CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Triangles and Triangle-like Formations

In technical analysis, various triangle-like formations, including wedges, have various names and definitions. According to technical analysis, the market behaves differently after completing the formation of each specific

type. Because false signals and fraudulent movements are frequent, itís hard to predict where the market will go after a break of a border of the formation. Anyway, a triangle or any other similar formation almost al- ways allows a trader to make a profitable transaction without dependence on any other reasons and circumstances. When trading triangles, I donít bother to think if this is a continuation or a reversal type formation. My approach to triangles is rather simple.

First, very frequently there is an opportunity of early identification of a triangle after two highs and two lows are formed, through which it is possible to draw lines that supposedly will then become borders of a tri- angle. Early identification of the triangle allows making 1 to 2 trades in- side this formation by opening positions from the bottom/top side in the direction of an opposite side, which will be the target. As the market reaches one side, liquidate the position, take profit, and open a position in the opposite direction, already having the opposite side of the formation as a target. In both cases, stops should be placed outside the formation and on both sides if the triangle is a narrow one. See Figure 9.10.

Stops

Stops

Sell

Sell and reverse

Buy and reverse

Buy and reverse

Stops

Stops

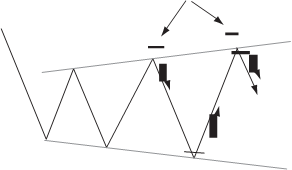

FIGURE 9.10 The broadening triangle is the only formation I really dislike. It looks obvious in the figure, but in reality it is very hard to identify before it is built completely. Most of my own irreversible losses can be attributed to this pattern, which is relatively rare. Only a third approach to one of the borders gives a useful and recognizable signal to enter the market in the direction opposite to the most current trend.

FIGURE 9.10 The broadening triangle is the only formation I really dislike. It looks obvious in the figure, but in reality it is very hard to identify before it is built completely. Most of my own irreversible losses can be attributed to this pattern, which is relatively rare. Only a third approach to one of the borders gives a useful and recognizable signal to enter the market in the direction opposite to the most current trend.

of the sides three times. (Sometimes it happens even later, on the fourth or fifth touch, but there is no need to wait so long.) After making trades in- side a triangle, from one side and to another, simply wait for fourth (or subsequent) touch of one of the sides and open a position in the direction of a movement after the market breaks out from the formation. See Figure

9.11. Here again, you can be trapped by an unpleasant and unexpected false break. In case of a false break, the position should be liquidated when the market returns inside a triangle. The profit should be taken at the level projected from the break point and at the distance equal to the triangle height. See Figure 9.12.

The second interesting factor of dealing with triangle-like formations is that, actually, a false break is in many cases even better for a trader than a real one. It arms him with a high degree of probability to forecast the further course of events, because a false break is nothing else but a per- fect confirmation of the market choosing the opposite direction for its next sizeable move. See Figure 9.13.

The false break of a triangle border in the majority of cases is an ex- cellent confirmation of further market intentions. It indicates the future

Sell

Sell

Buy

Buy

FIGURE 9.11 There shouldnít be a problem trading on a triangle-like formation. Everything is obvious, and a trader can start by entering a position toward one of the borders (heading inside) or on the break of any border (heading outside). Choosing a point to place stops is also an easy task.

FIGURE 9.11 There shouldnít be a problem trading on a triangle-like formation. Everything is obvious, and a trader can start by entering a position toward one of the borders (heading inside) or on the break of any border (heading outside). Choosing a point to place stops is also an easy task.

Triangle base

Buy

Stop and reverse

Measured target

Measured target

FIGURE 9.12 There is also no problem calculating in advance where to take a profit in the case of trading triangles.

FIGURE 9.12 There is also no problem calculating in advance where to take a profit in the case of trading triangles.

FIGURE 9.13 Trading option in case of a false break of the triangle.

allows the trader to make the assumption that the market again will cross the triangle and most likely will then reach the objective target, which can be calculated easily.

We will discuss the use of a triangle as a base for construction of trade plans, in Part V.

| OTHER FORMATIONS WITH PRECISE BORDERS | ||

Rectangles, flags and some other formations from the theory of technical analysis have the advantage of precisely outlined borders. These borders can and should be used as critical levels, such as supports and resis- tances. If the width of a particular formation is sufficient, then it is possi- ble to trade inside it, from one border to another. After breaking any one of formation sides, the position should be reversed.

The false break of a formation with a precise border is good, as was mentioned in the case with triangles, and the technique of trading is prac- tically the same.

Date: 2015-12-17; view: 1534

| <== previous page | | | next page ==> |

| Ascending and Descending Channels | | | A Currency Pair to Trade |