CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Edit] Economic historyEconomy of Russia

GNI per capita: Russia (9 370$) Higher GNI per capita compared to Russia Lower GNI per capita compared to Russia The economy of Russia is the ninth largest economy in the world by nominal value and the sixth largest by purchasing power parity (PPP).[1] Russian economy is today considered by IMF and World Bank a developing one. Russia has an abundance of natural gas, oil, coal, and precious metals. Russia has undergone significant changes since the collapse of the Soviet Union, moving from a centrally planned economy to a more market-based and globally integrated economy. Economic reforms in the 1990s privatized many sectors of the industry and agriculture, with notable exceptions in the energy and defense-related sectors. Nonetheless, the rapid privatization process, including a much criticized "loans-for-shares" scheme that turned over major state-owned firms to politically connected "oligarchs", has left equity ownership highly concentrated. As of 2011, Russia's capital, Moscow, now has the highest billionaire population of any city in the world.[15][16] In late 2008 and early 2009, Russia experienced the first recession after 10 years of experiencing a rising economy, until the stable growth resumed in late 2009 and 2010. Despite the deep but brief recession, the economy has not been as seriously affected by the global financial crisis, largely because of the integration of short-term macroeconomic policies that helped the economy survive.[citation needed] In 2011 Russia’s gross domestic product[17] grew by 4.2 percent, the world’s third highest growth rate among leading economies. The government expects it to grow 3.7 percent in 2012. "Following a 4.2 percent growth in 2011, we think the slowdown will lead to GDP growth of about 3.5 percent for the full year," S&P Chief Economist for Europe Jean-Michel Six said in a statement.[18] Russian GDP growth for the first half of 2012 was 4.4%.[19] It slowed at 3.8% in the month of September. edit] Economic history Main article: Economic history of the Russian Federation The two fundamental and independent goals – macroeconomic stabilization and economic restructuring – are indicators for a transition from central planning to a market-based economy. The former entailed implementing fiscal and monetary policies that promote economic growth in an environment of stable prices and exchange rates. The latter required establishing commercial, and institutional entities – banks, private property, and commercial legal codes— that permit the economy to operate efficiently. Opening domestic markets to foreign trade and investment, thus linking the economy with the rest of the world, was an important aid in reaching these goals. The Gorbachev regime failed to address these fundamental goals. At the time of the Soviet Union's demise, the Yeltsin government of the Russian Republic had begun to attack the problems of macroeconomic stabilization and economic restructuring. By mid-1996, results were mixed.[citation needed] Since the collapse of the Soviet Union in 1991, Russia has tried to develop a market economy and achieve consistent economic growth. In October 1991, Yeltsin announced that Russia would proceed with radical, market-oriented reform along the lines of "shock therapy", as recommended by the United States and IMF.[20] However, this policy resulted in economic collapse, with millions being plunged into poverty and corruption and crime spreading rapidly.[21] Hyperinflation resulted from the removal of Soviet price controls and again following the 1998 Russian financial crisis. Assuming the role as the sequel to the legal personality of the Soviet Union, Russia took up the responsibility for settling the USSR's external debts, even though its population made up just half of the population of the USSR at the time of its dissolution.[22] When once all enterprises belonged to the state and were supposed to be equally owned amongst all citizens, they fell into the hands of a few, who became immensely rich. Stocks of state-owned enterprises were issued, and these new publicly traded companies were quickly handed to the members of Nomenklatura or known criminal bosses. For example, the director of a factory during the Soviet regime would often become the owner of the same enterprise. During the same period, violent criminal groups often took over state enterprises, clearing the way by assassinations or extortion. Corruption of government officials became an everyday rule of life. Under the government's cover, outrageous financial manipulations were performed that enriched the narrow group of individuals at key positions of the business and government mafia. Many took billions in cash and assets outside of the country in an enormous capital flight.[23] That being said, there were corporate raiders such as Andrei Volgin engaged in hostile takeovers of corrupt corporations by the mid-1990s.[citation needed] The largest state enterprises were controversially privatized by President Boris Yeltsin and subsequently owned by insiders[24] for far less than they were worth.[20] Many Russians consider these infamous "oligarchs" to be thieves.[25] Through their immense wealth, the oligarchs wielded significant political influence.[citation needed] Edit] Recovery

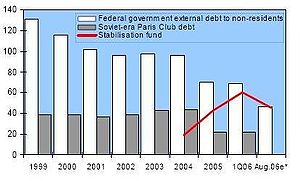

Russian public debt The Russian economy underwent tremendous stress as it moved from a centrally planned economy to a free market system. Difficulties in implementing fiscal reforms aimed at raising government revenues and a dependence on short-term borrowing to finance budget deficits led to a serious financial crisis in 1998. Lower prices for Russia's major export earners (oil and minerals) and a loss of investor confidence due to the Asian financial crisis exacerbated financial problems. The result was a rapid decline in the value of the ruble, flight of foreign investment, delayed payments on sovereign and private debts, a breakdown of commercial transactions through the banking system, and the threat of runaway inflation.[citation needed] Russia, however, appears to have weathered the crisis relatively well. As of 2009 real GDP increased by the highest percentage since the fall of the Soviet Union at 8.1%, the ruble remains stable, inflation has been moderate, and investment began to increase again. In 2007 the World Bank declared that the Russian economy had achieved "unprecedented macroeconomic stability".[26] Russia is making progress in meeting its foreign debts obligations. During 2000–01, Russia not only met its external debt services but also made large advance repayments of principal on IMF loans but also built up Central Bank reserves with government budget, trade, and current account surpluses. The FY 2002 Russian Government budget assumes payment of roughly $14 billion in official debt service payments falling due. Large current account surpluses have brought a rapid appreciation of the ruble over the past several years. This has meant that Russia has given back much of the terms-of-trade advantage that it gained when the ruble fell by 60% during the debt crisis. Oil and gas dominate Russian exports, so Russia remains highly dependent upon the price of energy. Loan and deposit rates at or below the inflation rate inhibit the growth of the banking system and make the allocation of capital and risk much less efficient than it would be otherwise.[citation needed] In 2003, the debt has risen to $19 billion due to higher Ministry of Finance and Eurobond payments. However, $1 billion of this has been prepaid, and some of the private sector debt may already have been repurchased. Russia continues to explore debt swap/exchange opportunities.[citation needed] In the June 2002 G8 Summit, leaders of the eight nations signed a statement agreeing to explore cancellation of some of Russia's old Soviet debt to use the savings for safeguarding materials in Russia that could be used by terrorists. Under the proposed deal, $10 billion would come from the United States and $10 billion from other G-8 countries over 10 years.[citation needed] On 1 January 2004, the Stabilization fund of the Russian Federation was established by the Government of Russia as a part of the federal budget to balance it if oil price falls. Now the Stabilization fund of the Russian Federation is being modernized. Stabilization Fund of the Russian Federation will be divided into two parts on 1 February 2008. The first part will become a reserve fund equal to 10 percent of GDP (10% of GDP equals to about $200 billion now), and will be invested in a similar way as Stabilization Fund of the Russian Federation. The second part will be turned into the National Prosperity Fund of Russian Federation. Deputy Finance Minister Sergei Storchak estimates it will reach 600–700 billion rubles by 1 February 2008. The National Prosperity Fund is to be invested into more risky instruments, including the shares of foreign companies. Shyhkin, Maxim. "Stabilization Fund to Be Converted into National Prosperity". http://www.kommersant.com/p791856/new_fund_to_specialize_on_portfolio_investments/. Retrieved 2 August 2007. Date: 2015-12-11; view: 1093

|

Moscow International Business Center

Moscow International Business Center