CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Influence on Competitors – RegressionBut our main question is whether significant news affects the competitors. In the previous regressions we had all the data, but now only significant news are analysed. Approximately 10% of the largest returns (both positive and negative) were chosen as “important” news (the number is equal to the number of outliers in the first tests). I regressed competitors’ returns on company A’s significant returns and controlled for the industry using S&P technology index.

- - - - Proportion of the news’ effect on competitor(s)’ return H0: company A’s significant return does not negatively affect its competitors’ returns on the same day. Ha: company A’s significant return negatively affects its competitors’ returns on the same day.

This time the only significant results are shown by Apple. It has a dramatic opposite effect on its competitors. The results are also highly significant. NCR and Microsoft also show some opposite effect, but the results are insignificant and are very close to 0. Discussion of the Results Date: 2015-12-17; view: 591

|

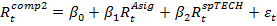

– denotes significant returns at time t for company A

– denotes significant returns at time t for company A – is the constant term

– is the constant term – is the return of the first (second) competitor at time t. If the company A has only 1 competitor, the second regression is not calculated.

– is the return of the first (second) competitor at time t. If the company A has only 1 competitor, the second regression is not calculated. – is the industry return (return of the S&P index for technological companies only) at time t.

– is the industry return (return of the S&P index for technological companies only) at time t.

for competitors 1 and 2

P-value less than 0.1 denotes 90% significance level

P-value less than 0.05 denotes 95% significance level

P-value less than 0.01 denotes 99% significance level

for competitors 1 and 2

P-value less than 0.1 denotes 90% significance level

P-value less than 0.05 denotes 95% significance level

P-value less than 0.01 denotes 99% significance level