CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Infrastructure barrier to shale development cycleGLOBAL SHALE LAGGING - HERE'S WHY April 10, 2015

Gas-to-wire modular development model proposed for shale infrastructure in some countries André Olinto do Valle Silva, Matheus Nogueira, and André Ramos, SBC, Rio de Janeiro Shale gas development has revolutionized the US energy industry, reversing a trend of rapidly declining domestic production. Between 2000 and 2015, natural gas production from shale rocks increased by 10 Tcf/year, while non-shale production fell by 4 tcf/year - a slump of almost a quarter. The perennial question is whether the US shale revolution will be replicated elsewhere around the world. The potential is certainly there. The US Energy Information Administration, for example, estimates that more than 90% of the world's technically recoverable resources are outside the US. But this potential has not yet translated into significant production, even 10 years after the start of the US shale-gas boom (Figure 1).

Infrastructure barrier to shale development cycle One reason for the slow progress is the limited reach of gas pipeline systems in many of the countries that have promising geological potential. Over one-third of prospective shale gas fields in the 10 largest shale gas countries outside the US have no access to gas pipelines. Overall, the gas pipeline density in these 10 countries is 30 times lower than in the US.

The shortage of infrastructure is a barrier to E&P activity in general, both in conventional and unconventional developments. But it is particularly problematic in shale gas projects. Because of the heterogeneous nature of shale formations, reserves must be proved on a well-by-well basis, which requires intense drilling activity and a large number of wells. Indeed, on average, shale deposits require 10 times more wells than conventional deposits in order to prove same amount of reserves (Figure 2).

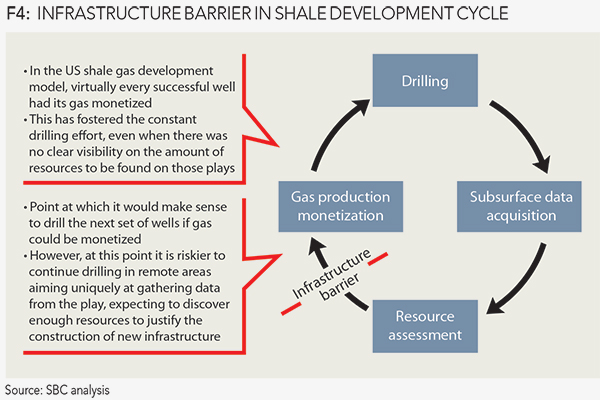

In conventional E&P, reserves are mostly proved during the exploration phase, after which a final investment decision is made (Figure 3). In shale gas operations, by contrast, resource-evaluation is a continuous, cyclical process (Figure 4). New wells are drilled with two purposes: monetizing production and generating cash flow; and acquiring subsurface data in order to provide a continual assessment of resources in place. The prospect of profitable reserves additions encourages the drilling of new wells and increases the cycle's momentum.

In the US, extensive infrastructure has enabled the immediate monetization of successful wells, encouraging gas companies to drill and strengthening the shale development cycle. Thousands of wells have been drilled every year in several US shale plays, enabling operators continuously to prove up reserves. But this cycle is unlikely to be sustainable in areas with no access to gas pipelines: if there is no immediate means of monetizing production, large drilling campaigns, involving thousands of wells, are unlikely. As a result, no significant amount of reserves will be proved and pipeline investments will remain too risky (Figure 4). Date: 2015-12-11; view: 1246

|