CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Financing international tradeDocumentary credits A company which sells goods or services to other countries is known as an exporter. A company which buys products from other countries is called an importer. Payment for imported products is usually by documentary credit, also called a letter of credit. This is a written promise by a bank to pay a certain amount to the seller, within a fixed period, when the bank receives instructions from the buyer. Documentary credits have a standard form. They generally contain: ■ a short description of the goods ■ a list of shipping documents required to obtain payment (see C below) ■ a final shipping date ■ a final date (or expiration date) for presenting the documents to the bank. Documentary credits are usually irrevocable, meaning that they cannot be changed unless all the parties involved agree. Irrevocable credits guarantee that the bank which establishes the letter of credit will pay the seller if the documents are presented within the agreed time. Bills of exchange Another method of payment is a bill of exchange or draft. This is a payment demand, written or drawn up by an exporter, instructing an importer to pay a specific sum of money at a future date. When the bill matures, the importer pays the money to its bank, which transfers the money to the exporter's bank. This bank then pays the money to the exporter after deducting its charges. A bank may agree to endorse or accept a bill of exchange before it matures. To endorse a bill is to guarantee to pay it if the buyer of goods does not. If a bill is endorsed by a well- known bank, the exporter can sell it at a discount in the financial markets. The discount represents the interest the buyer of the bill could have earned between the date of purchase and the bill's maturity date. When the bill matures, the buyer receives the full amount. This way the exporter gets most of the money immediately, and doesn't have to wait for the buyer to pay the bill. Export documents Exporters have to prepare a number of documents to go with the shipment or transportation of goods. ■I The commercial invoice contains details of the goods: quantity, weight, number of packages, price, terms of delivery, terms of payment, and information about the transportation. ■ The bill of lading is a document signed by the carrier or transporter (e.g. the ship's master) confirming that the goods have been received for shipment; it contains a brief description of the goods and details of where they are going. ■ The insurance certificate also describes the goods and contains details of how to claim if they are lost or damaged in transit - while being transported. ■ The certificate of origin states where the goods come from. ■ Quality and weight certificates, issued by private inspection and testing companies, may be necessary, confirming that these are the correct goods in the right quantity.

■ An export licence giving the right to sell particular goods abroad is necessary in some cases. Are the following statements true or false? Find reasons for your answers in A, B and C opposite. 1 With a letter of credit, the buyer tells the bank when to pay the seller. 2 Letters of credit are only valid for a certain length of time. 3 An exporter usually has the right to change a letter of credit. 4 The bill of lading confirms that the goods have been delivered to the buyer. 5 With a bill of exchange, the seller can get most of the money before the buyer pays. 6 Bills of exchange are sold at less than 100%, but redeemed at 100% at maturity. Put the sequence of events in the correct order. The last stage is b. Look at B opposite to help you. a A bank accepts or endorses the bill of exchange. b The accepting bank pays the full value of the bill of exchange to whoever bought it. c The exporter sells the bill of exchange at a discount on the money market, d The importer receives the goods and pays its bank, e The importer's bank transfers the money to the accepting bank. 45.1 45.2 f The seller or exporter writes a bill of exchange and sends it to the buyer or importer (and ships the goods).

45.3 Find verbs in A, B and C opposite that can be used to make word combinations with the nouns below. Then use the correct forms of some of the verbs to complete the sentences. a bill of exchange

goods 1 Exporters can get paid sooner if a bill of exchange is by a bank. 2 The bill of lading and the insurance certificate both the goods. 3 Exporters..................... goods to foreign countries. 4 The transporter..................... a document confirming that it has................ the goods. 5 In order to be paid, the exporter has to the shipping documents to a specific

bank. Ov&r +o tjpu Which banks in your country specialize in trade finance? Which aspects of trade finance would be the most interesting if you worked in this field? Incoterms Transport and additional costs Companies exporting or importing goods use standard arrangements called Incoterms - short for International Commercial Terms, established by the International Chamber of Commerce (ICC) - that state the responsibilities of the buyer and the seller. They determine whether the buyer or the seller will pay the additional costs - the costs on top of the cost of the goods. These include transportation or shipment, documentation - preparing all the necessary documents, customs clearance - completing import documents and paying any import duties or taxes, and transport insurance. The E and F terms There are 13 different Incoterms that can be divided into 4 different groups: an E Term (Departure), the F Terms (Free, Main Carriage Unpaid), the C Terms (Main Carriage Paid), and the D Terms (Delivered/Arrival). Each group of terms adds more responsibilities to the seller and gives fewer to the buyer. The E term is EXW or Ex Works. This means that the buyer collects the goods at the seller's own premises - place of business - and arranges insurance against loss or damage to the goods in transit. In the second group, the F terms, the seller delivers the goods to a carrier appointed by the buyer and located in the seller's country. The buyer arranges insurance. ■ FCA or Free Carrier means that the goods are delivered to a named place where the carrier can load them onto a truck, train or aeroplane. ■ FAS - Free Alongside Ship means that seller delivers the goods to the quay next to the ship in the port. ■ FOB - Free On Board means that the seller pays for loading the goods onto the ship. The C and D terms In the third group, the C terms, the seller arranges and pays for the carriage or transportation of the goods, but not for the payment of customs duties and taxes. Transportation of goods is also known as freight. ■ In CFR - Cost and Freight (used for ocean freight) and CPT - Carriage Paid To ... (used for air freight and land freight), the buyer is responsible for insurance. ■ In the terms CIF - Cost, Insurance and Freight (used for ocean freight) and CIP - Carriage and Insurance Paid To ... (used for air freight and land freight), the seller arranges and pays for insurance. In the fourth group, the D Terms, the seller pays all the costs involved in transporting the goods to the country of destination, including insurance. ■ In DAF - Delivered At Frontier, the importer is responsible for preparing the documentation and getting the goods through customs. If the goods are delivered by ship to a port, the two parties can choose who pays for unloading the goods onto the quay. The two possibilities are: ■ DES - Delivered Ex Ship - the buyer pays for unloading the goods from the ship ■ DEQ - Delivered Ex Quay - the seller pays for unloading the goods from the ship to the quay, and for the payment of customs duties and taxes. If the goods go through customs and are delivered to the buyer, there are two possibilities: ■ DDU - Delivered Duty Unpaid - the buyer pays any import taxes

■ DDP - Delivered Duty Paid - the seller pays any import taxes.

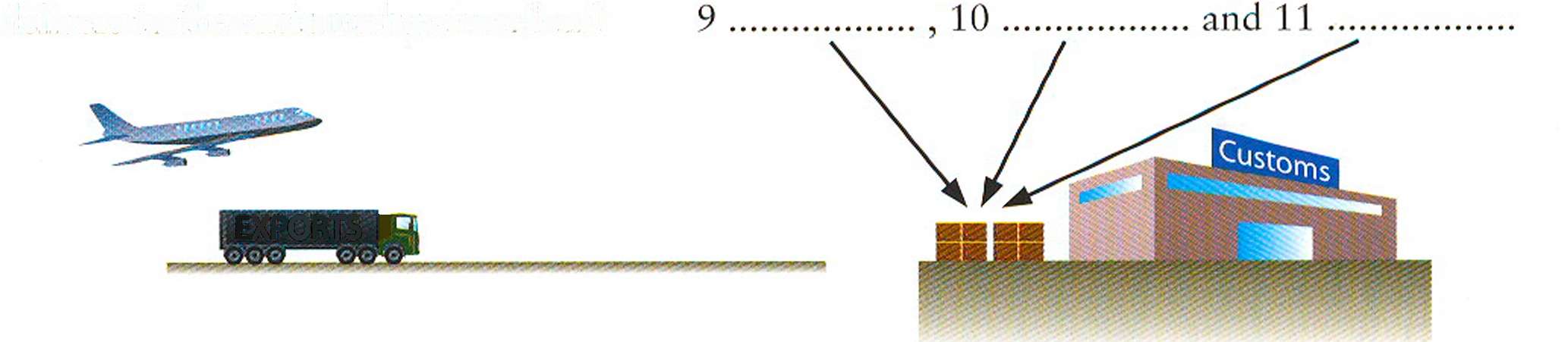

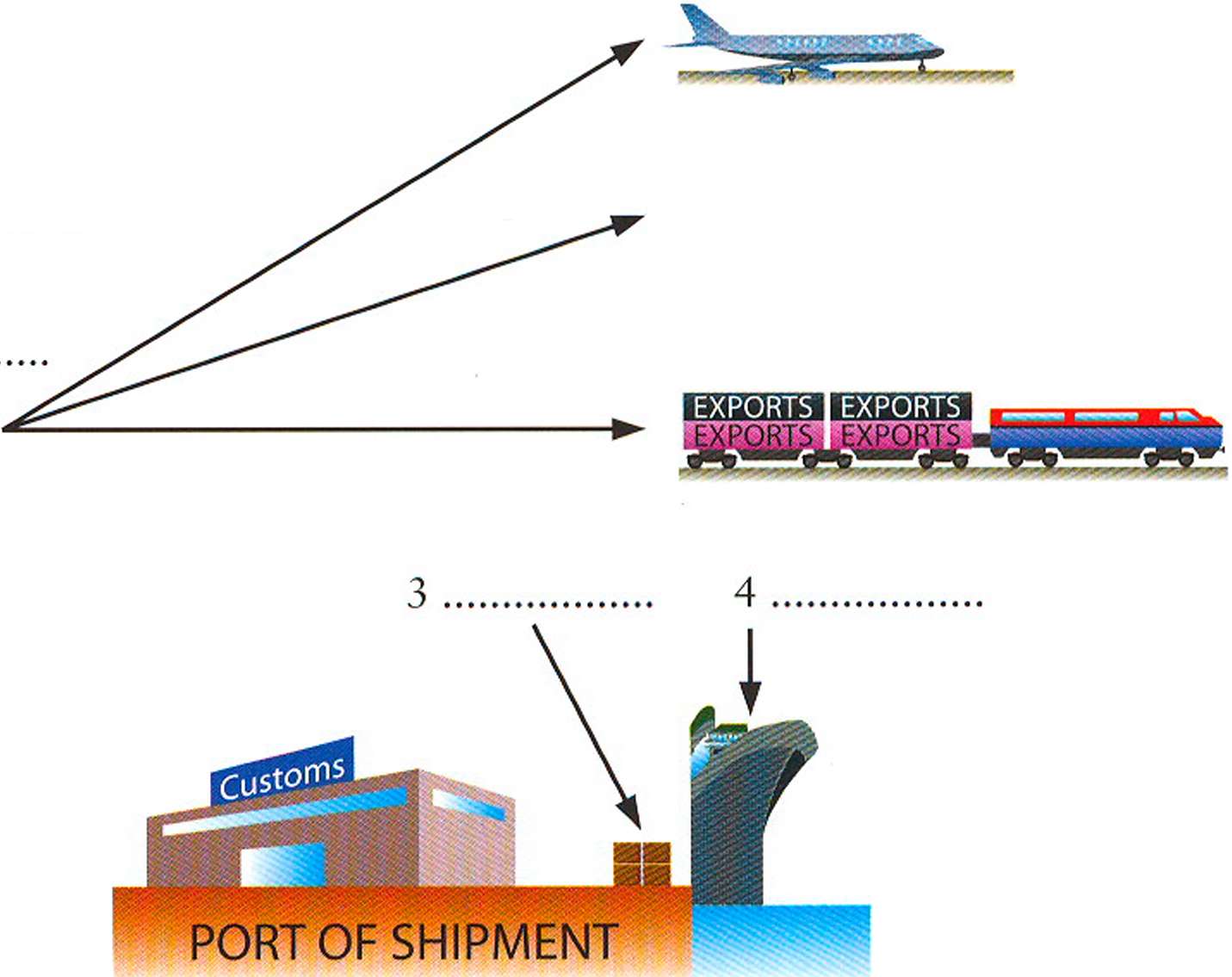

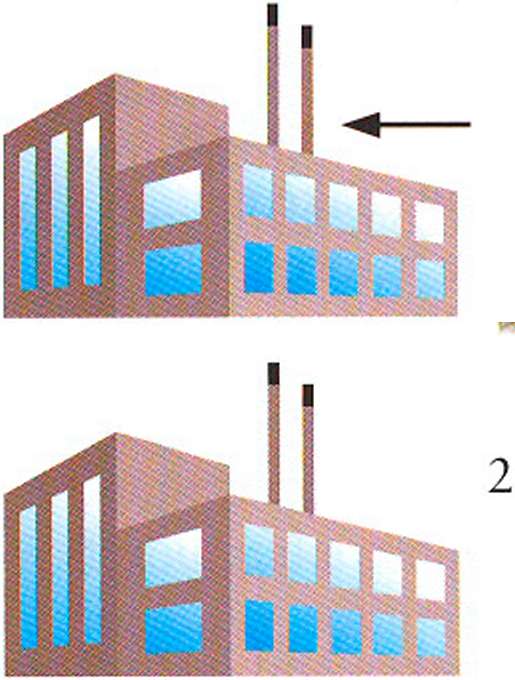

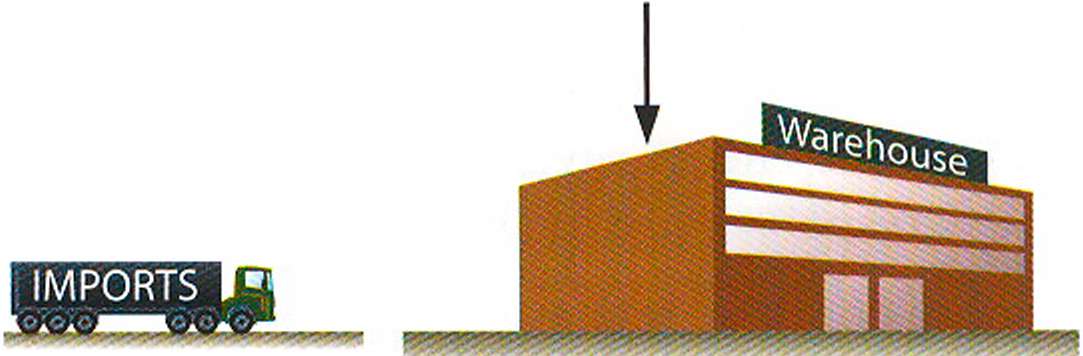

46.1 Label the diagram using the abbreviations for Incoterms. Look at A, B and C opposite to help you. Seller delivers to a carrier in its country buyer Seller delivers to a port of shipment

exports i

1 ................... Buyer collects

PORT OF DESTINA Seller delivers to a port of destination

Seller delivers to the customs by air or land exports i Seller delivers to buyer 12 or 13

How do imported goods normally arrive in your country? Are there taxes on imported products? If you were an importer, would you prefer to organize transport yourself, or let the seller do it?

Insurance Insuring against risks Insurance is protection against possible financial losses. Individuals, companies and organizations can make regular payments, called premiums, to an insurance company which accepts the risk (or possibility) of loss. When you buy insurance you make a contract, called a policy, with the insurance company - also known as the insurer. The contract promises that the company will pay you if you suffer loss of or damage to property, or sickness or personal injury. There are various losses which people or businesses can insure against: ■ theft - someone stealing their goods or possessions ■ damage from fire or other natural disasters such as floods, earthquakes and hurricanes If property is stolen or damaged, the person or company who is insured makes a claim - requests compensation - from the insurer. The insurer will then indemnify or compensate them: that is, pay them an amount of money equivalent to the loss. As the number of natural disasters seems to be increasing, so are the claims for damage to property, and this will lead to higher insurance premiums. In the past, many people buying insurance used independent brokers - people who searched for insurance at the lowest cost, or agents - people working for the insurance company. But like retail banking, the insurance industry has changed in recent years. A lot of insurance is now sold direct, by telephone or on the internet. This can be cheaper than insurance bought over the counter from a broker or an agent. Life insurance and saving Life insurance (also called assurance) will pay an agreed sum to someone else, for example your husband or wife, if you die before a certain age. People also use life insurance policies as a way to save for the future: you can buy a policy that pays a certain sum on a specific date, such as when you retire from work. As with pension plans, life insurance policies are tax shelters, or a way of postponing payment of tax. You do not have to pay income tax on life insurance premiums. However a lump sum - a single, large amount of money paid out when an insurance policy matures - will be taxable. Insurance companies Insurance companies have to invest the money they receive from premiums. Like pension funds, they are large institutional investors that invest huge sums in securities, especially low-risk ones like government bonds. The largest insurance market in the world is Lloyd's of London. This is an association of people called underwriters, who guarantee to indemnify other people's possible losses. Lloyd's spreads risks among a number of syndicates: groups of wealthy individuals, commonly known as 'names'. These people can earn a lot of money from insurance premiums if the clients never claim for compensation, but they also have unlimited liability or responsibility for losses. If insurance companies consider that they have underwritten too many risks, they can sell some of that risk to a reinsurance company. This is a company that will receive some of the premium and also bear, or take, some of the risk.

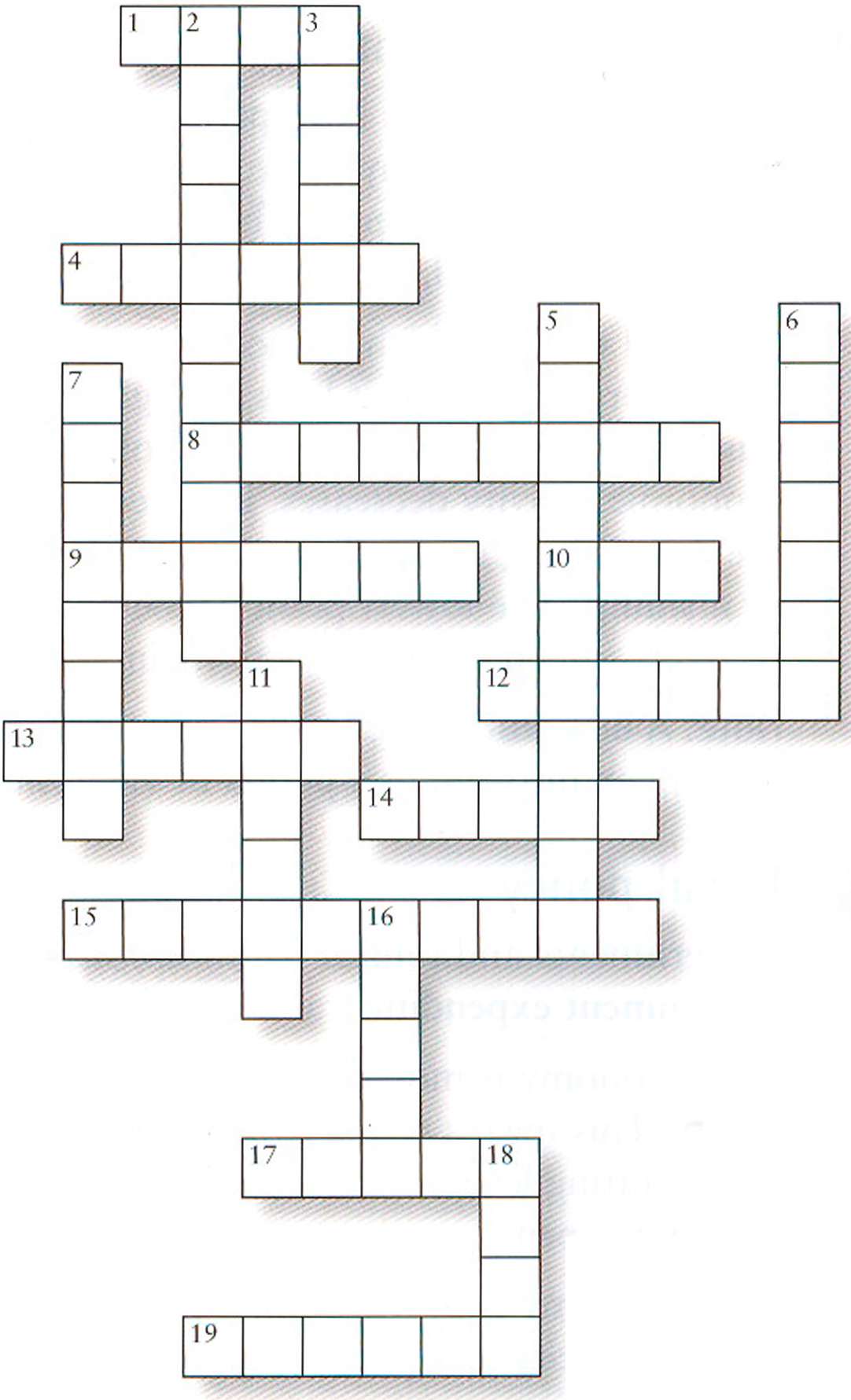

47.1 Complete the crossword. Look at A, B and C opposite to help you. Across 1 and 10 across Some people buy life insurance that pays a.............................. on retirement. (4,3) 4 Many insurance companies now sell , over the phone or the internet. (6) 8 I have a theft policy, so the insurance company will.................. me if my mobile phone is stolen. (9) 9 If you make a big claim from your insurance company, the cost of your will probably go up. (7) 10 See 1 across. 12 When I insured my house, I used a............. to find me the best deal. (6) 13 Exporters have to insure goods in transit in case somebody.................... them. (6) 14 I lost my job as an............ for an insurance company when people stopped buying over the counter. (5) 15 Lloyd's spreads the risks it insures among ................ made up of groups of underwriters. (10) 17 The individual underwriters at Lloyd's are commonly called.................. (5) 19 Natural disasters are expensive for insurance companies because they cause a lot of.......................... to buildings and their contents. (6) Down 2 Lloyd's............... risks worth over £14 billion. (11) 3 You should always read the small print - all the details - ............ (6) 5 There are............... companies that take on part of the risks companies. (11) 6 Life insurance can be a tax................. - a way of putting off paying tax till later. (7) 7 Most people insure their personal................. against loss, fire and theft. (8) 11 of London is the world's largest insurance market. (6) Fortunately, I've never had a car accident, so I've never had to.................. anything from the insurance company. (5) 18 Life insurance is also a way to............. money

and pay less tax. (4) before you accept an insurance underwritten by smaller "Hello, I'd like to apply for some property insurance." Over +o upu How many different insurance policies do you or your family have? Are there any risks you cannot insure yourself against? What insurance does your company or employer have? Date: 2015-02-28; view: 8785

|