment and we cannot rely on bringing people from abroad because other countries will have their own needs to solve, besides the fact that bringing foreign personnel would be very expensive. As a country, Mexico needs to make a bigger effort to increase and train people at all levels, so that it can further succeed and enhance its oil & gas industry".

Present in Mexico since 2004, LOC Mexico provides Marine Warranty Survey (MWS) services in the country. It also provides specialized marine consultancy and surveying services to the maritime industry. "In 2004 the Ku-Maloob-Zaap development was in its early stages. It was perfect timing for us to open the Mexican office as this allowed us to offer MWS services to PEMEX. Our participation in the review of the NRF-041, which is the standard established by PEMEX for the load-out, transportation and installation of marine platforms, is a good example of our participation with PEMEX in improving the industry practice in the country", recalls Martin. The issue of developing local expertise and increasing the local content in the Mexican oil and gas industry has been taken as a priority for PEMEX and for the Mexican government. Measures in this direction have boosted the demand for local start-ups such as SAFFC. With only five years of experience in the oil and gas industry, this service provider has specialized in the negotiation, management and supervision of strategic projects in areas such as exploration and exploitation, perforation, transport, hydrocarbon distribution, industrial safety and environmental protection.

With a crew of over 400 contributors working in Cantarell, Samaria Luna, Macuspana and Chicontepec, SAFFC's CEO Juan Carlos Paredes asserts that "The only reason why we have been able to capitalize on PEMEX's "going local" policy were our strong investments in high-quality standards, which culminated on the ISO 9001:2008 certification. This certification has been a major step in order to guarantee the enterprise's commitment to work according to its quality management system and to fulfill all international quality standards required by the industry." Paredes now expects to increase its service portfolio and, by doing so, help PEMEX to reach its local content targets. Safety First The Deepwater Horizon disaster of April 20th 2010 in the Gulf of Mexico, resulting in 11 deaths and the estimated spillage of between 4 and 5 million barrels of oil, has brought the paramount importance of high safety standards within the industry into sharp focus. The toughening of local security and environmental regulations has already changed the fate of companies such as Kidde de Mexico (a subsidiary of UTC Fire and Security). With an impressive safety record "Kidde has a record of more than five years with zero accidents on the work we have performed", says Horacio Fájer, Kidde de Mexico's president. "What is better for us in the long run is that we have been able to demonstrate that Kidde can sustain the systems beyond 98 percent availability. To have all fire systems beyond 98 percent is key to our main customer, PEMEX. That is because we have been able to train, educate, and report even a "near miss" – which is almost an accident or something that could eventually become an accident", highlights Fájer. As with most other Mexican service providers, the role of PEMEX is central to Kidde's present and future, "An important portion of our recent growth in the offshore and marine business is due to our expanded relationship with PEMEX. Kidde de Mexico now maintains fire systems in turbo-machinery, open areas and habitation units. The company is also committed to better train and develop the skills in the overall fire protection industry in Mexico, and is planning to offer training and certification to the PEMEX's crew in Spanish" explains Fájer. Strangely, only a few other companies offer training with 100% Spanish materials, which can pose a significant problem in sites with a high proportion of local crew. In addition to this, Mexican companies are quick to react to these highest needs for safety services and procedure. Promasa, for example developed an innovative safety system, called the "arnés inteligente" (smart harness). As general director Francisco Soriano explains, "The idea was born after a conversation between me and a PEMEX drilling manager. After he told me that despite all the security measures that they had, accidents were still happening, I told him we needed a 24-hour supervisor. We brainstormed how we could do this and it occurred to us that instead of thinking about only training people to warn others in case of danger, we should come up with an electronic device that could assist us in doing so 24/7. Then we investigated the technologies that were available and came up with a technology that uses a type of wireless computer alarm that gives a history and reports from the control area. This way, whenever a worker is in a dangerous place at a dangerous time, he and others are warned by the ‘arnés inteligente'." The company first started auditing air systems in drill wells in 1999 and then saw the opportunity to offer PEMEX's subcontractors risk studies and Rig Pass courses. "Regarding industrial security and environment-related courses, Promasa is accredited with more than 30 different courses, being the company with the second highest number of accreditations behind the Houston-based International Association of Drilling Contractors (IADC). Rig Pass is a basic course necessary to enter any PEMEX drilling installation", says Soriano. According to Soriano, a lot has changed in Mexico on the environmental requirement fields, "In the past, environmental audit services were too costly and were unnecessarily bureaucratic. Therefore, I saw a niche where Promasa could offer efficient and competitive services which ended up opening many interesting opportunities for us". More Oil & Gas Financial Journal Current Issue Articles

Date: 2015-12-24; view: 988

|