CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Money supply and controlMeasuring money

Professor John Webb, the banking expert we met in Unit 23, continues his interview.

What is the money supply? It's the stock of money and the supply of new money. The currency in circulation - coins and notes that people spend - makes up only a very small part of the money supply. The rest consists of bank deposits.

Are there different ways of measuring it? Yes. It depends on whether you include time deposits - bank deposits that can only be withdrawn after a certain period of time. The smallest measure is called narrow money. This only includes currency and sight deposits - bank deposits that customers can withdraw whenever they like. The other measures are of broad money. This includes savings deposits and time deposits, as well as money market funds, certificates of deposit, commercial paper, repurchase agreements, and things like that. (See Unit 25)

What about spending? To measure money you also have to know how often it is spent in a given period. This is money's velocity of circulation - how quickly it moves from one institution or bank account to another. In other words, the quantity of money spent is the money supply times its velocity of circulation. Changing the money supply The monetary authorities - sometimes the government, but usually the central bank - use monetary policy to try to control the amount of money in circulation, and its growth. This is in order to prevent inflation - the continuous increase in prices, which reduces the amount of things that people can buy. ■ They can change the discount rate at which the central bank lends short-term funds to commercial banks. The lower interest rates are, the more money people and businesses borrow, which increases the money supply. ■ They can change commercial banks' reserve-asset ratio. (See Unit 23) This sets the percentage of deposits a bank has to keep in its reserves (for depositors who wish to withdraw their money), which is generally around 8%. The more a bank has to keep, the less it can lend. ■ The central bank can also buy or sell treasury bills in open-market operations with commercial banks. If the banks buy these bonds, they have less money (and so can lend less), and if the central bank buys them back, the commercial banks have more money to lend. Monetarism

Monetarist economists are those who argue that if you control the money supply, you can control inflation. They believe the average levels of prices and wages depend on the quantity of money in circulation and its velocity of circulation. They think that inflation is caused by too much monetary growth: too much new money being added to the money stock. Other economists disagree. They say the money supply can grow because of increased economic activity: more goods being sold and more services being performed. 27.1Are the following statements true or false? Find reasons for your answers in A and B opposite. 1 Most money exists on paper, in bank accounts, rather than in notes and coins. 2 Banking customers can withdraw time deposits whenever they like. 3 The amount of money spent is the money supply multiplied by its velocity of circulation. 4 Central banks can try to control the money supply. 5 Commercial banks can choose which percentage of their deposits they keep in their reserves. 27.2Use the words below to make word combinations with 'money'. Then use the word combinations to complete the sentences. Look at A opposite to help you. broad narrow supply 1 The.............................................. is the existing stock of money plus newly created money. 2 The smallest or most restrictive measure is........................................................ 3 ........................................... is a measure of money that includes savings deposits.

27.3 Find three nouns in B and C opposite that make word combinations with 'monetary'. Then use the word combinations to complete the sentences below.

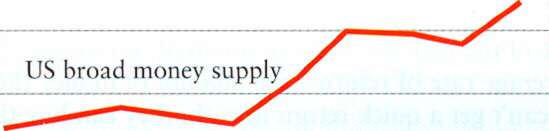

monetary 1 The.............................................. are the official agencies that can try to control the quantity of money. US inflation and money supply growth

2 The attempt to control the amount of money in circulation and the rate of inflation is called 3 Monetarism is the theory that the level of prices is determined by $7,000bn $6,000bn $5,000bn

US inflation rate —I------ 1— 2001 2003 4% 2% A 0%-

What is wrong with having inflation? What is the current inflation rate in your country? Has this changed a lot over the past 20 years? Try to discover what factors have caused any changes. L____________________________________________________________________________________________________________________________________ A Professional English in Use Finance Venture capital Raising capital

Alex Rodriguez works for a venture capital company: 'As you know, new businesses, called start-ups, are all private companies that aren't allowed to sell stocks or shares to the general public. They have to find other ways of raising capital. Some very small companies are able to operate on money their founders - the people who start the company - have previously saved, but larger companies need to get capital from somewhere else. As everybody knows, banks are usually risk-averse. This means they are unwilling to lend to new companies where there's a danger that they won't get their money back. But there are firms like ours that specialize in finding venture capital: funds for new enterprises. Some venture capital or risk capital companies use their own funds to lend money to companies, but most of them raise capital from other financial institutions. Some rich people, who banks call high net worth individuals, and who we call angels or angel investors, also invest in start-ups. Although new companies present a high level of risk, they also have the potential for rapid growth - and consequently high profits - if the new business is successful. Because of this profit potential, institutions like pension funds and insurance companies are increasingly investing in new companies, particularly hi-tech ones.' Note: Venture capital is also called risk capital or start-up capital. Return on capital 'Venture capitalists like ourselves expect entrepreneurs - people with an idea to start a new company - to provide us with a business plan. (See Unit 50) Because of the high level of risk involved, investors in start-ups usually expect a higher than average rate of return - the amount of money the investment pays - on their capital. If they can't get a quick return in cash, they can buy the new company's shares. If the company is successful and later becomes a public company, which means it is listed on a stock exchange, the venture capitalists will be able to sell their shares then, at a profit. This will be their exit strategy. Venture capitalists generally invest in the early stages of a new company. Some companies need further capital to expand before they join a stock exchange. This is often called mezzanine financing, and usually consists of convertible bonds - bonds that can later be converted to shares (see Unit 33) - or preference shares that receive a fixed dividend. (See Unit 29) Investors providing money at this stage have a lower risk of loss than earlier investors like us, but also less chance of making a big profit.' BrE: preference shares; AmE: preferred stock

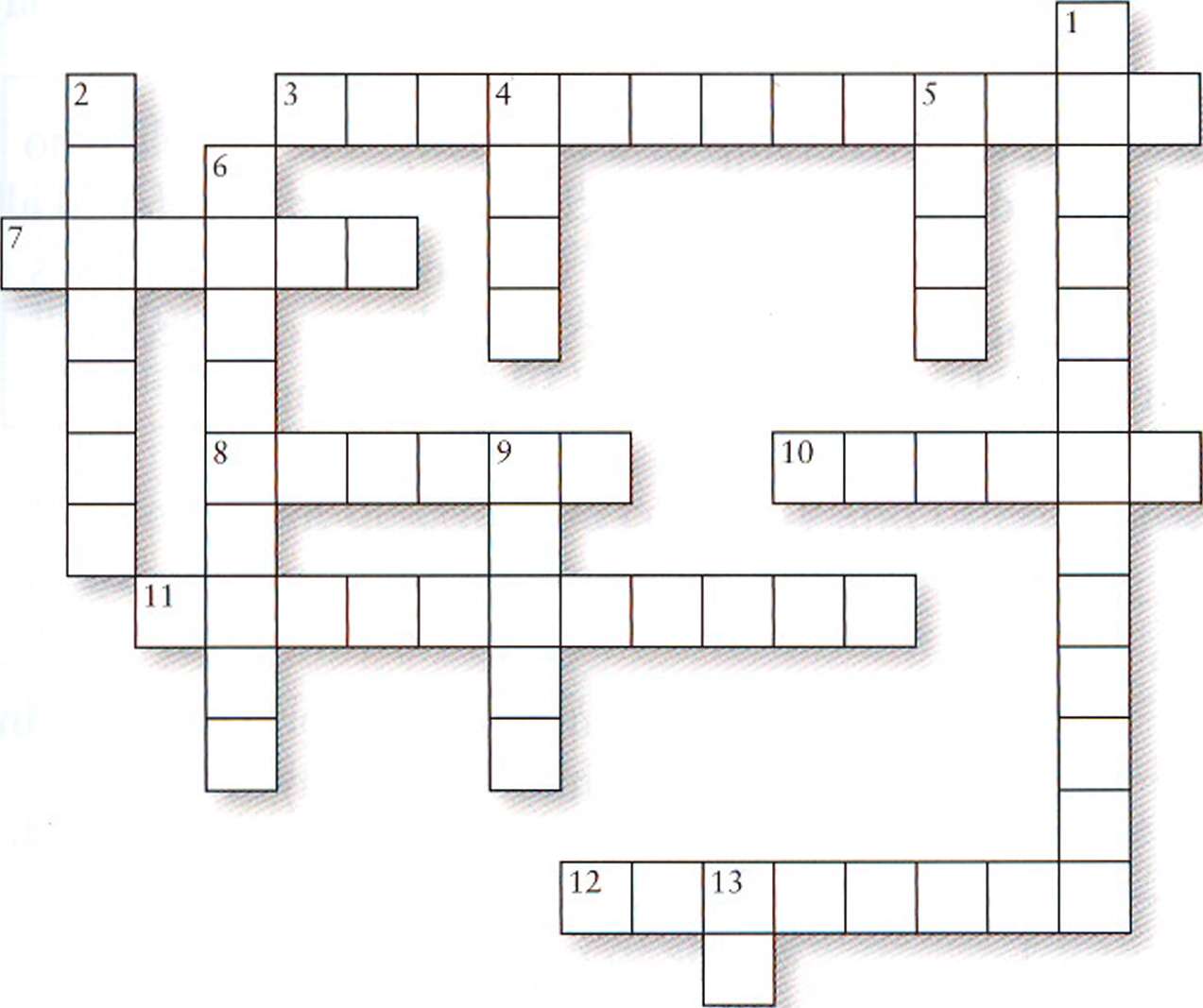

Across 3 A firm listed on a stock exchange is a.................. .................................................................................. (6,7) 7 Individuals who lend money to new companies are sometimes called............................. (6) 8 Banks that are risk-............ usually don't want to finance new companies. (6) 10 The amount of money made from an investment is its rate of............................................ (6) 11 New businesses often have to get finance from companies. (4,7)

Ov&r +o UpU Would you invest in start-ups? In which fields? If you wanted to start a business, how would you try to raise capital? 12 The people who start companies. (8)

28.2 Match the two parts of the sentences. Look at A and B opposite to help you. 1 Banks are usually reluctant 2 Start-ups often get money 3 New companies can grow rapidly 4 Risk capitalists usually expect 5 Venture capitalists need an exit strategy - a way 6 Mezzanine financing is a second round of financing 28.1 Complete the crossword. Look at A and B opposite to help you. a a higher than average return on their money, b and so are potentially profitable, c before a company joins a stock exchange, d to get their money back after a few years, e to lend money to new companies, f from specialized venture capital firms. Stocks and shares 1 Stocks, shares and equities Stocks and shares are certificates representing part ownership of a company. The people who own them are called stockholders and shareholders. In Britain, stock is also used to refer to all kinds of securities, including government bonds. (See Unit 33) The word equity or equities is also used to describe stocks and shares. The places where the stocks and shares of listed or quoted companies are bought and sold are called stock markets or stock exchanges. Going public A successful existing company wants to expand, and decides to go public. ___________________ Y________________ The company gets advice from an investment bank about how many shares to offer and at what price. go public: change from a private company to a public limited company (PLC") by selling shares to outside investors for the first time (with a flotation) Y The company gets independent accountants to produce a due diligence report. i The company produces a prospectus which explains its financial position, and gives details about the senior managers and the financial results from previous years. ____________________ Y_________________ The company makes a flotation or IPO (initial public offering). i ~ An investment bank underwrites the stock issue. Note: Flotation can also be spelt floatation. due diligence: a detailed examination of a company and its financial situation prospectus: a document inviting the public to buy shares, stating the terms of sale and giving information about the company financial results: details about sales, costs, debts, profits, losses, etc. (See Units 11-14) flotation: an offer of a company's shares to investors (financial institutions and the general public) underwrites a stock issue: guarantees to buy the shares if there are not enough other buyers BrE: ordinary shares; AmE: common stock Ordinary and preference shares If a company has only one type of share these are ordinary shares. Some companies also have preference shares whose holders receive a fixed dividend (e.g. 5% of the shares' nominal value) that must be paid before holders of ordinary shares receive a dividend. Holders of preference shares have more chance of getting some of their capital back if a company goes bankrupt - stops trading because it is unable to pay its debts. If the company goes into liquidation - has to sell all its assets to repay part of its debts - holders of preference shares are repaid before other shareholders, but after owners of bonds and other debts. If shareholders expect a company to grow, however, they generally prefer ordinary shares to preference shares, because the dividend is likely to increase over time. 29.1 Match the words in the box with the definitions below. Look at A, B and C opposite to help you. prospectus ordinary shares preference shares stock exchange to underwrite bankrupt going public flotation investors liquidation 1 a document describing a company and offering stocks for sale 2 a market on which companies' stocks are traded 3 buyers of stocks 4 changing from a private company to a public one, quoted on a stock exchange 5 the first sale of a company's stocks to the public 6 to guarantee to buy newly issued shares if no one else does 7 shares that pay a guaranteed dividend 8 the most common form of shares 9 insolvent, unable to pay debts 10 the sale of the assets of a failed company 29.2 Are the following statements true or false? Find reasons for your answers in A, B and C opposite. 1 New companies can apply to join a stock exchange. 2 Investment banks sometimes have to buy some of the stocks in an IPO. 3 The due diligence report is produced by the company's own accountants. 4 The dividend paid on preference shares is variable. 5 If a company goes bankrupt, the first investors to get any money back are the holders of preference shares. 29.3 Make word combinations using a word or phrase from each box. Then use the correct forms of the word combinations to complete the sentences below. Look at A, B and C opposite to help you. an issue a prospectus shares public offer go produce underwrite After three very profitable years, the company is planning to (1).............................................................................. (2)............................................................................ and we're (3)..................... 100,000 (4)................................... for sale. We've (5)............. a very attractive (6).................... , and although a leading investment bank is (7)......................... the (8)......................... ,

Have there been any big flotations in the news recently? Are there any private companies whose stocks you would like to buy if they went public? we don't think they'll have to buy any of the shares. Stocks and shares 2 Buying and selling shares After newly issued shares have been sold (usually by investment banks) for the first time - this is called the primary market - they can be repeatedly traded at the stock exchange on which the company is listed, on what is called the secondary market. Major stock exchanges, such as New York and London, have a lot of requirements about publishing financial information for shareholders. Most companies use over-the-counter (OTC) markets, such as NASDAQ in New York and the Alternative Investment Market (AIM) in London, which have fewer regulations. The nominal value of a share - the price written on it - is rarely the same as its market price - the price it is currently being traded at on the stock exchange. This can change every minute during trading hours, because it depends on supply and demand - how many sellers and buyers there are. Some stock exchanges have computerized automatic trading systems that match up buyers and sellers. Other markets have market makers: traders in stocks who quote bid (buying) and offer (selling) prices. The spread or difference between these prices is their profit or mark-up. Most customers place their buying and selling orders with a stockbroker: someone who trades with the market makers. New share issues Companies that require further capital can issue new shares. If these are offered to existing shareholders first this is known as a rights issue - because the current shareholders have the first right to buy them. Companies can also choose to capitalize part of their profit or retained earnings. This means turning their profits into capital by issuing new shares to existing shareholders instead of paying them a dividend. There are various names for this process, including scrip issue, capitalization issue and bonus issue. Companies with surplus cash can also choose to buy back some of their shares on the secondary market. These are then called own shares.

BrE: own shares; AmE: treasury stock Categories of stocks and shares Investors tend to classify the stocks and shares available in the equity markets in different categories. ■ Blue chips: Stocks in large companies with a reputation for quality, reliability and profitability. More than two-thirds of all blue chips in industrialized countries are owned by institutional investors such as insurance companies and pension funds. ■ Growth stocks: Stocks that are expected to regularly rise in value. Most technology companies are growth stocks, and don't pay dividends, so the shareholders' equity or owners' equity increases. This causes the stock price to rise. (See Unit 11) ■ Income stocks: Stocks that have a history of paying consistently high dividends. ■ Defensive stocks: Stocks that provide a regular dividend and stable earnings, but whose value is not expected to rise or fall very much.

■ Value stocks: Stocks that investors believe are currently trading for less than they are worth - when compared with the companies' assets. 30.1 Match the words in the box with the definitions below. Look at A and B opposite to help you.

1 new shares offered to existing shareholders 2 the price written on a share, which never changes 3 to turn profits into stocks or shares 4 the market on which shares can be re-sold 5 the price at which a share is currently being traded 6 shares that companies have bought back from their owners 7 the market on which new shares are sold 30.2 Are the following statements true or false? Find reasons for your answers in A and B opposite, 1 Stocks that have already been bought at least once are traded on the primary market. 2 NASDAQ and the AIM have more regulations than the New York Stock Exchange and the London Stock Exchange. 3 The market price of stocks depends on how many buyers and sellers there arc. 4 Automatic trading systems do not require market makers. 5 Market makers make a profit from the difference between their bid and offer prices. 30.3 Complete the sentences. Look at B and C opposite to help you. A stock whose price has suddenly fallen a lot after a company had bad news could be a............................... , as it will probably rise again. This stock used to be considered an ............................. , but two years ago the company started to cut its dividend and reinvest its cash in the business. The stocks of food, tobacco and oil companies are usually............................ , as demand doesn't rise or fall very much in periods of economic expansion or contraction. The financial director announced a forthcoming............................... of new shares to existing shareholders. Pension funds and insurance companies, which can't take risks, usually only invest in The best way to make a profit in the long term is to invest in The company is planning a ............................. of one additional share for every three existing shares. We have bought back 200,000 ordinary shares, which increases the value of our ............................. to ˆ723,000.

On ex +o upu If you had a lot of money to invest in stocks, what kind of stocks would you buy, and why? Date: 2015-02-28; view: 7336

|