CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

B) Profitability Index

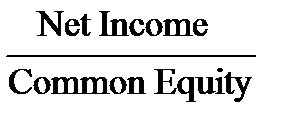

Question No. 11 The formula of the Return on equity is A)

Question No. 12 At what meaning of the PI the project is accepted? C) PI > 1

Question No. 13 Cash flows at the end of the project are E) The shutdown cash flows that are expected to occur at the end of the useful life of a project

Question No. 14 Sales breakeven point is: E) The level of sales that a firm must reach to cover its operating costs

Question No. 15 The formula of the Total Revenue C) TR= P x Q Question No. 16 The estimated rate of return for a proposed project, given the projectís incremental cash flows, is known as: B) Internal rate of return

Question No. 17 The formula E) Internal rate of return

Question No. 18 The formula of the Return on assets is B)

Question No. 19 At what meaning of the PI the project is rejected? E) PI < 1

Question No. 20 Initial investment cash flows are D) None of the above

Question No. 21 Total costs are: A) None of the above

Question No. 22 The formula of the total costs is: E) TC = FC + (VC x Q) Question No. 23 The balance sheet includes all, Except: E) Revenues Question No. 24 The income statement shows all, EXCEPT: E) Liabilities

Question No. 25 The income statement shows all, EXCEPT: E) Current assets

Question No. 26 The balance sheet shows all, EXCEPT: A) Operating income

Question No. 27 The balance sheet shows all, EXCEPT: D) EBIT

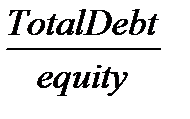

Question No. 28 The formula of theDebt to equity B) Question No. 29 The formula of the Times interest earned C)

Question No. 30 The formula of the Average collection period D)

VARIANT 5

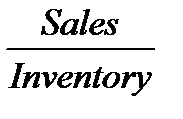

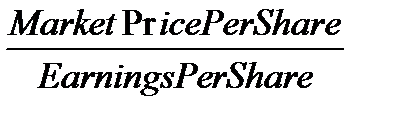

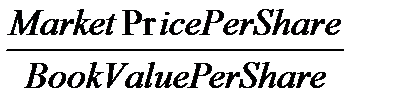

Question No. 1 The formula of the Inventory turnover B) Question No. 2 The formula of the Total asset turnover B) Question No. 3 The formula of the The price-to-earnings (P/E) ratio B) Question No. 4 The formula of the The market to book value (M/B) ratio B) Question No. 5 The cash flows that have already occurred, or will occur whether a project is accepted or rejected Date: 2015-12-18; view: 718

|

is used for accounts:

is used for accounts: