CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Economic Rent

CASE HISTORY OF AUTOMOBILE ACCIDENT.

1. A man, aged 31, was injured in an auto mobile accident, received multiple lacerations, and fractures of the facial bones. 2. He was first treated in a local hospital, where the wounds of the face were sutured. 3. The doctor saw the patient three days after the injury. 4. The nose was fractured and bent to the left. 5. The molar bone was fractured and displaced. 6. The upper jaw was fractured in at least three distinct places, with pronounced backward displacement of the segments. 7. There were numerous cuts on the face and forehead. 8. The patient had lost a considerable amount of blood and was quite pale. 9. Nine days after the injury the patient was operated on under general anesthesia. 10. In a month he was discharged from the hospital.

Exercise 12. Be ready to discuss the main traumatic diseases of the jaws.

TEST. 1. The result of trauma to the jaws depends … on the severity and partly on the fragility of the bones. A. Partly B. Frequently C. Slowly D. Rapidly E. quickly

2. … due to trauma uncomplicated by fracture is generally localized. A. Stomatitis B. Pulpitis C. Periostitis D. Appendicitis E. Halitosis

3. The affected part of the … is extremely tender to the touch.

A. Crown B. Jaw C. Face D. Gum E. Bone

4. Rise of temperature … infection. A. Indicate B. Indicated C. Has indicated D. To indicate E. Indicates

5. If there is infection, drainage should …. A. to establish B. to be established C. establish D. establishes E. established

6. Treatment is surgical, consisting … evacuation of the fluid content and curettage. A. On B. Of C. – D. Out E. From

7. … injuries result in subluxation, sometimes dislocation of the mandible may or may not be associated with fracture. A. Minor B. Mild C. Slight D. Severe E. Weak

8. Fracture of the face usually involves … bones. A. One B. More C. One or more D. One or two E. three

9. The roentgen …will show the amount of displacements. A. Film B. Scan C. Picture D. X-ray E. Photo

10. The jaw is … under general anesthesia and immobilized by a suitable method of fixation.

A. Induced B. Reduced C. Produced D. Increased E. Decreased

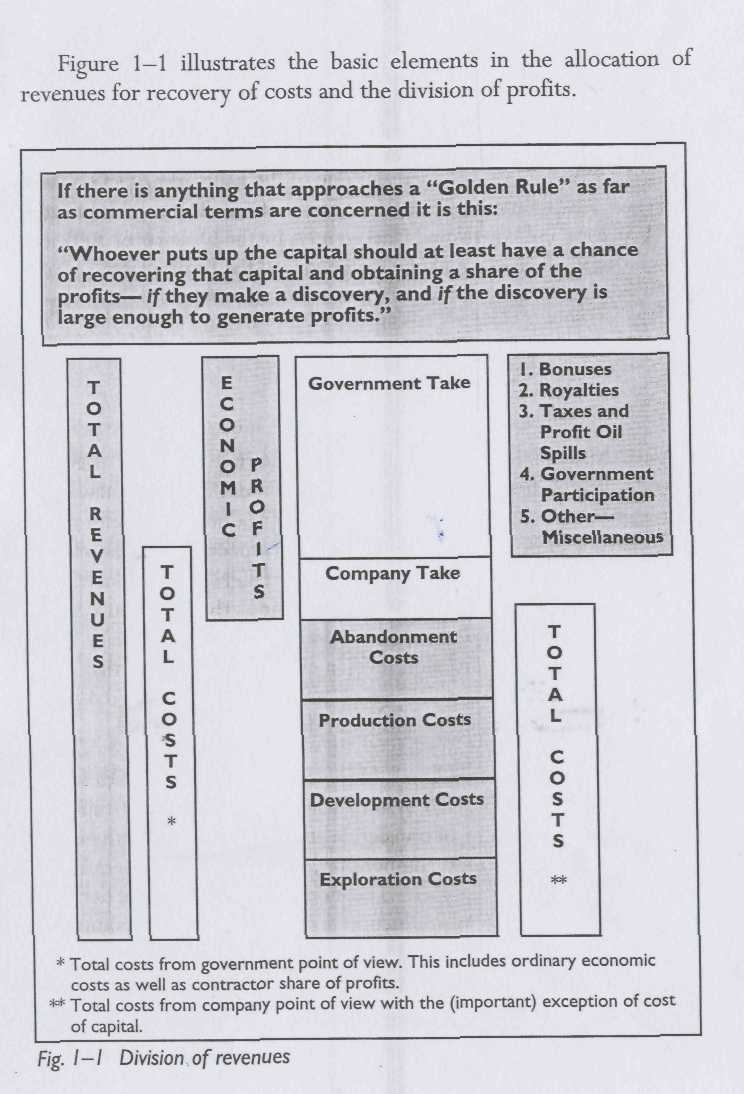

Economic Rent The concept of economic rent comes from the foundations of economic theory and the produce of the earth, which is derived from labor, machinery, and capital. Rent theory deals with how this produce is divided among the holders of the land, the owners of the capital, and the laborers through profit, wages, and rent. A strict distinction can be made between profits and rent, but in the popular language of the industry, this distinction is sometimes missed. But it is an important issue. Excess profits are synonymous with economic rent. That is the way it is defined in this text. However, there are other definitions used in the industry. For example, some economists equate rent with profit. Economic rent is the difference between the value of production and the cost to extract it. The extraction cost consists of normal exploration, development, and operating costs as well as required rates of return or share of profit for the contractor. Rent deals with the surplus. Governments attempt to capture as much as possible of the economic rent through various means, including taxation, levies, royalties, and bonuses, The problem for governments in determining how to efficiently capture rent is that nearly 9 out of 10 exploration efforts are not successful. This important element of risk strongly characterizes the upstream end of the oil industry. Developing fiscal terms that are capable of yielding sufficient potential rewards for exploration efforts must account for this risk. It is not an easy matter. Present value theory, expected value (EV) theory, and taxation theory are the foundation stones of fiscal system design and analysis. The objective of host governments in designing petroleum fiscal systems is to structure an efficient system where exploration and development rights are acquired by those companies who place the highest value on those rights. In an efficient market, competitive bidding can help achieve this objective. But one of the hallmarks of an efficient market is availability of information. Exploration efforts are dominated by numerous unknowns and uncertainty. In the absence of sufficient competition, efficiency must be designed into the fiscal terms. Governments can seek to capture economic rent at the time of the transfer of rights through signature bonuses or during the production phase of a contract, or concession through royalties, production sharing, or taxes. Royalties, taxes, and/or production-sharing formulas used for extracting rent are contingent upon production. The contractor and government therefore share in the risk that production may not result from exploration efforts. An important aspect as far as risk is concerned is that oil companies are risk-takers who theoretically diversify their risk. On the other hand, as far as their exposure in the exploration business is concerned, governments are not likely to be diversified. Their risk aversion level is quite different than that of an international oil company. This aspect provides much of the dynamics of international negotiations and fiscal design. Theoretically, a simple bonus bid with no royalties or taxes would be the ultimate example of a system where the government captured the economic rent at time of transfer. In an efficient market with perfect information and sufficient competition, the bonus would equal the present value of the total expected economic rent. This kind of behavior is seen to some degree in production acquisitions between companies where oil production is purchased and sold. From the government point of view, there is a trade-off between risk aversion (leaning toward bonus bids and royalties to some extent) and risk sharing (through production sharing or profit sharing through taxation schemes).

Governments have devised numerous frameworks for the extraction of economic rents from the petroleum sector. Some are very efficient and some perhaps not. Some are well balanced and cleverly designed and some are quite complex. But the fundamental issue is whether or not exploration and/or development is feasible under the conditions outlined in the fiscal system.The following pages outline the key aspects of contract negotiations and the numerous fiscal devices and systems designed to maximize host government profitability.

Date: 2014-12-21; view: 1897

|