CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

STUDY ON FINANCIAL OFFSHORE CENTRES

Today carollers generally collect money for charity. The 'Round Table' club in England often sends a big sleigh with a Christmas tree and people singing and playing carols around the cities and towns of England. In Wales, each village may have several choirs which rehearse well in advance of the holidays and then go carolling collecting money for charity. STUDY ON FINANCIAL OFFSHORE CENTRES THE RISKS AND DEREGULATION OF THE INTERNATIONAL FINANCIAL SYSTEM, CAPITAL LAUNDERING

AND TERRORISM FINANCING

MĂDĂLINA ANTOANETA RĂDOI*

ALEXANDRU OLTEANU **

Abstract

After the end of the 90’s crisis, the settlement of the international financial system has taken an important place within the international organizations. There are important debates regarding the need of a compulsory reform to prevent crises.

Means of preventing crises, especially within the field of foreign vulnerability assessment regard: transparency, following the international regulations and codes, refoundation of the financial compartments, liberalization of the capital movements.

In addition, a set of work program is needed regarding the crises settlement and sovereign debt restructuring. Serious matters are requested regarding the adoption of fight tools against money laundering and terrorism finance.

Offshore financial centers assessment is placed in the field of activity by refinancing of the financial sector, it is one of the health balance sheet elements achieved by the IMF and by the World Bank within the financial compartment assessment program.

Key words: offshore financial centers (CFO), risks CFO, FATF (Financial Action Task Force), FSF (Financial Stability Forum), bankruptcy risk.

Introduction

The aim of this study is to analyze the role of the offshore financial centers within the international financial system and the risk for its stabilization. The main thesis on the result analysis is the following:

The risk for international financial system stabilization increases together with the development of the activities from the offshore financial centers. The surveillance and control of the offshore financial centers is a must. The risk for the international financial system diminishes with the increase of the respect for the international regulations. In the future, information transparency and international regulation enforcement could replace offshore financial centers surveillance and control. Their Assessment program drawn by IMF is an important factor in risk reduction. The drawn analysis regards:

· Features of the offshore financial centers (CFO);

· Risks cause through CFO;

· CFO Assessment results.

* PhD, Associate Professor, Faculty of Economic Sciences, “Nicolae Titulescu” University of Bucharest (e-mail: madaradoi@gmail.com).

** PhD, Professor, Faculty of Economic Sciences, “Nicolae Titulescu” University of Bucharest (e-mail: aolteanu@univnt.ro). 1078 Challenges of the Knowledge Society. Finance and Accounting

Literature review

1. Features of the offshore financial centers (CFO) 1.1 Offshore financial centers concept

The offshore financial centers belong to the international financial market, which concerns activities among non-residents.

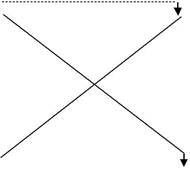

Four types of transactions are available in the international financial centers, represented in Diagram no.1.

Depositor/ Local

investor

Depositor/ Foreign investor

Local market A

C

International market

B

Offshore market

Local lender

Foreign lender

Diagram no. 1. Transactions scheme in international financial centers

If the depositors or local investors offer real funds to the local lenders, we deal with Local market A.

We deal with an international market B, C if the foreign funds offered to the local customers or the local funds offered to foreign customers.

The offshore market D appears when the foreign funds are offered to foreign investors.

It’s not a satisfactory definition for the offshore financial centers.

We should mention that, in general, a financial offshore center is a right where many activities are undergone by non-resident persons and which have unfavorable circumstances for international financial activities.

The word “offshore” means “outside the continent” and regards the islands situated far from

America and Europe, which offer reduced taxes and mild terms to register companies. In English, the terms “offshore” and “overseas” are used with the meaning “external”. The beginning of the concept’s use in USA dates back in the 30’s. The development of the CFO takes place in the 60’s and the 80’s once with the taxation increase and restraints regarding the capital circulation and exchanges, and, also, the expense increases on the national markets.

The appearance of the euro market in the 60’s represented the beginning of the financial operation liberalization in a currency, other than those of the countries or the establishment where it is situated. The European financial places (London, Paris) offer deposits, loans, bonds issuing in Eurocurrency. Then the transactions are achieved through offshore centers.

We should notice that the offshore centers are difficult to compare and classify due to the great differences on their size, their geographical position, their population, the GDP level, according to their main activities. Among the offshore financial centers, greater jurisdictions such as: Hong-Kong SAR, Luxemburg, Singapore or Switzerland can distinguish, but also smaller economies with international financial centers such as: Bahamas, Belize, Anguilla or Gibraltar. Richer centers, better structured, are competitive due to the efficiency of the services provided. The new centers, smaller and poorer, don’t have time or funds to increase the efficiency of the financial compartment. The GDP level is very weak in comparison with the financial inset which is being transferred. In order to get acquainted with the CFO classification, there is no unique list according to which a country of the offshore center can be classified.

The offshore lists are created by the countries, international organizations, agencies marked by the country risk and used to end the differences among them. If the countries admit “high tax”, they apply the prescriptions against the fiscal paradises the other way round.

FATF (Financial Action Task Force on capital laundry) and FSF (Financial Stability Forum) set a list of the “uncooperative” countries which don’t follow the international regulations or don’t do any effort to approach them. The lists are altered and updated periodically. The list drawn by the IMF together with OECD, Financial Stability Forum and the World Bank, contains 40 centers of offshore financial centers. The present document uses a list of 44 jurisdictions published in 2005 with the IMF report1) (1).

Date: 2014-12-29; view: 862

|