CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Limitations of the research

As suggested in the methodology part, three limitations were detected before the work was started.

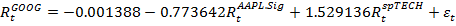

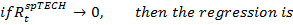

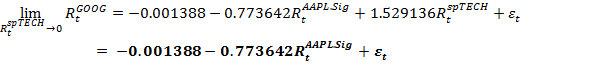

Control variables, such as S&P Technology index also have significant explanatory power. Even if the indicator says “Short Sell” competitor’s stock, the industry return can be significantly positive, suggesting an increase in competitor’s share price. To alleviate these effects, the trading program may check if the industry has low returns on that day, which would result in low effect on the share price from the index.

The second limitation is the presence of the transaction costs. Due to this fact some of the arbitrage opportunities disappear. Most notably Google and Hewlett Packard causing an opposite effect in Apple share price, as the beta-coefficients for their effects are low.

| Competitor 1 | Competitor 2 | |||

| P-value |

| P-value | |

| AAPL | -0.1225 | 0.0000 | -0.1480 | 0.0000 |

With leverage it can be possible to earn arbitrage profits, but that greatly increases risk in case the regression fails.

The third limitation is the absence of intraday data. Due that fact it was not possible to check the duration of price adjustments to the news releases. It was not also possible to check the duration of price adjustments to competitors’ news articles. The arbitrage opportunities are conditional on the difference in the durations of these adjustments. If they are of equal length, then the only way to earn the profits is to check if the news article is significant and positive using a text-mining program and then immediately execute a trade in the competitor’s stock, without checking main company’s reaction.

Two more limitations were detected during the study.

The fourth limitation is that Yahoo Finance states Hewlett Packard to be a competitor to a number of firms within the sample. This is caused due to diversification of company’s business. Moreover, due to that fact the company is rarely vulnerable to competitors’ news that causes Situation X. Joh and Lee (1992) supported the statement – their sample of homogeneous line of business firms were more exposed to competitors’ news due to poor business diversification.

The final limitation is the fact that news often release outside trading hours. In these cases the prices adjust before the market opens and all arbitrage opportunities dissapear.

Date: 2015-12-17; view: 935

| <== previous page | | | next page ==> |

| Regression analysis results | | | LES TROIS MOUSQUETAIRES 1 page |