CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

Topic 4 Market failure

1 When consumers see the price of a good, such as a new car, they can see the value of the good and immediately know how much money they would have to pay in order to buy the car. The car’s price signals information to the consumer, though other information, for example about the quality of the car, is also needed before making the decision whether or not to buy the car. (3 marks)

2 The price has decreased by £300 which immediately creates an incentive to buy the good. The iPhone is cheaper, which means that the consumer can enjoy using it and still have a considerable amount of money to spend on other purchases. However, if the price cut signals that a new and better version of the iPhone will soon be launched, some potential buyers may decide not to purchase the now cheaper current version of the iPhone. (4 marks)

3 The textbook example of a public good with non-excludability characteristics is a lighthouse. The lighthouse provides an invaluable service to ships, warning them of hazards and rocks, but it cannot prevent ships that do not pay from seeing the light beam that it creates. Hence ships can use the invaluable service provided but do not have to pay because there is no mechanism to make them pay for seeing light. Ships can ‘free-ride’ and benefit without having to pay, which is a market failure. Thus it is not profitable for lighthouses to operate in the marketplace because they cannot charge for their service, hence the missing market. In the UK lighthouses are funded through charitable donations.

(6 marks)

4 Non-rivalry (or non-diminishability and non-exhaustability) is a property which, along with non-excludability, is a defining characteristic of a public good. Non-rivalry means that when one extra person benefits from a pure public good such as national defence, he or she does not reduce the quantity of the good available to other people. (2 marks)

5 This is a public good service. Although the majority of citizens pay for the police force through general taxation, the service provided benefits the whole of society, even those who have not paid the taxes which finance the provision of the service. The very existence of the police force creates a deterrent that limits burglaries and street riots. The police force protects the whole of society and cannot, and should not, distinguish between those who contribute towards taxation and those who do not. Hence, the protection of the police force is non-excludable and citizens who do not pay taxation can free ride. However, policing can have private good properties when provided, for example, by a private security firm guarding a shopping mall. (5 marks)

6 An example of a positive externality is the benefit received by others when a person is educated. Society benefits from producing educated citizens because they add value to society. The many benefits received by third parties throughout society from education cannot be included in the price mechanism. Many of the benefits received from education are external from the price mechanism which is of course a market failure. (4 marks)

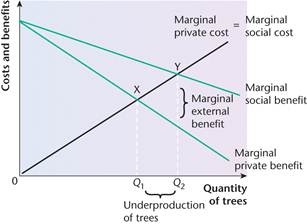

The diagram above illustrates the costs incurred and the benefits generated when a commercial forestry company plants trees. Tree planting produces a number of positive externalities, which include improved water retention in the soil. This means the marginal social benefit (MSB) of tree growing is greater than the marginal private benefit (MPB) accruing to the forestry company. In the diagram, the MSB curve is positioned above the MPB curve. The vertical distance between the two curves shows marginal external benefit (MEB) at each level of tree planting.

In order to maximise its private benefit, the commercial forestry plants Q1 trees. Q1 is immediately below point X, where MPC= MPB. However, Q1 is less than the socially optimal level of output Q2, located below point Y, where MSC= MSB The diagram illustrates the fact that, when positive production externalities are generated, the market fails because too little of the good is produced and consumed. Underproduction and under-consumption are depicted by the distance Q2–Q1.

(8 marks)

8 At the present day, because of a lack of economies of scale and the high price of parts for the car, electric cars are considerably more expensive to build than petrol and diesel alternatives.

There are only a limited number of recharging points across the UK. This generally makes it impossible to drive electric cars over long distances or to remote destinations. (4 marks)

9 Museums; libraries; art galleries (3 marks)

10 Market failure occurs whenever a market performs inefficiently. An example occurs when firms produce and/or consumers buy, the ‘wrong’ quantity of a good. The answer to Question 7 explains that because forestry companies gain no benefit from the positive externalities produced by the trees they plant, in a market environment they plant too few trees. In the case of healthcare, which is a merit good, other people benefit when a person consumes healthcare services. Consumption of healthcare produces positive externalities which benefit the whole community. As a result, the social benefit of consumption exceeds the private benefit enjoyed by the consumer. The community benefits because a healthy population means there are fewer ill people to catch diseases from. (6 marks)

11 A pure monopoly is when one firm has control of 100% of a product supplied to a market and can maintain this situation in the long run. (3 marks)

12 There is no doubt that Sky uses the monopoly power it has gained from buying up the rights to screen live Premiership football games to raise the price that viewers pay. As a result, fewer people choose to subscribe to Sky and to Sky’s sport channels than would watch live matches if the price was lower or if they could watch free.

Sky’s response is that this does not represent abuse of monopoly power. Sky claims that by paying a lot of money for exclusive rights to broadcast live matches, it has ‘invested’ in the Premier League, allowing clubs to use television revenues to buy expensive players that they would not have been able to afford without television revenues. In this way, Sky has improved the quality of the product. In any case, people can watch live match broadcasts in pubs and bars without having to pay.

However, there is a case for using regulation to reduce Sky’s monopoly power, and to a certain extent this has been achieved. ESPN, another ‘pay to view’ broadcasting company, can now buy the rights to broadcast a limited number of Premiership matches. It can be argued that regulation should go one stage further, by allowing football fans and pubs to buy Sky sports services from companies that possess the right to broadcast matches in other EU countries. This surely is the purpose of the Single European Market. (6 marks)

Answers to exam-style questions (data response)

01 A negative externality is a public bad which stems from either the production or consumption of a good or service and which is dumped on third parties without their consent. The negative externality is delivered outside of the price mechanism. (5 out of 5 marks)

Although this answer earns full marks, the fact that the word ‘externalities’ in the question is in the plural might have prompted the candidate to give two examples of negative externalities.

02 The first significant feature is that in every age group shown in Extract A more people choose not to smoke than to smoke. The 21–25 year age group are the most likely to smoke with 41.2% of people smoking, whereas the 12–13 year age group are the least likely to smoke with only 2.4% smoking.

The second significant feature is that after the age of 25 there is a gradual reduction in the percentage of people in each age group smoking. In the age group 21–25 as many as 41.2% of the people smoke but this figure falls and in the 65+ age group only 10% of people smoke. (8 out of 8 marks)

Two significant features of the data are correctly identified, with identification backed up in each case with evidence from the data. Mark schemes for part 02 and 06 questions award 2 marks for each point of identification (provided the examiner deems it to be significant) and 2 marks for statistical back-up. With the latter, it is important to include accurate units of measurement (in this case % signs).

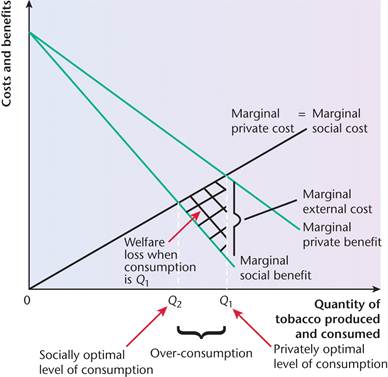

03 The diagram below depicts the marginal private, external and social costs and benefits incurred and received in a free market for tobacco products such as cigarettes.

Tobacco is a demerit good, which means that is it over-produced and over-consumed if provided in a free market. This occurs for two reasons.

First, when smoked tobacco dumps harmful negative externalities into the immediate atmosphere. Non-smokers do not choose to breath in this passive smoke but could suffer severe health effects such as lung cancer (Extract B, line 5). The market has no mechanism for charging smokers for the harm that they are inflicting on the health of non-smokers. Hence the true price of smoking is not reflected in the price. When left to the free market, smoking is under-priced and over-consumed. Over-consumption is shown by Q2–Q1 on the diagram.

Second, when people start smoking they fail to appreciate the true health effects of smoking. This is known as the information problem because humans cannot appreciate the long-term costs of smoking, which may take over 30 years to appear. Teenagers who start smoking often ‘ignore and downplay information’ about how addictions may be dangerous but they only fully comprehend the actual consequences of their actions in later life. As a result they over-consume tobacco because they make decisions based on short-term benefits but ignore long-term costs. This effect is not shown on the diagram. (12 out of 12 marks)

More often than not, part 03 and 07 questions ask for inclusion of an ‘appropriate diagram’. For questions on a market, such as the Topic 2 question on the gold market, the ‘appropriate diagram’ is almost always a supply and demand diagram. For questions on a market failure, including this question, the appropriate diagram is likely to be a marginal private, external and social cost and benefit diagram.

04 The justification for raising taxation on tobacco is that tobacco is a demerit good which is under-priced by the free market, hence its price is too low and it is over-consumed.

By increasing the level of taxation the government will be increasing the costs of production of firms supplying tobacco in the market. This is illustrated in the diagram below, as supply shifts to the left from S1 to S2. The suppliers will in turn pass the cost of the tax increase onto consumers. The government hopes that the higher price will create a disincentive for consumers not to buy tobacco.

The main problem with this argument is that most smokers develop an addiction to cigarettes when they are young (Extract B, line 9). Once smokers are addicted to tobacco their demand is often inelastic, as can be seen in the diagram. This means that the increase in the level of taxation on tobacco is ineffective at reducing demand.

Anti-smoking campaigners argue that even if the tax increase is ineffective it is still justified on the grounds that it will raise revenues for the government worth billions of pounds each year that can be used to treat people with smoking-related diseases. This is a powerful argument. Smoking tobacco is harmful for both the individual who chooses to consume cigarettes and third parties who unintentionally passive smoke. Hence, increased taxation can be used to help correct the immense damage caused by smoking.

The tobacco industry disputes part of this argument. As can be seen in Extract C, tobacco firms warn that excessive taxation actually reduces government tax revenues because it leads to higher levels of smuggling (line 5) which deprives the UK exchequer of £3 billion per year.

Although this is a strong argument it is not a reason for not taxing tobacco heavily. The government should use the police and revenue and customs agencies to enforce the law and prevent illegal smuggling. However, if the government really wants to decrease the level of smoking it needs a policy that discourages young people from starting smoking. Taxation can be effective by making cigarettes expensive but to be truly effective an educational government policy is needed to make young smokers fully aware of the long-term cost of smoking. (19 out of 25 marks)

This answer reaches Level 4, for which the descriptor is:

| AS LEVELS OF RESPONSE | AO1 KNOWLEDGE and UNDERSTANDING of theories, concepts and terminology | AO2 APPLICATION of theories, concepts and terminology | AO3 ANALYSIS of economic problems and issues | AO4 EVALUATION of economic arguments and evidence, making informed judgements |

| Level 4 17–21 marks (mid-point 19) Good analysis but limited evaluation or Reasonable analysis and reasonable evaluation | Good throughout the answer with few errors and weaknesses Good throughout much of the answer with few errors and weaknesses | Good application to issues Good use of data to support answer Some good application to issues Some good application to issues Some good use of data to support answer | Relevant and precise with a clear and logical chain of reasoning Largely relevant and well organised with reasonable logic and coherence | Limited but showing some appreciation of alternative points of view Reasonable, showing an appreciation of alternative points of view |

To reach Level 5, a winding-up concluding paragraph is necessary, linking back to, but not merely repeating, arguments stated earlier in the answer. It is often a good idea to ‘save’ one important argument until the conclusion and then to use it as the ‘killer’ argument which sways you in favour of either ‘the case for’ or ‘the case against’.

Date: 2015-02-03; view: 1099

| <== previous page | | | next page ==> |

| Topic 3 Production and efficiency | | | Topic 5 Government intervention in the market |