CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Budgetary PolicyThe transformation of the economic and political systems in Ukraine has been accompanied ... substantial reforms in the budget process, including budget preparation and classification, a new treasury system for budget execution and expenditure control, considerable autonomy of subnational governments in the formulation of their budgets. On the whole, the budgetary policy in Ukraine is aimed ... attaining the efficient allocation of national resources, the desirable redistribution of income ... the poorer groups in society, and the maintenance of a macroeconomic environment with stable prices, full employment and equilibrium in the balance of payments. Accurate budget evaluation is more necessary now than ever before. The economic transition has led ... drastic retrenching in public resources so there is a need to increase the efficiency with which public resources are used. Proper budget evaluation will provide critical information and feedback to policy makers ... how well budget objectives are being attained ... the implementation of the budget. The transition ... the market economy has significantly increased the complexity of interactions of the government with the private sector thus increasing the opportunities ... misuses of funds and ... corruption. For these reasons it is important that an effective and independent ex-post audit be carried ... by at all levels of government.

Ex. 14 a) Read the analysis of public spending in the UK. Replace the underlined expressions from the text using the list of word combinations

Reached the highest record level, went down, leveled out, remained at the level of, a leap, has gradually risen, recovered, soared, made up, remained steady

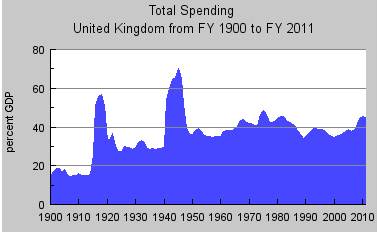

Public spending in the United Kingdom has steadily increased from 12 percent of Public Spending in the 20th century is dominated by the great exertions of the world wars. But peacetime expenditures show clear trends. Prior to World War I, public spending sat at about 15 percent of GDP. Then, after the war it emerged at about 25 percent of GDP, and remained at about that level, except for a surge at the start of the depression in the 1930s. After World War II, public spending consumed about 35 percent of GDP, and this level continued through the 1950s. At about 1960 expenditures began a steady rise that peaked in the early 1980s at 45 percent of GDP. During the 1980s public spending was cut as a percent of GDP from about 45 percent down to 35 percent in 1989. But then, with the ERM sterling crisis and associated recession, it rose back to 40 percent of GDP before declining to 36 percent in 2000. After 2000 public spending increased rapidly, with a peak of 47 percent of GDP expected in 2011 in the afermath of the financial crisis of 2008.

b) Complete the excerpt on defence spending in the United Kingdom using words and word combinations from the list soared to, spending over, peaking at, reached, slipping below, expanded, contracted down, declining, has fluctuated Defence spending in the United Kingdom (1)___ in the last century, starting at 6.5 percent of GDP during the Boer War, (2)______ 46.4 percent in World War II, (3)_____ from 10 percent in the early years of the Cold War to under three percent today. Defence began in 1900 at 3.69 percent of GDP but quickly (4) ____ during the Boer War1 to 6.47 percent. After the war it (5) ______ to about 3 percent of GDP. World War I saw an extraordinary mobilisation of nation resources, beginning from a standing start of 3.15 percent of GDP spent on defence in 1914. Defence spending (6) _____ 21.68 percent of GDP by 1919. But spending quickly contracted after the Great war, (7) _______ three percent of GDP by 1927, and staying at the same level thereafter. Defence spending began to increase well before World War II. Starting at 3.01 perent of GDP in 1935, it (8) _____ 3.71 percent in 1936, 4.82 in 1937, 8.72 in 1938, and 15.19 in 1939. After the start of World war II, Britain mobilised all its national resources for the war, (9) ______ 40 percent of GDP on defence for four years, peaking at 46.37 percent of GDP in 1943. Note 1Àíãëî-áóðñüêà â³éíà 1899—1902 — çàãàðáíèöüêà â³éíà Âåëèêî¿ Áðèòàí³¿ ïðîòè áóðñüêèõ ðåñïóáë³ê Îðàíæåâî¿ ³ Òðàíñâààëþ, îäíà ç ïåðøèõ âîºí åïîõè ³ìïåð³àë³çìó

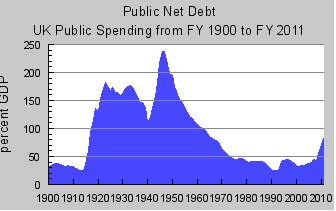

ñ) The text below contains 7 mistakes. Correct the mistakes using the information from the graph.

After World War II the National Debt was reduced to 25 percent of GDP in 1992. Thereafter it remained steady until the financial crisis of 2008. The National Debt is expected to exceed 100 percent of GDP in the aftermath of the crisis.

Ex. 15. a) Fill each gap with a suitable word below b)Sum up the text in 5-7 sentences and present your summary in class.

Coin, known, invented, handle, forms, small, using, big, used, objects, money, instruments, called, assets

What Is Money? Money is an asset that serves as a means of payment, a store of value, and a unit of account. Money was _____1 a long time ago. Gold and silver coins are the best form of money. They have the longest history and have been more widely accepted as payment than any other form of commodity money. The popularity and universal acceptability of _____2 money is easy to understand. Coins are solid, attractive, hard-wearing and easy to. In addition to the qualities mentioned above, coins can be produced in ____3 and ____4 denominations. Societies ____5 gold and silver have used other as money, including shells, beads and pelts. Anything can serve as _____6 that is easily recognized, widely accepted, and not easily copied. Gold, shells, and pelts are no longer used as money in the majority of countries. Today two kinds of financial _____7 serve as money: currency (coins and bills) and checking deposits at banks and thrift institutions. Currency plus checking deposits at banks and thrifts is often ____8 Ml. The money that includes balances in money market funds, savings deposits in banks and thrifts and certain other liquid is called Ì2. Along with coins, paper currency, and checking deposits, “plastic money” is widely _____9 today. “Plastic money” comes in two ____10 - credit cards and debit cards.

Ex. 16 Read the following texts and choose the correct word, A, B, C, or D to fill gap (1-10) A Gross Domestic Product, or GDP for ____ measures the value of a nation’s ______ of goods and services for some period of time, usually a year. It is not the only measure of output – the Federal Reserve, for example, publishes an_______ of industrial production – but the GDP has become a favourite among economists because it is the most ____ of output measures. In arriving at GDP, the Commerce Department is careful not to double count transactions. If it counted the sale of steel to General Motors from U.S.Steel and also the value of the cars that GM produced, it would count the steel twice, once in an unfinished form, and once in a finished form. In practice it _____ double counting by only including the value added at each stage of production. Value added issales minus the cost of raw materials and unfinished goods. Neither does the Commerce Department ____ the sale of second-hand items. These were counted when they were originally purchased, and to count them again would involve double counting. Finally, it doesn’t count financial transactions, such as the sales of stocks and _____ .These transactions involve sales of ownership or debt and do not spring directly from the production of final output. The _____ of all transactions not counted is much larger than the size of GDP, the transactions of GDP are only a tiny fraction of total transactions of the economy. Because GDP measures the value of output, it can increase for two distinct reasons. It can increase because more goods and services arebeing produced, or it can increase because prices of goods and services have _____.To eliminate the _____.of changing prices, one must compute real or constant-dollar GDP which values the output of various time periods with a set of _____ prices.

B) The proper role of government provides a starting ______1 for the analysis of public finance. In theory, under certain circumstances, private markets will _____2 goods and services among individuals efficiently (in the sense that no waste occurs and that individual tastes are matching with the economy's productive abilities). If private markets were able to provide efficient outcomes and if the distribution of income were socially _____3 then there would be little or no _____4 for government. "Market _____5 " occurs when private markets do not allocate goods or services efficiently. The existence of market failure provides an efficiency-based rationale for collective or governmental provision of goods and services. Externalities, public goods, informational advantages, strong economies of _____6 and network effects can cause market failures. Public provision via a government or a voluntary association, however, is subject to other inefficiencies, termed "government failure." Under broad ______7 , government decisions about the efficient scope and level of activities can be efficiently separated from decisions about the design of taxation systems . In this view, public sector programs should be designed to maximize social benefits minus costs (cost-benefit analysis), and then revenues needed to pay for those ______8 should be _____9 through a taxation system that creates the fewest efficiency losses caused by distortion of economic activity as possible. In practice, government budgeting or public budgeting is substantially more complicated and often results in inefficient practices. Public finance is closely connected to issues of income distribution and social equity. Governments can reallocate income through transfer payments or by designing tax systems that _____10 high-income and low-income households differently. The Public Choice approach to public finance seeks to explain how self-interested voters, politicians, and bureaucrats actually operate, rather than how they should operate.

DISCUSSION

Ex. 17. Give extensive answers to these discussion questions: 1. Do you agree with the definitions of finance and financial system given in the main text? 2. What role do financial intermediaries play? Is financial intermediation developed in Ukraine? 3. What bodies are involved in the budget formulation? How is the budget process arranged in Ukraine now? 4. Is a deficit budget typical of many countries? 5. Describe the budget system existing in Ukraine now. 6. What classification of revenues is accepted now? 7. What are the sources of revenues? 8. How are the budget revenues spent? 9. How is the problem of unequal possibilities for raising revenue in different regions of Ukraine solved? 10. How is the budget execution controlled?

Ex.18. Choose the best alternative, using the data from the table. What conclusion can you make about the state of economy in the country?

Real GDP Overview Consumer spending slowed / picked up in the second quarter. The slowdown was widespread. The largest contributors to the slowdown were downturns / jumps in motor vehicles and parts and in clothing and footwear. In contrast, spending for both housing and utilities services and gasoline and other energy goods turned up / rocketed. Nonresidential fixed investment slowed / leveled off, mainly reflecting a downturn in power and communications structures. In contrast, equipment and software picked up, mainly reflecting an upturn / dip in industrial equipment. Residential fixed investment slowed / surged, mainly reflecting the trend in “other” structures and in single-family structures. Inventory investment turned up / bottomed out, primarily reflecting upturns in wholesale trade inventories and in “other” industries inventories. Exports of goods and services picked up, mainly reflecting a pickup / downturn in goods exports. Both industrial supplies and materials and food, feeds, and beverages turned up. Imports of goods and services accelerated / slowed down. Federal government spending decreased / rose less than in the first quarter, mainly reflecting a smaller decrease in national defense spending. State and local government spending decreased / leveled off about the same as in the first quarter; it was the eleventh consecutive quarterly decrease.

Ex. 19 a) Look at the pie chart and scan through the analysis of budget expenditures in the UK. Replace the underlined phrases with other similar expressions.

The pie chart shows the budget of the UK government in 2011. Overall, social security, health, and education were the most important targets. The biggest segment was social security. Pensions, employment assistance and other benefits made up about 30% of total expenditure. Health was the second highest budget cost. Hospital and medical services accounted for £53 billion, or about 15% of the budget. The government spent about seven percent of revenue on debt, and similar amounts went towards defence (£22 billion) and law and order (£17 billion). Spending on housing, transport and industry totaled £37 billion. Finally, other expenditure accounted for £23 billion. In conclusion, the bulk of British government spending goes on social welfare and health. However, education, defence, and law and order are also major areas of spending.

b) Look at the pie chart below and analyse the budget revenues it reflects ñ) Analyze the relevant data to find out about budget revenues and expenditures in Ukraine. Compare any changes in both revenues and expenditures over a five year period. d) If you were the prime minister, how would you spend the budget resources? Say what you think about supervision over budget execution

Ex.20.a) Scan through the text about budgeting in the UK. What are the aims pursued by the government in budget preparation? Deliver the summary of the text to the class. A budget for lasting prosperity -combining sustained economic growth with low inflation so that living standards go on rising year after year For helping people keep more of what they earn -basic rate of income tax reduced to 23p -inheritance tax threshold increased For high quality public services spending more on services people care most about -the health service -education -combating crime For responsible public finances -maintaining firm control of public spending -reinforcing the downward path of borrowing For protecting the ordinary taxpayer -fighting tax and social security fraud -closing tax loopholes -phasing out special reliefs and allowances

The Budget helps people keep more of what they earn The Government believes in a low tax economy and is committed to a 20p basic rate of income tax. The Budget takes another step towards this goal and further boosts wage packets by: -cutting the basic rate of income tax by 1p to 23p, the lowest basic or standard rate for nearly 60 years; -widening the 20p income tax band by 200 Pounds; -increasing personal allowances by 200 Pounds more than inflation. All 26 million taxpayers will pay less income tax because of these changes and over a quarter of all taxpayers now pay tax at only 20 per cent. So that people can leave more to their families, there will be a further 15,000 Pounds increase (three times more than inflation) in the level where inheritance tax becomes payable. The Budget helps deliver high quality public services The Government will spend more on the services people care most about while maintaining firm control of public spending. Continuing growth of the Private Finance Initiative will improve efficiency throughout the public sector. The Budget gives extra money to: -the health service (1,600 Pounds million for patient services); -education (an extra 875 million Pounds). The Government will also continue to clamp down on its own running costs. Buying services through the Private Finance Initiative brings high quality services at better value for money. Last year 1 1/2 billion Pounds worth of PFI deals had been agreed. That figure has now risen to more than 7 billion Pounds. Challenge funding will continue to foster partnerships between communities and the private sector by allocating funds on a competitive basis. The Budget promotes responsible public finances To maintain a world beating modern economy fit to compete in international markets, the Governments objective is to reduce borrowing and bring public spending down to below 40 per cent of national income (GDP). The Budget helps to achieve this by: -maintaining a firm control of public spending; -reinforcing the downward path of borrowing. The Government is set to meet its target of reducing public spending to below 40 per cent of GDP. Borrowing will fall from 31 1/2 billion Pounds to a forecast 26 1/2 billion Pounds. The Budget changes some indirect taxes: -the duty on spirits will be cut by 4 per cent; -the duty on beer and wines will be frozen; -insurance premium tax will increase from 2 1/2 per cent to 4 per cent; -air passenger duty will go up from 5 Pounds to 10 Pounds for most flights within Europe and from 10 Pounds to 20 Pounds for flights outside Europe. The Budget helps protect the ordinary taxpayer Tax due should be tax paid. The Government is committed to securing the tax base in order to spend money on high quality public services while reducing the rate of income tax. The Budget takes steps to achieve this by: -increasing resources for the Inland Revenue; -boosting the fight against social security fraud to make sure that taxpayers money is spent only on those in need; -closing tax loopholes where they are being exploited to reduce tax bills; -tackling a number of special reliefs and allowances which have outlived their purpose such as tax relief on profit related pay The Budget helps business and enterprise The Government is committed to business and enterprise. As well as a stable economic framework with low inflation and low interest rates, taxes on UK business are among the lowest of any G20 country. The Budget takes further steps to improve the environment for business to grow and invest: -the small companies rate of corporation tax will be cut from 24p to 23p helping 400,000 small firms to keep more of their own profits to invest as they choose; -more than 1 1/4 million small properties (including 400,000 small shops) will have no increase in their rates bill next year; -the VAT registration threshold will be increased in line with inflation

b) Complete the following sentences: 1. The Budget boosts wage packets by ….2. The Government will spend more on the services ….3. The Government will also continue to clamp down on … 4. To maintain a world beating modern economy fit to compete in international markets, … 5. The Government is set to meet its target of reducing public spending to ….6. The Budget changes some indirect taxes: …7. The Government is committed to securing the tax base in order to ….8. The Budget takes steps to secure the tax base by: … c)Complete the following prepositional phrases. Consult the text if necessary. To phase ____ special reliefs; to spend more ___ the services; to improve the environment ___ business to grow; to go ____ from 5 Pounds to 10 Pounds; to increase resources ___ the Inland Revenue; to keep more of their own profits; to cut the duty ___ spirits; to clamp down ____ the costs of running business; to allocating funds ____ a competitive basis; to pay tax ___ the rate of only 20 per cent; to meet the target _____ reducing public spending; to take steps ____reaching this goal; to boost wages ____ 10%; to be commited ____ the same interest rate; to bring spending ____ to 5% against 8% last year; to expect an icrease ____ GDP; to go ___ rising year ___ year.

READING PRACTICE Ex.21.Read the text below quickly to find the type of budget classification. Explain the difference between functional and economic classifications. Types of Budget Classification

A system of budget classification enables the myriad government operations and transactions to be organized into relatively homogeneous categories that facilitate the analysis of the impact, nature, and composition of revenues, expenditures, and other financing activities of government. On the revenue, taxes are classified by the type of activity on which the tax is levied (income, sales, property and so on). Other current non-tax revenues are classified by the nature of the inflow, such as income from government property, sales proceeds, fines, and donations. Capital revenues are classified by the type of asset sold. Grants are distinguished by whether they come from domestic or foreign governments and international institutions and whether they are for current or capital purposes. On the expenditure, outlays are frequently classified by the responsible institution or organization. The two most useful types of classifications of government expenditures are the functional classification and the economic classification. In functional classification, expenditures (and lending) are classified according to the main purpose or function, such as defense, education, and health. The three-level Classification of the Functions of government published by the Statistical Office of the United Nations is commonly accepted. The value of functional classifications is that they permit analysis of trends in government expenditures even when the organizational structure of government changes. The economic classification groups expenditures into current and capital and by whether they are requited or unrequited; if requited, for what kind of goods and services, and if unrequited, by the type of person or institution receiving the payment. The objective is to show the kinds of transactions through which the government performs its functions and their impact on markets, financial conditions, and the distribution of income. These transaction categories are wages and salaries, purchases of goods and services, interest on the debt, subsidies to enterprises, transfers to households and other governments, and lending. One of the most useful ways to analyse government outlays is by means of a cross-classification by economic character and function. This classification reveals the means by which government performs its functions and the impact these activities will have on the rest of the economy.

Ex.22 Read the text and sum it up in 7-9 sentences. Say what you know about the budget process in Ukraine.

In market economies the budget is the proposed and later the authorized statement of revenues and expenditures for a period, normally a fiscal year. The government budget may show the planned or authorized expenditure of central government alone, or may incorporate also expenditures and revenues of regional and local governments. The budget is the key instrument for expression and execution of the government’s economic policy. Government budgets have a wide implication for the national economy. There are various practical approaches to budgeting, including the administrative budget, which emphasizes the expenditures of ongoing government operations; the capital budget, which gives separate treatment to public works projects and their special financing requirements; the cash budget, which simplifies budgetary procedures, etc. In the United States the federal budget deals mainly with expenditure programmes, and revenues are covered only briefly. The size of the budget deficit or surplus is regarded as very important. An important aspect of the budgetary process is a great influence of the Congress. The US budget is submitted in January for the fiscal year coming in July. It is then considered by several sub-committees of the House of Representatives and the Senate. In Great Britain the preparation of the budget is the function of The Treasury, which is headed by the Chancellor of the Exchequer. The emphasis of the British Budget is on taxation and the state of the economy. The Budget is the Government’s main economic statement of the year. It is announced by the Chancellor of the Exchequer who reviews the nation’s economic performance and describes the Government’s economic objectives and the policies it intends to follow in order to achieve them. cash Ex. 23 Read and translate the article. Deliver the meaning of it to the class.

Public Sector Modernization: Governing for Performance. Over the past two decades, public sector performance has taken on special urgency as a lot of countries have faced recession, mounting demands for more and better public services, budget constraints, demands for more public accountability and transparency. Performance- or results-based budgeting, management and reporting is the latest trend in attempts to improve government performance. These reforms seek to refocus management and budgeting process away from inputs towards results. In essence, this involves writing into the formal management goals, targets, indicators and measures relating not to how the service is provided but to how the results are achieved. The desire to improve government performance is not something new. In fact results-based or performance-based budgeting was first reccommended by the Hoover Commission in the United States in I949. In the 1950s and 1960s many OECD countries, including the United States, started using performance indicators and targets to assess agencies not on how much they spent but on what they actually produced. But these systems ultimately failed because they were too rigid to take account of uncertainty and unpredictability. As a result, performance targeting and measurement fell from grace in the late 1970s and mid-1980s. Governing for performance has witnessed a revival in the past 20 years as budget constraints, changing economic environments, and demands from citizens for higher quality services put improving the performance of ministries and public servants back on the political agenda in many OECD countries. Countries’ approaches to performance are constantly evolving. For example, Australia, the Netherlands, and New Zealand began by concentrating on outputs and are now moving to an outcomes approach. France has passed a law which requires the production of results as well as inputs in budget documentation for the majority of programmes. Governments have introduced performance-based management and budgening for four main reasons: to improve efficiency; to improve decision-making in the budget process; to improve transparency and accountability; and to achieve savings. Methods for strengthening performance have demonstrated their validity over the years and remain the most important steps that organizations need to take in order to become more performance- oriented. Experts on public sector management point out that it is one thing to try and improve performance, but how can governments be sure they are being successful, particularly in the increasingly complex societies of the early 21 st century? The simpliest way initially seemed to be evaluation, assessing the impact of public policies on society. At the same time, budget constraints led parliaments to become more interested in whether programmes were achieving the desired results and whether money was being well spent.This led to the rise of value-for-money auditing and other results-based techniques. In some countries, evaluation was built into the entire policy process from preparation of the budget to final results. By this time, governments have learned that the three main objectives of modern public management are fiscal discipline, effectiveness, and efficiency. These goals are not independent of one another. Fiscal discipline is a prerequisite for effectiveness and efficiency of government activity. Without it any government programme almost inevitably gets distorted. Ex. 24. a) Read the text. Put 5-7 questions to the text. Single out the main facts of the text. Present them in a short review. b) Compare the budget of New York with the budget of Kyiv. Name the major budget expenditure items.

The Budget Message of the Mayor (the City of New York) April 29, 2011 To Members of the City Council: The budget for fiscal year 2011 has been prepared in the context of the directions for the City of New York set forth in the budget for 2010, which is being executed rather successfully. In this connection I would like to stress that as the city authorities promised the crime is down dramatically, the quality of life has improved, the imbalances between the public and private sectors have been reduced and private sector employment is growing. It is worth mentioning here that at the beginning of the year we carried out a reduction of 15,000 positions in the City’s workforce to cut the costs and get some additional savings. The reduction was accomplished without layoffs with the help of the municipal unions. In the course of productive negotiations with the unions the City was provided with employee redeployment rights, a valuable management tool which enabled us to transfer employees between government agencies where, in the past, layoffs may have been required. Besides, the readjustments we made earlier this year stabilized the private sector and helped to provide the first significant growth in private sector jobs. The private sector has grown by 35,000 jobs. However, we have to recognize that not everything is being done to execute the budget for 2010 fully. For example, the revenues are less than had been projected. To offset some of the difference, the City has proposed that the State restore funding for reimbursement for preschool for handicapped children as well as revenue-sharing payments. As we work we learn important lessons and gain experience which helps us to assess the situation more correctly, which, we hope, the 2011 budget will reflect. The 2011 budget of the City of New York is $ 31.1 billion. This is the sixteenth successive budget which is balanced under generally accepted accounting principles. The budget is balanced without relying on unreasonable State and Federal aid, taxes being the largest source of revenue. We understand, however, that for the economic well-being of our City, we must reduce the burden on our taxpayers. Hence, the budget for 2011 reflects our plans to expand the tax reduction program and to boost local economic activity by providing tax reliefs. Reductions in the hotel tax, the commercial rent tax and the unincorporated business tax introduced earlier, have already had an effect. Besides, we shall be stimulating non-tax revenue initiatives. The budget assumes the attainment of $ 600 million in labour savings and productivity in fiscal year 2011. In recognition of the need to reduce the costs of the government we are planning to continue to improve, restructure and streamline government workforce through agency reductions, consolidation of agency functions, agency mergers, and managerial pay freeze. It should be pointed out specifically that the budget for 2011 provides a meaningful program for developing a long-term capital investment strategy to improve and expand projects in environmental protection, housing, transportation, education and medical aid. $350 m will be earmarked for investing in emergency medical services. The budget proposes the purchase of the water and sewer system. The purchase will be funded by issuance of bonds. The budget is based on the commitment of the City’s authorities to provide an equitable distribution of the city’s resources, to correct the imbalances, and to mitigate the impact of the cuts on those whose incomes have not kept pace with inflation. As we enter the budget adoption process I welcome a rational discussion of our city’s priorities, which, I am confident, will give the city its best opportunity to participate in the national recovery.

Date: 2015-02-28; view: 1476

|

GDP in 1900 to 47 percent today.

GDP in 1900 to 47 percent today. At the beginning of the 20th century in 1900 the National Debt stood at a very manageable 60 percent of GDP and soared to 25 percent of GDP by 1914 despite the intervening Boer War. But the Great War, World War I, caused a drop in the National Debt up to 135 percent of GDP in 1919. Then, in the economic troubles of the 1920s it rose to 181 percent in 1923 and stayed well under 150 percent of GDP until 1937. The National Debt went up to 110 percent of GDP in 1940 before plummeting to 238 percent of GDP after the close of World War II in 1947.

At the beginning of the 20th century in 1900 the National Debt stood at a very manageable 60 percent of GDP and soared to 25 percent of GDP by 1914 despite the intervening Boer War. But the Great War, World War I, caused a drop in the National Debt up to 135 percent of GDP in 1919. Then, in the economic troubles of the 1920s it rose to 181 percent in 1923 and stayed well under 150 percent of GDP until 1937. The National Debt went up to 110 percent of GDP in 1940 before plummeting to 238 percent of GDP after the close of World War II in 1947.