CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Fundamental Analysis

Industry Outlook

S&P Capital IQ has a neutral fundamental outlook on the entertainment and movies industry due to a “continued weak consumer spending environment”. DVDs and CDs have long ago become saturated and are giving way to newer content-sharing methods, such as online streaming, video-on-demand, mobile devices, and other.

Declining CD sales have been offset by growing digital market places (ITunes, Pandora, Amazon, etc.). There seems to be consolidation going on in areas of concert promotion, artist management, ticketing, and music recording.

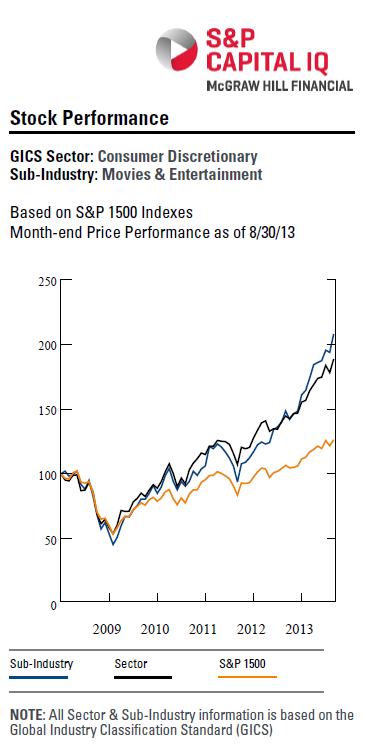

The S&P Movies and Entertainment Index rose more than 38% year-to-date (Disney increased by 32%) in comparison with the broader S&P 500’s ~19% gain:

Although valuations are high at this point, analysts still expect further consolidation in the industry as giant TMT companies with clean balance sheets and reasonable levels of cash look forward to adding more services and products to their pipelines and key segments.

Valuation

Having read a number of recent researches on the company, I have noticed two things: the company is almost unanimously rated as a “BUY” and usually has price targets of as low as $72 (~11% upside) to $84 (29% upside). Before I roll out my number I would like readers to look at a couple of cautionary moments in regards to the current market valuation of Disney’s stock:

The 10-year chart shows that the price reached a plateau because investors are not confident about the further appreciation in price: one can see that there was a recent dip to ~$60 before the price restored back to current levels. Technical indicators such as MACD and RSI also suggest that the stock is oversold at current price levels. Fundamentally, the picture is as follows:

The data from StockRover shows that Disney is trading near or at the upper limits of the historical 5yr valuation metrics. On the one hand, this implies a certain level of risk that an investor must co-op with if s/he initiates a position at current prices. On the other hand, the 5yr data may not be representative enough (it tracks since 2008 when valuations were depressed).

Fundamental Analysis

The DCF model I used to value Disney has the following assumptions:

1. WACC is 6.5% - 7.5% (the difference does not result in a lot of sensitivity in the output)

2. Terminal EV/EBITDA is set at 8.0X, below current implied multiple of 9.9X. Here is why:

Because the company has little debt in ratio to capitalization its EV is highly sensitive to changes in market cap: the last twelve months’ run-up caused the valuations to get past historical limits.

3. Weighted-average projected revenue growth rate for the next five years stands at ~7%, which is higher than the eight-year CAGR of ~4.5%. The expected growth rate is comparable to historical growth rates for Parks and Resorts (5.8% CAGR), Media Networks (6.4% CAGR), and Consumer Products (7.2% CAGR)

4. I set next 5yr EBITDA margin to be around 30%, which is above historical levels but intact with 2012 and LTM figures. Moreover, there has been a gradual uptrend from ~21% (2005) to recent 30% (LTM), which gives further validity for the assumption. EBIT also stays higher at 25% for the modeling purposes; same goes for D&A expense which has been edged up to 5% from historical 4.4%

5. CAPEX is set at 10% of revenues which definitely is high and reduces free cash flows considerably. However, this assumption is a good hedge against rising prices of construction in the Parks and Resorts sector

6. Net Income margin is set at 15%, which corresponds to the current data

The output of the model is as follows:

Correspondingly, the distribution of fair value factors is given below:

Observations:

- Terminal Value makes up over half of the valuation. Although it is reasonable in the sector, analysts who value the stock over $70 most likely assign greater importance to this driver

- Share repurchases (especially, given the recent news about the $6-$8B buy-back program in 2014) represent a considerable margin in the overall valuation trumping future dividends by a factor of >2X

- Dividends are projected using the most recent payout ratios and Net Income projections (not EPS since it also grows through share count reduction)

Besides DCF, I also used analysts’ EPS estimates and applied current P/E ratio to picture a range of implied stock prices in a matrix:

My numbers are a little bit lower mainly because I assigned lower multiples to future earnings, although my EPS estimates in the model track closely the Medium trench of the distribution.

Technical

Technical analysis has been performed by analysts from Recognia Inc.:

For the period between the beginning of the year and June 2013 the price has been above the 50-day moving average, dipping in August and early September and climbing above the benchmark thereafter. Technicians suggest buying opportunities exist at and above $65 per share in the medium-term, while it is appropriate to sell if the price goes below $63. Based on the number of buy signal it is clear that analysts have a bullish sentiment towards the stock.

Summary

Walt Disney has a strong balance sheet and excellent free cash flow generating abilities. It is quite well diversified operationally but relies heavily on the US market. Growth prospects are bright from the management’s point of view, while internal optimization has also been adding to the bottom line. The main question is whether the market has already factored these drivers into the market price, especially given this year’s run up, despite analysts’ suggestions and price targets.

Conclusion

I issue a “HOLD” recommendation for long-term investors and a “BUY” for risk-takers. Investors may wish to hedge their positions using put options with strikes of around $60-$61.

Date: 2015-12-24; view: 1030

| <== previous page | | | next page ==> |

| SHIFTING ORDER CONTRARY TO CUSTOMS. | | | Development of a new market (market innovation); |