CATEGORIES:

BiologyChemistryConstructionCultureEcologyEconomyElectronicsFinanceGeographyHistoryInformaticsLawMathematicsMechanicsMedicineOtherPedagogyPhilosophyPhysicsPolicyPsychologySociologySportTourism

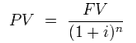

Monopolistic models of competition.Monopoly is characterized by one seller of a specific, well-defined product that has no good substitutes. Barriers to entry are high: licenses, patents, natural barriers (economies of scale). Monopoly decides for a quality when MC=MR and defines the price looking at Demand curve. Monopolies are price searchers. They experiment different prices to find the one to maximize its profits. Monopolistic competition has the following market characteristics: 1) large number of independent sellers; 2) differentiated products; 3) firms compete on price; 4) quality and advertisement are important; 5) Law barriers to entry. Like in the situation of monopoly, firms in monopolistic competition maximize profits when MR=MC. The efficiency of monopolistic competitions is not clear. Companies spend millions to advertise their products, but those expenses are treated sometimes as a benefit for customers – they learn more about the product. Firms also tend to innovate a lot to receive an edge over competitors. Unlike in a case of monopoly, monopolistic competition forces firms to improve quality of their products and their functionality, enhance effectiveness and efficiency of manufacturing processes inside the organization. 32. Interest rates, investments, capital markets and uncertainty. An interest rate is the rate at which interest is paid by a borrower for the use of money that they borrow from a lender. For example, a small company borrows capital from a bank to buy new assets for their business, and in return the lender receives interest at a predetermined interest rate for deferring the use of funds and instead lending it to the borrower. Investment is putting money into something with the expectation of profit. More specifically, investment is the commitment of money or capital to the purchase of financial instruments or other assets so as to gain profitable returns in the form of interest, income (dividends), or appreciation (capital gains) of the value of the instrument. A capital market is a market for securities (debt or equity), where business enterprises (companies) and governments can raise long-term funds. It is defined as a market in which money is provided for periods longer than a year, as the raising of short-term funds takes place on other markets (e.g., the money market). The capital market includes the stock market (equity securities) and the bond market (debt). Uncertainty. Riskier projects are usually require higher costs of capital, as investors expect higher returns for the risk they are ready to undertake. Talk about rating agencies, decision making processes, risks (credit risk, default risk, currency risk). 33. Money to money relation: today & in the future. The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. Present value of a future sum

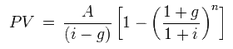

Present value of an annuity for n payment periods

Present value of a growing annuity

Present value of a perpetuity PV=A/i Present value of a growing perpetuity PV = A/(i-g) 34. Decision making under uncertainty If to look from the side of business owners, they make their decisions based on one of the following numbers: NPV, Payback Period, Discounted payback period, IRR. They also have to look at risks (political, environmental, macroeconomic etc). From investor’s side – risks have to be rewarded with higher returns. Different coefficients and percentages are helpful – risk of developing markets, 35. Financial system: instruments, market, institutions. Federal Reserved System (FED) - controls money supply to ensure economy growth, low inflation, full employment (when cyclical employment is zero). It controls money supply making open-market operations (buys or sells securities), assigns the discount rate (cost of money that are borrowed from FED). Market – talk about money demand and money supply. Money demand is determined by the interest rate. Money supply is chosen by FED. Talk about money multiplier (mm= (1+c)/(r+c)), bank reserve requirements. Institutions: Commercial banks (depository institution, allowed to take deposits), thrifts (very similar to commercial banks) and money market mutual funds (debt up to 1 year), investment banks. 36. Banking system: the role of central, commercial and investment bank in financial system. Central bank - money printing, controls money supply to ensure economy growth, low inflation, full employment (when cyclical employment is zero). Commercial banks – could take deposits, so creating liquidity by using funds from deposit accounts to make loans. They also act as financial intermediaries, decreasing people’s expenses for looking for people and making deals with them. They also pool individual loans in the portfolio and hold that risk. Investment bank - a financial institution that assists individuals, corporations and governments in raising capital by underwriting and/or acting as the client's agent in the issuance of securities. An investment bank may also assist companies involved in mergers and acquisitions, and provides ancillary services such as market making, trading of derivatives, fixed income instruments, foreign exchange, commodities, and equity securities. 37. Capital and money markets and instruments. The money market is a component of the financial markets for assets involved in short-term borrowing and lending with original maturities of one year or shorter time frames. Common money market instruments: certificate of deposit, repurchase agreement (sell securities with an agreement to repurchase them on a certain date), commercial paper (usually sold with the discount, unsecured notes), federal funds (overnight loans, other short-term financing for different institutions), municipal notes, T-bills, Foreign exchange swaps Capital market - a capital market is a market for securities (debt or equity), where business enterprises (companies) and governments can raise long-term funds. Bonds and stocks are instruments. 38. Time and money relation. Talk about inflation, cost of capital, return on investments, risks The time value of money is the value of money figuring in a given amount of interest earned over a given amount of time. PV, FV Where is it used: NPV, payback period, credits and deposits, etc. 39. Risk and return theory – CAPM model. Capital asset pricing model: determine risk free rate, short-term Treasury relevant yield, stock’s beta value, and then calculate the required return using the following formula: CAPM = RiskFreeRate + Beta*(ExpectedMarketReturn – RiskFreeRate). The result is the cost of equity capital, or required rate of return on a firm’s common stock. To save on debt costs, the firm may buy back their stocks if it has cash in retained earnings. Date: 2015-02-03; view: 641

|